- Expectations associated with Spot Ethereum ETFs are high on the back of their launch

- Ethereum’s utility, adoption, transactions, and fees could come in handy for the altcoin

As a seasoned researcher with extensive experience in the crypto market, I have witnessed the evolution of digital assets and their impact on traditional finance. The recent launch of Ethereum ETFs has generated immense excitement within the community, and as an observer of this dynamic space, I believe Ethereum holds significant potential to challenge Bitcoin’s dominance in the spot ETF segment.

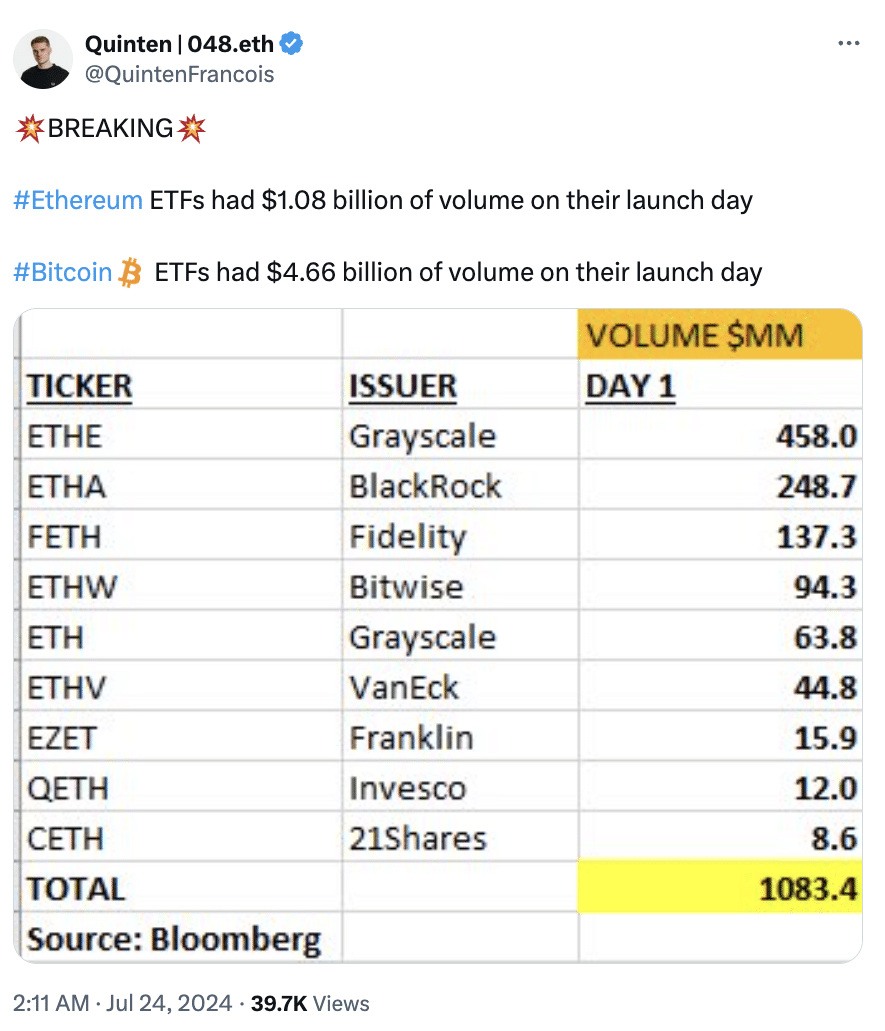

Twenty-four hours have passed since Ethereum Exchange-Traded Funds (ETFs) started trading, and early indications suggest success. The inaugural trading day is said to have generated over a billion dollars in total trading volume.

The trading volumes of Ethereum ETFs on their debut day indicate a promising beginning. Yet, it remains to be seen if they can eventually surpass Bitcoin ETFs in terms of demand and volume. It’s important to mention that the daily trading volumes for Ethereum spot ETFs were only a quarter of those recorded for Bitcoin spot ETFs during their first day of trade.

