- LDO is nearing its $1.33 resistance, but low volatility and overbought RSI may limit gains.

- Open interest is rising, but daily active addresses decline, signaling potential hurdles ahead.

As a seasoned crypto investor with a knack for spotting trends and interpreting market signals, I find myself intrigued by Lido DAO‘s [LDO] current situation. The token is poised to breach its critical resistance at $1.33, but the low volatility and overbought RSI are causing me a bit of concern.

Lido DAO’s Simple DVT Module has been busy fostering growth, now boasting more than 2,250 validators and safeguarding approximately 72,000 ETH. At present, the platform is deliberating on substantial updates, including the integration of Bolt and improving the Distributed Validator Voting (DVV) system.

Currently, LDO is being traded at $1.16 and has seen a 4.24% increase over the past day. But, it’s worth considering whether these updates will help LDO surpass its significant resistance point of $1.33.

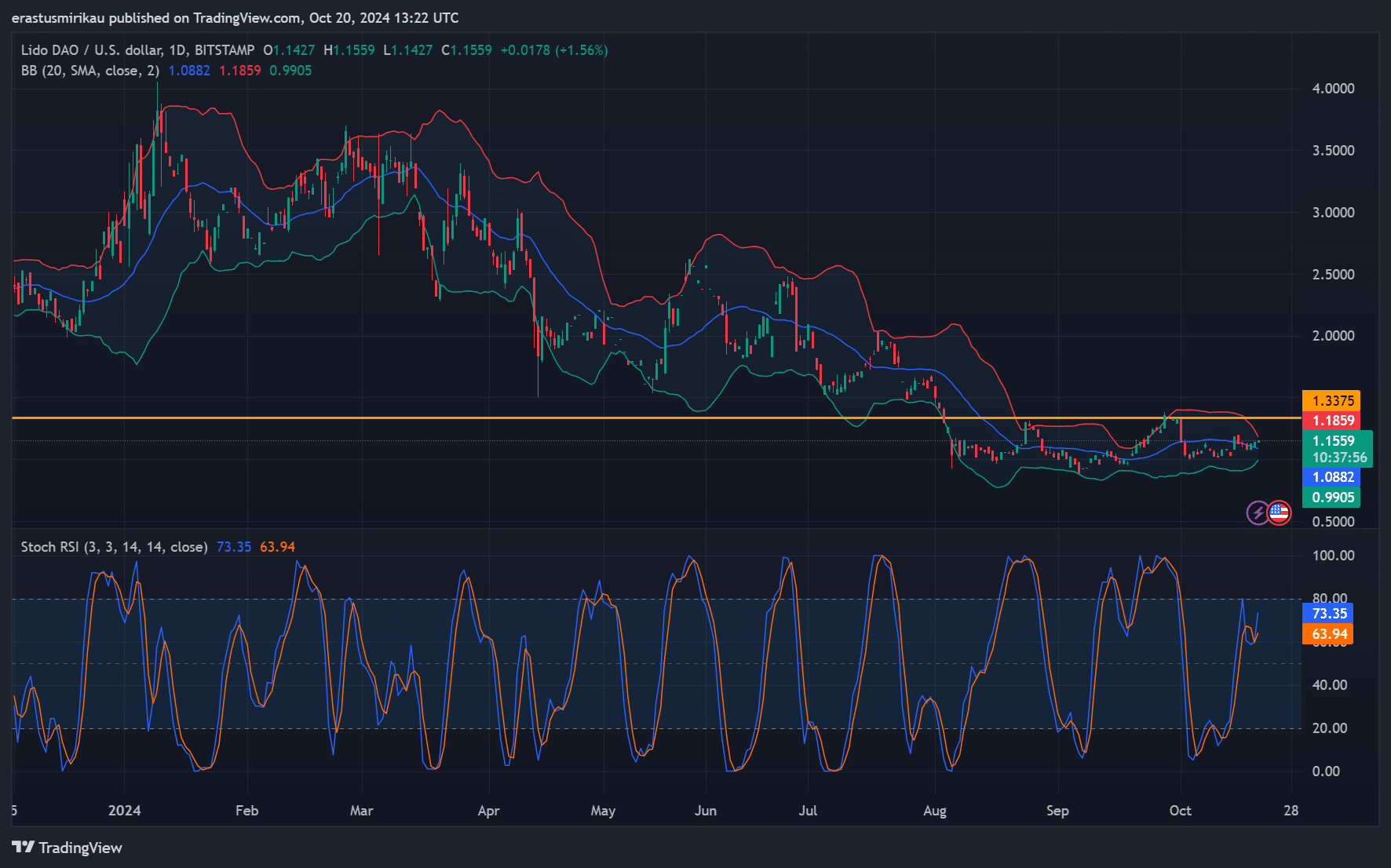

LDO chart analysis: Will resistance at $1.33 continue to hold?

Lido DAO is getting close to a significant resistance point around $1.33, and the latest market fluctuations have piqued curiosity. The Bollinger Bands hint at continued low volatility, indicating a period of consolidation.

However, the Stochastic RSI points to overbought conditions, raising the possibility of a near-term pullback. Support is evident around $1.08, but Lido DAO will need significant bullish activity to break through $1.33.

Consequently, traders are carefully observing to ascertain if this resistance level will be maintained or if the token’s strength will propel it upward further.

