-

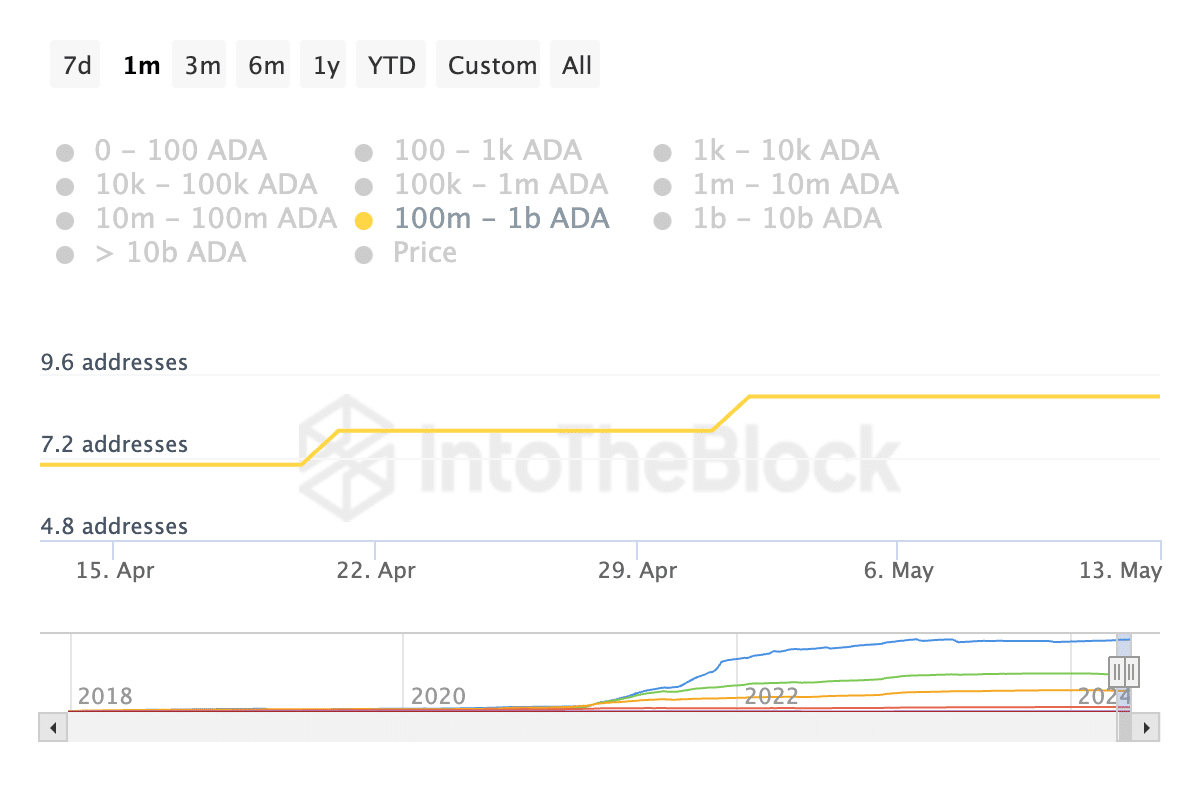

The number of ADA whales that hold between 100 million and 1 billion coins has increased in the last month.

However, ADA’s price remains plagued by bearish sentiments.

As an experienced analyst, I’ve closely monitored Cardano (ADA) and its whale activity with great interest. The surge in the number of large ADA investors holding between 100 million and 1 billion coins in the last month is a significant development that could potentially impact the altcoin’s price dynamics. However, I remain cautious as ADA’s price remains plagued by bearish sentiments.

Recent data from IntoTheBlock reveals that there’s been a notable uptick in large-scale transactions involving Cardano‘s cryptocurrency ADA over the past month.

Over the last thirty days, there has been a 29% rise in the count of ADA holders with between 100 million and 1 billion coins, according to the latest figures from our on-chain data source.

Despite the overall market decline over the past month, the increased whale activity in ADA has yet to influence its price significantly. Currently, the cryptocurrency is trading at approximately $0.43.

According to CoinMarketCap’s data, its value has fallen by 7% in the past 30 days.

Where might ADA be headed?

As a researcher studying the trends in the cryptocurrency market, I’ve observed an uptick in the number of significant investors in ADA within the past month. However, this growth has not been matched by an equivalent surge in demand for the altcoin itself. Instead, there seems to be a prevailing downtrend in the market’s appetite for ADA.

