- Ethereum’s MACD indicator on the one-day chart showed a bullish divergence.

- Ethereum exchange outflows and open interest have spiked, hinting toward bullish sentiment.

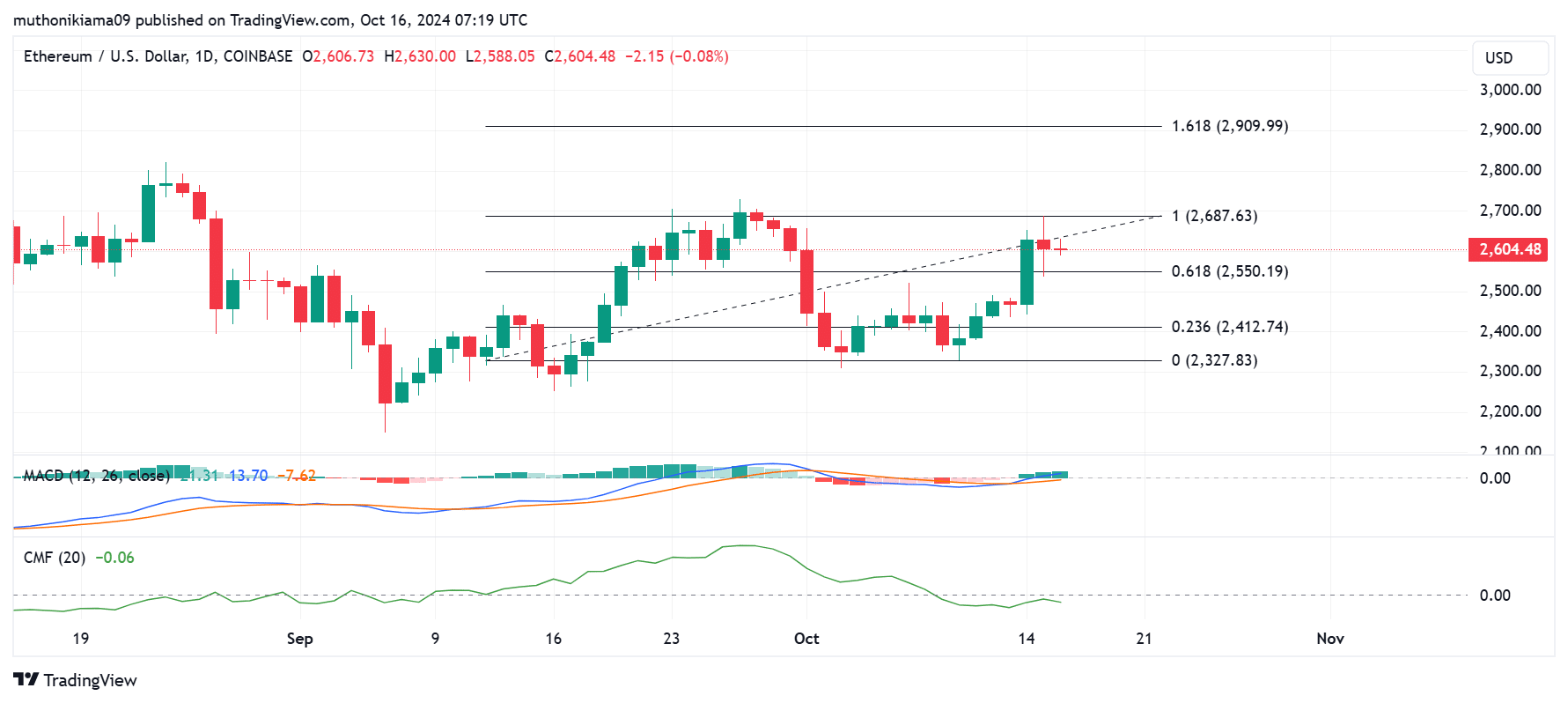

As a seasoned crypto investor with a knack for deciphering market trends, I find myself intrigued by the recent developments in Ethereum (ETH). The bullish divergence shown by its MACD indicator on the one-day chart and the spike in exchange outflows and open interest are signs that could potentially propel ETH to new heights. However, the Chaikin Money Flow’s negative value suggests that buyers might still be hesitant, waiting for a decisive break above the crucial resistance at $2,687.

