- QNT is consolidating within a descending wedge, with technical indicators signaling potential upward movement.

- Despite bullish sentiment, rising exchange reserves could introduce selling pressure and limit upside.

As a seasoned analyst with over two decades of experience in the crypto markets, I have seen my fair share of bull runs and bear markets. The current situation with Quant [QNT] has me intrigued, to say the least.

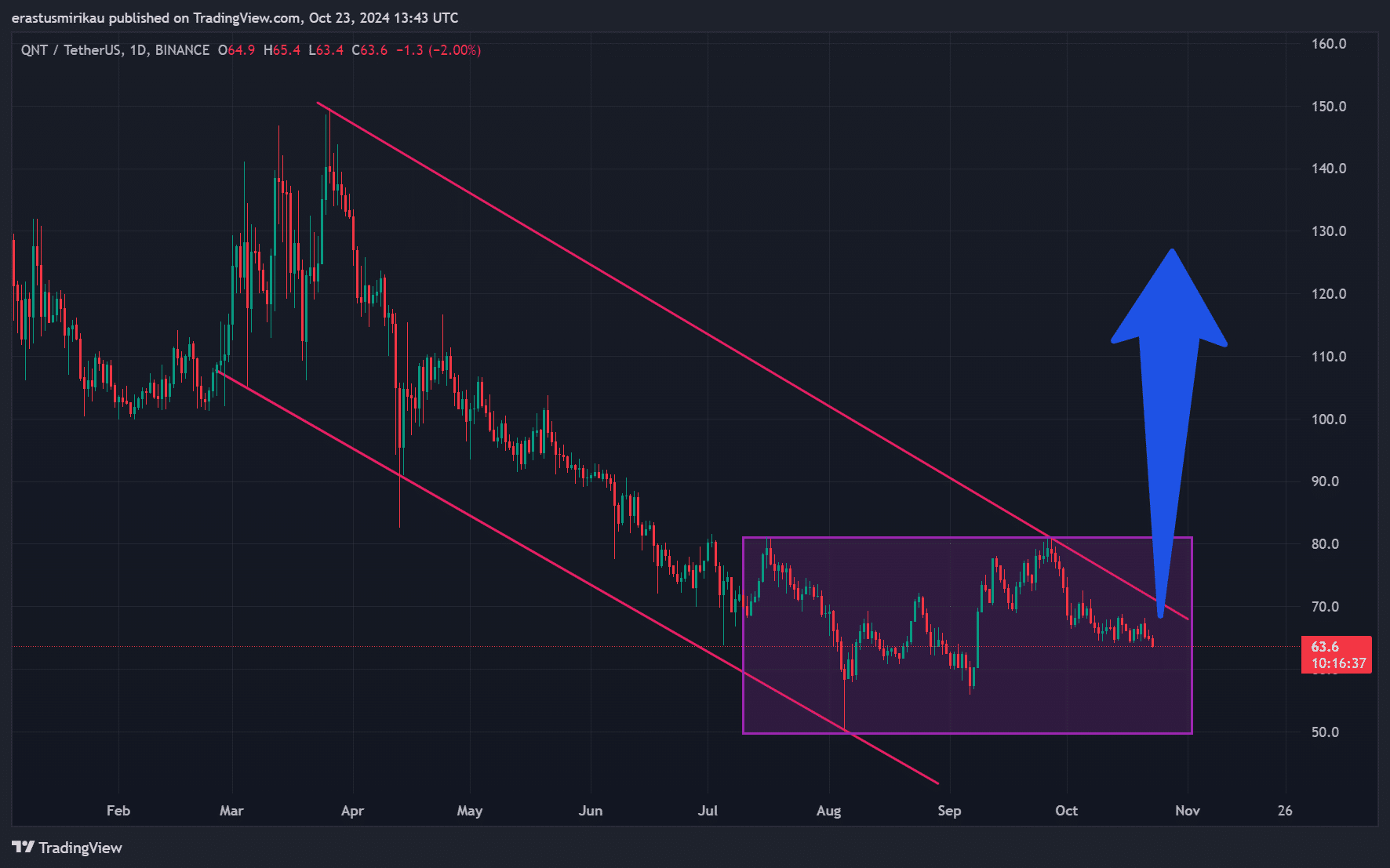

Since mid-March, Quant [QNT] has been trapped within a descending wedge formation, with its value fluctuating between approximately $60 and $70 for several months. Lately, the coin’s consolidation around $64.2 suggests that a potential breakout could be on the horizon.

