- The Sandbox has continued with bearish trends after a 4% drop in 24 hours.

- The widening Bollinger bands and rising liquidations show that volatility is rising.

As a seasoned researcher with years of experience in the cryptocurrency market, I’ve seen my fair share of bull runs and bear markets. The Sandbox [SAND]’s recent rally is no exception. While it’s exciting to witness such massive gains, the current trend seems to be veering towards the bearish side.

The Sandbox [SAND] has rallied by 75% in the last seven days, amid gains across the cryptocurrency gaming sector. At press time, SAND traded at $0.602 after a 4% drop in 24 hours. Meanwhile, trading volumes had dropped by 51% per CoinMarketCap.

SAND’s recent gains came on the back of heightened volatility. This was evidenced by the widening Bollinger bands on the altcoin’s four-hour chart.

Earlier this week, a robust upward trend (bullish momentum) in SAND caused it to surpass the upper limit of the Bollinger band. Yet, currently, the price has pulled back to the midpoint of the band, indicating that demand for purchasing may be decreasing.

In simpler terms, the Relative Strength Index (RSI), which had previously been in overbought areas, now stands at around 53. Moreover, the RSI line is currently moving beneath its signal line, suggesting that sellers might be influencing the market’s direction.

It seems that buyers are trying to maintain the current price floor at 0.58 dollars. However, if they fail to do so amidst increasing selling pressure, SAND might fall towards the lower boundary of the Bollinger band, which is around 0.501 dollars.

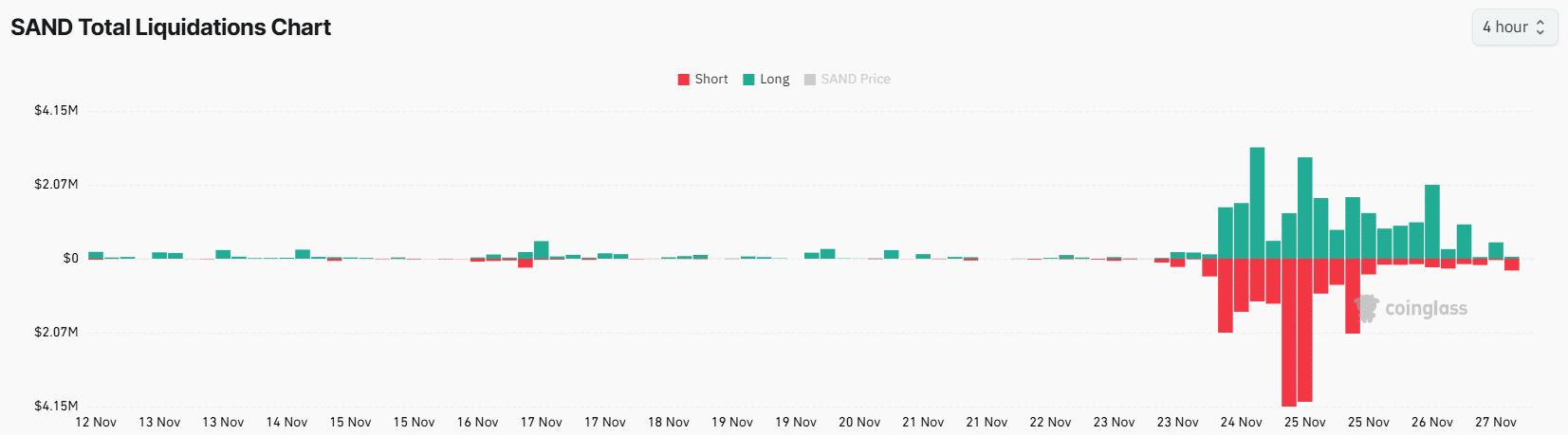

Liquidations could spur more volatility

According to data from Coinglass, traders holding both short and long leveraged positions on The Sandbox experienced over $44 million in liquidations within a span of four days. This mass closure of positions – whether through selling or buying – significantly increased market volatility.

The process of liquidation has affected the ongoing number of contracts as well, and it currently stands at approximately $168 million at present moment, having decreased by 6% over the past day. This implies that fewer new trading positions for SAND are being initiated.

Reducing trade in the derivatives market might cause a drop in volatility, but it may as well result in SAND experiencing a phase of stability or consolidation.