The Crypto Fear & Greed Index surged to 73 following Bitcoin‘s [BTC] price jump over $67,000. However, Ethereum [ETH] has not shown substantial growth despite this generally optimistic market sentiment.

The largest altcoin traded at $2,604 at press time after a slight 0.4% dip in 24 hours.

On the daily chart, Ethereum appears to be demonstrating a pattern called “bullish divergence.” This indicates that while its price may temporarily decrease, it could potentially increase in the future because the Moving Average Convergence Divergence (MACD) has turned positive, suggesting an upward trend.

Furthermore, the MACD histogram bars are now larger and green, indicating a rise in optimism among buyers.

Conversely, the Chaikin Money Flow (CMF) showed a negative figure, implying that there was a greater outflow of funds from ETH compared to inflows into it as an altcoin.

It appears that purchasers remain uncertain, potentially holding off until Ethereum surpasses a significant resistance point at around $2,687, after which they might decide to enter the market.

If the bullish trend indicated by the Moving Average Convergence Divergence (MACD) holds true, Ethereum (ETH) could surpass its current resistance and aim for a new high of around $2,900. The on-chain data indicates that this upward momentum is probable.

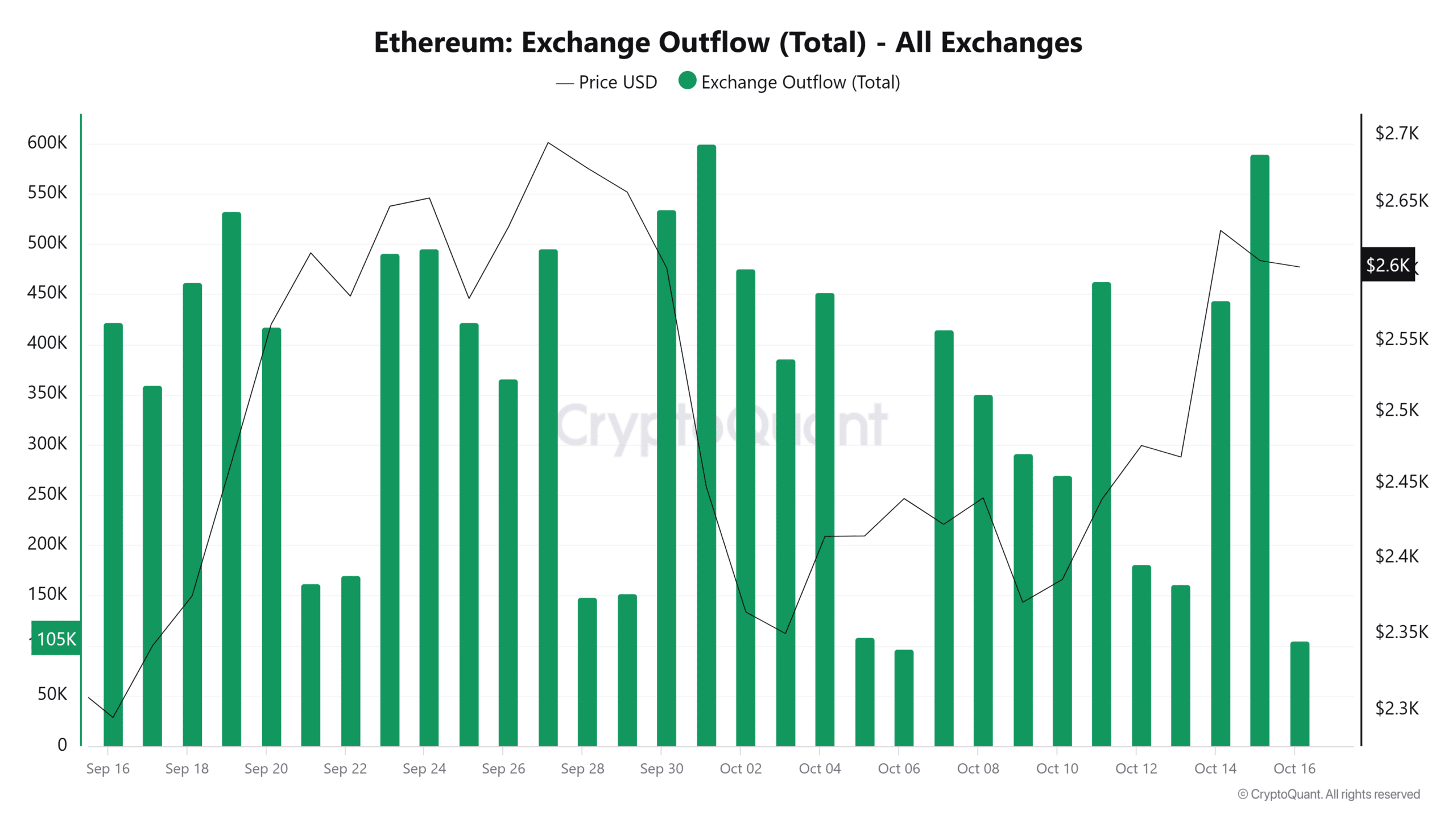

Ethereum exchange outflows hit two-week high

On October 15th, there was a significant increase in Ethereum withdrawals from exchanges, reaching a two-week peak. This action by traders suggests they are not planning to offload their tokens at this time.

During the day, ETH outflows reached 589,611, valued at more than $1.5 billion.

As a result, the total inflow of Ethereum has reached its peak since late September, implying that the demand for ETH might be increasing, potentially leading to a rise in its price.

