- Bullish sentiment around Chainlink rose on the back of Bitcoin’s halving

- Buying pressure was high, hinting at a sustained price hike

Chainlink (LINK) experienced a strong rebound in the past few hours, with its price surging due to renewed bullishness on the cryptocurrency market. This development occurred following Bitcoin’s (BTC) fourth halving event. It would be interesting to examine LINK’s current situation to determine whether the upward trend was driven by the excitement surrounding the halving or if underlying metrics played a role in its growth.

Chainlink turns bullish

Many cryptocurrencies, including LINK, experienced a decline in value over the past week, with LINK losing more than 9%. But following Bitcoin’s halving event, there has been a shift in the market mood, leading to a surge of optimism among investors.

The price of LINK‘s token rose by 4% within a day, causing it to impact the platform as well. At present, Chainlink is being exchanged for $13.98 per token and boasts a market value exceeding $8.2 billion.

Although the cost increase took place, more than 43% of LINK investors experienced losses based on IntoTheBlock’s latest information. Nevertheless, it’s worth noting that LINK may recover soon since it appeared to rebound from a significant support level.

A well-known cryptocurrency analyst, World Of Charts, recently posted on Twitter about the rising trend of LINK in relation to Bitcoin. This indication suggests that LINK’s value may continue to increase steadily.

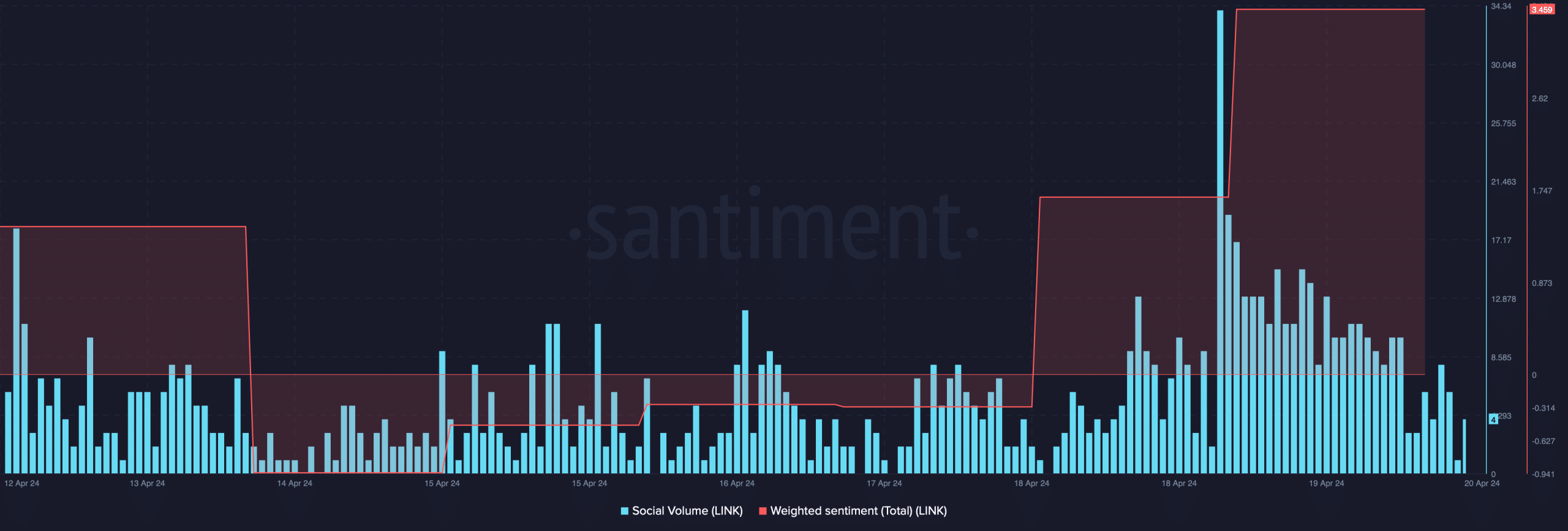

According to AMBCrypto’s interpretation of Santiment’s findings, investor trust in LINK increased significantly, as indicated by a surge in its weighted sentiment. Furthermore, the token gained popularity within the cryptocurrency community, resulting in an uptick in social volume.

LINK’s rally to last longer

After examining LINK‘s statistical data, AMBCrypto determined if the token’s price surge would persist. Our investigation revealed an uptick in purchasing activity for the token, indicating a positive trend.

