- Analysts forecast Litecoin’s breakout to $105-$110, backed by strong technical indicators and growing market momentum.

- Over 90% of Litecoin holders are profitable, signaling positive sentiment and sustained interest in the crypto.

As a seasoned analyst with over two decades of experience in the financial markets, I must admit that the current Litecoin [LTC] situation has piqued my interest significantly. The technical indicators are pointing towards a potential breakout, and the growing market momentum is hard to ignore.

Recently, Litecoin [LTC] has displayed notable resilience, leading some analysts to forecast a possible price increase.

As an analyst, I’m sharing my perspective on Litecoin: I believe this digital currency is gearing up for a substantial surge. If the anticipated breakout materializes, we might see Litecoin climbing to the $105–$110 zone.

The analyst noted,

“Right now, LTC appears strong and seems ready for a breakthrough. If the breakthrough is successful, we might see it heading towards the range of $105 to $110.”

Furthermore, a different analyst from ZAYK Charts has also made a comparable prediction, noting the emergence of a downward trending channel in Litecoin’s daily chart.

The chart’s analysis suggested that while the pattern was typically bearish, a breakout above the upper trendline could indicate a bullish reversal.

According to ZAYK Charts,

“When a breakout happens, next target will be $100.”

According to technical analysis rules, when there’s a breakout from a negative pattern, it usually results in a substantial rise in the price.

Current price movement

Currently, Litecoin is being exchanged for approximately $65.52 per coin. This represents a slight uptick of 0.28% in the last day, and a more substantial growth of 8.59% over the last week.

Currently, the total value of all Litecoins in circulation is approximately $4.88 billion, and during the last 24 hours, a trading volume of around $438 million worth of Litecoin has been exchanged.

Keeping an eye on Litecoin’s progress as it has a total circulation of 75 million coins, traders are eagerly waiting for any signs of positive movement in the market.

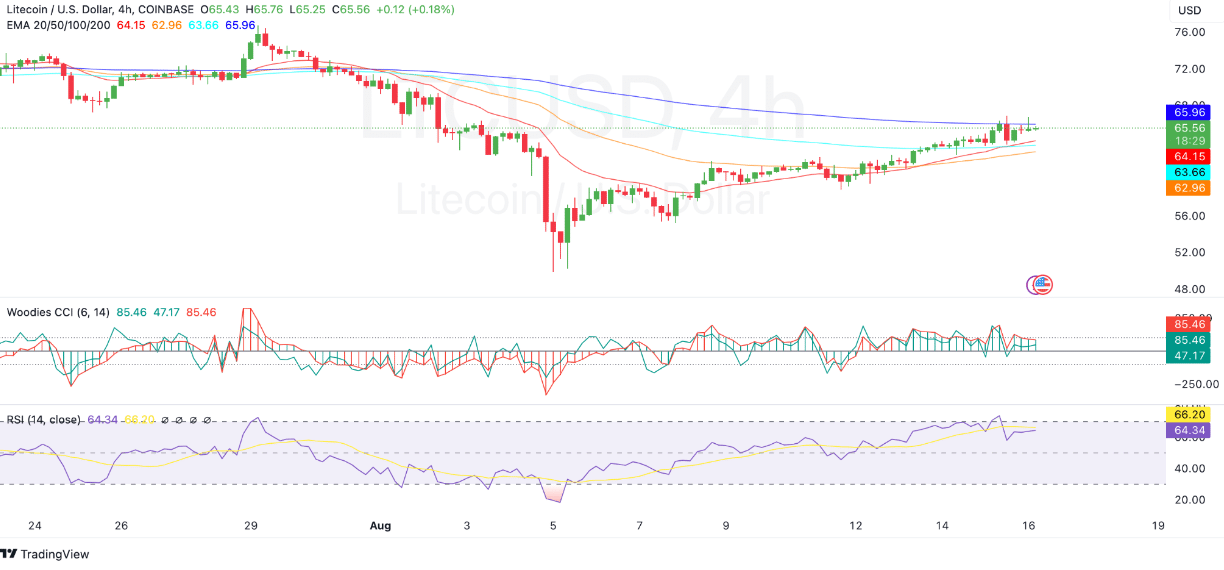

On the 4-hour scale, Litecoin appears to be consistently rising, bolstered by its short-term, medium-term, and long-term exponential moving averages.

Approaching the potential barrier at the 200-day Exponential Moving Average (EMA) priced at $65.96, this level might pose difficulties for any additional advancement.

Should Litecoin surpass this current threshold, it might ignite further optimistic energy and raise the chances of hitting the projected $100 mark as suggested by financial experts.

Although things appear optimistic, certain signs call for prudence. The Woodies Commodity Channel Index stands at 87.82, indicating that Litecoin has moved into an overbought state.

