-

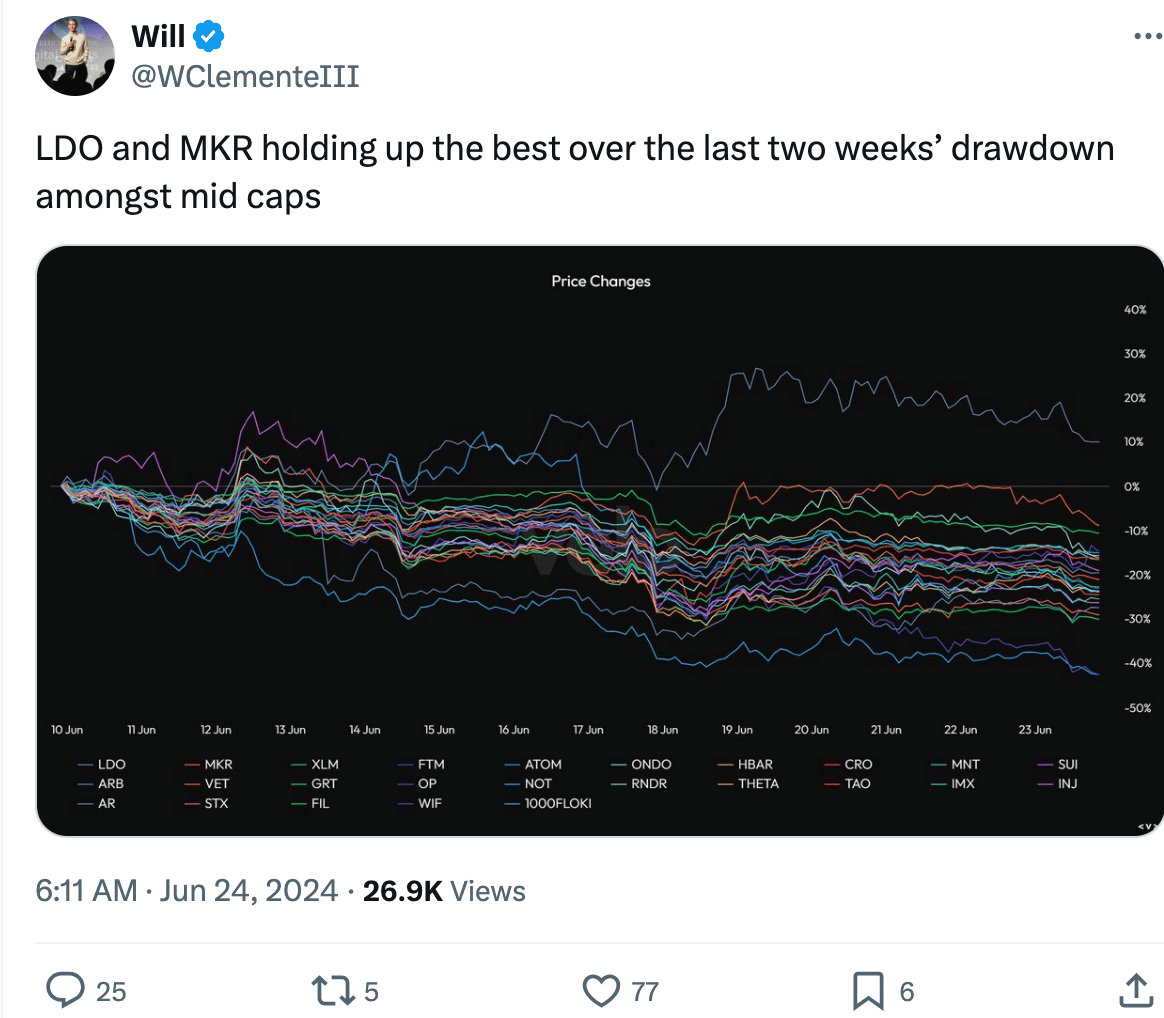

LDO and MKR show relatively positive price movement despite the market drawdown over the last two weeks.

New addresses exhibited interest in MKR, however, LDO failed to garner the same attention.

As a seasoned crypto investor with a keen interest in the DeFi sector, I’ve been closely monitoring the price movements of LDO and MKR amidst the recent market drawdowns. Based on my analysis of the available data and market trends, I believe that both tokens have shown relatively positive price movement compared to other mid-cap tokens, but their performances took a bearish turn over the past 24 hours.

