-

In a highly bullish case, SHIB may rally to $0.00038 but resistance at $0.000027 might invalidate the run.

Shiba Inu’s network was undervalued, suggesting that the price could recover.

As a researcher with experience in analyzing cryptocurrency markets, I believe that Shiba Inu (SHIB) has the potential to rally to $0.00038 if bullish sentiment prevails. However, there are significant challenges that could prevent this from happening.

As a SHIB investor, I’ve been pondering over this thought: If we were to remove yet another zero from Shiba Inu’s price, would it surpass its all-time high? This is a question that has been circulating in the minds of many token holders. However, achieving such a feat isn’t an easy task and depends on several factors including market sentiment, adoption rates, and potential partnerships or developments within the SHIB ecosystem. Only time will tell if this parable comes true for us SHIB enthusiasts.

At the moment of publication, SHIB‘s price stood at $0.000023 – a significant drop of 73.02% from its peak of $0.000088 reached in October 2021. Additionally, this decline represented a modest loss of 3.20% over the past 30 days.

Shib Knight, a bullish analyst, expressed his belief that the SHIB token’s price could touch $0.0001. He made this prediction in a recent post on platform X and suggested that this goal could be reached relatively quickly.

Bears are not giving up

In February, SHIB experienced a significant price increase which caused it to drop the last zero from its value. According to AMBCrypto’s report, the price was at $0.0000095 on the 22nd of that month.

On the last day of the previous month, SHIB‘s price reached $0.000012. Then, over the next ten days in March, there was a remarkable increase, pushing the price up to $0.000035.

During that time, the market conditions were characterized by robust growth. Lately, however, there’s a notable lack of excitement, indicating that SHIB may find it difficult to attain those former peaks.

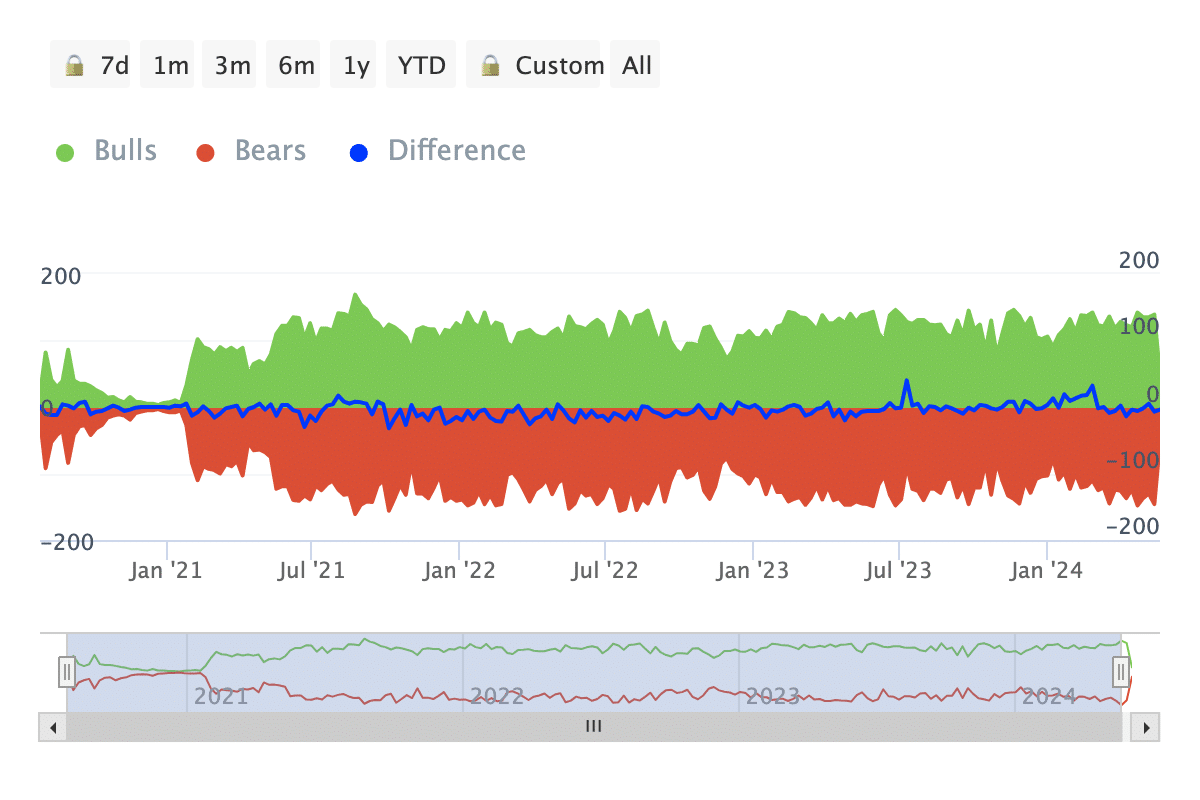

As a researcher studying the cryptocurrency market, I came across an intriguing finding from AMBCrypto. They identified a specific metric that challenged the validity of a particular investment thesis. The tool they used to uncover this insight was the Bulls and Bears indicator offered by IntoTheBlock.

