- Market sentiment around Chainlink remained bearish despite a price hike in the last 24 hours.

- If market indicators are to be believed, LINK might first target $29.

As a seasoned crypto investor with over a decade of experience under my belt, I’ve seen my fair share of market swings and trends. After carefully analyzing the latest developments surrounding Chainlink (LINK), I find myself cautiously optimistic about its potential in the coming days and weeks.

Despite the bearish sentiment that has lingered around LINK for some time now, the recent price hike is a promising sign, especially given the red weekly chart we’ve seen. While I remain wary of social metrics like Weighted Sentiment and Social Volume, which have shown a sharp decline, it’s important to remember that market sentiment can sometimes be misleading.

Looking at the on-chain data, the increase in buying pressure is evident, as demonstrated by the rise in LINK addresses “in the money” and the decrease in its supply on exchanges. These factors suggest that investors are accumulating LINK, which could drive the price upward.

However, I always remind myself to stay vigilant when the market is in a “greed” phase, as it often signals a potential correction. The fear and greed index reading of 61% supports this concern, but technical indicators like the approaching lower limit of the Bollinger Bands may spark a bull rally instead.

In my humble opinion, if LINK can reclaim $29 in the near term, it could pave the way for a push towards the much-anticipated $50 mark. The slight uptick in the Money Flow Index (MFI) also supports this prediction.

As always, I’d like to remind fellow investors that the crypto market is unpredictable and volatile, so it’s essential to diversify your portfolio and never invest more than you can afford to lose. And as they say, “Don’t cry over spilled milk; it’s too sour to drink anyway.” In this case, we might as well laugh at the market’s ups and downs and enjoy the crypto rollercoaster ride!

As an analyst, I delved into the on-chain analysis of Chainlink (LINK) following its recent bullish turn from a red weekly chart to a green daily chart. Consequently, I sought to forecast where this token might be heading by 2025.

Chainlink bulls are back in action!

According to information from CoinMarketCap, the value of LINK decreased by about 1.2% over the past week. However, within the last day, supporters of LINK (bulls) have been active, causing the token’s worth to increase by over 2.5%.

Currently, Chainlink’s price stands at around $21.73, and its total market value exceeds $13.8 billion.

Or simply: At the moment, Chainlink is being traded for approximately $21.73, with a total market cap of over $13.8 billion.

Due to the recent price surge, approximately 478,000 Chainlink wallets have become profitable, making up nearly two-thirds (68%) of all Chainlink wallets, according to IntoTheBlock’s data.