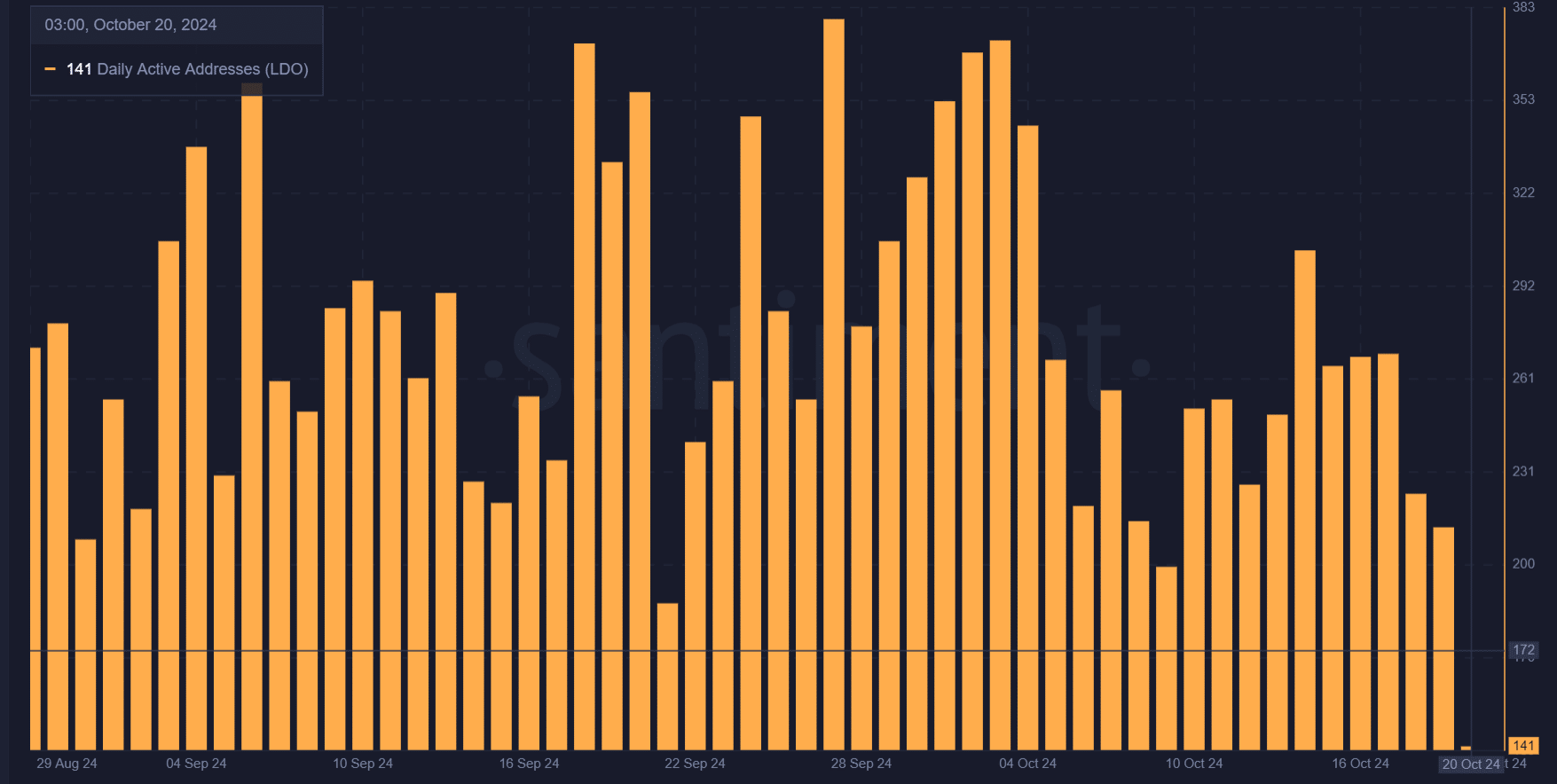

Daily active addresses decline: A concern for LDO?

Despite Lido’s impressive technological progress, the drop in the number of daily active users is something to be mindful of. In fact, the number of active addresses has decreased from 213 to 141, suggesting a decline in user interaction.

As a result, the decrease in on-chain activity may restrict Lido DAO from surpassing the resistance at $1.33. This downturn might imply that Lido’s recent updates haven’t yet attracted much interest from the wider market.