The collective feeling among both average investors and experts is becoming optimistic, leading us to ponder whether Quantstamp (QNT) can break free from its downward trend and climb towards higher resistance points.

QNT’s descending wedge: Is a reversal on the horizon?

In simpler terms, the “descending wedge” is often a sign of an upcoming bullish price reversal. As Quant (QNT) hovers near $63.6 right now, traders are eagerly waiting to see if it might lead to a significant price increase.

A breakout above the key resistance levels around $70 could open the door to a rally toward $120.

But whether Quant manages to build enough buying momentum to escape the wedge and move upwards is uncertain. Furthermore, the shrinking trading range suggests a tight market movement, often a precursor to major price swings.

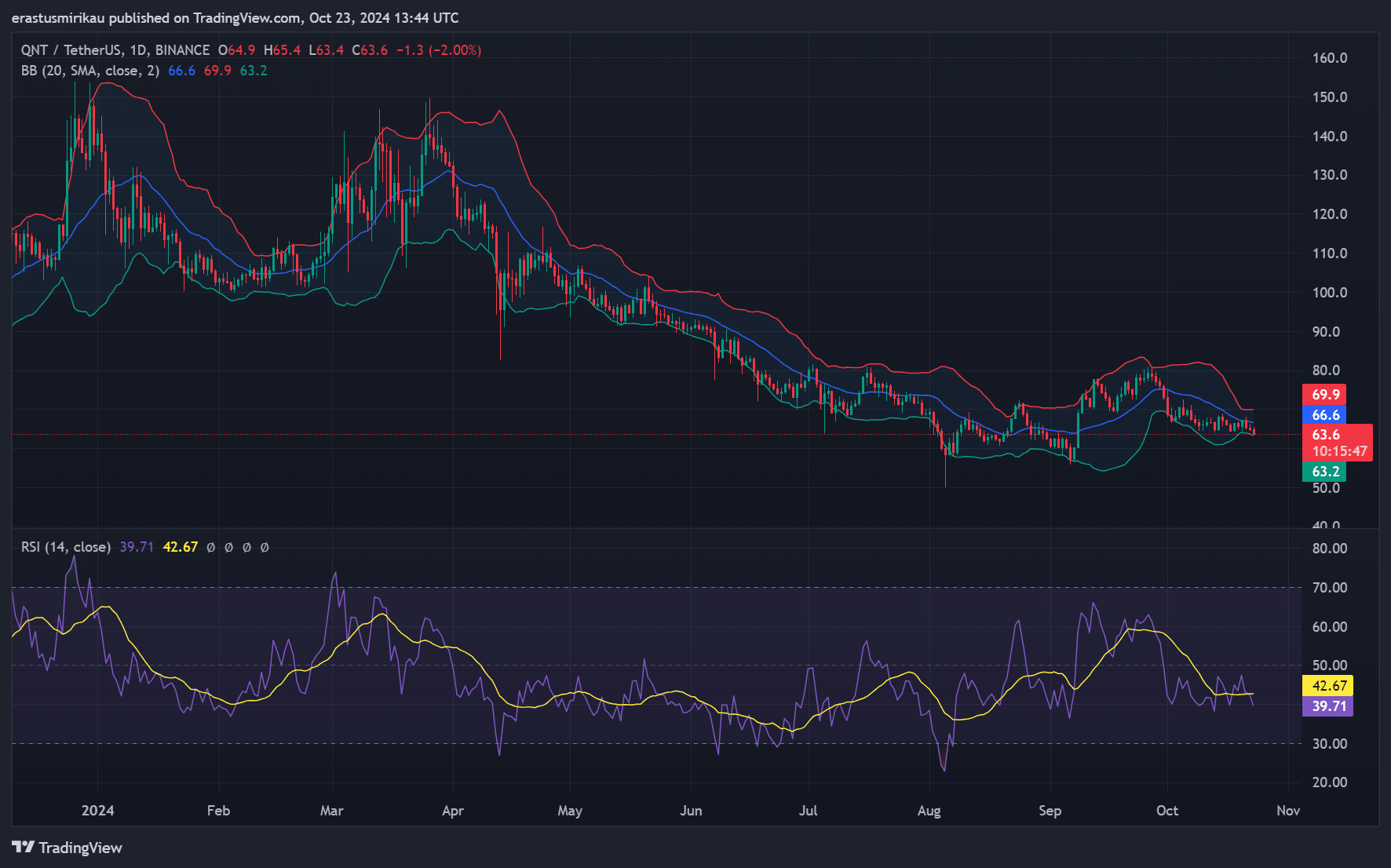

Bollinger Bands and RSI: Is momentum building?