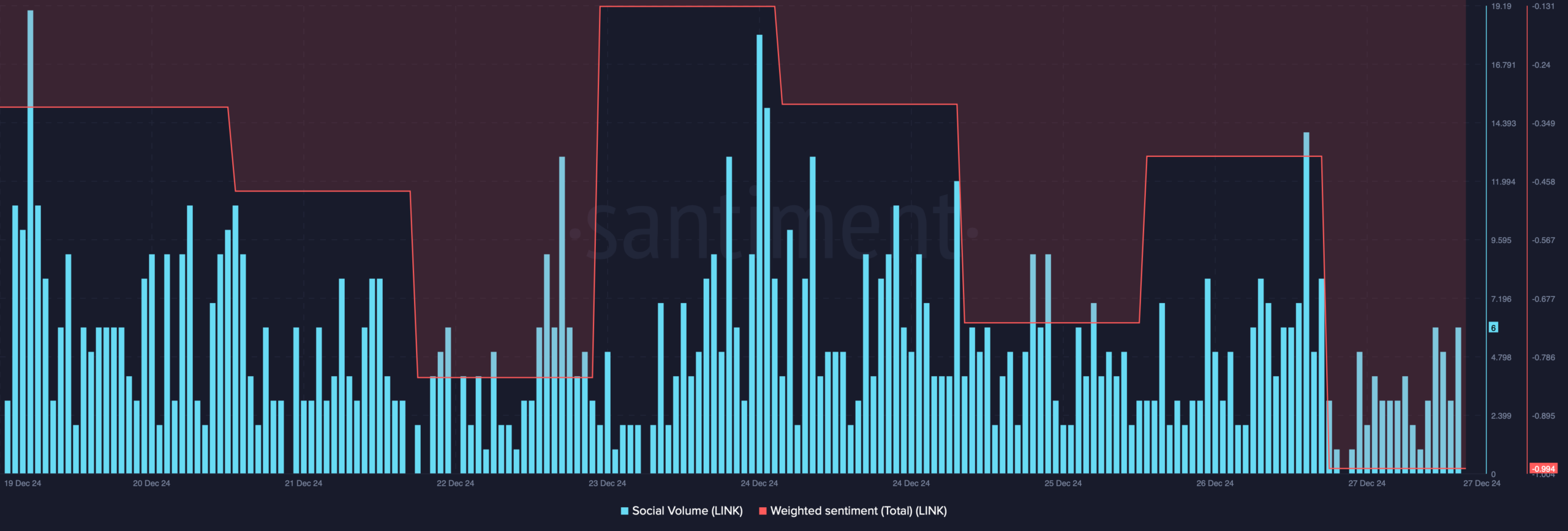

Despite an increase in the token’s price over the past day, it didn’t lead to improvements in its social metrics. In fact, there was a significant drop in the Weighted Sentiment for LINK, suggesting that investors are becoming increasingly pessimistic about the token.

Moreover, the Social Volume of Chainlink decreased last week, signaling a drop in the token’s current interest or popularity.

Will LINK touch $50?

As a seasoned crypto investor with over five years of experience under my belt, I have learned to pay close attention to the insights shared by respected analysts like World Of Charts. In this case, his recent tweet about LINK trading within an optimistic range has caught my eye. Given the market trends I’ve observed, I believe there is a strong possibility that the token could indeed move towards $50 in the coming days. This prediction aligns with my own research and analysis, making me more confident in my decision to hold onto my LINK tokens for now. However, as always, I remind myself to remain cautious and adaptable, knowing that the crypto market can be unpredictable at times.

Consequently, AMBCrypto looked into additional data sources to determine if LINK might reach that level within a medium term span. Fortunately, it was observed that demand for the token was gradually picking up.

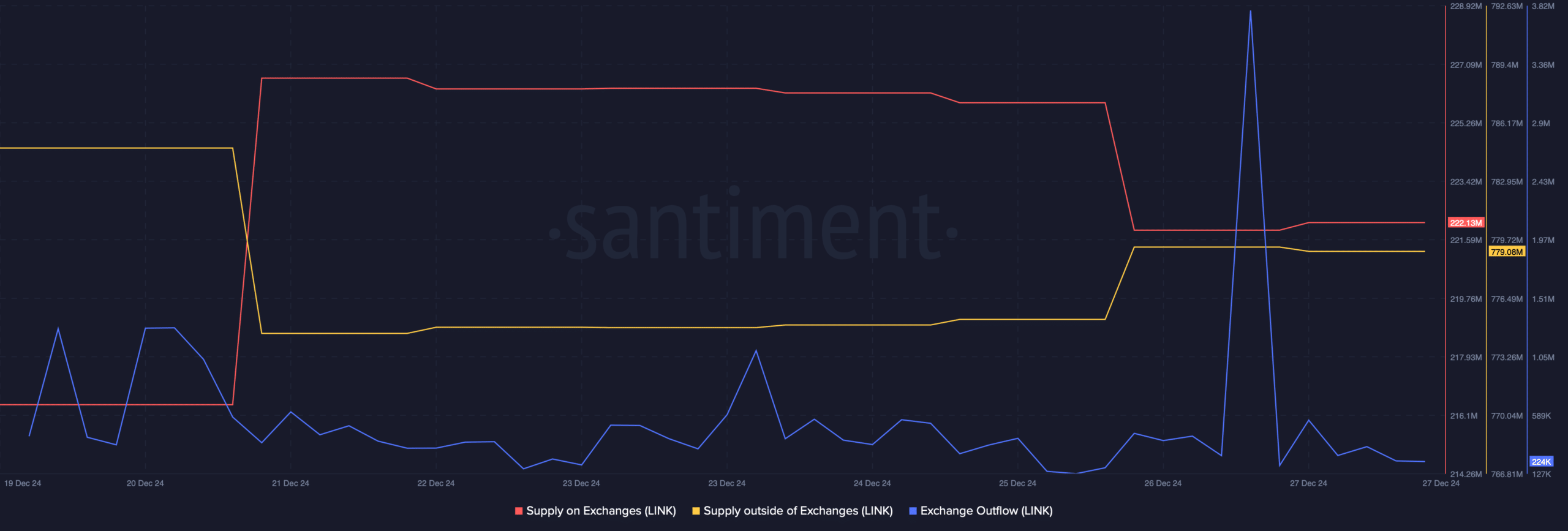

It was clear because there was an increase in its availability beyond the exchanges, accompanied by a decrease in its availability on the exchanges.

Additionally, it’s worth noting that Chainlink’s outflows from exchanges surged on the 26th of December as well, suggesting an increase in demand or purchasing interest.

What’s next for LINK?

