- SHIB’s MACD and RSI flashed mixed signals, with momentum lacking for a strong bullish move

- Exchange reserves fell, but trader sentiment remained rather cautious

As a seasoned crypto investor with a knack for spotting trends and interpreting technical indicators, I have to admit that Shiba Inu (SHIB) has me intrigued. The massive surge in active accounts on its blockchain and the impressive number of daily transactions are certainly noteworthy. However, as someone who’s learned the hard way that charts don’t always tell the whole story, I can’t help but feel a bit cautious.

Currently, there’s a significant 1,557% increase in active accounts on Shiba Inu‘s [SHIB] blockchain platform, Shibarium, and it’s handling approximately 1.76 million transactions every day. This substantial rise in on-chain activity has sparked lots of enthusiasm within the SHIB community.

But could this action spark a surge for SHIB, or will persistent resistance hold back its growth as a meme coin?

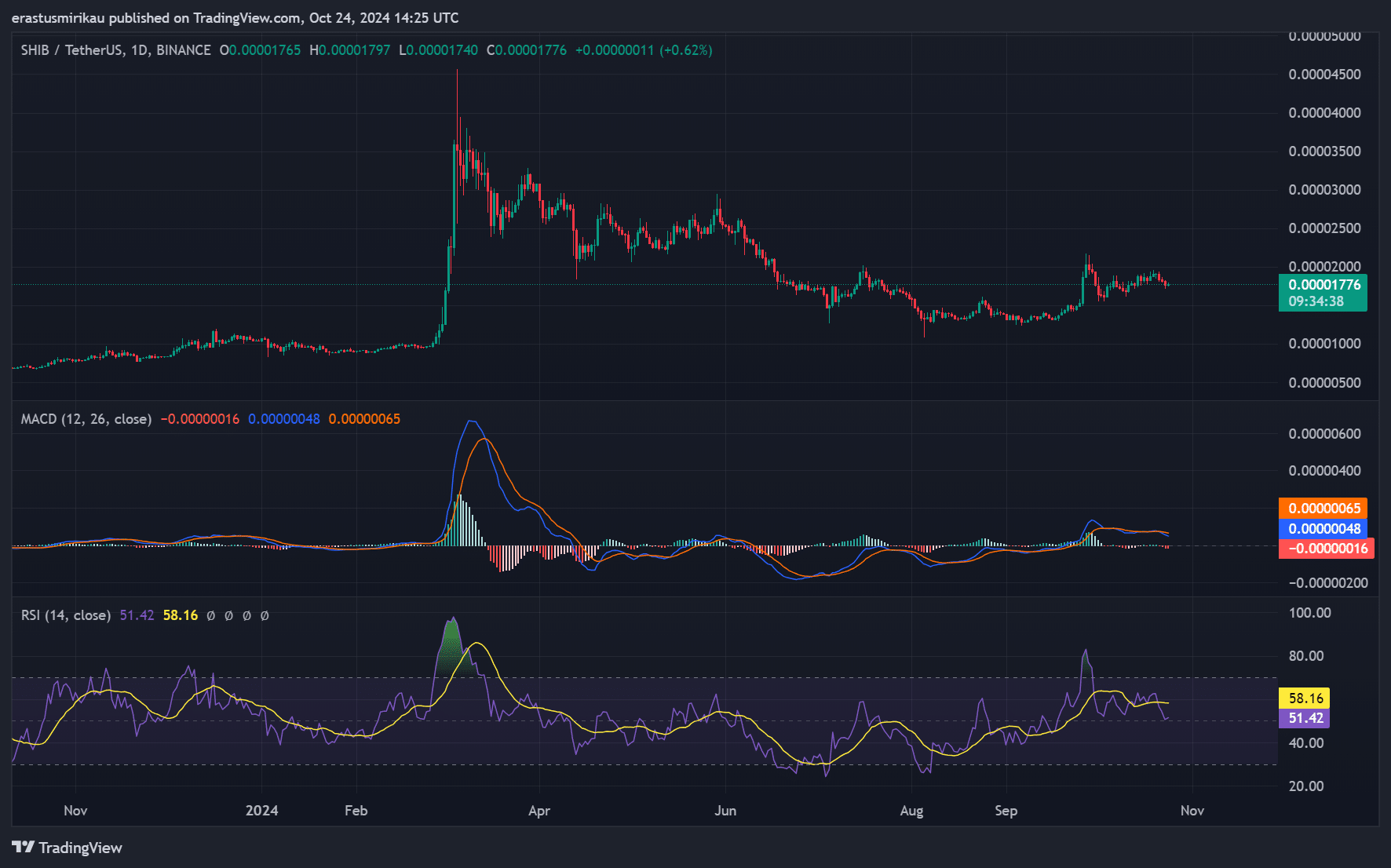

MACD and RSI flash mixed signals for SHIB

By examining the Moving Average Convergence Divergence (MACD) and Relative Strength Index (RSI) of Shiba Inu, there are several crucial signs to take note of. The MACD appears to display narrowing lines, suggesting that a change in momentum could be imminent.