In simpler terms, the technical indicators provide additional understanding about Quant’s current state. The Bollinger Bands are becoming narrower, indicating a decrease in market volatility. Meanwhile, the Relative Strength Index (RSI) stands at 42.67, slightly above the oversold zone.

As a result, the Relative Strength Index (RSI) implies that there’s still an opportunity for further price increases. In the past, when these two indicators line up, a surge usually takes place. But traders need to exercise caution since false surges can occur without adequate volume and thrust.

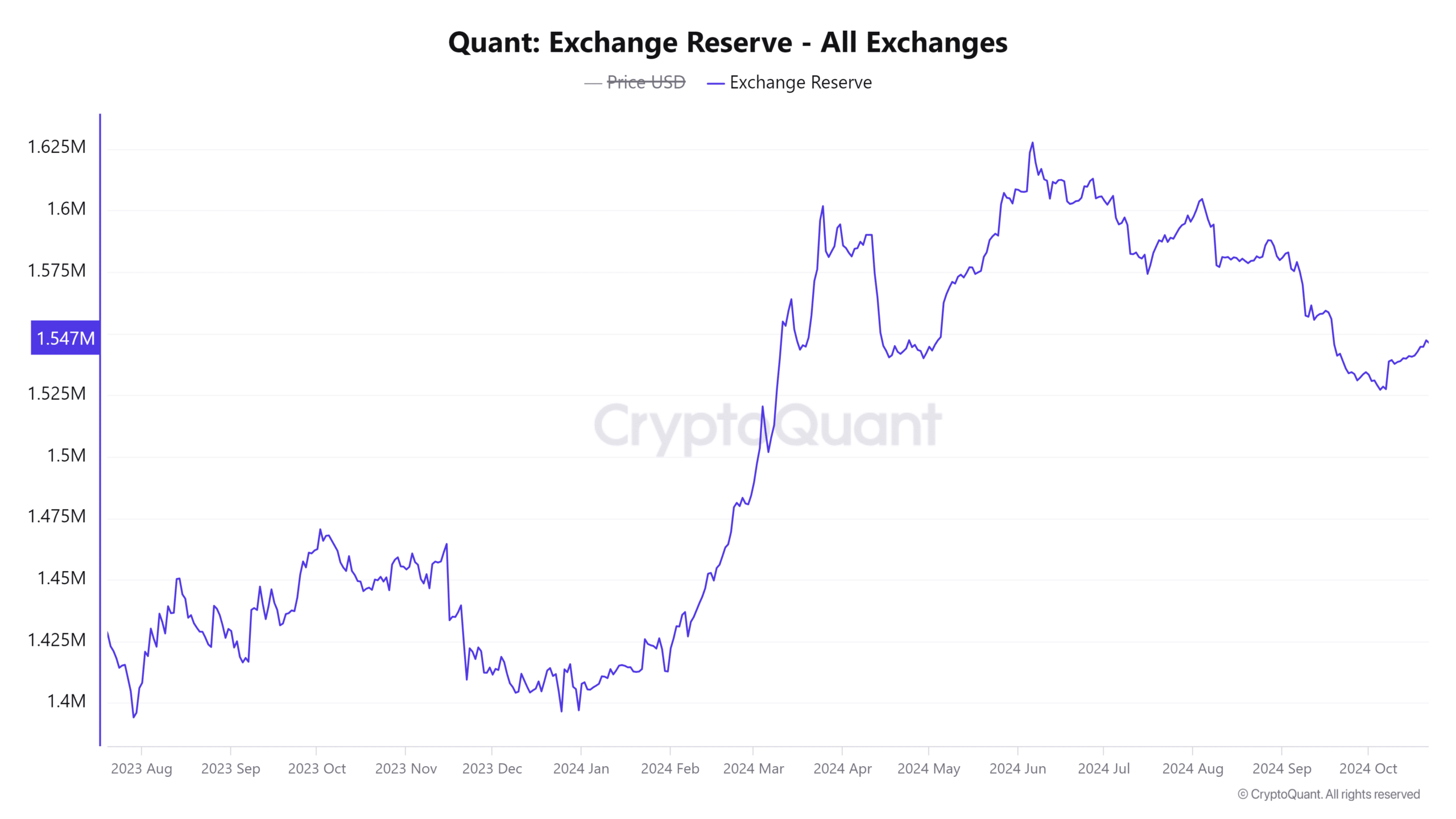

Exchange reserves: Is selling pressure increasing?

