- Chainlink’s exchange supply ratio gradually rose to a one-month high as wallet profitability climbed

- Open interest surged to its highest level since April too

As a seasoned researcher with years of experience navigating the cryptocurrency market, I can confidently say that the recent surge in Chainlink (LINK) is nothing short of remarkable. The token’s impressive 52% monthly gain and current trading price at $18.63 are testaments to its robust performance. However, while these gains have undeniably stirred profit-taking activities, as evidenced by the rising exchange supply ratio, it’s the surge in wallet profitability that has truly caught my attention.

During November, Chainlink (LINK) along with many other altcoins experienced substantial growth. At the moment of reporting, Chainlink was being traded at $18.63. Intriguingly, it saw a rise of approximately 5% in just the past day, resulting in its monthly gains exceeding an impressive 52%.

It appears that these profits have sparked trading activities aimed at realizing gains, as indicated by the increasing exchange supply ratio. According to CryptoQuant, this particular indicator has been on an upward trend, reaching a peak of 0.161 for the month.

As a crypto investor, when I notice that the ratio is trending upward, it suggests more LINK tokens are being transferred to exchanges – A red flag indicating growing sell pressure. This can be concerning, particularly if trading volume doesn’t increase to counterbalance the sold coins, potentially signaling a bearish market movement.

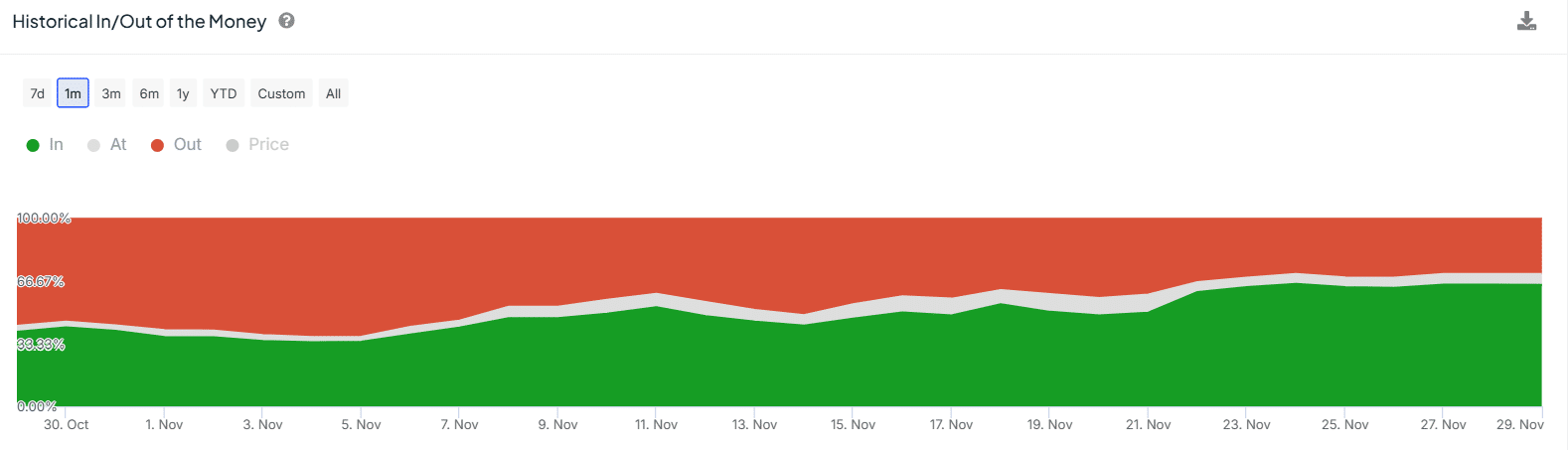

It’s noteworthy that the increase in the exchange supply ratio occurred simultaneously with an upward trend in wallet profits. As reported by IntoTheBlock, a substantial 64% of LINK owners are currently experiencing profitability – a considerable increase from 36% at the start of November.

At the same time, wallets in losses dropped from 59% to 29%.

An increase in wallet profits might also foster a favorable market atmosphere, potentially boosting prices due to optimistic investor sentiments.