However, the MACD line remained slightly below the Signal line – A sign that a bullish trend is yet to fully materialize. Additionally, Shiba Inu’s RSI lay at 51.42, underlining neutral market sentiment.

Essentially, at the current moment, Shiba Inu didn’t appear to be overly undervalued, but it wasn’t showing enough positive momentum to trigger a significant surge or rally.

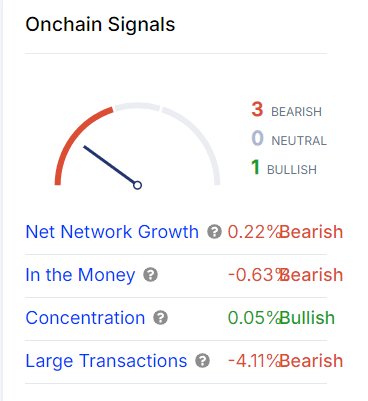

On-chain data highlights cautious sentiment

The analysis of on-chain data explains the relatively weak performance seen in SHIB’s recent price movement. A small decrease in network participation is suggested by SHIB’s net network growth rate of -0.22%, which indicates fewer new participants joining the network. Additionally, only a tiny fraction (0.05%) of Shiba Inu holders qualify as large holders, providing a minor bullish signal, but it’s not substantial enough to instill much confidence.

The “In the Money” metric flashed figures of -0.63%, indicating most holders are at a slight loss.

Notably, a decrease of 4.11% in larger transactions indicates that ‘whales’ may be reducing their involvement. This, coupled with some minor positive indicators, suggests that overall, the SHIB ecosystem has been leaning towards bearish trends in its on-chain activity.

