- Ethereum has plunged 12% this week, mirroring the broader struggle as altcoins face double-digit losses.

- Its recovery now hinges more than ever on a wider market rebound.

After the election, Ethereum[ETH] saw significant gains, but it has since shed more than half of those post-election increases, finding itself in a tense struggle for dominance.

In light of Bitcoin‘s ongoing consolidation not triggering a significant breakout, investors seem to be adopting a more cautious approach. Therefore, considering the present situation, should one practice prudence or grab the chance?

The scale is tipping in favor of…

Historically, when Bitcoin’s growth slowed down, it was often a signal that altcoin seasons were starting – but not this time around. Most of the top 10 high-cap altcoins (excluding stablecoins), accounting for 70%, have experienced double-digit losses in just one week.

Just like other cryptocurrencies, Ethereum hasn’t been exempt from the recent downturn, experiencing a 12% drop over the past week. This decline can partly be attributed to robust U.S. economic data. Furthermore, the ETH/BTC pair has reached new daily lows, suggesting that Ethereum’s potential recovery may hinge on a broader market rebound.

The stress doesn’t let up, as it appears whales have faced some challenges, selling off 10,070 Ether at approximately $3,280 each, resulting in a significant loss of one million dollars. This action caused Ether to dip by 1.15%, with its current price standing at $3,227 as we speak. However, it’s important to note that the risks have never been greater.

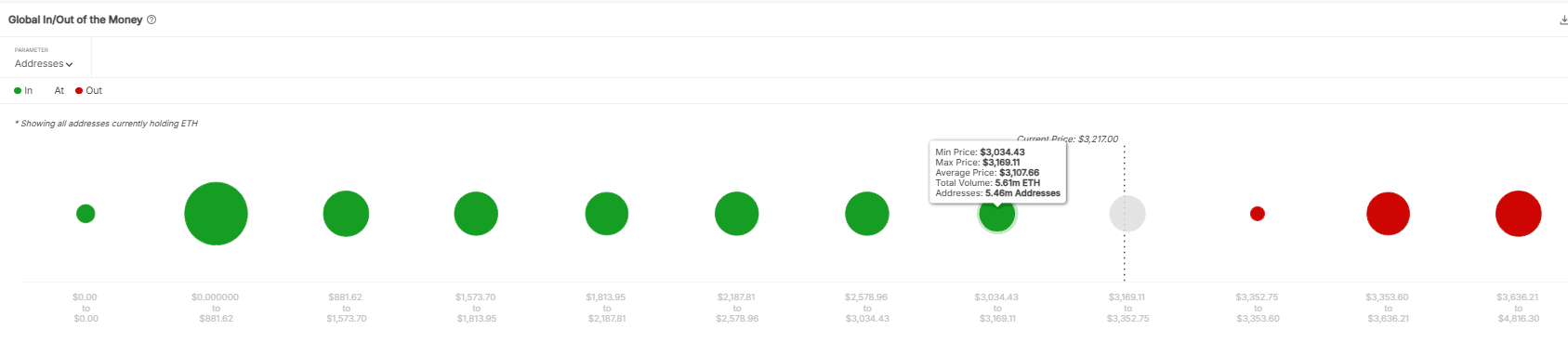

As an analyst, I’m observing a potential continued capitulation in the Ethereum market. If this trend persists, Ethereum could dip down to approximately $3,169. This price point is significant because it represents a level where approximately 5.46 million wallets have previously purchased around 5.61 million Ether.

The decision taken by these long-term investors (HODLers) could significantly impact Ethereum’s future direction. They face a critical choice: hold onto their assets in anticipation of a market recovery or sell now to avoid potential losses from another market downturn.

Will Ethereum whales take the risk?

Making this choice requires a mix of psychological insights and statistical analysis. As a matter of fact, the current Ethereum (ETH) value remains 33% higher than what it was after the election, a level that historically has functioned as robust support.

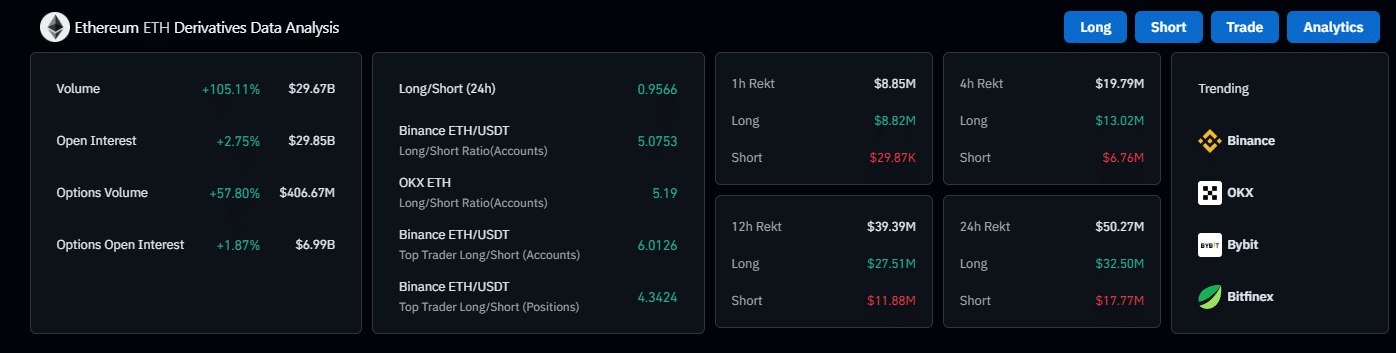

Furthermore, there’s a significant surge in the activity on futures markets. The volume of derivatives has increased by an impressive 105%, and Open Interest (OI) is up by 2%.

However, it’s not just this factor at work – investors are anticipating a reoccurrence of the Q4 pattern, aiming for another ‘Trump rally.’ Undeniably, the psychological drive is present, but will it be sufficient? As per AMBCrypto’s analysis, a definite ‘Yes’ remains elusive.

Read Ethereum’s [ETH] Price Prediction 2025–2026

What’s causing this doubt? With key players becoming less certain, it might diminish the “Fear of Missing Out” (FOMO), potentially dampening the present market enthusiasm. Meanwhile, retail and institutional investors haven’t returned in full force yet, and there’s a lot of apprehension around.

Contrary to how Ethereum surged up to $4K following a previous Trump rally, a comparable surge now seems less and less probable. Even with the “Trump boost,” it may not have sufficient power to initiate a robust comeback for Ethereum.

Essentially, it’s important to be careful at this moment as Ethereum’s recovery strongly depends on the overall market recovery. The enthusiasm about the possible Trump effect is appealing, but it’s vital to avoid being carried away by the excitement and make informed decisions instead.

Read More

- PI PREDICTION. PI cryptocurrency

- WCT PREDICTION. WCT cryptocurrency

- Florence Pugh’s Bold Shoulder Look Is Turning Heads Again—Are Deltoids the New Red Carpet Accessory?

- Quick Guide: Finding Garlic in Oblivion Remastered

- BLUR PREDICTION. BLUR cryptocurrency

- How to Get to Frostcrag Spire in Oblivion Remastered

- Katy Perry Shares NSFW Confession on Orlando Bloom’s “Magic Stick”

- How Michael Saylor Plans to Create a Bitcoin Empire Bigger Than Your Wildest Dreams

- Disney Quietly Removes Major DEI Initiatives from SEC Filing

- Unforgettable Deaths in Middle-earth: Lord of the Rings’ Most Memorable Kills Ranked

2025-01-13 13:11