From my research perspective, currently, the spread between the number of bullish and bearish market participants stands at a figure of 4. This metric holds significance for Shiba Inu’s price movement as it represents the difference in the number of addresses transacting 1% of its trading volume.

If bulls prevail in the market, there’s a potential for an uptick in SHIB‘s price. However, given that bears have exerted selling pressure amounting to 1%, SHIB may face another round of price decreases.

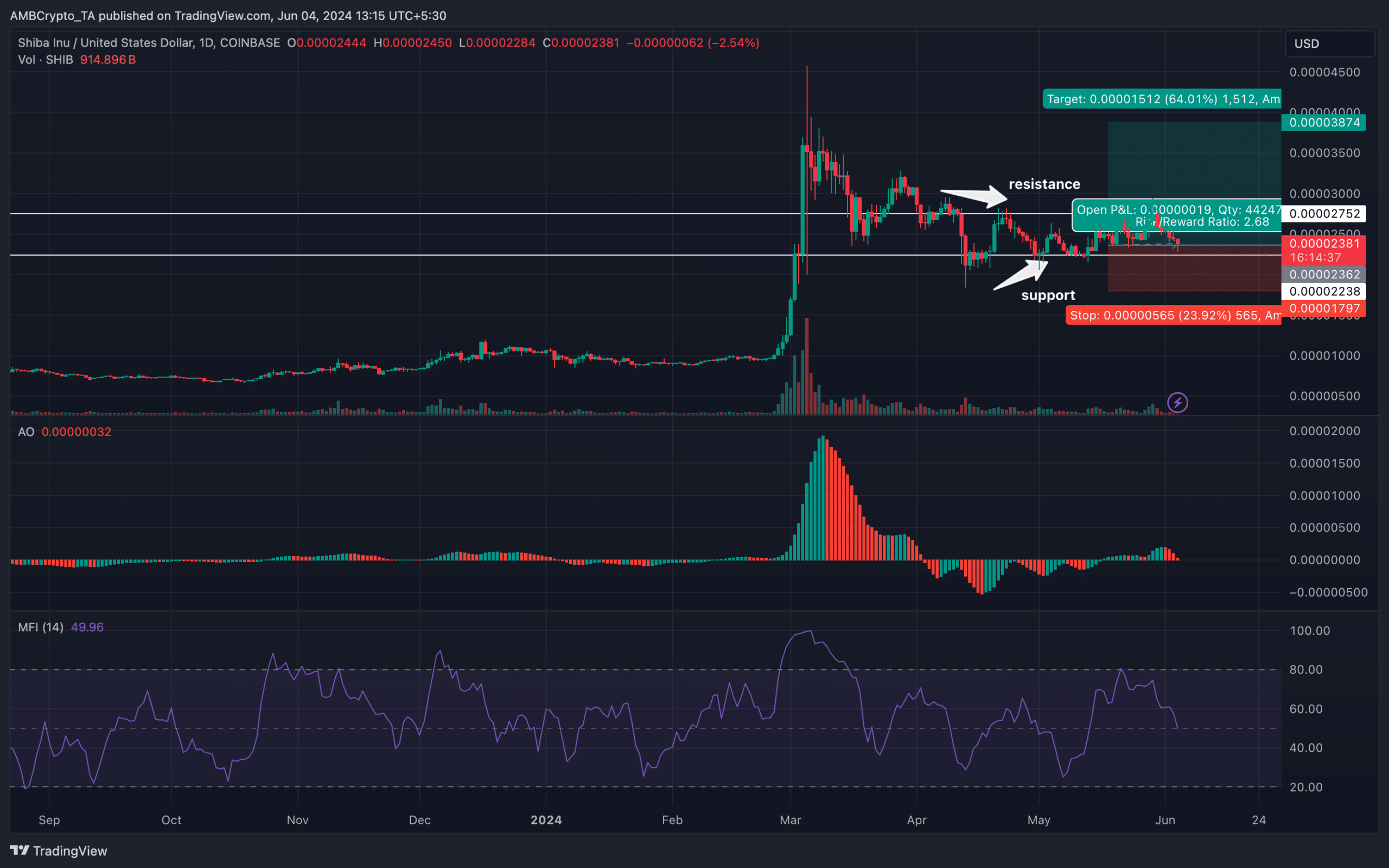

Additionally, it’s crucial to assess the price prospects using a technical standpoint. The Shiba Inu (SHIB) on the daily chart exhibited indecisiveness as the price fluctuated within a narrow trading band.

Is a 64% increase possible?

As a researcher examining the cryptocurrency market, I’ve noticed that AMBCrypto has pinpointed $0.000022 as a support level for Shiba Inu (SHIB). Bulls have been making efforts to keep the price above this threshold. However, there are signs that SHIB’s price might be on the brink of dropping below this support.

should the price reach $0.000018, the token would experience a decrease in value amounting to 23.92%, based on its current price.