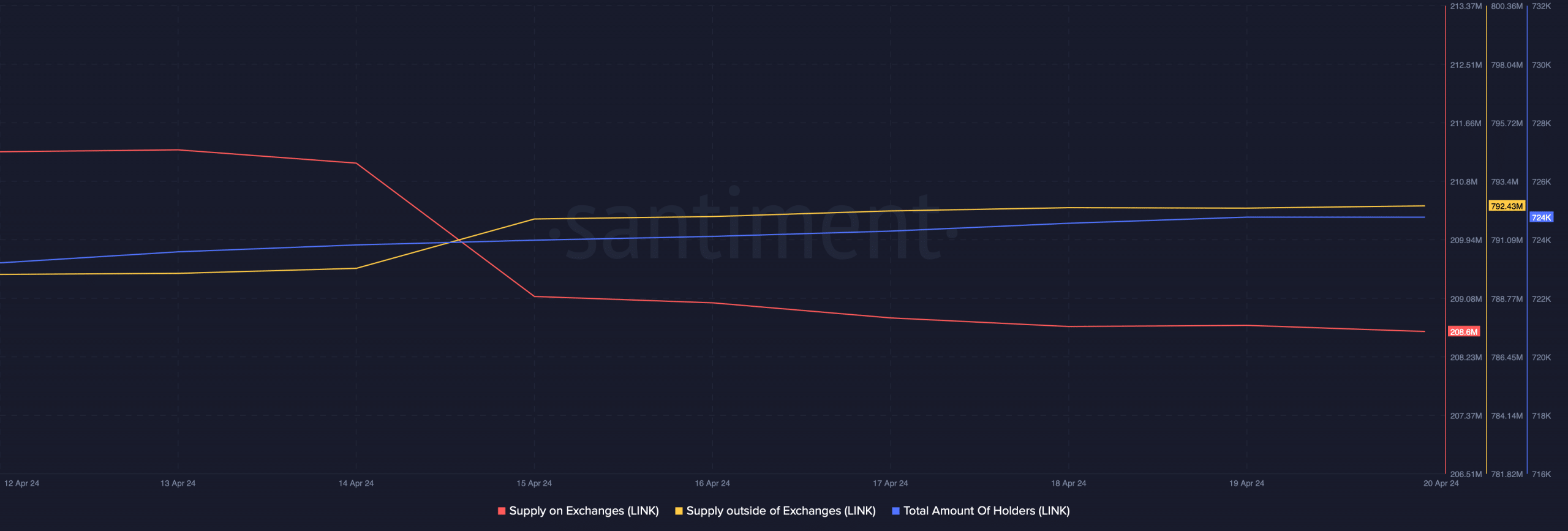

Over the past week, the quantity of Chainlink (LINK) held on exchanges decreased, whereas the amount off-exchange increased. This trend suggests that investors are buying and holding more LINK rather than selling it on the markets. Furthermore, there has been a notable rise in the total number of LINK holders during this period.

