-

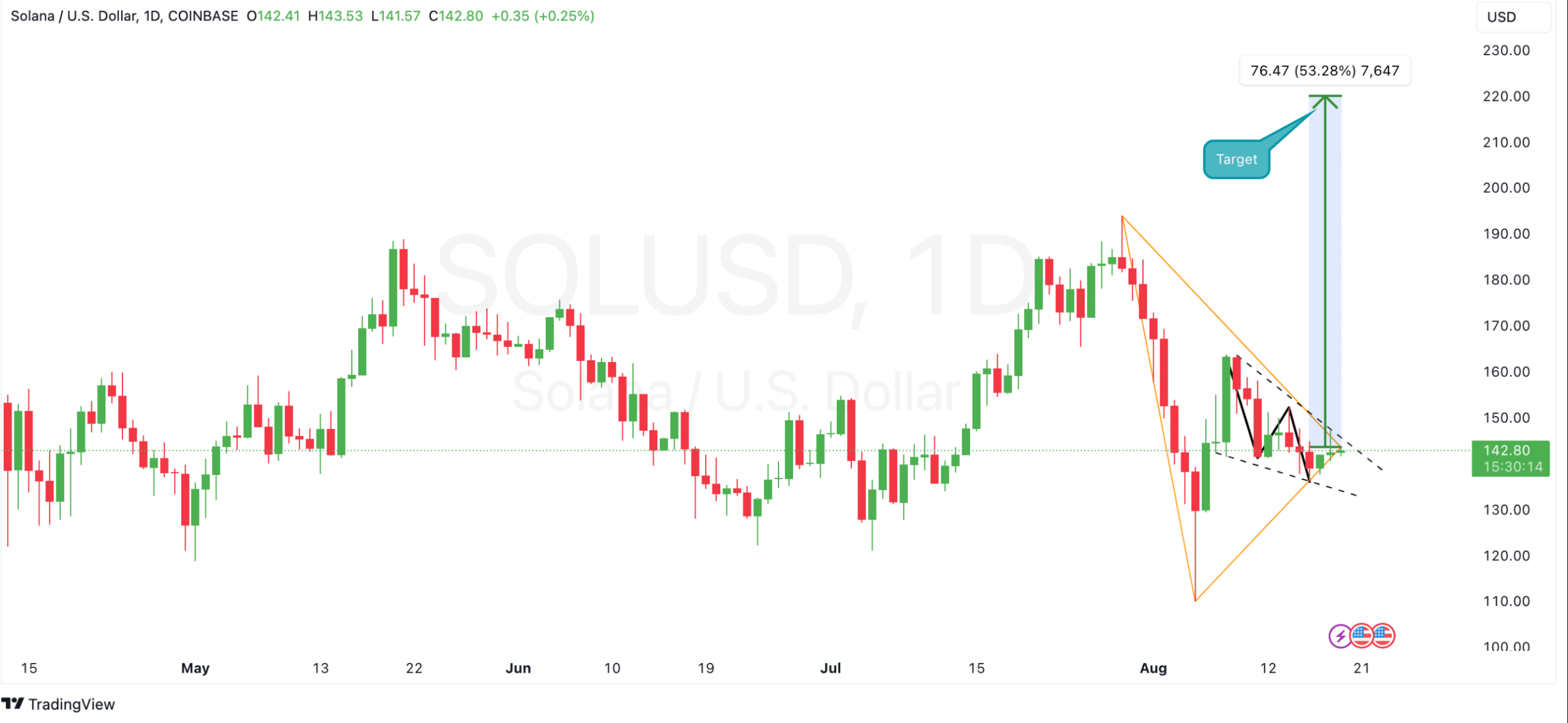

Solana’s symmetrical triangle pattern hints at a potential breakout, possibly pushing the price up to $220.

Derivatives data shows a 51.5% surge in SOL trading volume, signaling heightened market activity and volatility.

As a seasoned crypto investor with a penchant for technical analysis and market trends, I find myself intrigued by Solana’s current situation. The symmetrical triangle pattern on its chart suggests that we might be witnessing a turning point, with potential upwards momentum towards $220 if the resistance is broken. However, it’s important to remember that past performance doesn’t guarantee future results – in crypto, anything can happen!

🌪️ Storm Brewing: EUR/USD Forecast Turns Chaotic Under Trump!

Discover why the next days could be critical for forex traders!

View Urgent ForecastAt the moment of reporting, Solana’s [SOL] value was actively traded, hovering near $140.97. According to technical analysis, there could be a shift or reversal in Solana’s trend due to significant chart patterns and growing curiosity in the derivatives market.

The price of SOL has dropped by 2.74% over the last 24 hours, with a 7-day decline of 2.54%, reflecting some bearish pressure in the market.