Based on my years of trading experience, I believe there could be short-term selling pressure and a potential pullback if the price doesn’t manage to break through key resistance levels. I’ve seen this pattern play out many times before, so it’s important to be cautious and prepared for such a move.

Furthermore, the Relative Strength Index (RSI) stood at 66.21, suggesting a strong upward trend, yet it hasn’t reached the extremely overbought territory of 70.

Should the Relative Strength Index (RSI) surpass 70, there could be an increase in selling activity for Litecoin, potentially limiting its ability to continue rising.

Pay attention to these technical indicators, as they might impact the future direction of Litecoin, traders are reminded.

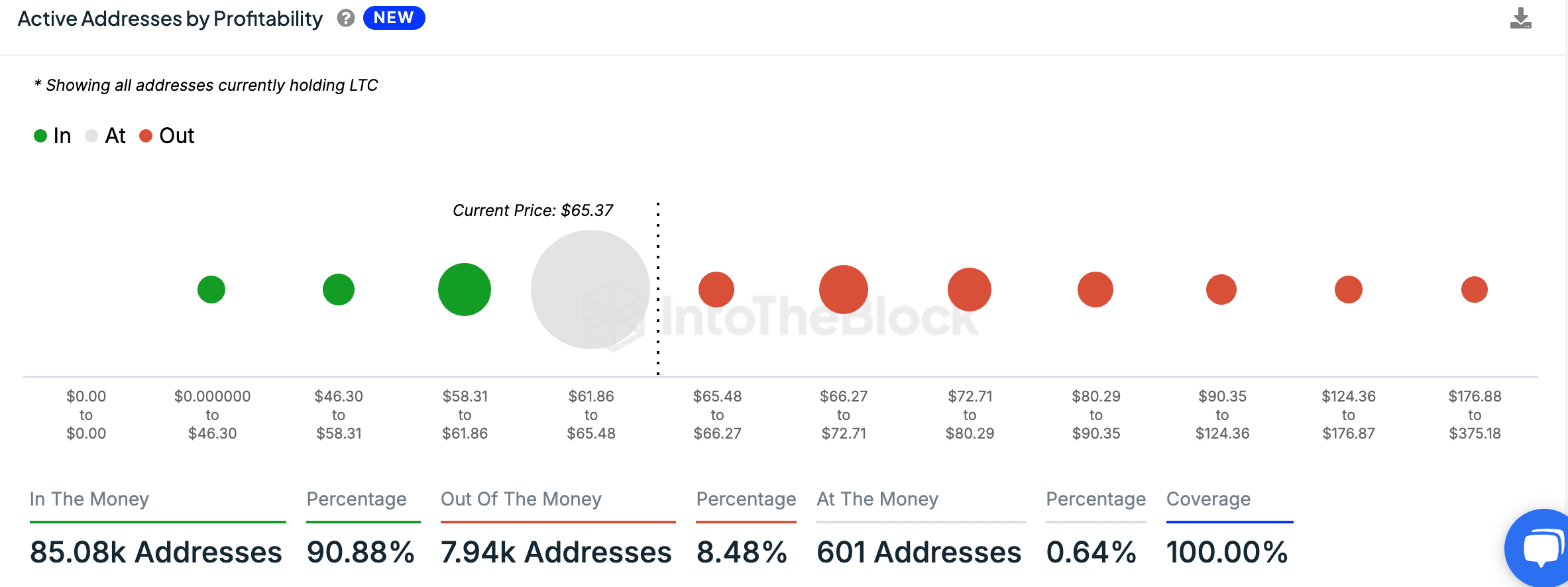

Active addresses and profitability

As an analyst, I’ve recently observed from IntoTheBlock’s data that the vast majority of Litecoin investors have been enjoying profits.

Approximately 90.88 percent of all LTC (Litecoin) wallets, or around 85,080 wallets, are considered “profitable,” as the LTC in these wallets were bought at a price lower than the current market value.

As an analyst, I’m observing that approximately 8.48% of the addresses I’m tracking hold Litecoin purchased at a price higher than its current value of $65.37. These individuals are currently “out of the money.”

Approximately 601 addresses have investments that were bought close to the present market price, which represents a tiny percentage, about 0.64% of the total number.

At the current moment, the data I’ve been analyzing indicates that a significant number of Litecoin holders are experiencing gains. This trend lends credence to the optimistic outlook prevailing in the cryptocurrency market.

As reported by DefiLlama, the Total Value Locked (TVL) in Litecoin currently stands at approximately $3.41 million. Over the last 24 hours, fees generated have totaled around $1,342.

Additionally, there were 435,508 active addresses within the network.

The blend of ongoing profitability and high levels of user interaction suggests that there remains a strong, enduring curiosity about this cryptocurrency among its community.

Read More

2024-08-17 02:48