- Dogecoin was testing key resistance at $0.12 after breaking a 6-month downtrend.

- On-chain data showed rising network activity and accumulation as traders eye a breakout past $0.12.

As a seasoned researcher with over a decade of experience in the ever-evolving world of cryptocurrencies, I find myself intrigued by Dogecoin’s [DOGE] recent breakout from its 6-month downtrend. The current resistance at $0.12 is a key level to watch, as it has acted as both support and resistance in the past.

Dogecoin (DOGE) has managed to escape its six-month slump, leading to enthusiasm among traders. Currently, DOGE is valued at $0.1025, marking a 5.37% growth in the past week, although it experienced a slight dip of -2.88% within the last 24 hours.

As an analyst, I find myself observing the dynamic of Dogecoin, currently boasting a market capitalization close to $15 billion and recording a 24-hour trading volume of approximately $553 million. At present, this digital currency is challenging certain crucial resistance levels, with traders’ eyes firmly set on the $0.12 mark as they anticipate a substantial surge if breached.

An inverse head-and-shoulders setup combined with a descending triangle (or falling wedge) could indicate a possible price surge for Dogecoin (DOGE), signaling a bullish trend reversal might be on the horizon.

It seems like a potential breakout might be imminent based on the observed trends. If the price exceeds the significant $0.1200 barrier, which historically has served as both a support and resistance point, it could signal the start of this breakout.

Critical levels for Dogecoin: $0.1050 support and $0.1200 resistance

keep a close eye on the significant barrier at around $0.1200 for Dogecoin, as surpassing this level might spark a robust surge. If that happens, Dogecoin could head towards $0.20.

In this critical zone spanning between $0.1050 and $0.1200, a prolonged rise could signal a transition in the market’s perspective, from pessimistic (bearish) to optimistic (bullish).

To keep its upward trend, DOGE needs to stay above the $0.1050 resistance level. Dropping below this point might initiate additional falls, pushing the price back into a period of sideways movement.

Experts are underscoring the role of momentum as we move through these stages, and the upcoming trading days may prove decisive in shaping Dogecoin’s immediate trend.

Technical indicators point to potential breakout

dogecoins technical signs are giving a blend of warnings and hopeful messages. The Relative Strength Index (RSI), presently stands at 47.45, which means that Doge isn’t excessively purchased or sold, offering a balance between caution and optimism.

If the RSI moves above 50, it could indicate renewed bullish momentum.

Currently, the Moving Average Convergence Divergence (MACD) is about to show a bullish trend reversal, but it’s important to note that the confirmation signal is still relatively weak at present.

If the price surpasses the $0.1200 barrier, it might signal confirmation of the MACD crossover, potentially fueling further growth.

Key points to keep an eye on involve the possible support at 10.5 cents and the potential resistance at 12 cents, with a possible aim of reaching 20 cents if there’s a breakthrough.

