- Helium’s record data revenue and increased token burns were driving bullish momentum at press time.

- Technical and on-chain metrics suggested room for further growth, but resistance seemed near.

As a seasoned crypto investor with over a decade of experience under my belt, I’ve seen my fair share of market fluctuations and trends. The current bullish momentum surrounding Helium [HNT] is certainly intriguing, and here’s why.

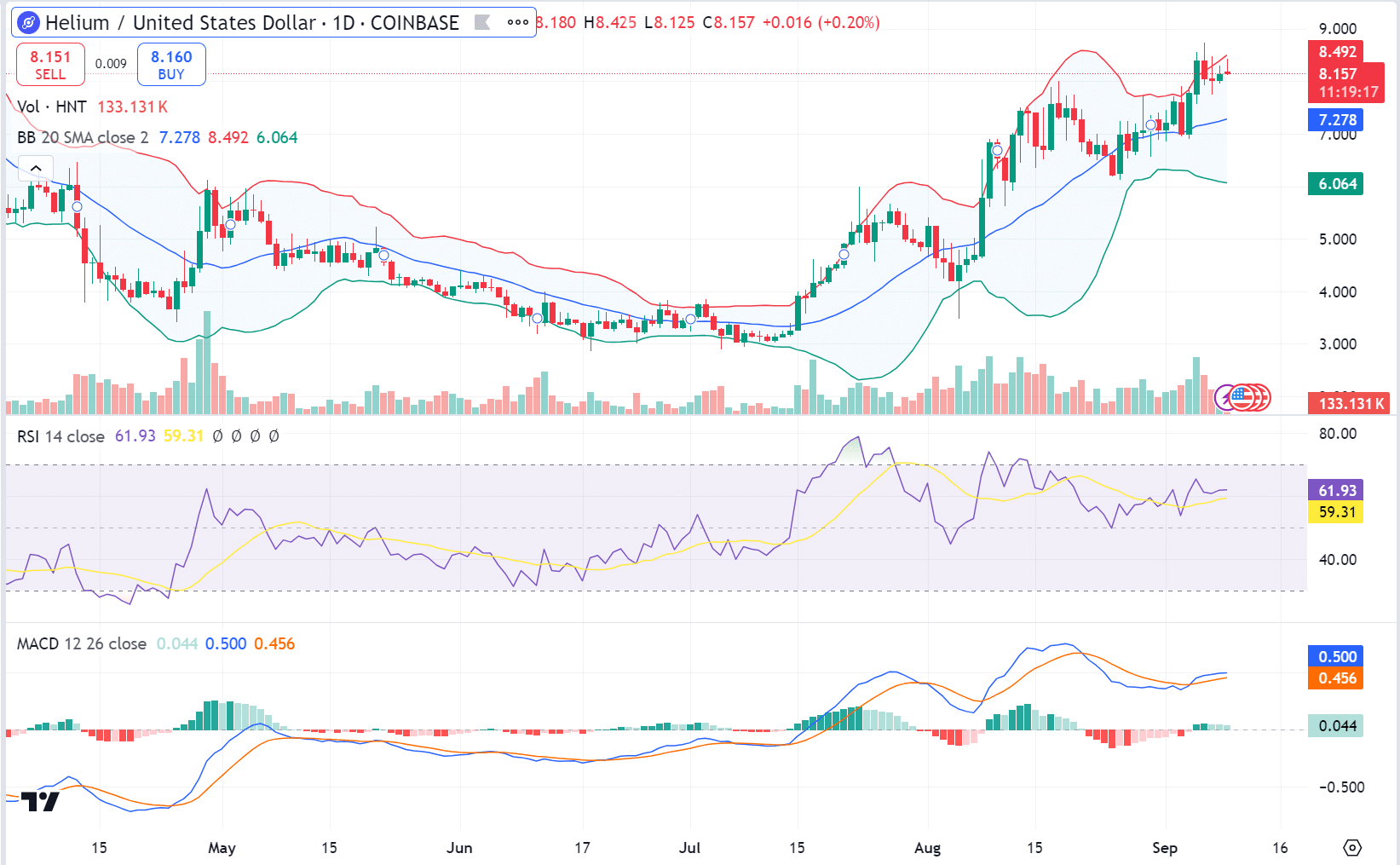

At the moment, Helium (HNT) is valued at $8.16, marking a modest 0.2% increase over the past day. This growth can be attributed to robust data earnings and an uptick in token destruction.