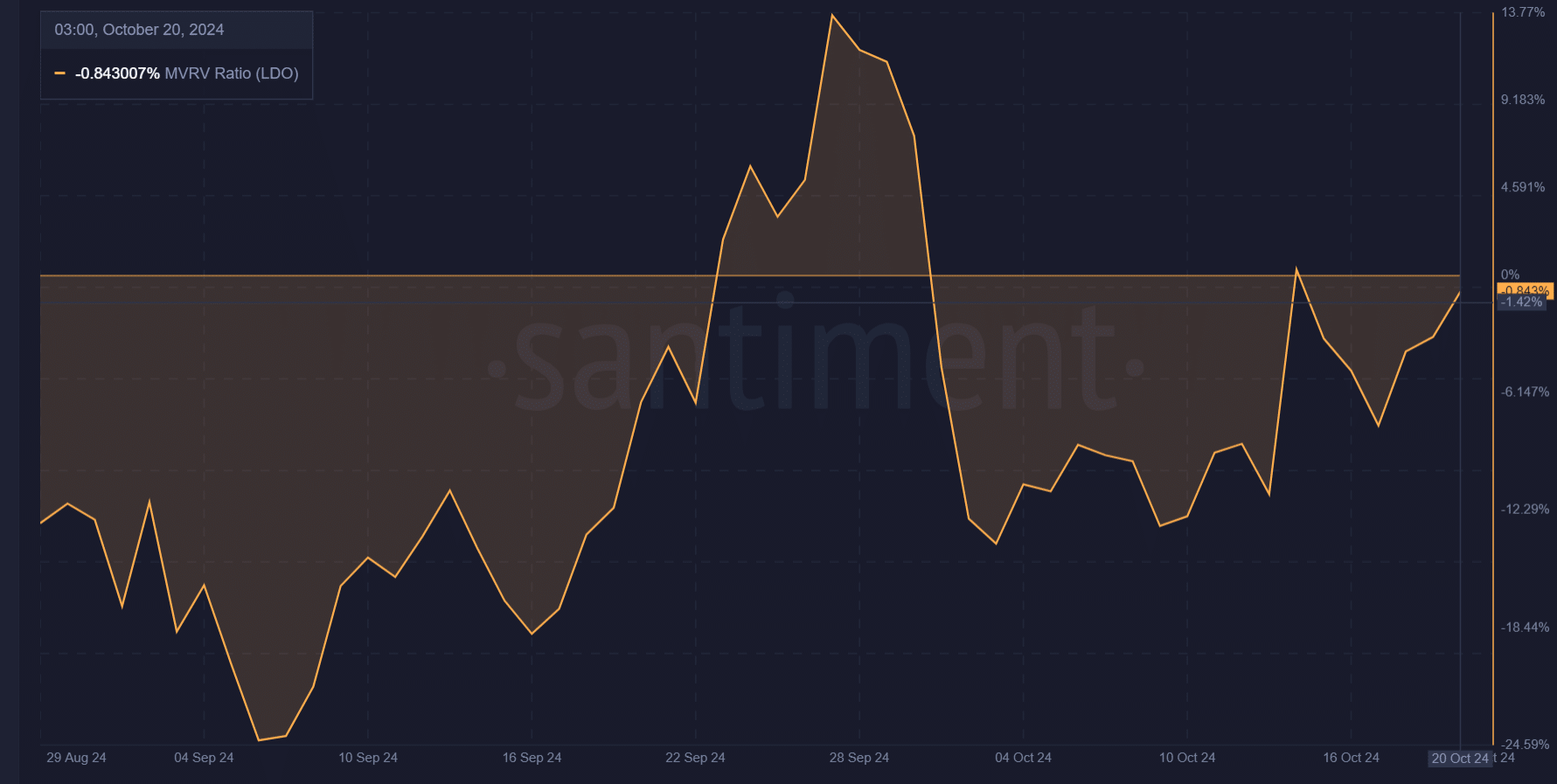

MVRV ratio: What does it mean for LDO‘s price action?

The MVRV ratio, which currently stands at -0.84%, reveals that most investors are holding LDO at a loss. Therefore, there may be less incentive for holders to sell, potentially supporting the price in the short term.

If the MVRM (Moving Average of Realized Value to Market Value Ratio) flips positive, there might be an increase in selling as investors realize profits. This trend could potentially apply downward pressure on the token. Consequently, the MVRM ratio becomes a vital aspect to consider when deciding if LDO can maintain its bullish trend and surpass the $1.33 resistance level.

Open interest rises: Growing trader confidence

The interest in Lido DAO has grown by 1.98%, reaching a total of $64.9 million. This upward trend suggests that traders are gaining more faith in the platform, with an increase in the number of active positions being established.

To result in an upward breakthrough, the volume should also increase. As a result, we’ll keep a close eye on rising open interest to determine whether it propels LDO towards a breakout above $1.33 or leads to another rejection at that price point.

Read Lido DAO’s [LDO] Price Prediction 2023-24

The advancements being made by Lido DAO look hopeful, yet they face difficulties due to a decrease in daily active users and an overbought condition indicated by the Stochastic RSI.

Despite a hint of optimism from rising open interest and MVRV ratio, successfully breaching the $1.33 barrier calls for consistent effort and substantial trading volume.

Read More

- WCT PREDICTION. WCT cryptocurrency

- LPT PREDICTION. LPT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- The Bachelor’s Ben Higgins and Jessica Clarke Welcome Baby Girl with Heartfelt Instagram Post

- Chrishell Stause’s Dig at Ex-Husband Justin Hartley Sparks Backlash

- SOL PREDICTION. SOL cryptocurrency

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- New Mickey 17 Trailer Highlights Robert Pattinson in the Sci-Fi “Masterpiece”

- Shrek Fans Have Mixed Feelings About New Shrek 5 Character Designs (And There’s A Good Reason)

2024-10-21 10:15