- Solana’s trading volume surged by 94.85%, despite an 8.68% price drop in the last 24 hours.

- SOL faced resistance at $217; $195 support is crucial for stability as institutional interest grows.

At the moment of reporting, Solana (SOL) was being traded at $197.05, showing an 8.68% decrease within the last day, yet managing to increase by 4.31% in the last seven days.

Over the past day, I’ve observed a significant surge in the trading volume of this cryptocurrency, reaching an impressive figure of $6.69 billion. This robust activity suggests a strong market interest and demand.

Currently, Solana’s market cap is around $95.54 billion, considering its total supply of 480 million coins. Over the last 24 hours, its price has varied between $193.90 and $215.98, while over the past week, it has ranged from $188.79 to $221.35.

In this rephrased version, I aimed to make the text more conversational and easy to understand, using terms like “Currently” and “over” instead of formal terminology.

At present, the value of the asset stands 24.9% lower than its peak record of $263.21, which was reached on November 23, 2024. It encounters resistance at significant points.

Technical indicators point to bearish momentum

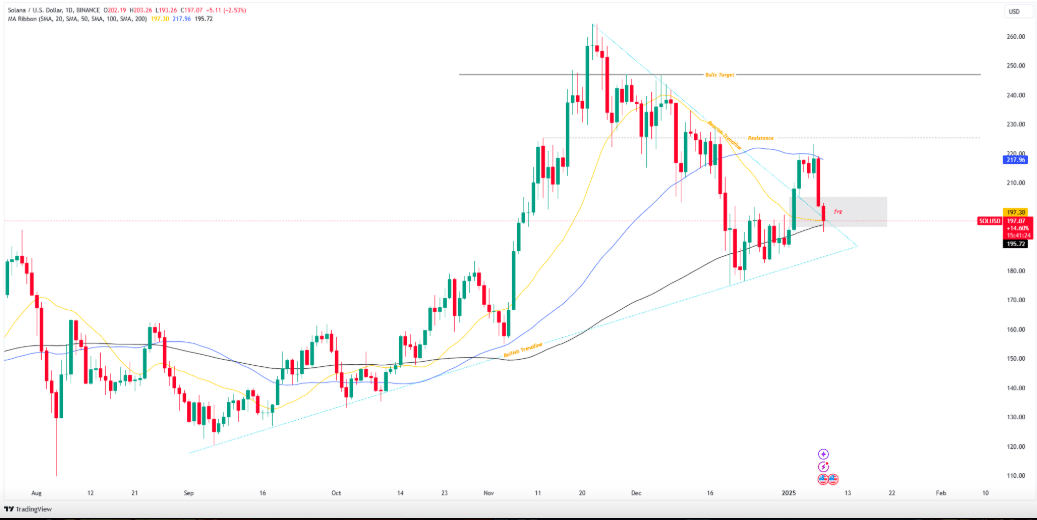

Current market behavior suggests a downward break from the previously bullish trendline and the Fair Value Gap (FVG). Additionally, the 200-day Moving Average (MA) at approximately $217.96 serves as significant resistance in the upward movement of the price.

Right now, there’s strong support around $195.72. If this support doesn’t keep the price up, we might see it drop to approximately $180.

In simpler terms, when Multiple Analysis (MA) shows alignment, it could signal an upswing in market turbulence. Traders are keeping a close eye on Solana (SOL), to see if it manages to surpass the $200 mark again and push towards the potential resistance level of $220.

Maintaining a downward trend might challenge existing lower price floors, leading to market instability and doubt.

Derivatives data reveals trader caution

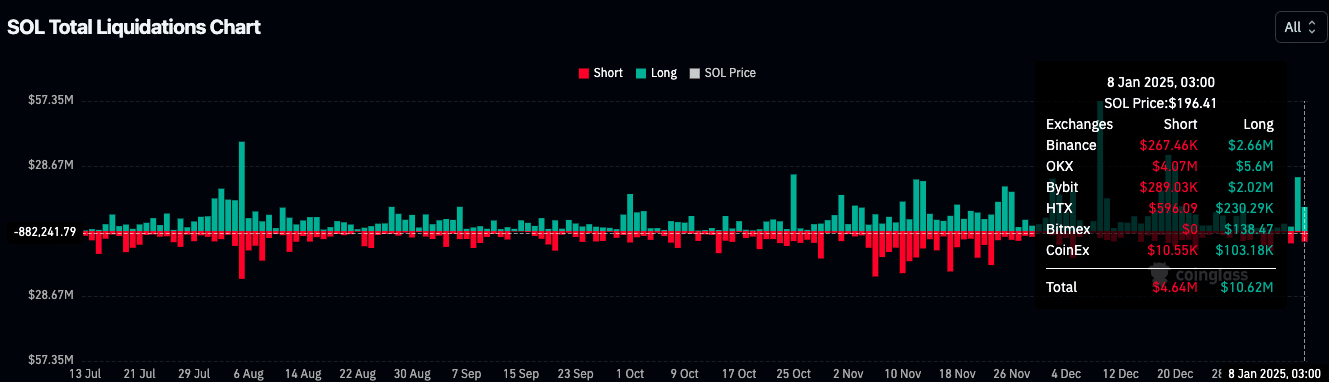

According to data from Coinglass, the feelings in derivatives markets appear split. The trading volume significantly surged by approximately 94.85%, reaching a total of $12.62 billion. However, Open Interest (OI) decreased by around 10.68% to $6.03 billion, suggesting that the number of leveraged positions has decreased.

The number of options traded significantly increased, showing a 447.63% jump in trading volume to reach approximately $902,320, and a 14.97% hike in open interest (OI) to around $1.97 million.

The information from the liquidation process shows that a total of $10.62 million worth of long positions had to be sold off, while only $4.64 million in short positions were closed. This implies that traders who anticipated a market recovery were unexpectedly caught out by the price decline.

As a researcher examining the recent market events, I’ve noticed that a significant number of liquidations took place primarily on Binance and Bybit platforms. It appears that those who held long positions were the ones largely affected by these liquidations, shouldering most of the losses in this scenario.

SOL’s network activity remains strong

As reported by DefiLlama, the Total Value Locked (TVL) for Solana currently stands at approximately $8.79 billion. This figure represents a decrease of 7.59% over the past 24 hours.

On Solana’s platform, the market value of stablecoins currently amounts to approximately $5.56 billion. During this same timeframe, the network collected roughly $4.35 million in transaction fees and generated around $2.18 million in earnings.

24-hour network activity remains robust, hosting approximately 4.74 million active addresses and tallying up a massive 62.43 million transaction records.

Read Solana’s [SOL] Price Prediction 2025–2026

Despite the recent fluctuations in prices, growing institutional engagement, for instance, like Coinbase’s liquid staking partnership with Solana, remains a key factor sustaining market enthusiasm.

With Solana hovering around $197, attention from traders and investors is centered on crucial technical indicators and network actions, looking for signals suggesting a potential rebound or continued downtrend.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Masters Toronto 2025: Everything You Need to Know

- WCT PREDICTION. WCT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- LPT PREDICTION. LPT cryptocurrency

- Elden Ring Nightreign Recluse guide and abilities explained

- Solo Leveling Arise Tawata Kanae Guide

- Despite Bitcoin’s $64K surprise, some major concerns persist

2025-01-08 15:36