In other words, when I was putting this together, the Fear & Greed Index for Chainlink stood at 61%. This suggests that the market was experiencing “greed”, and historically, such conditions may lead to a possible price adjustment or correction.

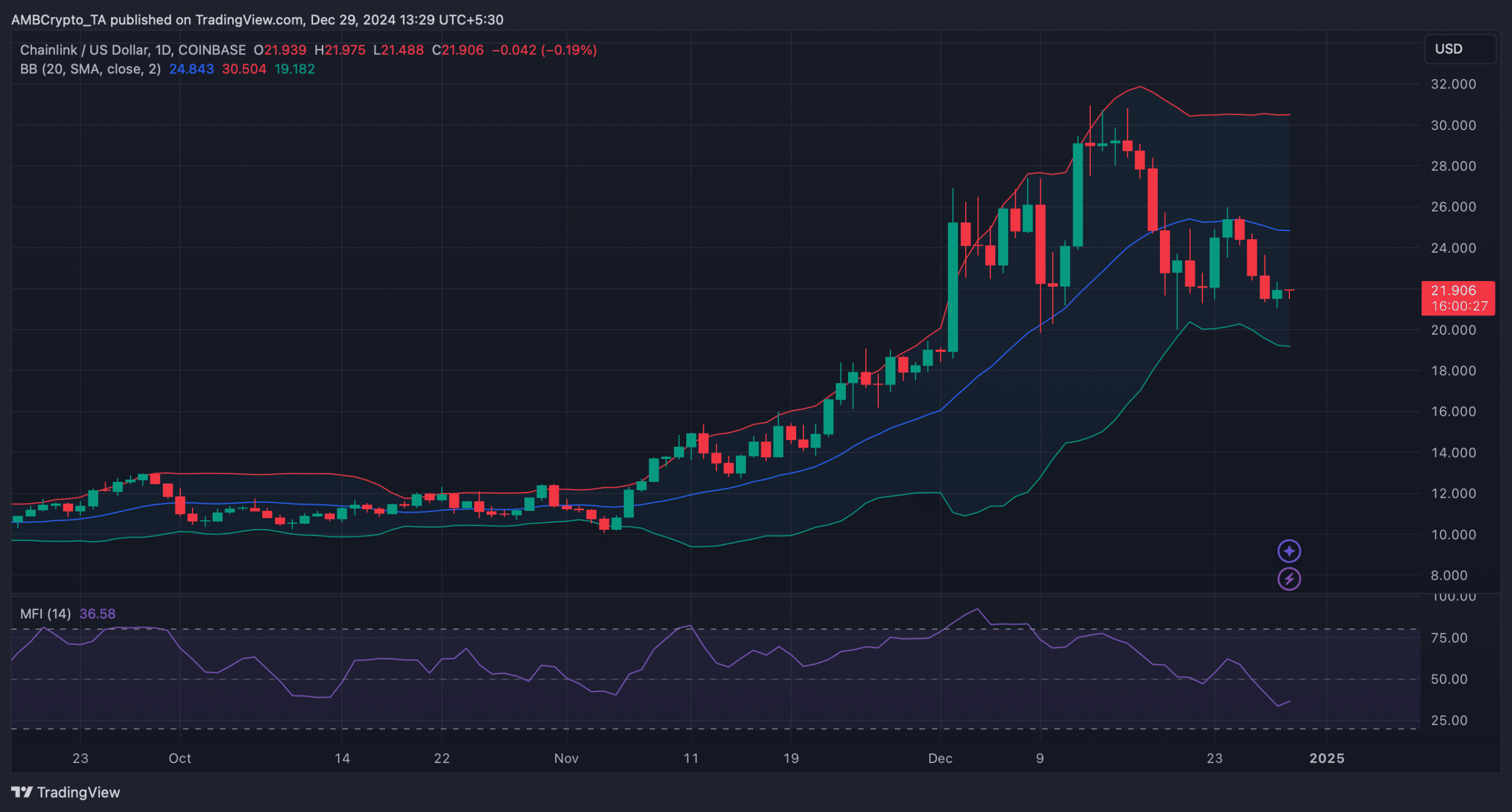

However, based on the technical analysis, the price of LINK appeared close to reaching the lower boundary of the Bollinger Bands. This potential event could initiate a surge in its value, leading to a possible bull run.

A further price hike could allow the token to reclaim $29 before it eyes $50.

Indeed, following a dip, the Money Flow Index (MFI) showed a small increase as well, potentially bolstering the token’s path toward reaching $29.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- LPT PREDICTION. LPT cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- WCT PREDICTION. WCT cryptocurrency

2024-12-29 20:08