Lido [LDO] and MakerDAO[MKR] have been the most dominant protocols in the DeFi sector.

LDO and MKR remain afloat

In simpler terms, the prices of these tokens have held up better than many other mid-sized tokens during the past two weeks due to the effectiveness of their protocols and the generally positive public perception surrounding them.

However, the performances of LDO and MKR took a bearish turn over the past 24 hours.

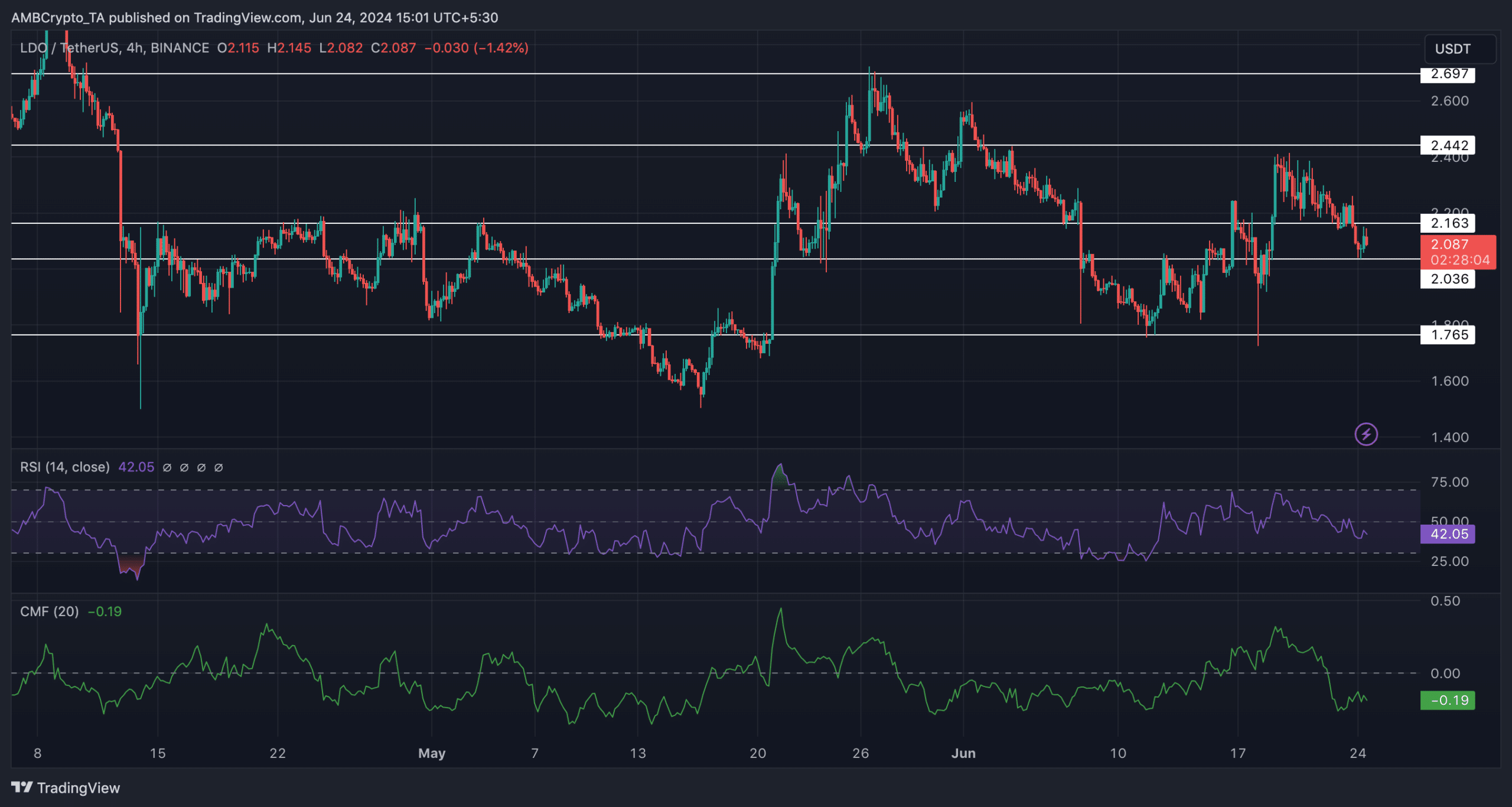

I’ve observed that as of now, LDO was priced at $2.10 on the market. Unfortunately, its value had dropped by a significant 3.92% over the past 24 hours. However, there has been a noteworthy increase in LDO’s price since May 16th, with a substantial surge of approximately 38%.