On the positive side, we encountered resistance at the price of $0.000027. If SHIB rebounds to this point and manages to break through this level, it could potentially reach $0.000038, marking a 64.01% increase in value.

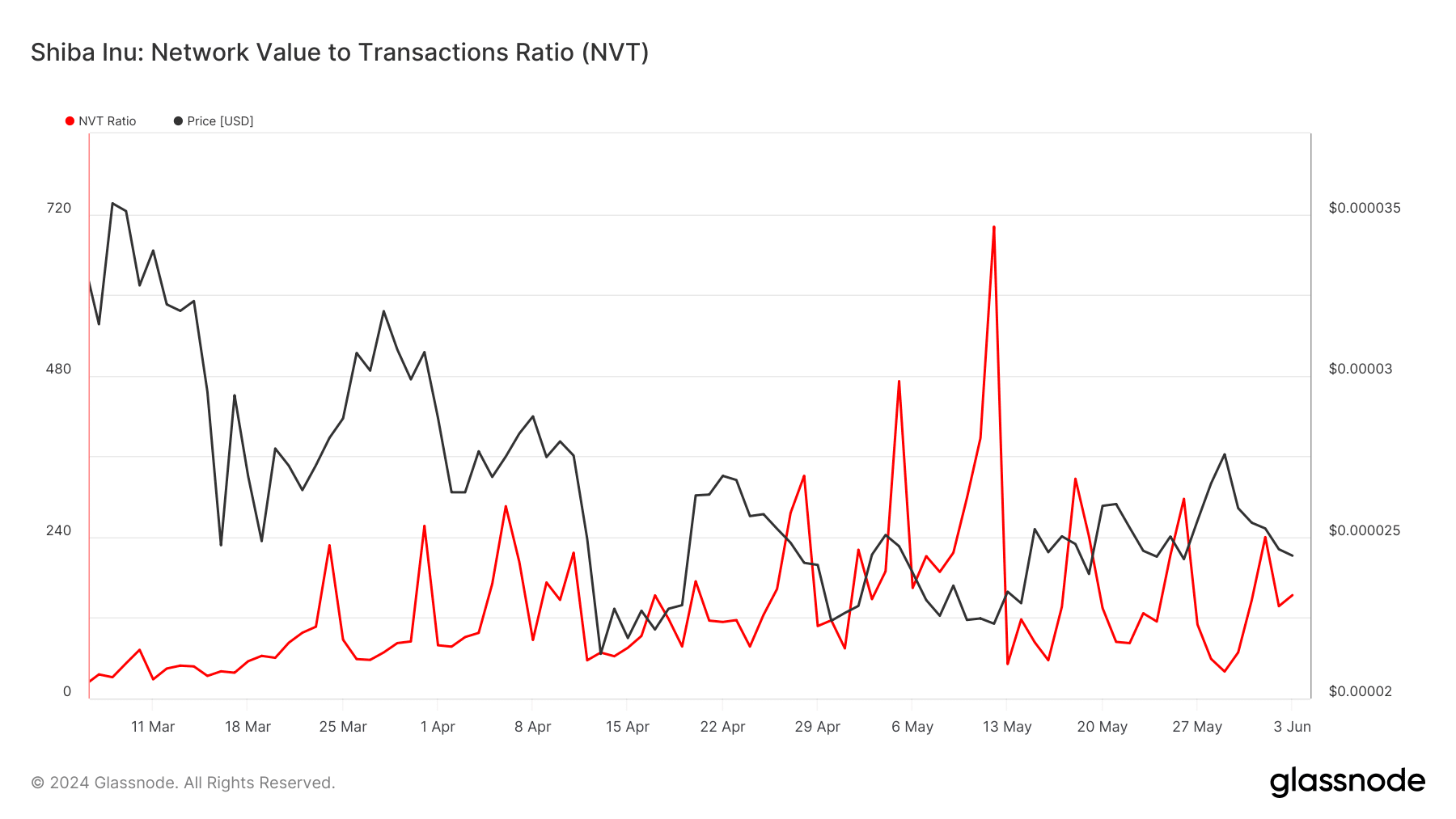

During the month-long rally of SHIB, the Network Value to Transaction (NVT) ratio stood at 153.65. This was a relatively low figure compared to other periods. A high NVT ratio suggests that the network’s value is overvalued in relation to the number of transactions taking place.

Is your portfolio green? Check the Shiba Inu Profit Calculator

Based on the data, a low NVT (Network Value to Transactions) ratio implies that the value of Shiba Inu’s network may have been underestimated relative to the volume of transactions taking place within it.

Regarding the cost, this ratio may confirm the anticipated rise in the interim period. Nonetheless, the value of the token could continue to fluctuate erratically in the near future, and reaching $0.0001 is a possibility at any moment.

Read More

- Gold Rate Forecast

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- PI PREDICTION. PI cryptocurrency

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Rick and Morty Season 8: Release Date SHOCK!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

2024-06-05 02:16