On-chain metrics show growing interest in Dogecoin

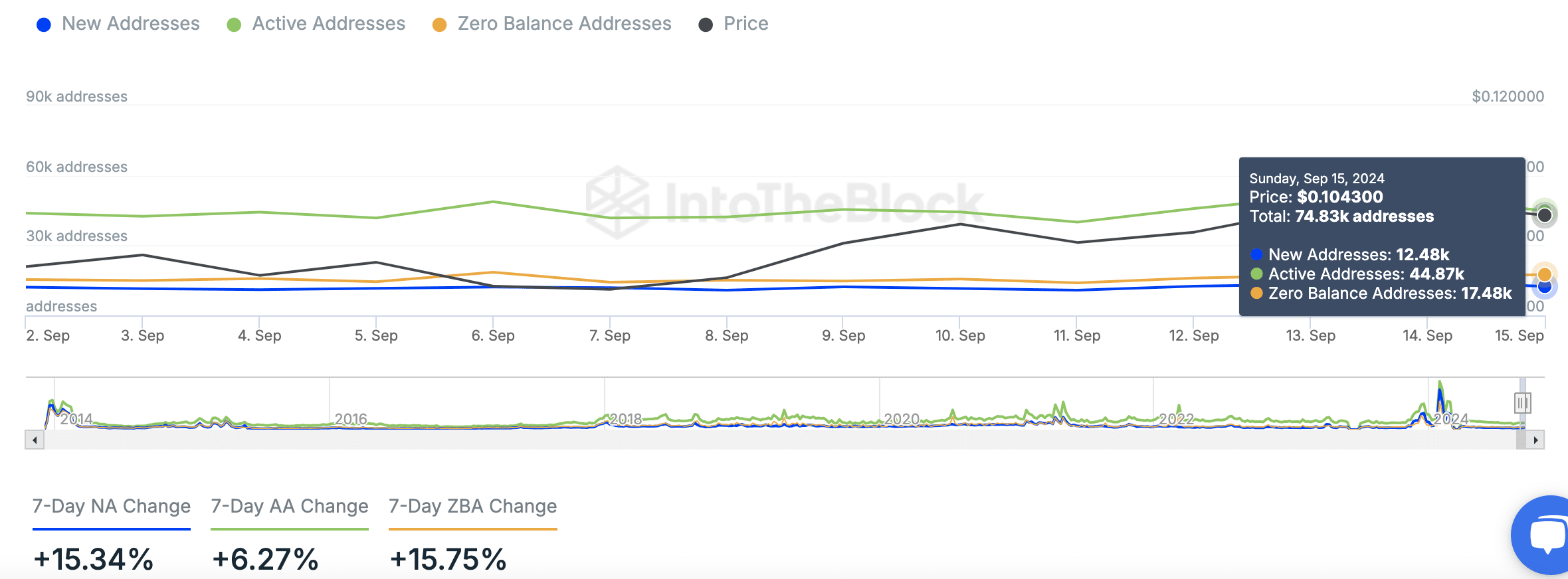

Based on information from IntoTheBlock, it appears that there’s growing involvement within the Dogecoin network, potentially fueling the recent price trend. On September 15th alone, Dogecoin saw a total of 74,830 active addresses, with an additional 12,480 joining the network on that day.

Active addresses stood at 44,870, indicating rising participation within the network.

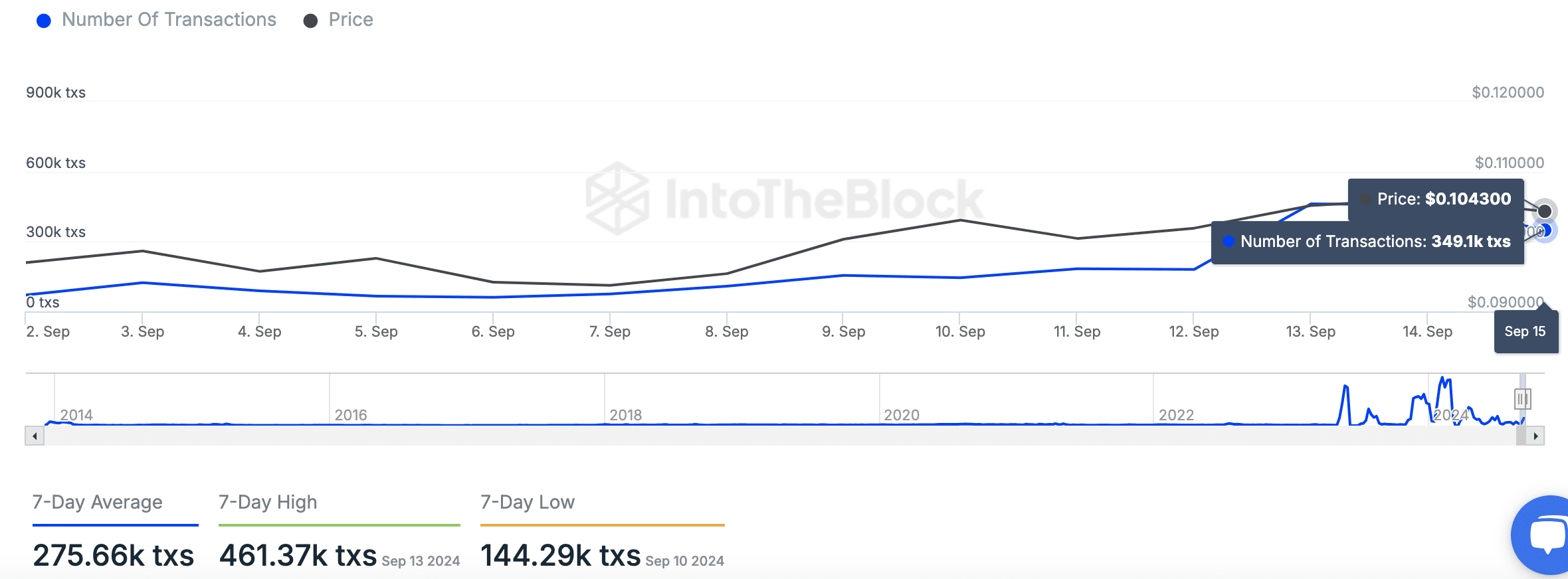

Furthermore, it’s worth noting that Dogecoin processed approximately 349,100 transactions over the course of a day, and on average, it handled about 275,660 transactions daily over the past week. The peak transaction count for the last seven days was reached on September 13th, with a staggering 461,370 transactions processed that day.