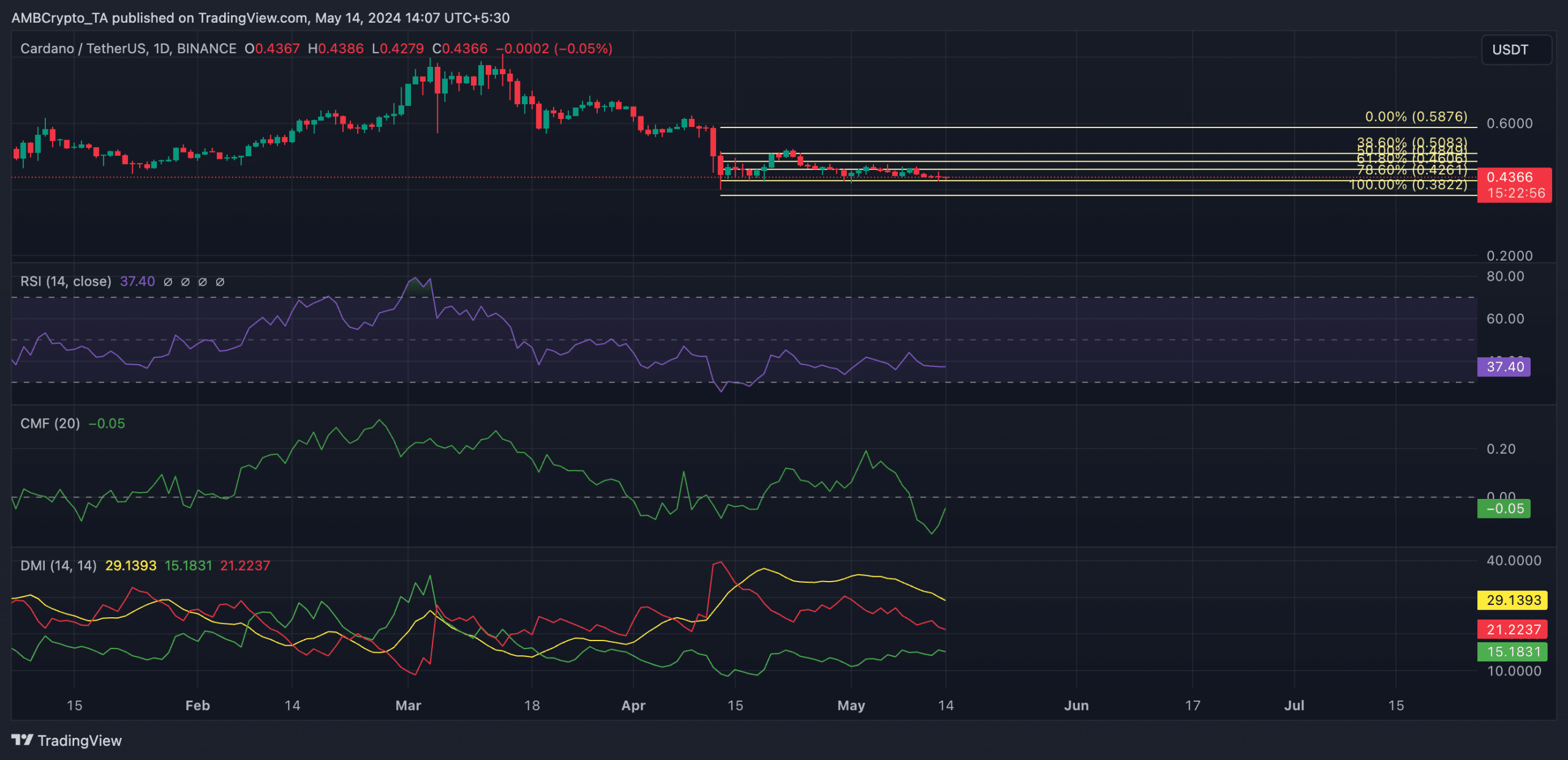

Readings from its key momentum indicators observed on a one-day chart confirmed this.

The RSI of ADA, as calculated by me currently, stands at 37.42. This reading suggests that the coin’s distribution among market participants has been robustly active.

Additionally, at present, the Chaikin Money Flow (CMF) for the coin is registering below its zero threshold. This signifies that more capital has been flowing out of the asset than into it according to this particular technical indicator.

As a crypto investor, when I notice that an asset’s value has dipped into negative territory, I interpret this as a sign of heightened selling pressure in the market. Historically, such periods have often been followed by further declines in the asset’s value.

At press time, ADA’s CMF was -0.04.

The ADA coin’s positive indicator, signaling its bullish trend, was situated beneath its bearish indicator in terms of their color-coded directions.

As a researcher studying the Directional Movement Index (DMI) of an asset, I would interpret a setup in which the lines are arranged in this particular manner as indicative of a robust downward trend.

With an Average Directional Index (ADX) value of 29, ADA’s downtrend was strong at press time.

At the current price, supporters of ADA are holding it up at a vital line of defense. But if bears gain strength, ADA could fall below this level and trade as low as $0.38.

If the bearish predictions prove to be incorrect, the coin’s price could surge towards $0.46 instead.

Read Cardano’s [ADA] Price Prediction 2023-24

The increase in transactions in the coin’s future market indicates a persistent optimistic view among traders, even as the price takes a downturn.

Based on data from Coinglass, the funding rates for the cryptocurrency on various exchanges stay in a positive position. This indicates that futures traders have persistently opted to open long positions.

Read More

- WCT PREDICTION. WCT cryptocurrency

- The Bachelor’s Ben Higgins and Jessica Clarke Welcome Baby Girl with Heartfelt Instagram Post

- Royal Baby Alert: Princess Beatrice Welcomes Second Child!

- AMD’s RDNA 4 GPUs Reinvigorate the Mid-Range Market

- Chrishell Stause’s Dig at Ex-Husband Justin Hartley Sparks Backlash

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- PI PREDICTION. PI cryptocurrency

- Studio Ghibli Creates Live-Action Anime Adaptation For Theme Park’s Anniversary: Watch

- SOL PREDICTION. SOL cryptocurrency

- New Mickey 17 Trailer Highlights Robert Pattinson in the Sci-Fi “Masterpiece”

2024-05-14 22:16