However, for LINK to continue its uptrend, it needs a surge in buying activity.

Chainlink price analysis – Are buyers active?

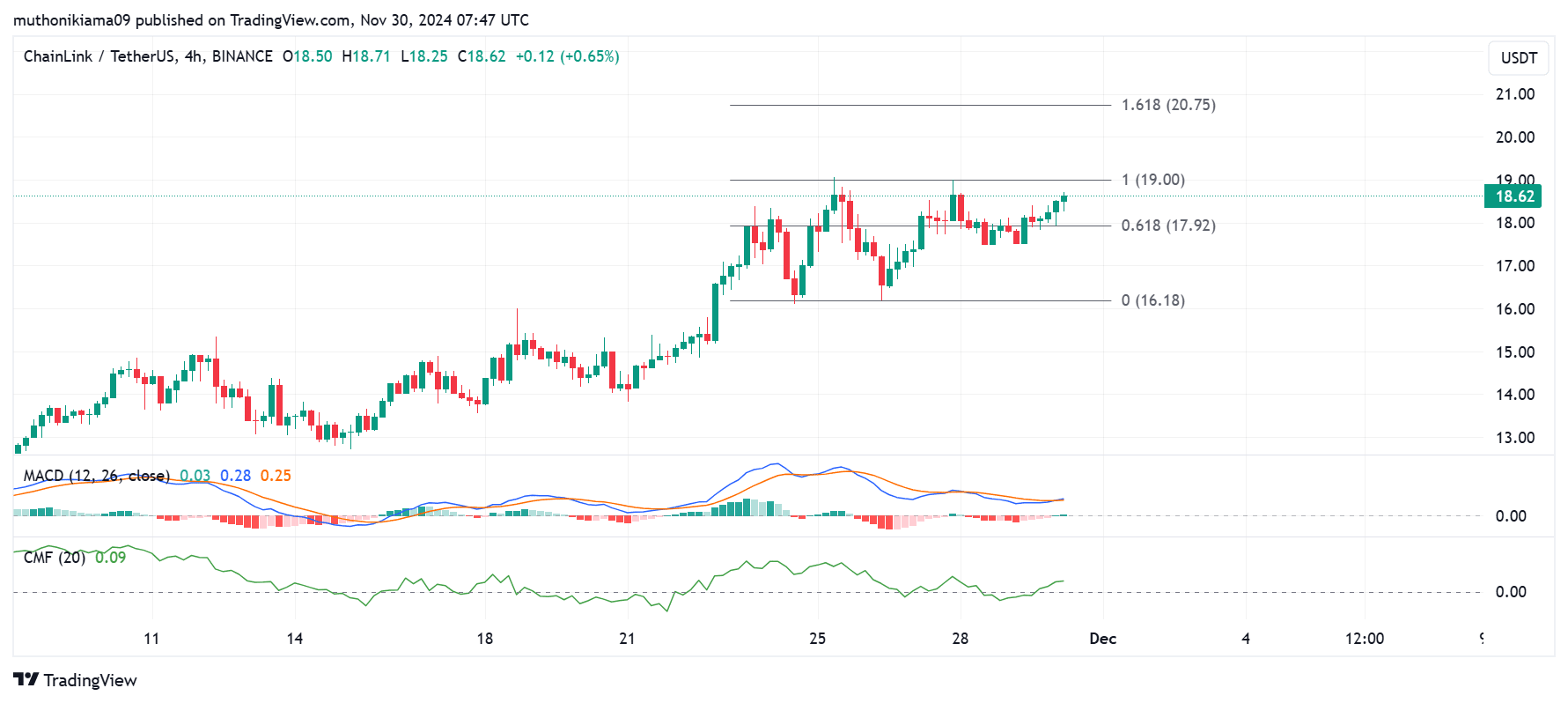

As a researcher examining Chainlink’s four-hour chart, I observed a notable imbalance in market dynamics with buying pressure dominating over selling pressure. This trend was clearly demonstrated by the Chaikin Money Flow (CMF) indicator, registering a positive value of 0.02. Furthermore, the upward trajectory of the CMF suggests an influx of recent buyers into the market, a positive sign for potential price growth.