This consistent network activity points to steady user interest, even as the price fluctuates.

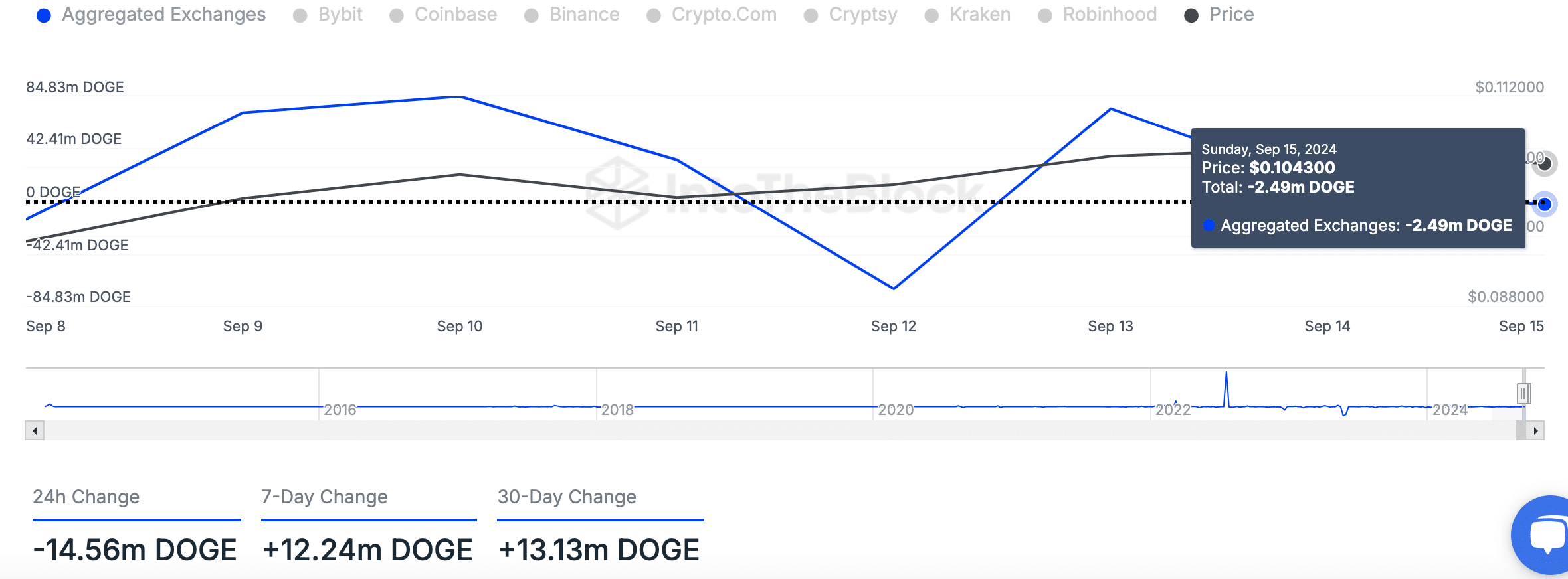

Additionally, it appears that Dogecoin may be experiencing accumulation as there was a net withdrawal of approximately 2.49 million DOGE from combined exchanges in the latest data. In the last day alone, this outflow increased to 14.56 million DOGE, while the 7-day net flow shows an inflow of 12.24 million DOGE. This suggests a possible trend where more Dogecoin is being stored rather than traded.

Read Dogecoin’s [DOGE] Price Prediction 2024–2025

Although Dogecoin’s prices have been unstable lately, the data indicates a trend where significant investors might be transferring their Dogecoins from exchanges, potentially in preparation for potential profits down the line.

With the $0.1200 level in sight, Dogecoin’s price movement remains critical.

Read More

- PI PREDICTION. PI cryptocurrency

- WCT PREDICTION. WCT cryptocurrency

- LPT PREDICTION. LPT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- Gold Rate Forecast

- Shrek Fans Have Mixed Feelings About New Shrek 5 Character Designs (And There’s A Good Reason)

- SOL PREDICTION. SOL cryptocurrency

- Playmates’ Power Rangers Toyline Teaser Reveals First Lineup of Figures

- FANTASY LIFE i: The Girl Who Steals Time digital pre-orders now available for PS5, PS4, Xbox Series, and PC

- Despite Bitcoin’s $64K surprise, some major concerns persist

2024-09-16 22:16