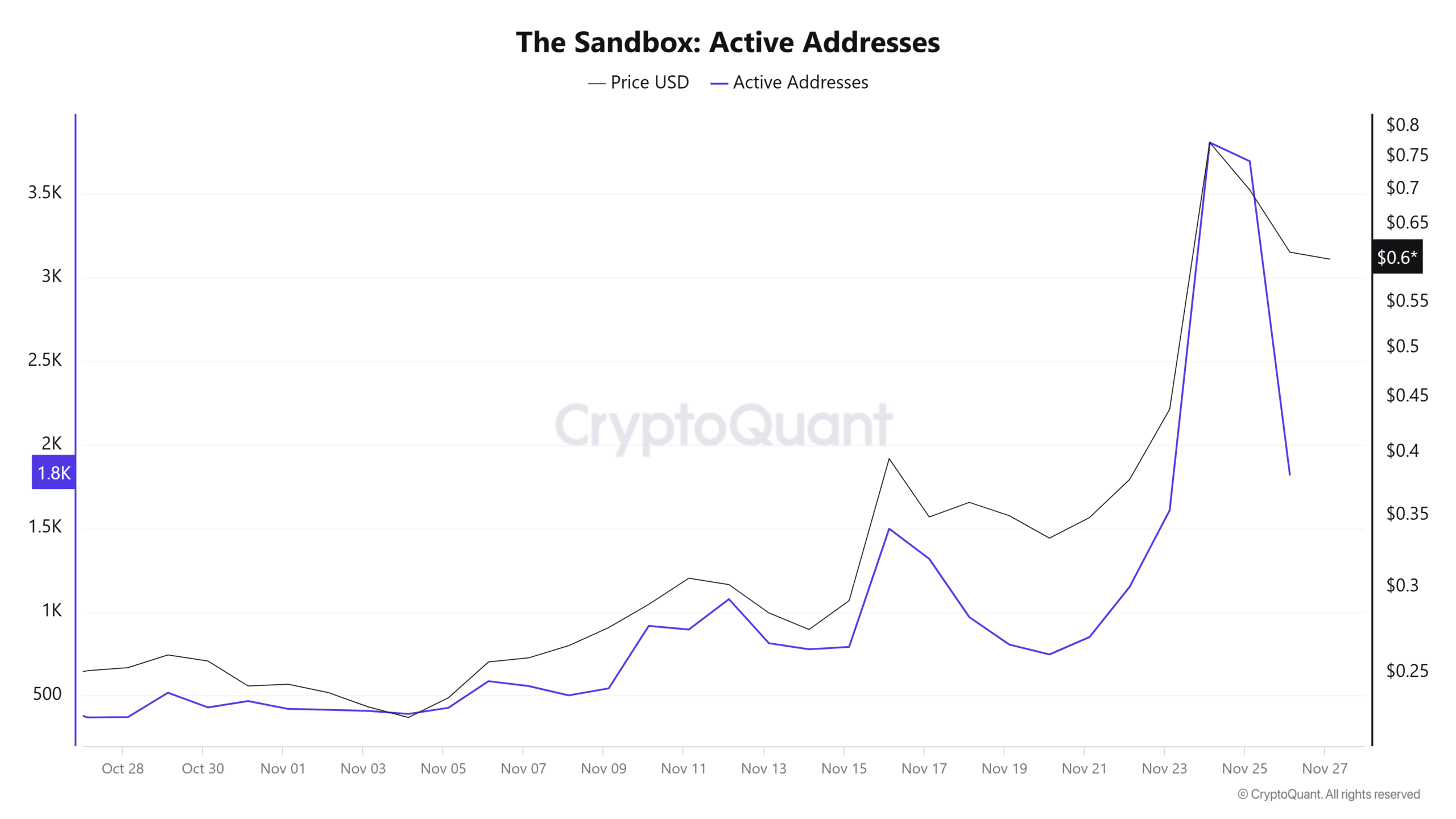

Active addresses fall from peak

The lack of fresh buying activity around SAND can be attributed to a notable decline in the number of active addresses. Data from CryptoQuant shows that in the last three days, the number of active addresses around the token has dropped from 3,809 to 1,821.

As a cryptocurrency investor, I’ve noticed that this dip might be indicative of dwindling market enthusiasm due to a scarcity of recent profits. If this trend continues, it’s possible that SAND may prolong its downward trajectory.

Realistic or not, here’s SAND market cap in BTC’s terms

What’s next for SAND?

If demand for the SAND token doesn’t pick up to counteract the selling pressure, it might cause additional drops in its value. Once the Relative Strength Index (RSI) fell below the signal line and formed a sell signal, the upward momentum softened. A potential trend reversal may occur if buyers return to the market.

Keep an eye on the market, as a fall beneath the lower boundary of the Bollinger band may indicate decreased investor confidence, potentially causing prices to decrease further.

Read More

- Gold Rate Forecast

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- PI PREDICTION. PI cryptocurrency

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Rick and Morty Season 8: Release Date SHOCK!

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Masters Toronto 2025: Everything You Need to Know

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

2024-11-28 09:43