- Injective has been consolidating above its 2021 all-time high.

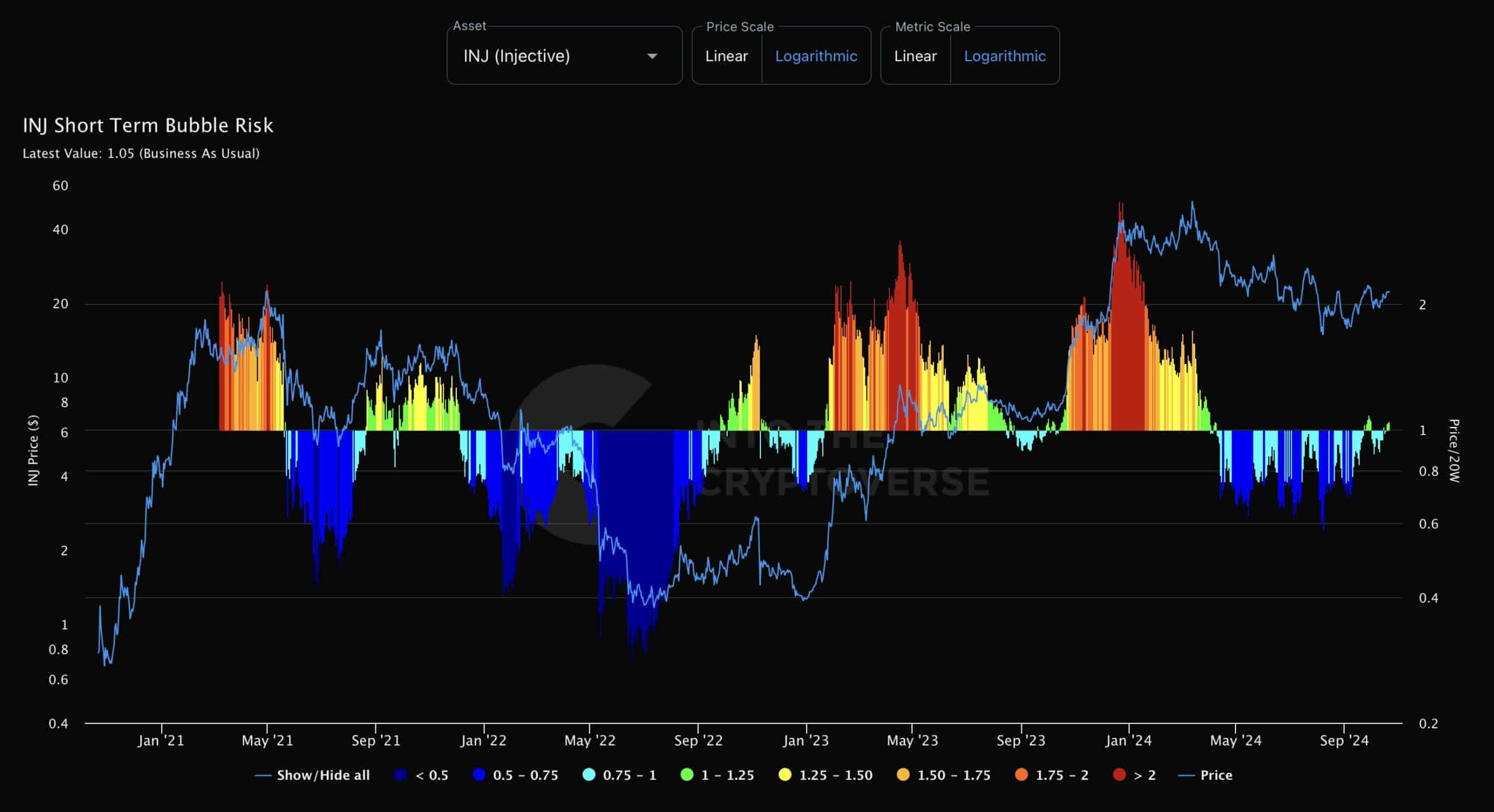

- Injective’s short-term bubble risk is looking good.

As an analyst with years of experience navigating the crypto market, I’ve seen my fair share of price fluctuations and trends. Injective [INJ] has been intriguing me lately due to its resilience amidst recent market turbulence.

😱 Trump's Tariff Bombshell Could Crush EUR/USD!

Markets on edge — read the urgent new forecasts before it’s too late!

View Urgent ForecastDespite the recent ups and downs in the market, Injective (INJ) appears resilient, managing a modest increase of approximately 0.39% over the past month, as reported by CoinMarketCap.

However, data reveals a decline of nearly 4% last seven days, after an additional 2.7% drop at the time of writing.

Even though there may be some challenges, the weekly chart for Injective shows a positive trend as it holds steady above its old record high from 2021.

If INJ moves upwards towards the $35 level and continues to hold its ground above this significant support point, it might signal a positive trend in the immediate future, boosting investor’s faith.

If INJ manages to maintain its strength above the significant $21.60 threshold, it could potentially scale up towards higher value points on the chart.

Supporters are hopeful that INJ will surpass market expectations in the upcoming year, maintaining a positive outlook.

2024 has not been particularly favorable for INJ thus far, but there’s optimism about a prolonged upward trend, with some experts forecasting a potential price surge to $100 and beyond.

The price contraction seen in the 4-hour timeframe is inching toward a decision zone.

If this resistance level is breached with force, it might initiate a quick increase of around 20-30%, paving the way for a potentially explosive growth trend towards 2025.