As an analyst, I believe Bitcoin holds the initial edge due to its first-mover status. However, Ethereum possesses certain strengths that could potentially boost its trading volumes and spark increased demand in the future Spot ETF market. Let’s delve into some of these factors that might enable Ethereum to challenge Bitcoin:

Ethereum shines in utility

A recently introduced ETF provides traditional investors with access to Ethereum, deviating from the typical investment standards of the crypto market. Instead of prioritizing speculative elements, these investors place greater emphasis on Ethereum’s organic growth factors, making it a favorable choice in this context.

As a crypto investor, I can tell you that the network I’m invested in boasts an impressive capability to execute smart contracts. This feature has fueled an incredible expansion of its ecosystem over the past few years. At present, there are more than 4,000 Decentralized Applications (Dapps) operating on it. These Dapps generate substantial demand for Ethereum (ETH), which is required to pay gas fees.

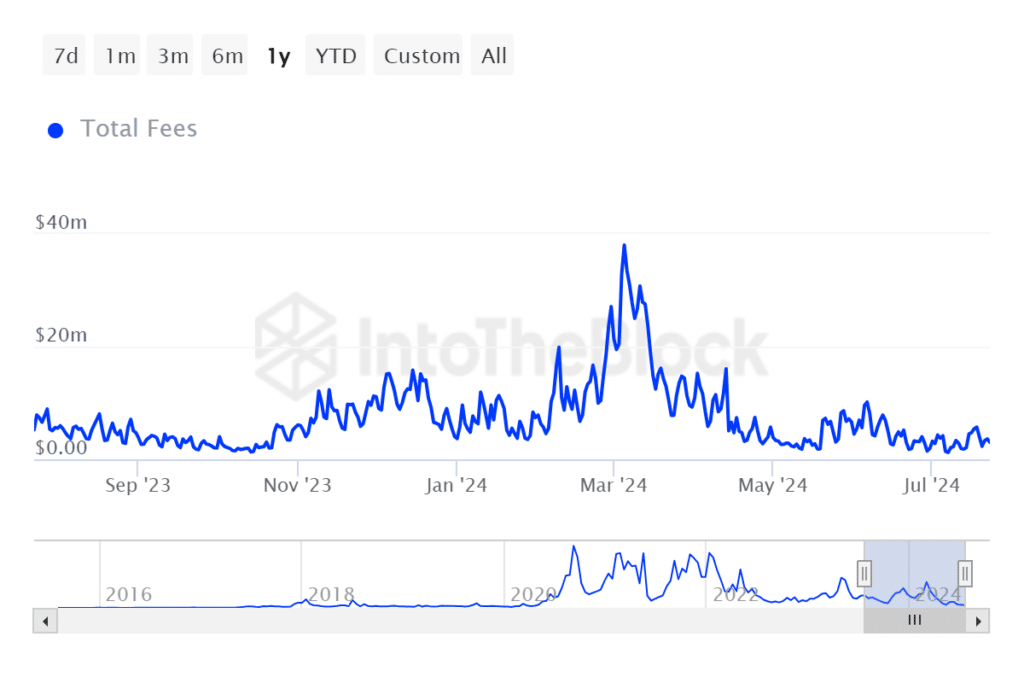

In the previous year, Ethereum transaction fees varied significantly, ranging from a low of approximately $1.22 million to a high of around $38 million.

Furthermore, Ethereum’s staking mechanism offers a passive income alternative similar to dividends in conventional financial markets. This characteristic might attract traditional investors.

