-

SOL has witnessed a drop in buying momentum in the past few days.

This signals the re-emergence of SOL bears.

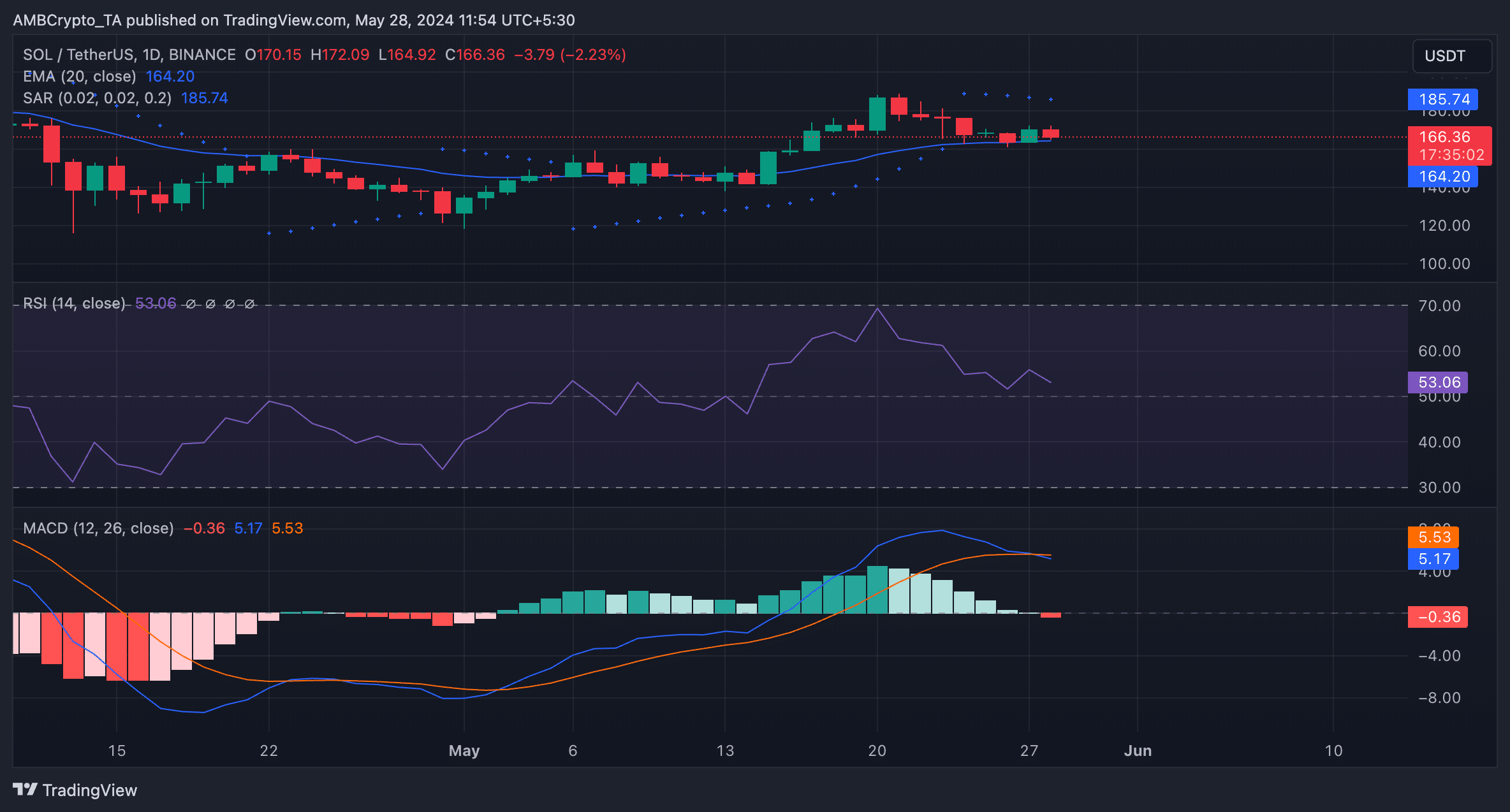

As an experienced analyst, I’ve been closely monitoring the Solana (SOL) market and I have to admit, recent price developments are concerning. The buying momentum that had propelled SOL above its 20-day exponential moving average (EMA) just a week ago has faded, and the coin is now at risk of falling below this key level.

The 20-day exponential moving average (EMA) of Solana [SOL] may act as a resistance level, causing the price to potentially drop if it fails to hold this mark, indicating decreasing demand.

Last week, the SOL coin’s value surpassed its 20-day moving average for the first time. In simpler terms, the average price of Solana from the previous 20 days was exceeded by its current value.

As a crypto investor, when I observe that a coin’s price dips beneath the average price it has held over the last twenty days, I perceive this as a sign of weakening demand and an uptick in selling activity. In simpler terms, the coin is trading at a price lower than its recent history, indicating that more investors are cashing out than buying in.

SOL sees rising bearish activity

Based on an analysis by AMBCrypto, Solana’s 1-day chart indicates a decrease in buying momentum or bullish sentiment, suggesting that the coin’s price may be trending downward.

As a researcher examining SOL‘s Moving Average Convergence Divergence (MACD) indicator, I observed that the MACD line (represented by the blue line) crossed below the signal line (orange) at the current moment.

When the MACD line of an asset falls below its signal line, this event is referred to as a “bearish cross.” This indicator suggests that the asset’s recent price surge may be weakening, increasing the likelihood of a downward price trend.

Traders often interpret this crossover as a signal to sell or open short and exit long positions.