During this time frame, despite a notable increase in LDO‘s price, no clear bullish or bearish market trend was set.

Over the past few days, the RSI (Relative Strength Index) for LDO experienced a significant decrease, signaling that the bullish energy surrounding LDO may be weakening.

Additionally, the Chaikin Money Flow (CMF) indicator for the token has dropped, implying a decrease in the inflow of capital.

As a researcher examining the data on LDO‘s performance, I’ve identified several factors that indicate a need for patience when it comes to expecting a swift recovery for this investment strategy in the short term. While LDO has demonstrated impressive long-term gains, these elements suggest that some setbacks may be in store before we see significant progress again.

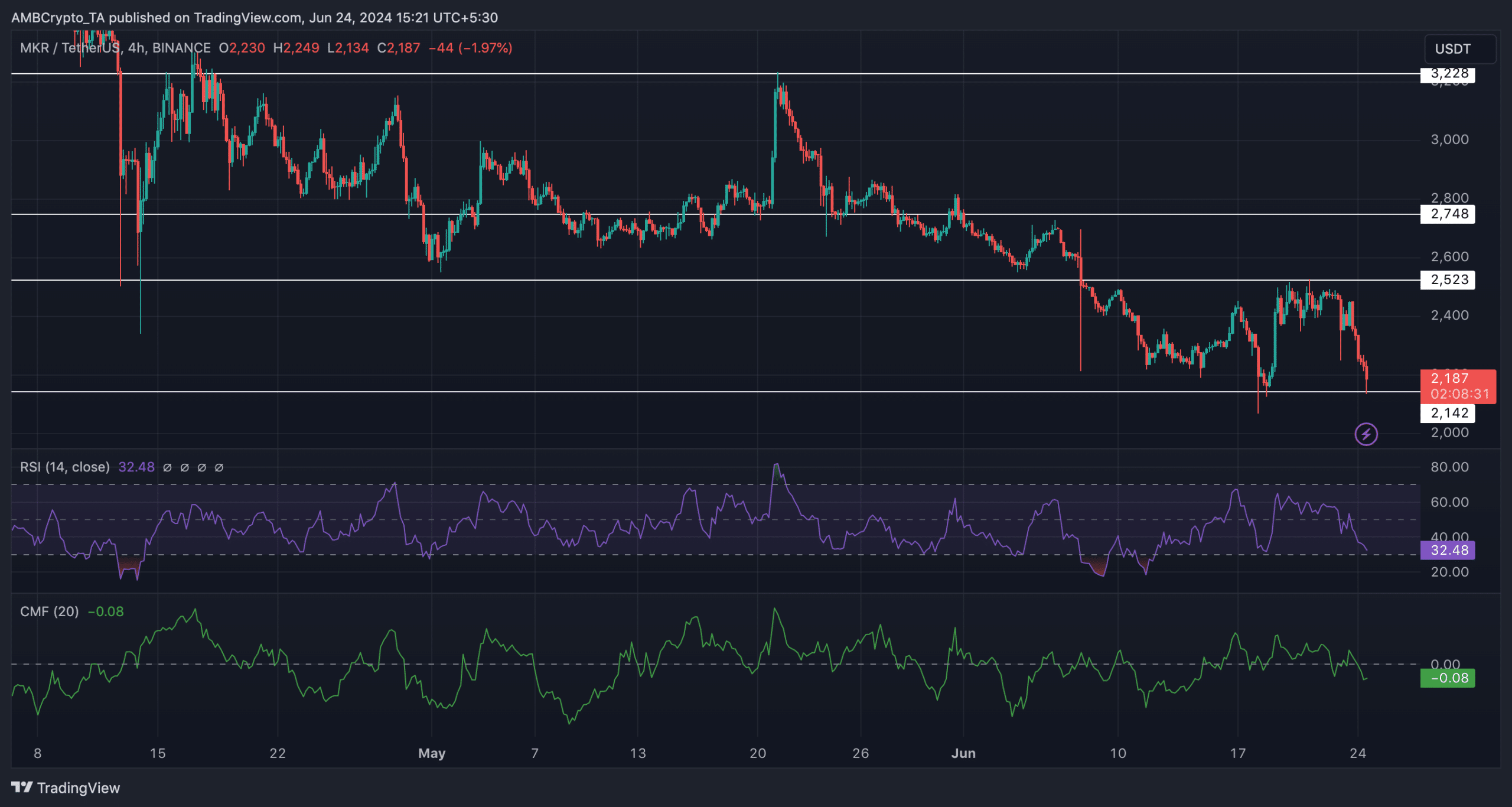

MKR, on the other hand faced more fury from the bears.