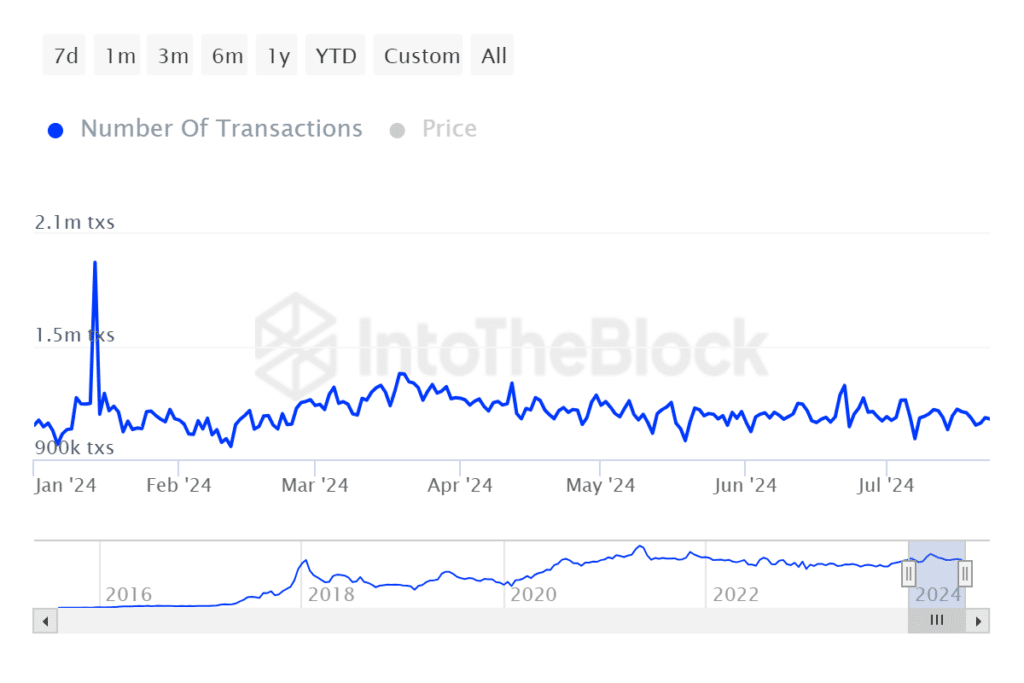

The number of Ethereum transactions per day paints a more appealing picture compared to Bitcoin. While Bitcoin has only managed an average of around 500 daily transactions so far this year, Ethereum boasts an average of over one million daily transactions.

The utility, fees, and transactions underscore key areas where Ethereum outperforms Bitcoin.

Examining the current prices of cryptocurrencies could also be worthwhile. For instance, Ethereum is priced much lower than Bitcoin ($3,450 versus $66,422 as of now). This price disparity might lead some to believe that investing in Ethereum ETFs could potentially yield greater returns.

After all, profit is the name of the game.

Easier said than done

Based on the information presented, Ethereum can compete effectively with Bitcoin. However, Bitcoin’s early entry into the market and the preference of many traders for it due to this first-mover advantage give BTC a significant edge. Furthermore, Bitcoin’s proof-of-work system, considered the epitome of decentralization, is another compelling feature that draws some investors towards it.

Institutional interest in Bitcoin remains robust, even with the launch of Ethereum ETFs. In the coming days or weeks, we’ll gain more insight into which cryptocurrency will dominate in terms of ETF demand.

Read More

- PI PREDICTION. PI cryptocurrency

- WCT PREDICTION. WCT cryptocurrency

- Royal Baby Alert: Princess Beatrice Welcomes Second Child!

- The Bachelor’s Ben Higgins and Jessica Clarke Welcome Baby Girl with Heartfelt Instagram Post

- Sea of Thieves Season 15: New Megalodons, Wildlife, and More!

- SOL PREDICTION. SOL cryptocurrency

- FANTASY LIFE i: The Girl Who Steals Time digital pre-orders now available for PS5, PS4, Xbox Series, and PC

- SUI’s price hits new ATH to flip LINK, TON, XLM, and SHIB – What next?

- Michael Saylor’s Bitcoin Wisdom: A Tale of Uncertainty and Potential 🤷♂️📉🚀

- Sacha Baron Cohen and Isla Fisher’s Love Story: From Engagement to Divorce

2024-07-25 08:07