Additionally, the Parabolic SAR dots on SOL‘s chart sat atop the price at present. These dots have maintained this position since May 24th, according to AMBCrypto’s findings.

This indicator signifies possible trends and trend reversals. When its dashed lines lie above an asset’s price chart, the market is considered to be experiencing a downturn. The implication being, the asset’s value has been decreasing and could potentially continue to do so.

The RSI of SOL‘s price chart indicated a decrease in demand for the altcoin. With a current value of 53.47 and a downward trend, the RSI signaled that selling forces were gaining momentum.

Not the end of the road for Solana

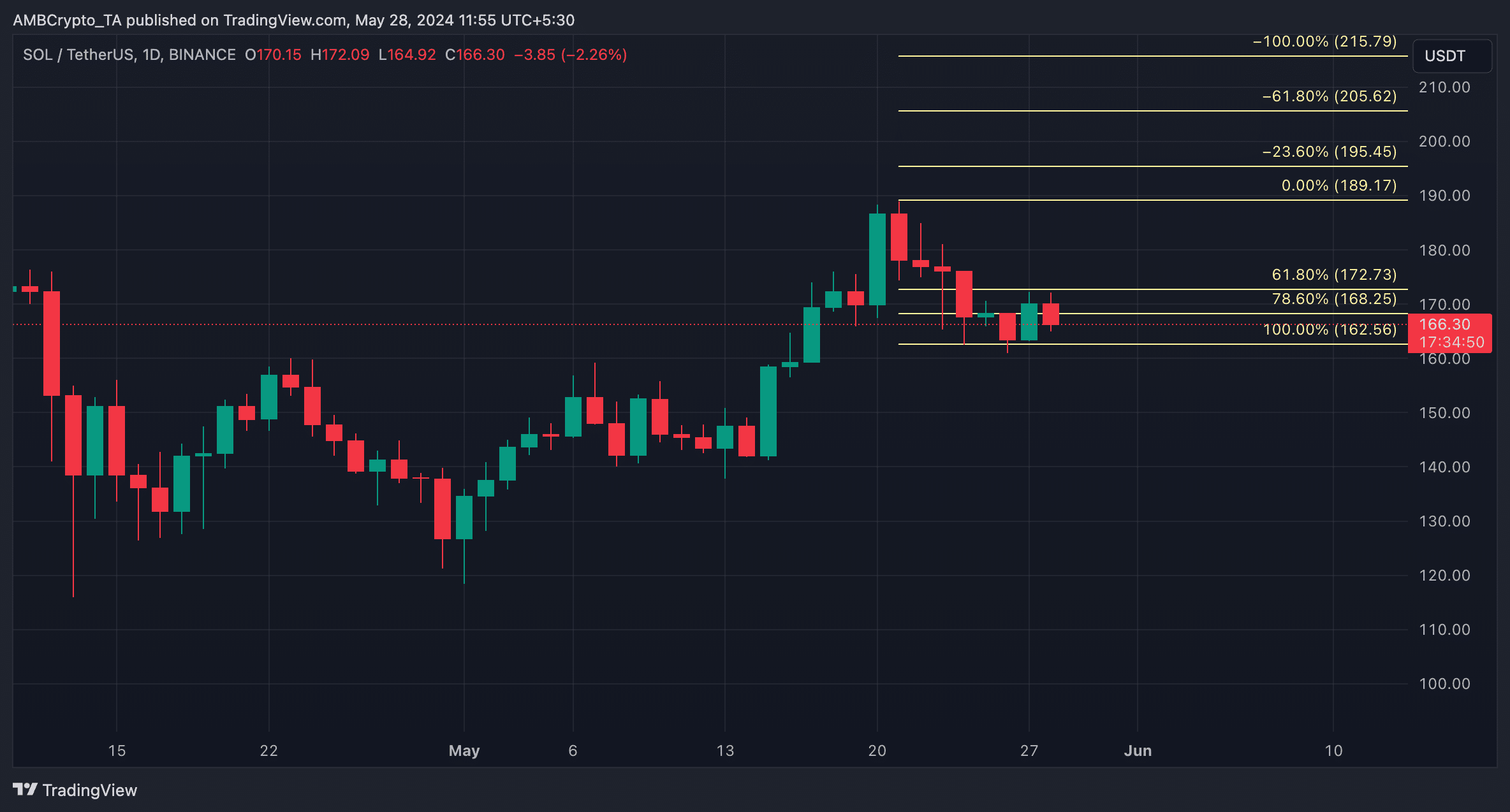

If SOL’s buying momentum plummets further, the coin’s price might fall toward $162.56.

If the bearish forecast proves incorrect and the bulls take charge once more, the altcoin could surge in value, potentially reaching prices above $170, specifically at approximately $172.73.

As a crypto investor, I believe that there’s a good chance of positive developments for Solana (SOL) in the near future based on its current situation in the futures market. Despite facing some challenges recently, the funding rate for SOL remains positive, indicating a steady flow of capital into the market. This suggests to me that there is ongoing bullish sentiment among traders and investors, which could lead to potential price increases.

Read Solana’s [SOL] Price Prediction 2024-25

As a crypto investor, I utilize funding rates in my perpetual futures trading to keep the contract’s price aligned with the current market price. These rates act as a mechanism to incentivize long or short positions based on the market conditions, thereby minimizing the price discrepancy between the futures and spot markets.

A positive funding rate for an asset implies a robust interest in holding long positions, as indicated by the data from Coinglass. Currently, Solana (SOL) has a funding rate of 0.0147%.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

2024-05-28 22:15