- Solana faced another rejection from the two-month highs.

- The buying was steady but did not reach breakout levels.

As a seasoned analyst with years of experience under my belt, I see Solana [SOL] as a coin with potential but also one that requires patience and a keen eye. The latest rejection at the two-month highs is a setback, but it’s not a deal breaker. The steady buying is promising, although it hasn’t yet reached breakout levels.

On its third try since August, Solana [SOL] failed to surpass the $163 resistance point. Over the last two days, there has been some fluctuation in its short-term price, resulting in a 3.4% decrease from its recent peak at $161.8.

An uptick in whale ownership and heightened social media engagement hints at a positive trend for Solana over the next few days. However, a decrease in immediate market demand might foreshadow a more significant retreat.

Solana price action remains bullish

On the $154 mark, the bulls were competing for dominance, as this price point matched the 50% retracement level. Yet, from a broader perspective in September, the market trend leaned towards the bulls, following the breakthrough of the $140 resistance level on lower timeframes.

Over the last three months, the A/D indicator has consistently risen, indicating that buyers have been more influential during this period. Additionally, the daily Relative Strength Index (RSI) has shown a positive trend as well.

For swing traders aiming to buy, a break above the resistance zone between $162 and $165 is needed first. After that, if successful, they might aim for the upper boundary of the range at $187.

Although the indicators suggested optimism (bullish signals) from accumulation/distribution, the trading volume remained consistent with its average over the past six weeks as Solana (SOL) neared a critical resistance level. This steady volume caused concern among holders, as it lacked the surge typically seen when such resistance is approached.

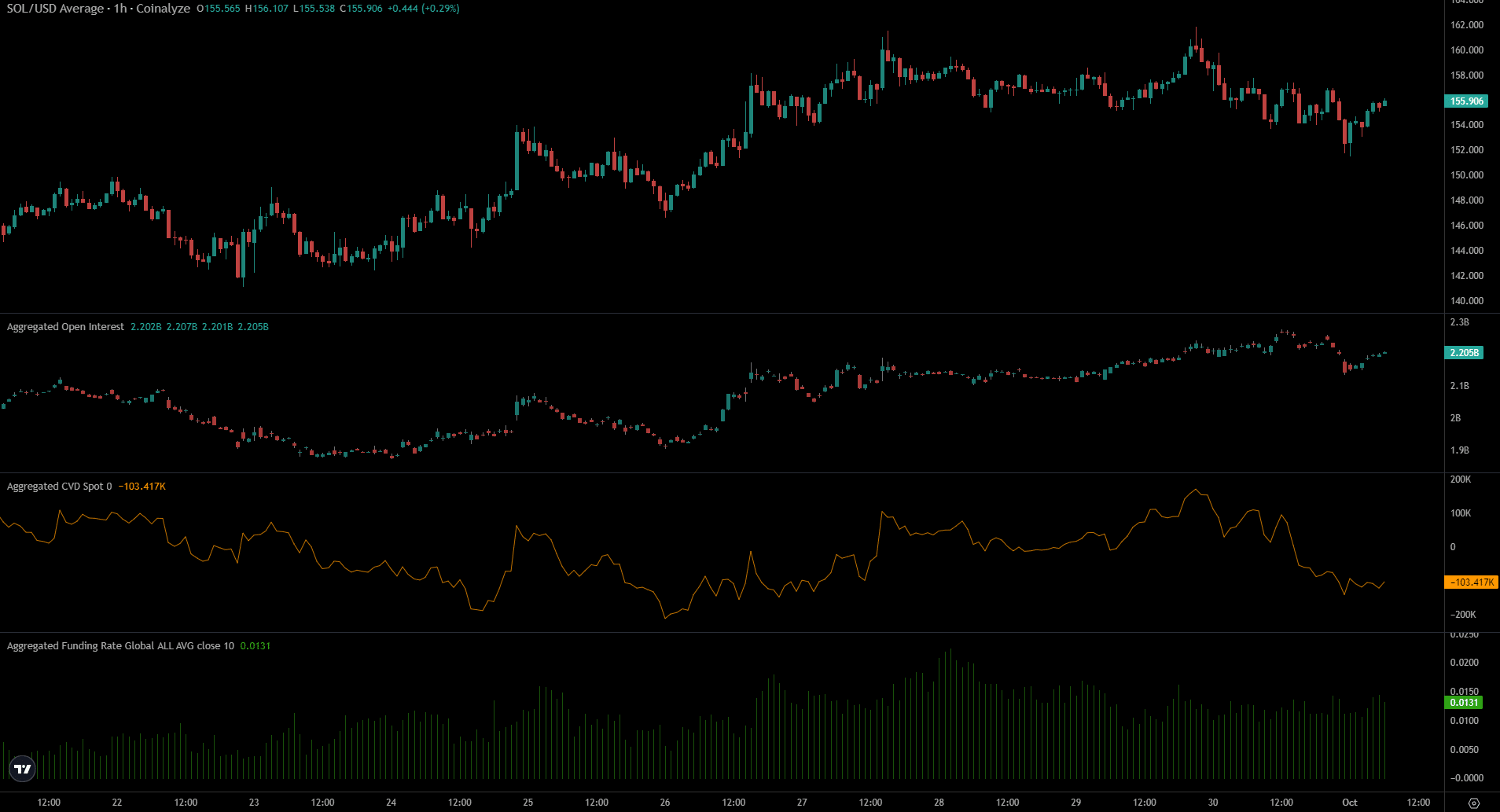

Coinalyze trends indicate heightened volatility

Over the last two days, AMBCrypto observed a downward trend in the CVD spot market, which aligns with the retreat from the $161.8 level. The surge in sell-offs around a resistance area decreased the likelihood of an immediate breakout.

Read Solana’s [SOL] Price Prediction 2024-25

The financing cost remained positive, and the Open Interest (OI) continued to climb. However, even the decline impacted the OI; yet, within the past few hours, there have been signs of recovery.

Overall, a pullback below $154 appeared likely due to the volume.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- WCT PREDICTION. WCT cryptocurrency

- LPT PREDICTION. LPT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- Solo Leveling Arise Tawata Kanae Guide

- Despite Bitcoin’s $64K surprise, some major concerns persist

- Clarkson’s Farm Season 5: What We Know About the Release Date and More!

- Planet Coaster 2 Interview – Water Parks, Coaster Customization, PS5 Pro Enhancements, and More

- Chrishell Stause’s Dig at Ex-Husband Justin Hartley Sparks Backlash

2024-10-01 18:15