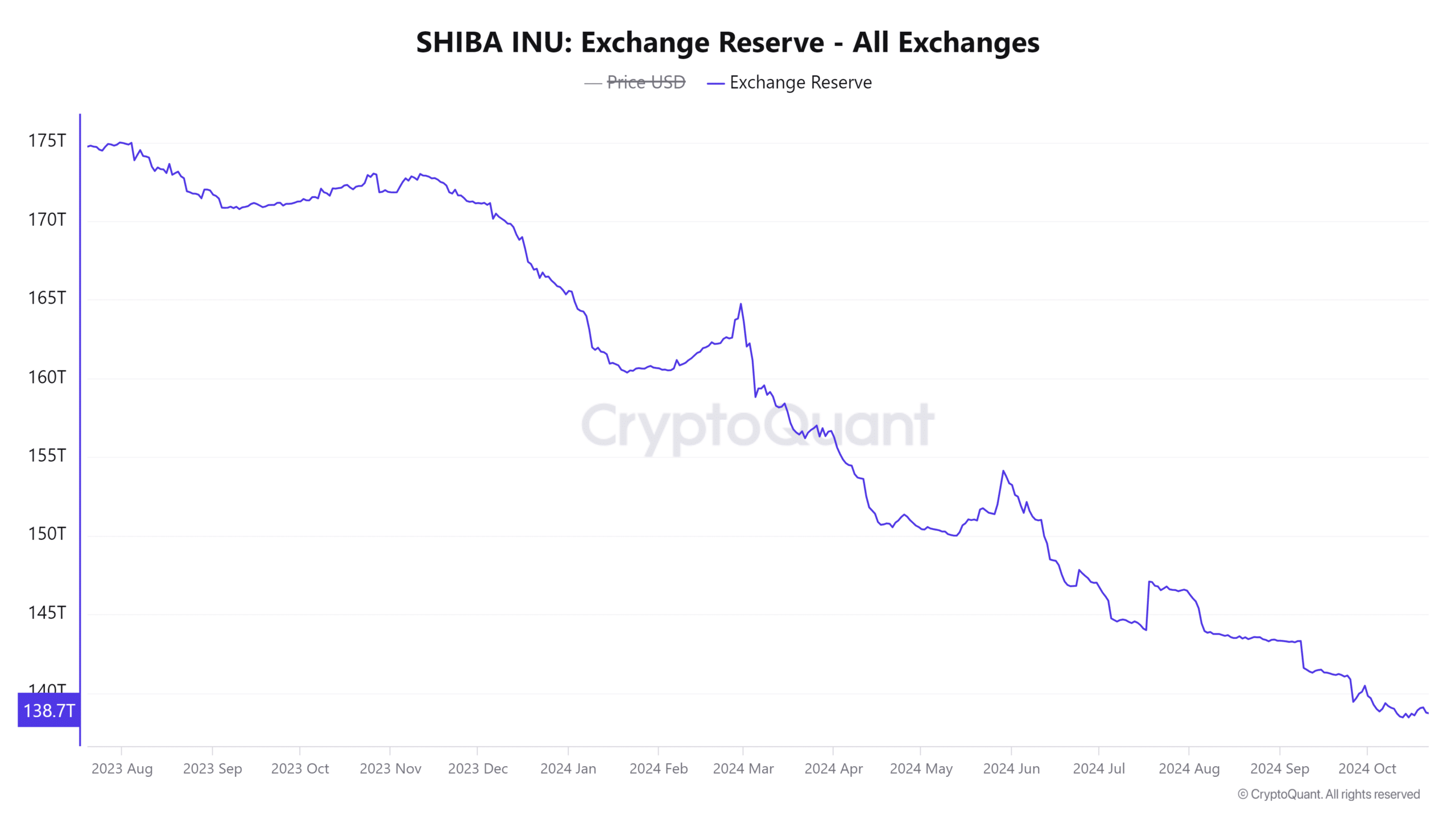

SHIB’s exchange flows and trader sentiment

Currently, when I’m typing this, the Shiba Inu token reserves held by exchanges were gradually decreasing and stood at approximately 138.67 trillion tokens. Typically, a decrease in exchange reserves suggests that individuals are accumulating these tokens, moving them from exchanges into personal wallets. This action reduces the pressure to sell, as fewer tokens are readily available on the exchanges.

Over the past day, there’s been a slight increase of 0.02% in Shiba Inu’s reserve flow, suggesting possible upcoming selling pressure. Furthermore, it appears that about 52.05% of traders are currently shorting SHIB, which indicates cautiousness among them.

Read Shiba Inu [SHIB] Price Prediction 2024-2025

To summarize, although Shibarium’s rapid expansion offers intriguing prospects, Shiba Inu encounters substantial obstacles – On technical and emotional levels.

A potential surge could occur for Shiba Inu, but it needs to surpass its resistance levels and enhance positive investor attitudes before any significant upward trend takes place.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

2024-10-25 09:43