- BOME holds key support, with bullish patterns hinting at possible breakout in coming sessions.

- Market sentiment remains cautious yet optimistic as BOME eyes critical resistance for trend reversal.

As an analyst with over two decades of market experience under my belt, I find myself optimistically watching Book of Meme [BOME] as it navigates through its current consolidation phase. The Bull Flag formation and the break above the descending trendline are encouraging signs that hint at a possible bull run in the near future. However, it’s essential to remain cautious due to the volatile nature of the meme coin market.

bookofmeme (BOME) has had a rollercoaster week, currently sitting at $0.008752. This marks a decrease of 1.60% over the last day and a drop of 1.36% over the past seven days. With a circulating supply of about 69 billion BOME in circulation, the current market value stands around $603.8 million.

Although it’s seen a drop in prices lately, BOME has been able to maintain its position above a significant support threshold. This level might be instrumental in facilitating the company’s potential rebound.

According to Coinglass data, the daily trading volume is recorded at approximately $361.7 million, and the current open interest is around $89.96 million. This indicates a decline of about 1.58% in open interest compared to previous figures.

Bullish patterns developing amid consolidation

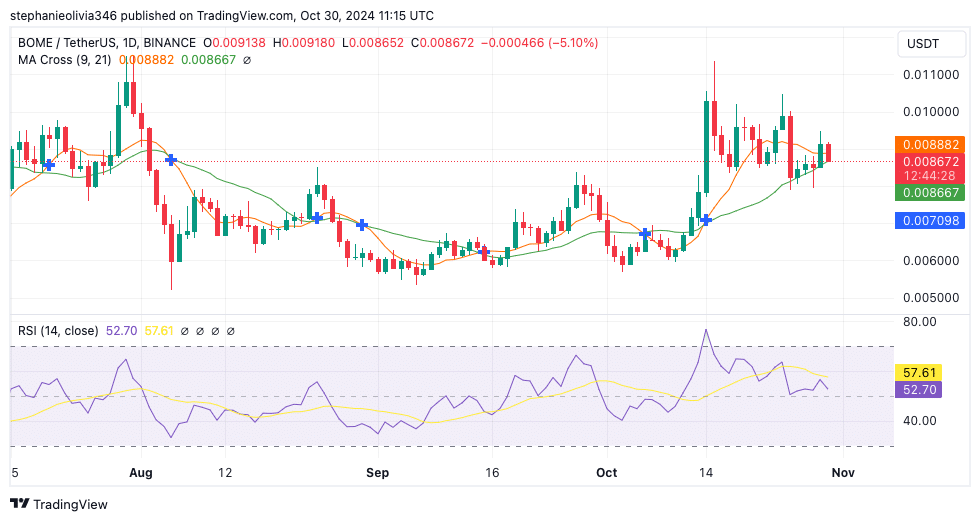

On BOME’s technical analysis chart, there appears to be a developing Bull Flag pattern, signifying a brief halt before an expected price surge could occur. Lately, the price has rebounded and touched the $0.00836 low within the blue range as a potential support level. If this pattern is verified, it might signal further price increases ahead.

As suggested by Rekt Capital, if the current pattern is successfully broken, it may result in additional growth for BOME, potentially causing it to ascend within its wider price range.

The token recently broke above a descending trendline that stretched from April to mid-September, signaling the possibility of a trend reversal.

Furthermore, we noticed a symmetrical triangle pattern breaking out, indicating a possible transition from a consolidation phase to a new trend direction. Analysts are keeping a keen eye on whether the price maintains this level, since if it does, it may signal more growth ahead.

Key levels to watch for price continuation

At the moment, support stands at $0.00836 (represented by the blue line), while immediate resistance is around $0.009925 (the black line). If BOME can break through this resistance, it might aim for the next potential level at $0.014527.

If the price falls beneath its current support point, it might force another test at lower prices. This could potentially result in more stabilization or consolidation.

Based on current market trends, it seems wise to keep an eye on the price level of approximately $0.009254. If this level is surpassed in a weekly close, it might signal sustained bullish energy. In the long term, if the overall trend stays optimistic, the next significant resistance at around $0.018476 could become an important goal to aim for.

Moving averages and RSI indicate neutral momentum

In simpler terms, the 9-day and 21-day average lines suggest an optimistic trend change because they’ve crossed each other, which could mean a rise in price is on the horizon. But right now, the 9-day line is being challenged as potential support that might hold the price up.

A position slightly under the 21-day moving average may hint at a change in momentum direction, suggesting potential temporary vulnerability over a short period.

In simple terms, the Relative Strength Index (RSI) currently stands at 52.63, indicating a balanced momentum. This middle-ground RSI value indicates that the market may be stabilizing, allowing for potential increases or decreases in price.

A rise in RSI (Relative Strength Index) above 57.60 may suggest a resurgence of the bullish trend, while a fall below 50 could signal an escalation of bearish pressure.

Read Book of MEME’s [BOME] Price Prediction 2024-25

Market sentiment and outlook

Although there have been some recent drops, there’s a tentative sense of hope that BOME may bounce back, as long as it continues to hold its current level of support.

Boasting a daily trading volume exceeding $361 million, it’s clear that this token continues to attract active traders. This indicates that it hasn’t slipped off the watchlists of many investors.

Read More

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- The Lowdown on Labubu: What to Know About the Viral Toy

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- Mario Kart World Sold More Than 780,000 Physical Copies in Japan in First Three Days

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Microsoft Has Essentially Cancelled Development of its Own Xbox Handheld – Rumour

- Gold Rate Forecast

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

2024-10-31 09:12