The growing reliance on mobile and IoT services over the Helium network has significantly influenced both the availability of tokens and their market trends.

This examination aims to determine, by analyzing both technical and blockchain data, whether it’s probable that the current bullish pattern will continue.

What’s driving HNT’s demand?

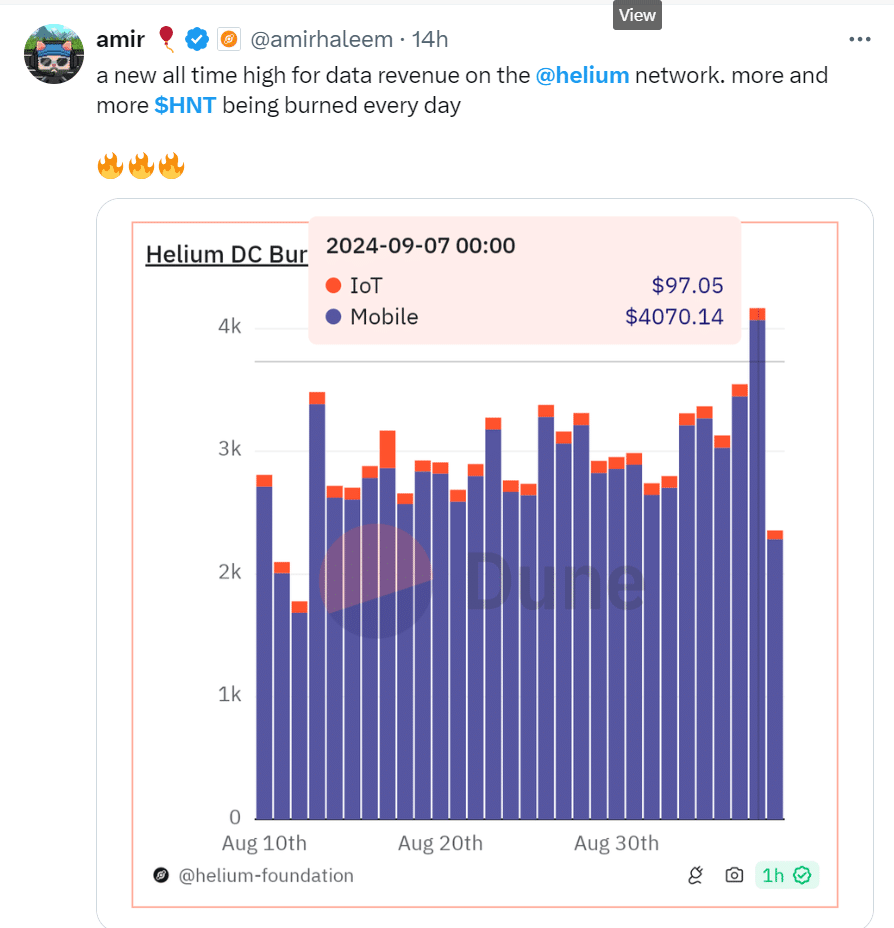

On September 7th, Helium saw a peak in daily earnings from data, with $4,070.14 generated through mobile services and an additional $97.05 from IoT services.

Due to the functioning of the Helium network, an increase in the amount of HNT getting destroyed occurs because HNT tokens are used to generate data credits (DC).

Over the past day, approximately 9.6 million DC have been destroyed, suggesting a reduction in the total amount of $HNT currently circulating.

Notably, Amir Haleem, our innovative founder, highlighted another milestone in a recent post on his platform (previously known as Twitter). He underscored that the regular increase in token burns was due to the expanding use of our network, reflecting its growing popularity.

As the usage of the network grows, causing a rise in consumption and thus faster depletion of resources, this aligns with the built-in deflationary nature of the Helium Network Token (HNT).

Currently, approximately 7.68% of the entire Helium Network Token (HNT) supply is currently staked, thereby reducing the available supply in the market.

Technical indicators point to short-term strength

AMBCrypto’s look at Helium pointed to the currency’s positive direction.

At the moment, the Relative Strength Index (RSI) stands at 61.93 for $HNT. This implies that the asset hasn’t yet reached the oversold threshold of 70, indicating there might be more room for it to increase in value.