Over the past day, there’s been a slight rise of 0.22% in the quantity of Quant held by exchanges, now totaling approximately 1.5487 million. A higher exchange reserve typically indicates an increase in selling pressure, as more tokens are being transferred to these platforms.

Consequently, an increase in selling might cap the immediate gains. Furthermore, for Quantitative Inverse ETF (QNT) to keep moving upward, it must first handle the current selling pressure.

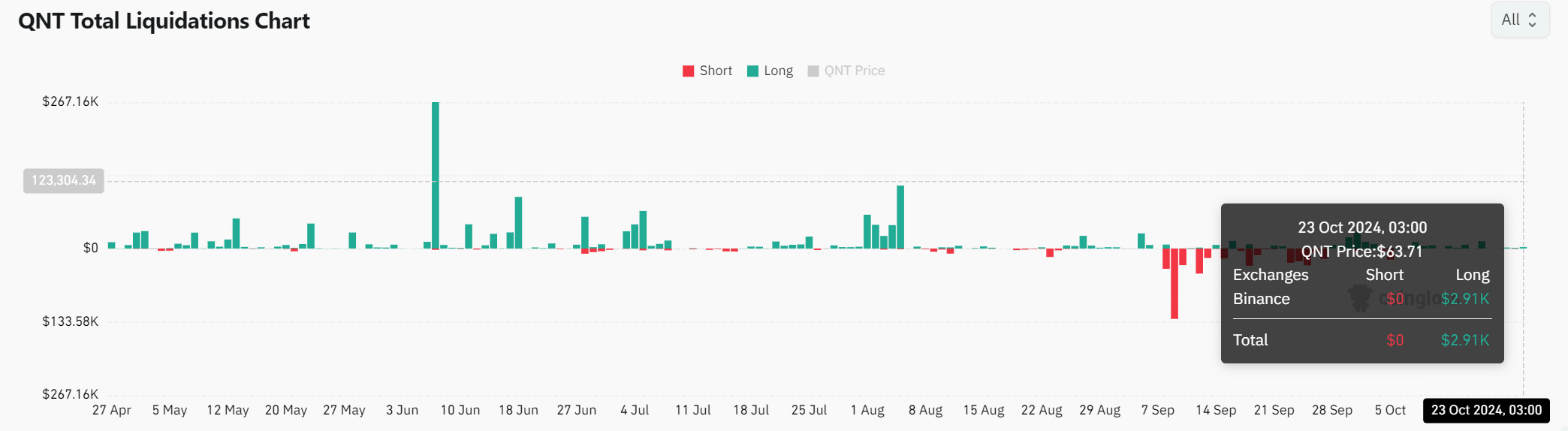

Liquidations: Market stability or risk?

The data from the liquidation process indicates a small amount of long positions being closed, totaling just $2,910. As a result, the market exhibits a high level of stability due to its moderate leverage, thereby lowering the chances of compulsory selling.

In the event that QNT’s price suddenly spikes, liquidations might increase rapidly, which could further intensify market volatility.

Read Quant’s [QNT] Price Prediction 2024–2025

Will QNT break out?

As optimism grows and technical signs point towards a potential breakthrough, QuantumSCape (QNT) seems poised for a prospective price rise.

On the flip side, increasing exchange reserves might suggest that sellers may counterbalance any potential price increase. If Quantstamp (QNT) manages to break through its resistance levels and continues to gain traction, it could potentially push towards higher prices, even approaching $120.

Read More

- PI PREDICTION. PI cryptocurrency

- WCT PREDICTION. WCT cryptocurrency

- How to Get to Frostcrag Spire in Oblivion Remastered

- ANKR PREDICTION. ANKR cryptocurrency

- Quick Guide: Finding Garlic in Oblivion Remastered

- Isabella Strahan Shares Health Journey Update After Finishing Chemo

- DOOM: The Dark Ages Debuts on Top of Weekly Retail UK Charts

- This School Girl Street Fighter 6 Anime Could Be the Hottest New Series of the Year

- LINK PREDICTION. LINK cryptocurrency

- K-Pop Idols

2024-10-24 09:11