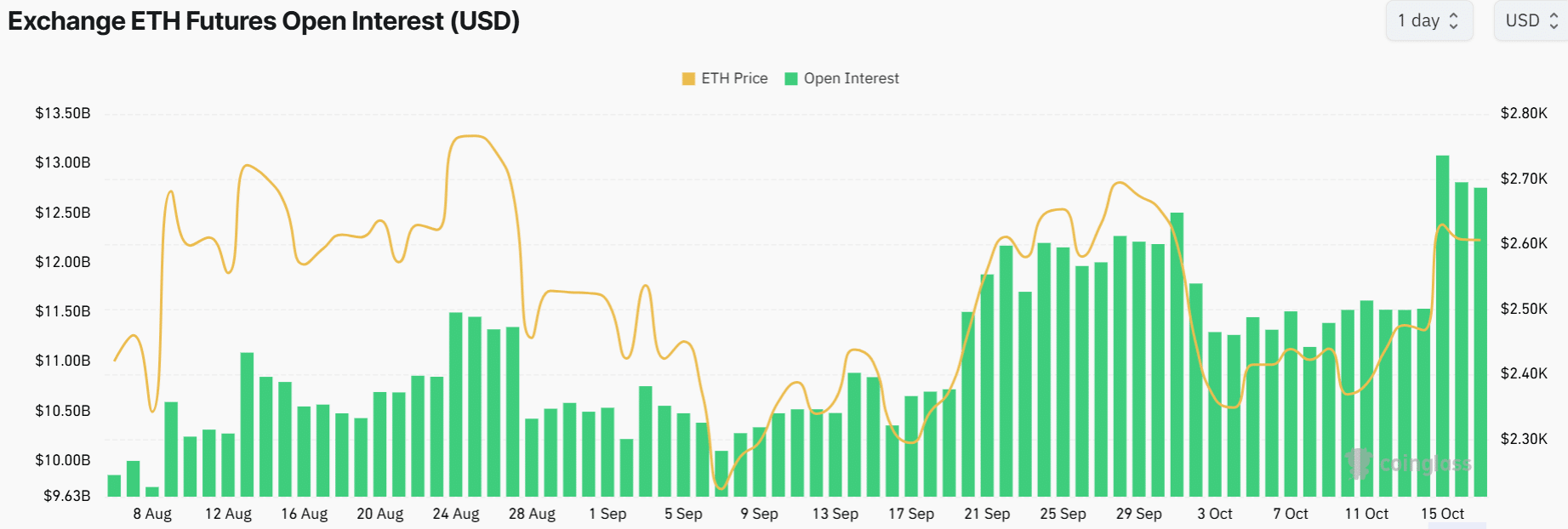

Risining Open Interest

The level of open interest in Ethereum might impact its price fluctuations. Currently, Ethereum’s open interest stands at approximately $12.76 billion, signifying an increase in market activity and engagement from traders using derivative contracts.

An increase in Open Interest, despite minimal price fluctuations, suggests that there’s growing speculative interest in Ethereum.

If traders start to exit their trades due to significant price fluctuations in either upward or downward direction, it may lead to increased market volatility.