INJ valuation and risk

As we look at Injective’s value relative to Bitcoin (INJ/BTC), it’s clear that the coin has seen a decrease, but there are signs of a possible rebound emerging in its chart.

A double bottom formation has broken to the upside, and the price is now in a retest phase.

If INJ/BTC can regain control and maintain momentum, it could signal a bullish rally.

If the price of this cryptocurrency drops below its 2021 peak and negates the double bottom formation, I might brace myself for a possible downtrend ahead, before anticipating any potential rebound.

Injective’s short-term bubble risk indicator is also worth noting.

This metric evaluates market sentiment, and currently, the reading is at 1.05, indicating that the market sentiment remains stable.

As an analyst, I find myself growing more optimistic about potential long positions, given the current trend’s indications of possible profits.

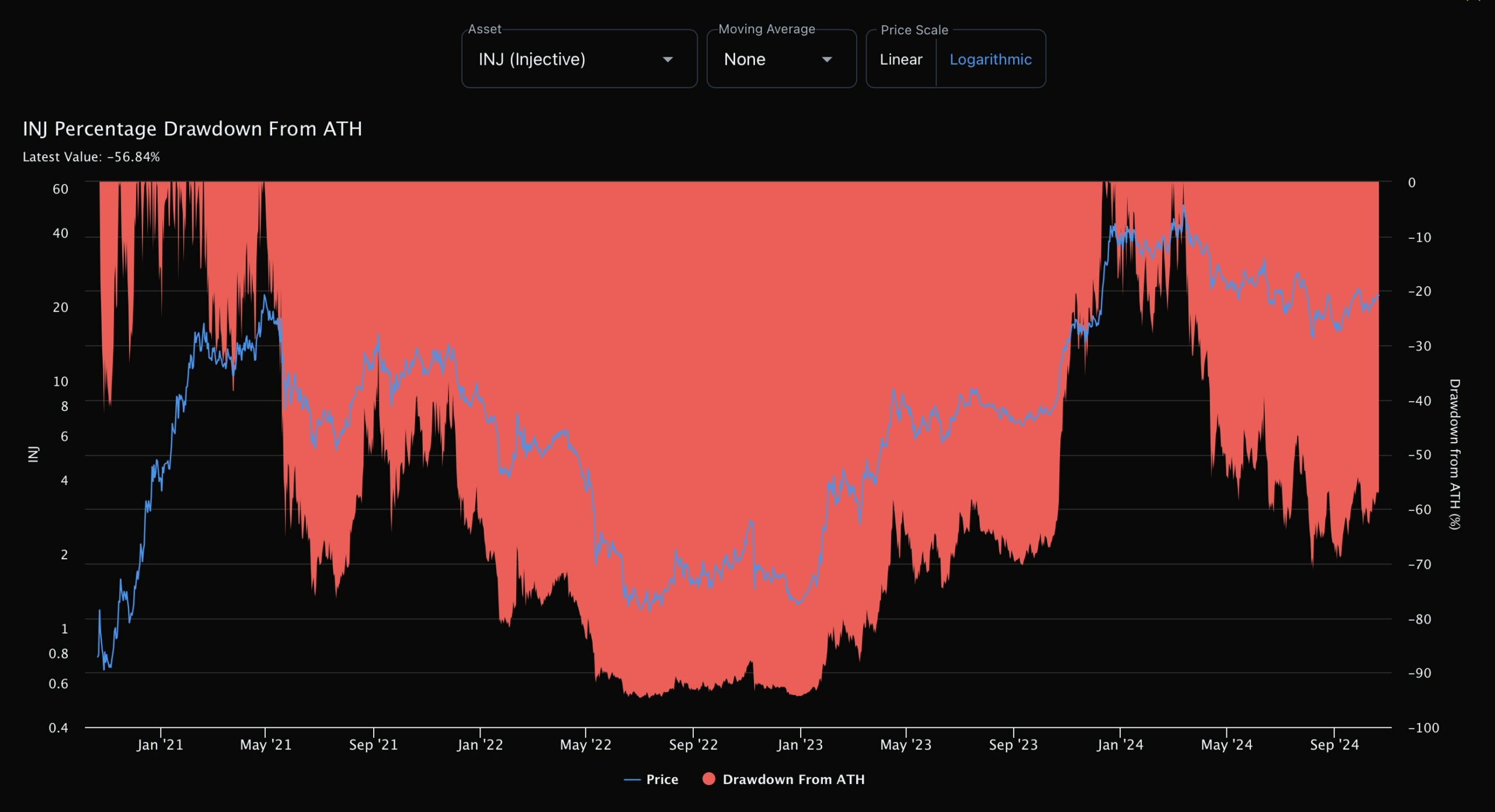

Percentage drawdown from ATH

To conclude, the current level represents a 56% drop from INJ’s record high, offering a potential chance for long-term investors to predict a future rebound.

However, given the unpredictable nature of the market, these gains are not guaranteed.

Read Injective’s [INJ] Price Prediction 2024–2025

With Bitcoin nearing the $70,000 threshold, there’s a strong possibility that this milestone could ignite a more widespread optimistic pattern throughout the cryptocurrency market, potentially boosting the value of INJ as well.

Currently, there’s a good chance that Injective will maintain its position above its 2021 peak and keep on surging. However, it’s essential for traders to stay vigilant, keeping a close eye on crucial levels for the best possible moments to enter or exit the market.

Read More

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Gold Rate Forecast

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- The Lowdown on Labubu: What to Know About the Viral Toy

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

2024-10-23 03:04