Although there’s been a drop lately, experts notice a forming symmetrical triangle shape, suggesting a potential breakout may be imminent.

If Solana surpasses its current resistance, it might potentially rise to around $220, indicating a possible increase of approximately 53.28%.

Traders are monitoring this potential breakout, looking for confirmation of an upward rally.

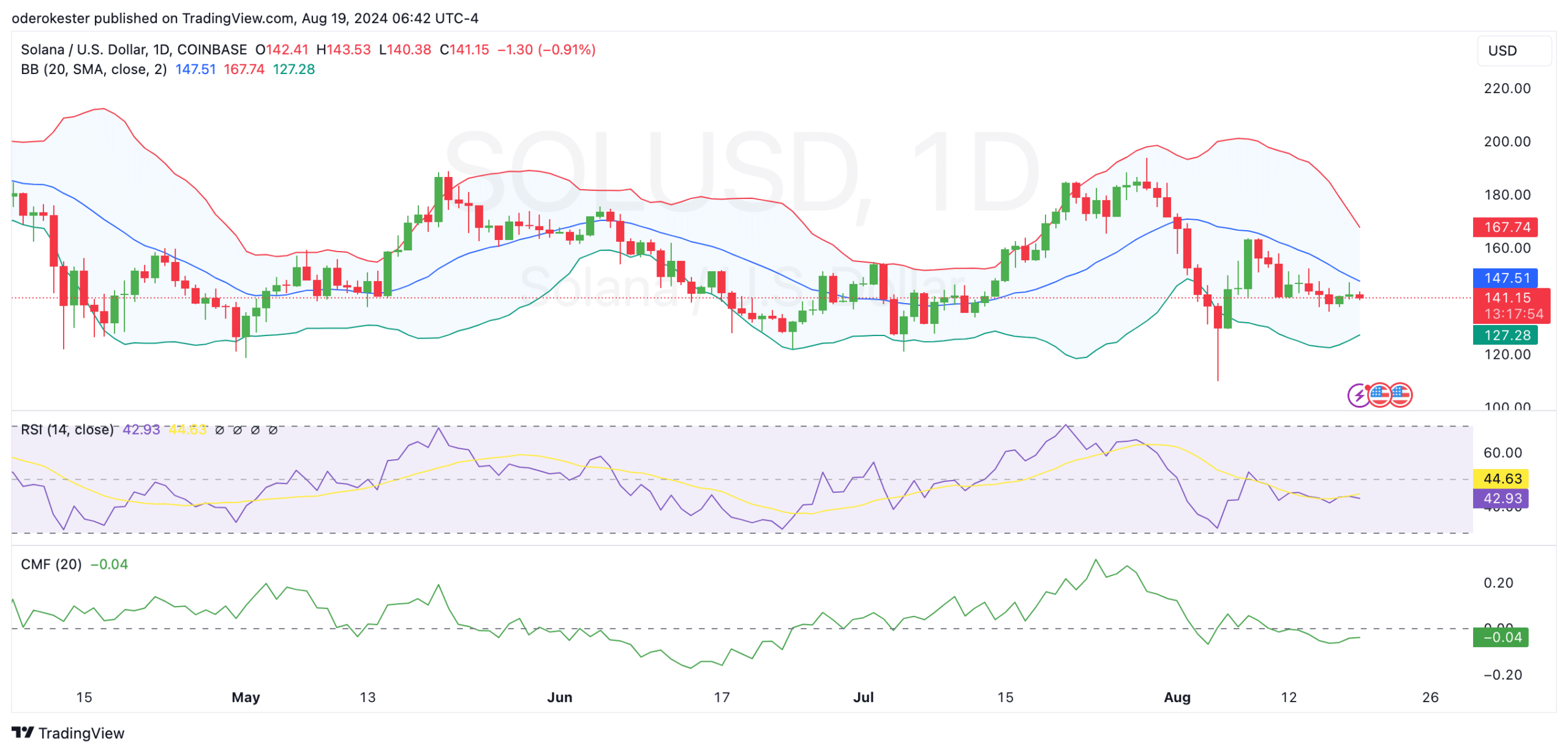

Technical indicators signal mixed market sentiment

At the moment of reporting, SOL was hovering around $140.76, slightly below the middle Bollinger Band at $147.49. This indicates a potential buildup of downward pressure, and if volatility increases, the trading range could extend from approximately $167.75 to $127.23.

Traders may use this range to guide their short-term strategies as market conditions shift.

At present, the Relative Strength Index (RSI) stands at 42.69, which is less than the neutral 50 threshold, indicating that the trend continues to lean towards bears, signifying downward momentum.