Over the past day, MKR‘s token price dropped by nearly 10%. This decrease is an extension of a larger downward trend that started on May 21st. The price movements during this time have exhibited progressively lower lows and highs, suggesting a bearish market for MKR.

As a crypto investor, I’ve noticed that both the Relative Strength Index (RSI) and the Chaikin Money Flow (CMF) for Maker (MKR) have taken a downturn recently. The falling RSI reading suggests that the bullish momentum has weakened, while the decreasing CMF indicates a decline in money flow into the asset.

As a analyst, I’ve observed that MKR held up better than many other tokens during market downturns. However, based on current trends and market conditions, I anticipate a bearish outlook for this altcoin in the near future.

Realistic or not, here’s LDO’s market cap in BTC’s terms

Divergence in holder behaviour

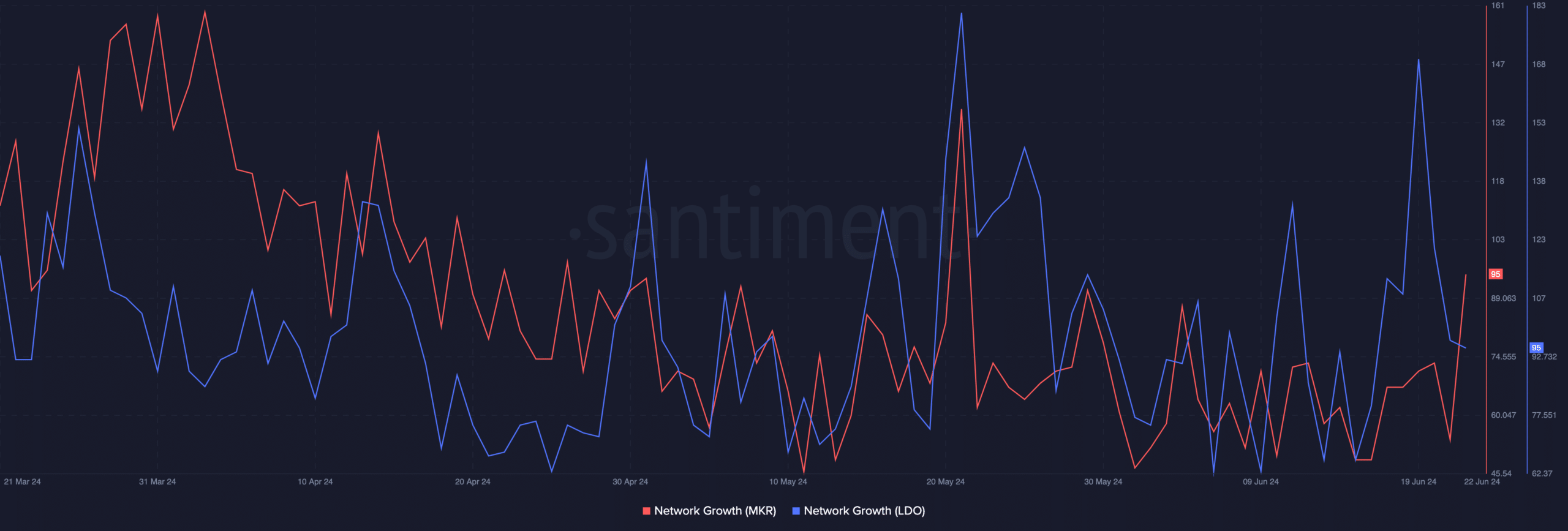

As a researcher observing the dynamics of MKR‘s network, I’ve noticed a significant increase in the number of new addresses engaging with the token, indicating growing interest and potential adoption.

In recent times, both the expansion of LDO‘s network and the value of its price have taken a downturn.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

2024-06-25 05:11