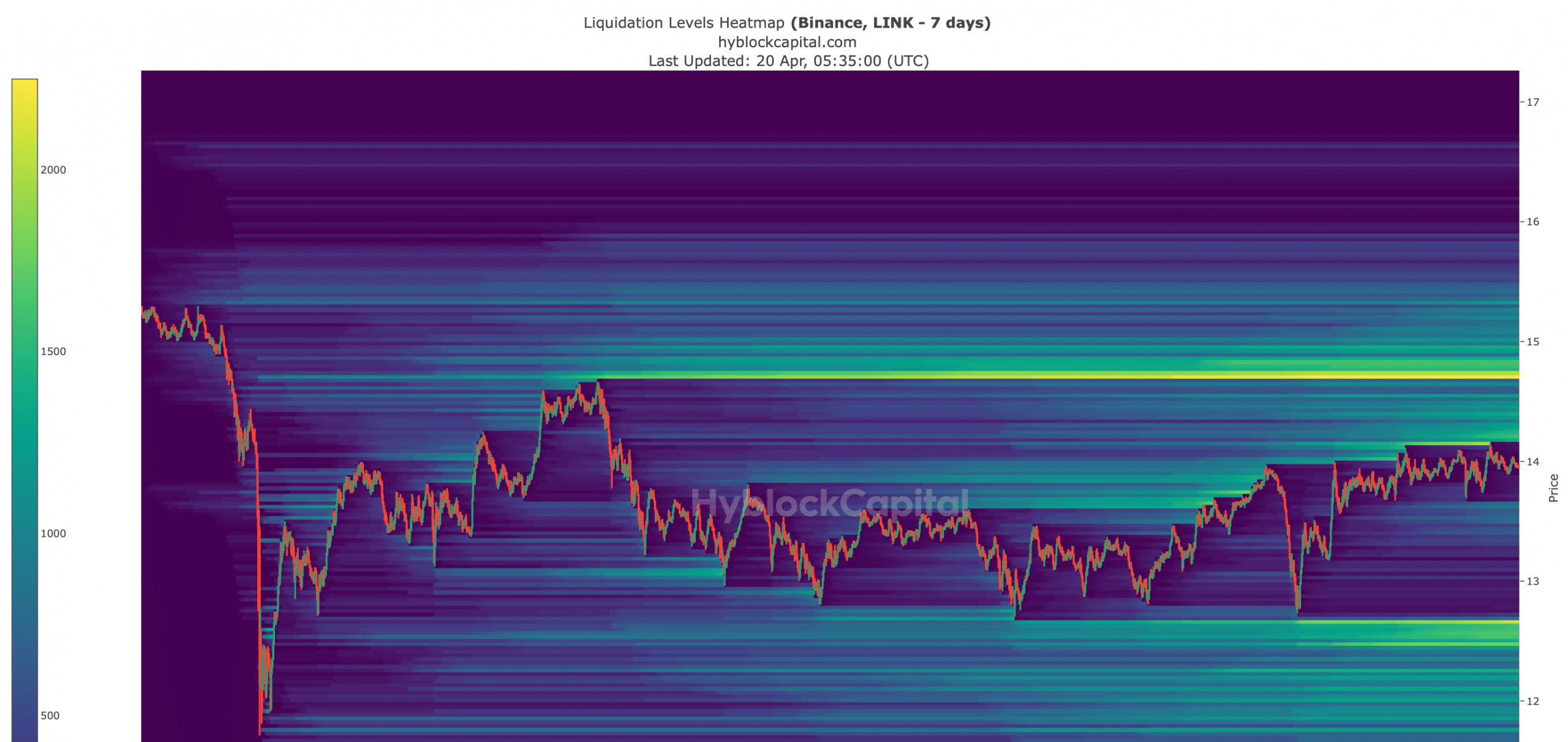

Based on our examination of Hyblock Capital’s figures, it’s essential for Chainlink to surpass $14.7 for a sustained bull run. Once it reaches this threshold, the token’s liquidation price will significantly increase, potentially obstructing its advancement.

A successful breakout above $14.7 could easily result in LINK reclaiming the $15-level.

Read Chainlink’s [LINK] Price Prediction 2024-25

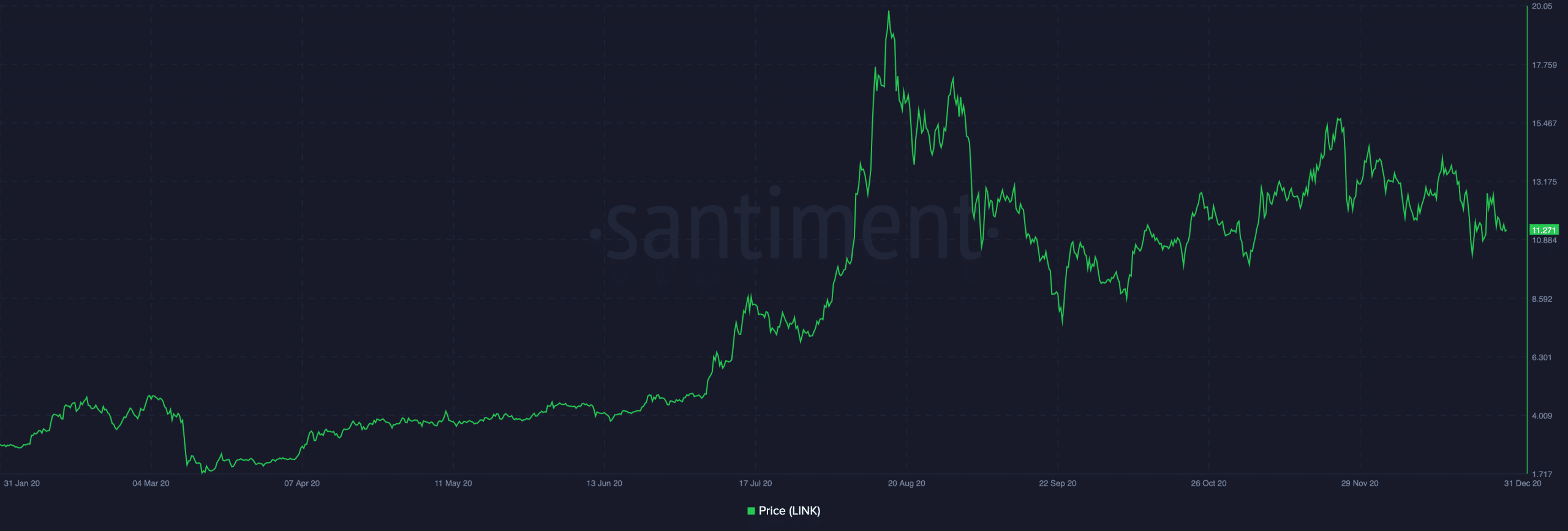

Here, it’s worth looking at historical references too.

In the past Bitcoin halving, which occurred in 2020, LINK displayed a response analogous to its current behavior. The token’s price experienced a surge in bullish energy and reached a new record high within only two months. Consequently, it is recommended that investors closely monitor LINK’s progress over the upcoming weeks.

Read More

- LDO PREDICTION. LDO cryptocurrency

- JASMY PREDICTION. JASMY cryptocurrency

- Can Ethereum ETFs outperform Bitcoin ETFs – Yes or No?

- Chainlink to $20, when? Why analysts are positive about LINK’s future

- Citi analysts upgrade Coinbase stock to ‘BUY’ after +30% rally projection

- Why iShares’ Bitcoin Trust stock surged 13% in 5 days, and what’s ahead

- Spot Solana ETF approvals – Closer than you think?

- Orca crypto price prediction: Buying opportunity ahead, or bull trap?

- Top 10 Stocks and Crypto Robinhood Alternatives & Competitors

- ‘China’s going to have it’ – Donald Trump crypto stance, finally explained

2024-04-20 20:07