-

Ethereum fear and greed index is transitioning gradually.

ETH token summary, on-chain signals and false break-out suggest price set to surge.

As a seasoned analyst with years of experience navigating cryptocurrency markets, I find myself cautiously optimistic about Ethereum’s [ETH] near-term prospects. The Fear and Greed Index moving from extreme fear to neutral sentiment is a positive sign, indicating growing investor confidence in the market.

🚀 EUR/USD to Explode? Trump Trade Shocks Incoming!

Don't miss the crucial analysis before the market reacts!

View Urgent ForecastCurrently, the Fear and Greed Index for Ethereum (ETH) stands at 38, indicating a generally neutral mood in the market compared to the intense fear felt a week ago.

At the moment when this article was written, Ethereum’s price stood at approximately $2705. This equilibrium of fear and greed indicates an increasing level of trust among investors.

As a seasoned investor with years of experience in the volatile world of cryptocurrencies, I have learned to keep my eyes open for signs of positive momentum. One such sign is a sentiment suggesting that Ethereum might soon challenge and potentially surpass the $2.8K resistance level. Having witnessed several bull runs and bear markets, I can tell you that this kind of prediction excites me and gives me confidence in the potential growth of both Ethereum and the broader cryptocurrency market. However, I always remind myself to remain cautious and patient, as the crypto market is known for its unpredictability. Nonetheless, if Ethereum manages to break through this resistance level, it could be a significant step towards even higher prices in the near future.

ETH/USD approaching resistance

In simple terms, Ethereum has surpassed the $2,800 resistance level, making it an essential foundation for recovery following this week’s market decline.

Will the ongoing market trend successfully surpass this resistance level, given that Ethereum’s optimism seems to be growing? After dipping to its weekly minimum, Ethereum has shown resilience and closed on a very bullish note. This upward momentum hints at a possible breakthrough over the current support in the near future.

A momentary drop under $2.8K might appear as an unsuccessful breakout, hinting at a potential change in direction since the price promptly rebounded and surpassed that threshold again.

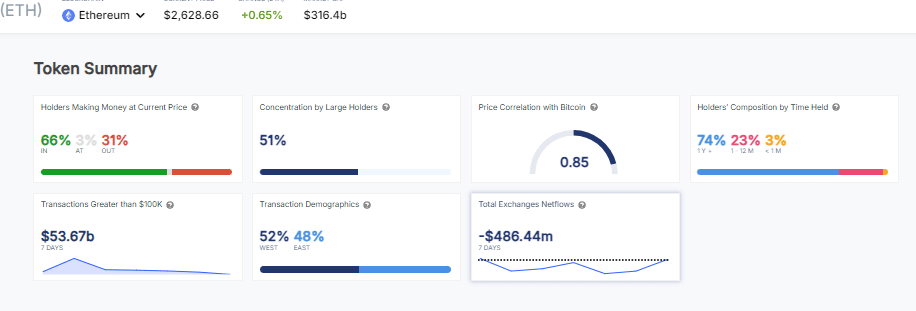

Token summary

As a researcher delving into the intricacies of the Ethereum ecosystem, my latest findings indicate a potential surge for Ether (ETH) beyond the $2.8K resistance barrier, given the growing investor confidence.

Currently, 66% of total holders are profitable, and 51% of ETH is concentrated among large holders.

In simpler terms, the cost of Ethereum tends to mirror that of Bitcoin (with a correlation coefficient of 0.85), while about three-quarters of its owners have held onto their investment for more than a year.

Over the past seven days, I’ve observed a staggering $53.67 billion worth of transactions exceeding $100,000. This substantial activity suggests a significant build-up of pressure on Ethereum’s current resistance level. Given this trend, it seems plausible that Ethereum could soon break through this critical barrier, mirroring the growing faith and optimism surrounding this asset among investors like myself.

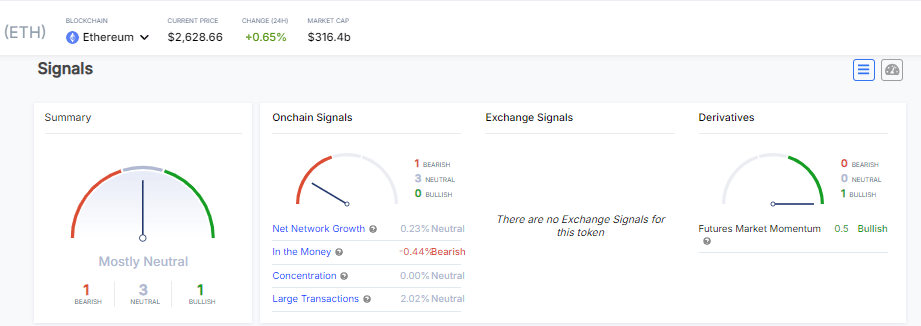

On-chain signals

In simple terms, the signals from Ethereum’s built-in data suggest it’s neither an ideal time to buy or sell. The network expansion rate remains stable at a growth of 0.23%, while the number of successful transactions that bring profit (in-the-money) has slightly decreased by -0.44%.

Read Ethereum (ETH) Price Prediction 2024-25

Concentration and large transactions also remain neutral, with readings of 0% and 2.02%, respectively.

On the other hand, the futures market indicates a gentle uptrend of about 0.5%, implying that Ethereum could potentially surpass the $2,800 resistance point as investor trust in Ethereum assets strengthens.

Read More

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- The Lowdown on Labubu: What to Know About the Viral Toy

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- Mario Kart World Sold More Than 780,000 Physical Copies in Japan in First Three Days

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Microsoft Has Essentially Cancelled Development of its Own Xbox Handheld – Rumour

- Gold Rate Forecast

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

2024-08-12 13:12