In other words, since the Relative Strength Index (RSI) isn’t indicating oversold conditions yet, it suggests that the market may continue to fall or could potentially rebound if buyer demand increases.

The Chaikin Money Flow (CMF) indicates a modest outflow of capital, as it stands at -0.04. This finding adds to the prevailing sense of caution among traders.

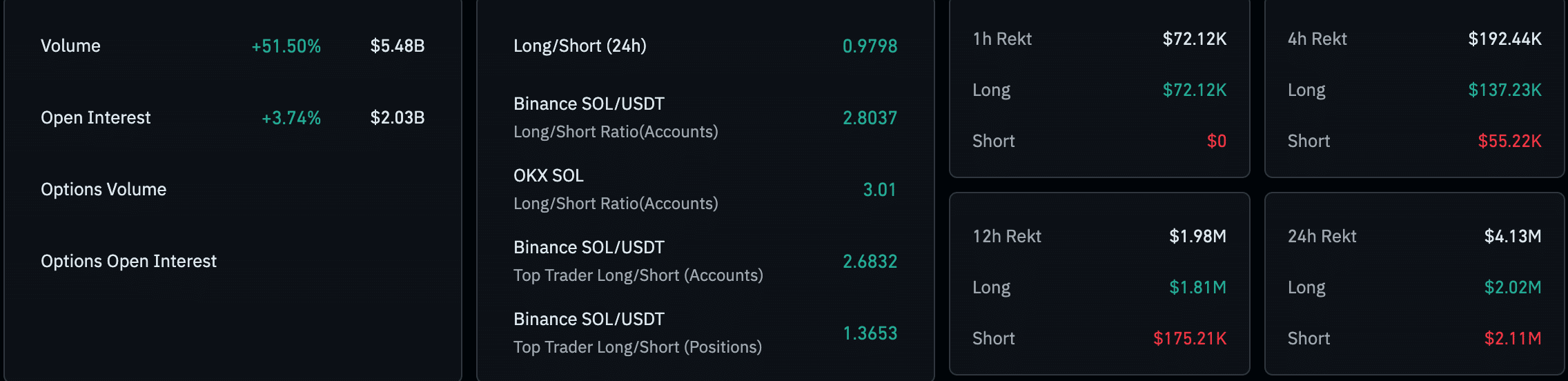

Solana’s trading surge signals volatility

The statistics on derivatives for Solana indicate a significant jump in trading activity and investment. Specifically, the trading volume experienced a substantial rise of approximately 51.5%, reaching an impressive total of about $5.48 billion. Additionally, open interest saw a growth of around 3.74%, ending up at roughly $2.03 billion.

Based on my years of trading experience, I believe that the recent surge in market activity indicates a trend where traders are actively taking positions, likely predicting significant price fluctuations. The increase in open interest in the options market is particularly noteworthy and suggests growing speculation about Solana’s future price direction. In my career, I’ve witnessed similar patterns precede major market shifts, making this an interesting development to monitor closely.

The balance of positions between buying (long) and selling (short) on prominent trading platforms presents a varied outlook. Specifically on Binance, the long-to-short ratio hovers near equilibrium at approximately 0.9798, suggesting that traders are adopting an evenly split strategy.

On OKX, the sentiment leans more towards optimism with a ratio of 3.01, suggesting a greater belief in Solana’s future price growth potential.

Read Solana (SOL) Price Prediction 2024-25

In the last 24 hours, records indicate a total of $4.13 million worth of assets were liquidated. This amount was approximately equally distributed between long and short positions, indicating a high degree of market instability due to the current volatile conditions.

Recent fluctuations in Solana’s price and heightened trading activity indicate that the asset may be approaching a significant turning point.

Read More

- Disney’s Animal Kingdom Says Goodbye to ‘It’s Tough to Be a Bug’ for Zootopia Show

- Jujutsu Kaisen Reveals New Gojo and Geto Image That Will Break Your Heart Before the Movie!

- Gaming News: Why Kingdom Come Deliverance II is Winning Hearts – A Reader’s Review

- Taylor Swift Denies Involvement as Legal Battle Explodes Between Blake Lively and Justin Baldoni

- Why Tina Fey’s Netflix Show The Four Seasons Is a Must-Watch Remake of a Classic Romcom

- The Weeknd Shocks Fans with Unforgettable Grammy Stage Comeback!

- Hut 8 ‘self-mining plans’ make it competitive post-halving: Benchmark

- The Elder Scrolls IV: Oblivion Remastered – How to Complete Canvas the Castle Quest

- S.T.A.L.K.E.R. 2 Major Patch 1.2 offer 1700 improvements

- WWE’s Braun Strowman Suffers Bloody Beatdown on Saturday Night’s Main Event

2024-08-19 23:04