When the Moving Average Convergence Divergence (MACD) line surpassed the Signal line, it signaled a potential buy opportunity. If the MACD line persists in staying above the Signal line, it may bolster the altcoin’s positive price movement.

Should purchasers successfully drive up LINK beyond the resistance point of $19, it may potentially target $20.75. Yet, it’s worth noting that Chainlink has previously encountered rejections at this potential support level on multiple occasions. A significant increase in buying activity is necessary to facilitate a successful breakout.

As of the latest report, the number of active addresses indicated a relatively low level of buying activity. According to IntoTheBlock’s data, this number decreased by almost half within a week, going from 7,420 to 4,210. Furthermore, the number of new addresses also saw a decline, dropping from 2,650 to 1,530.

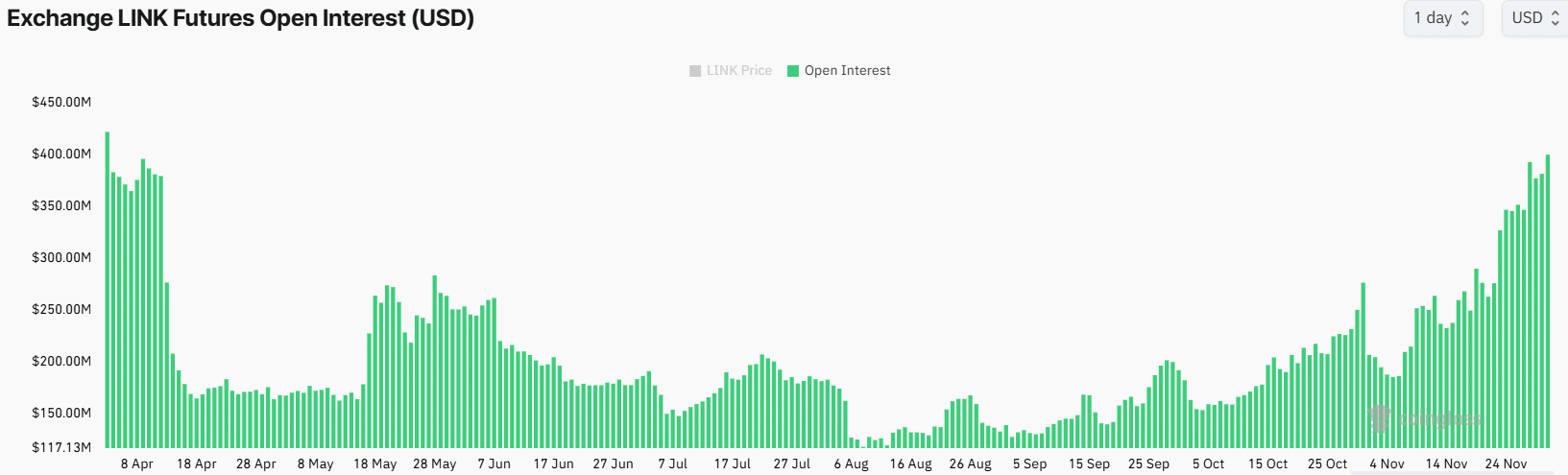

Open interest approaches 8-month high

As a researcher, I’ve noticed an uptick in activity on the derivatives market related to Chainlink. Interestingly, the Open Interest (OI) has reached its peak in over half a year.

At the moment, LINK’s overall investment (OI) is valued at approximately $396 million. This figure suggests that derivative traders are actively creating fresh positions in the altcoin.

The increase in Chainlink’s funding rates signifies a majority of new trading positions being taken by investors who are optimistic about further price increases, or long traders as they are often called.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- WCT PREDICTION. WCT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- LPT PREDICTION. LPT cryptocurrency

- Elden Ring Nightreign Recluse guide and abilities explained

- Despite Bitcoin’s $64K surprise, some major concerns persist

- Solo Leveling Arise Tawata Kanae Guide

- ETH Mega Pump: Will Ether Soar or Sink Like a Stone? 🚀💸

- Shrek Fans Have Mixed Feelings About New Shrek 5 Character Designs (And There’s A Good Reason)

2024-11-30 19:03