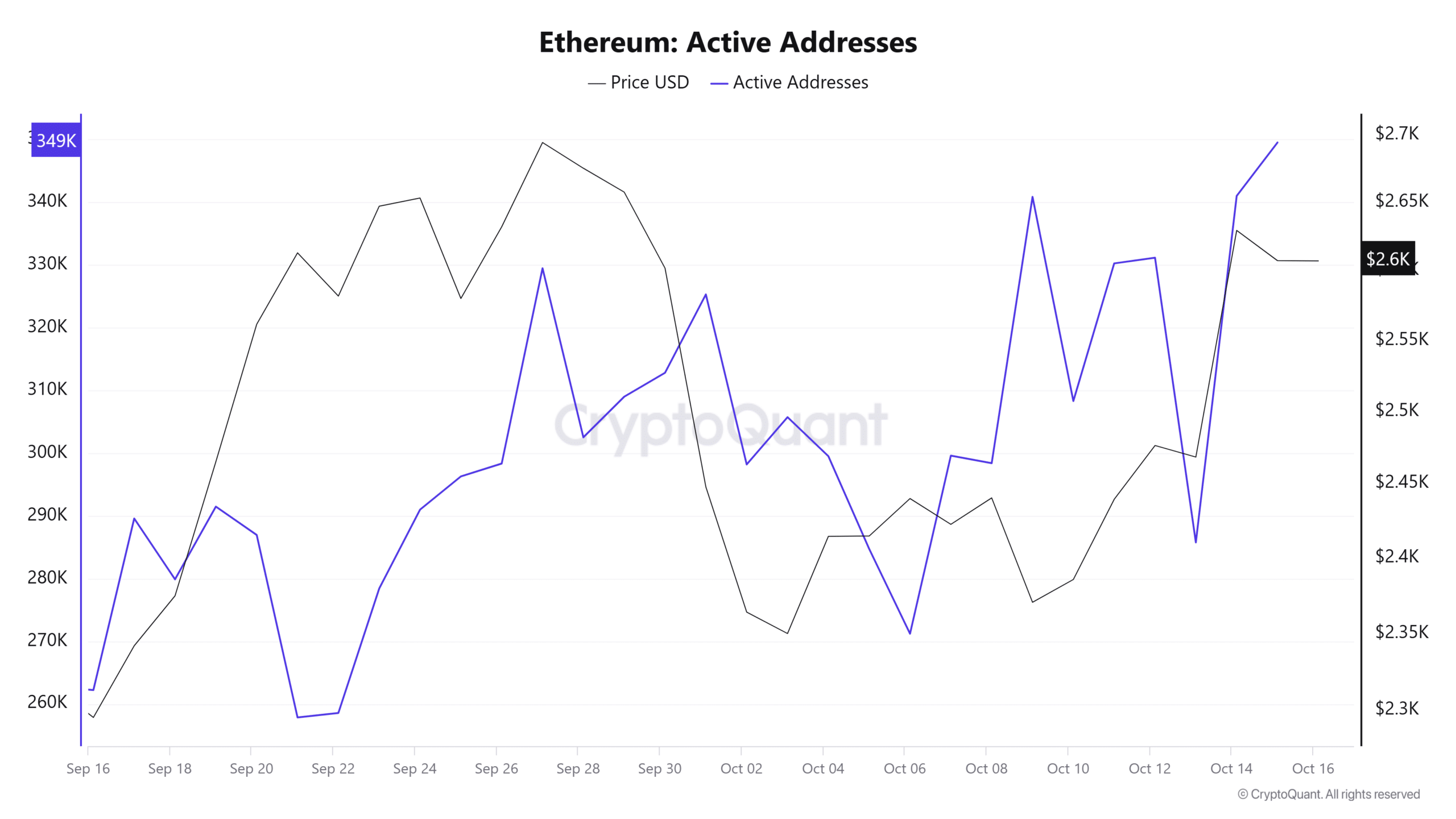

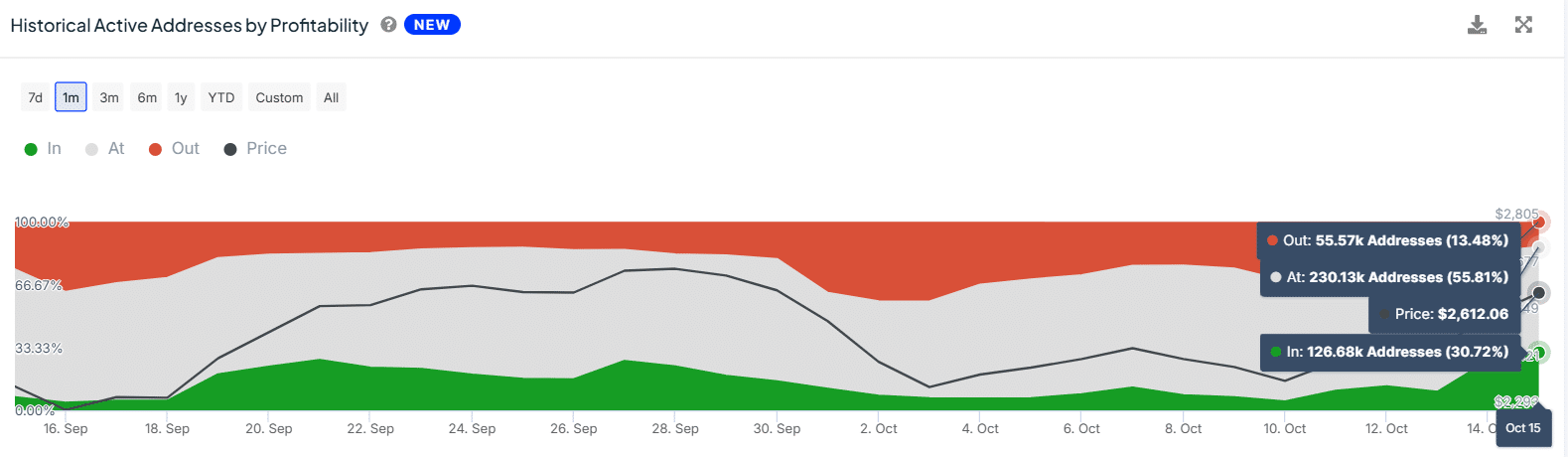

Active addresses show bullish signs

On October 15th, the number of active Ethereum addresses peaked at a one-month high, reaching 349,507 – a sign that could indicate increased interest in Ether or heightened network activity.

The increase in these addresses also coincided with rising profitability.

Read Ethereum’s [ETH] Price Prediction 2024–2025

According to IntoTheBlock’s data analysis, we’ve seen a surge in the number of daily users making profits recently, with this figure reaching an impressive 30% – the highest it has been in the last one month.

At the same time, the daily active Ethereum addresses in losses have dropped to 13%.

Read More

- Gold Rate Forecast

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- PI PREDICTION. PI cryptocurrency

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Rick and Morty Season 8: Release Date SHOCK!

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Masters Toronto 2025: Everything You Need to Know

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

2024-10-17 00:08