The MACD (Moving Average Convergence Divergence) line is currently crossing above its signal line, indicating a bullish signal, and the MACD line is positioned 0.005 higher than the signal line. This implies that the market is continuing to move in an uptrend.

However, the price is getting close to the upper Bollinger Band, which is $8.492.

In simpler terms, when an asset is close to the upper limit of the Bollinger Band, it often shows higher price fluctuations or a period of stability.

If the price cannot break through this level, there is a high possibility of pullbacks.

On-chain and sentiment contrast

According to data verified on the blockchain, the bullish argument for Helium appears to be validated. At the present moment, the network boasts over 357,000 active hotspots, which is significant because it underscores the expansion of the physical infrastructure crucial for the decentralized wireless service’s operation.

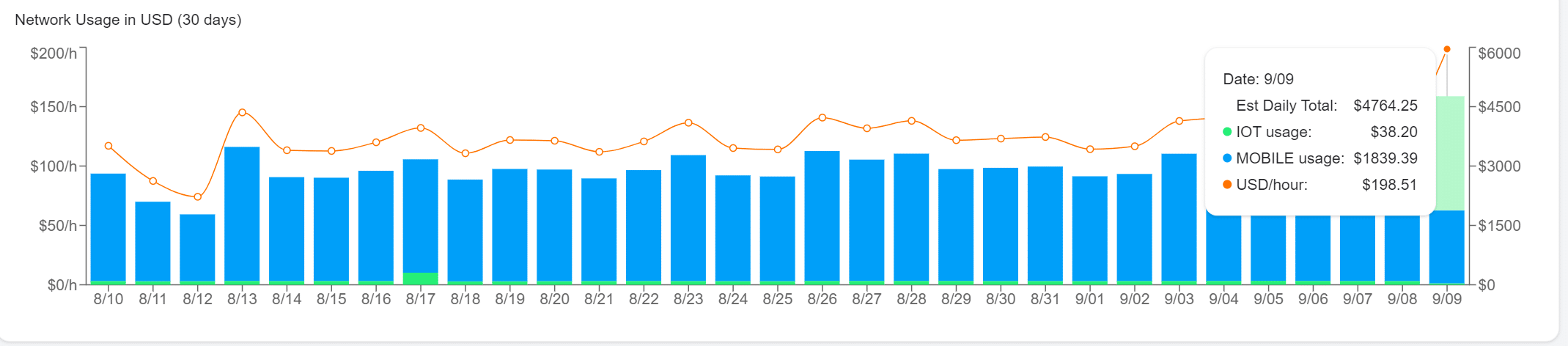

Furthermore, on the 9th of September, the total count of Helium mobile users stood at 113,250 – this represents actual user activity on their network.

On this specific day, the network generated approximately $4,764.25 as its daily income, primarily attributable to mobile and IoT usage. This activity also contributes significantly to the reduction in supply by causing token burns.

At the moment of reporting, the general sentiment towards Helium remained optimistic, as indicated by the consistent increase in network activity and an upward trend in tokens being destroyed (or “burned”). This burning process contributes to a decrease in the total supply of HNT, creating deflationary pressure.

However, investors should not be blind to other market conditions, because, even though Helium’s fundamentals are great, but broader market conditions may affect the price of HNT even as the network grows.

Sustainability of bullish momentum

Based on our examination, it’s clear that Helium’s core factors – including rising data income, token destruction, and rapid network acceptance – are robustly backing up a positive market direction in the near future.

Translating HNT into a deflationary system implies that as the network expands and sees increased usage, the quantity of $HNT coins available for circulation decreases. Consequently, due to scarcity, the value or price of each coin tends to rise over time.

In simpler terms, both the Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD) from our detailed examination suggest a continued upward trend, supporting the optimistic outlook.

Yet, keep a close eye on the potential resistance at the $8378 level within the Bollinger Band, as well as any shifts in the broader market sentiment.

Despite a positive outlook at present, sudden shifts or significant challenges in the market could cause temporary ups and downs.

Read Helium’s [HNT] Price Prediction 2024–2025

As the pace at which tokens are destroyed (token burn rate) rises, due to growing data income and an increasingly involved network community, this trend also boosts the value of $HNT.

Keeping a close eye on important resistance levels and market trends is essential for determining whether the current momentum will continue or if temporary reversals might occur.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Masters Toronto 2025: Everything You Need to Know

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

2024-09-10 13:12