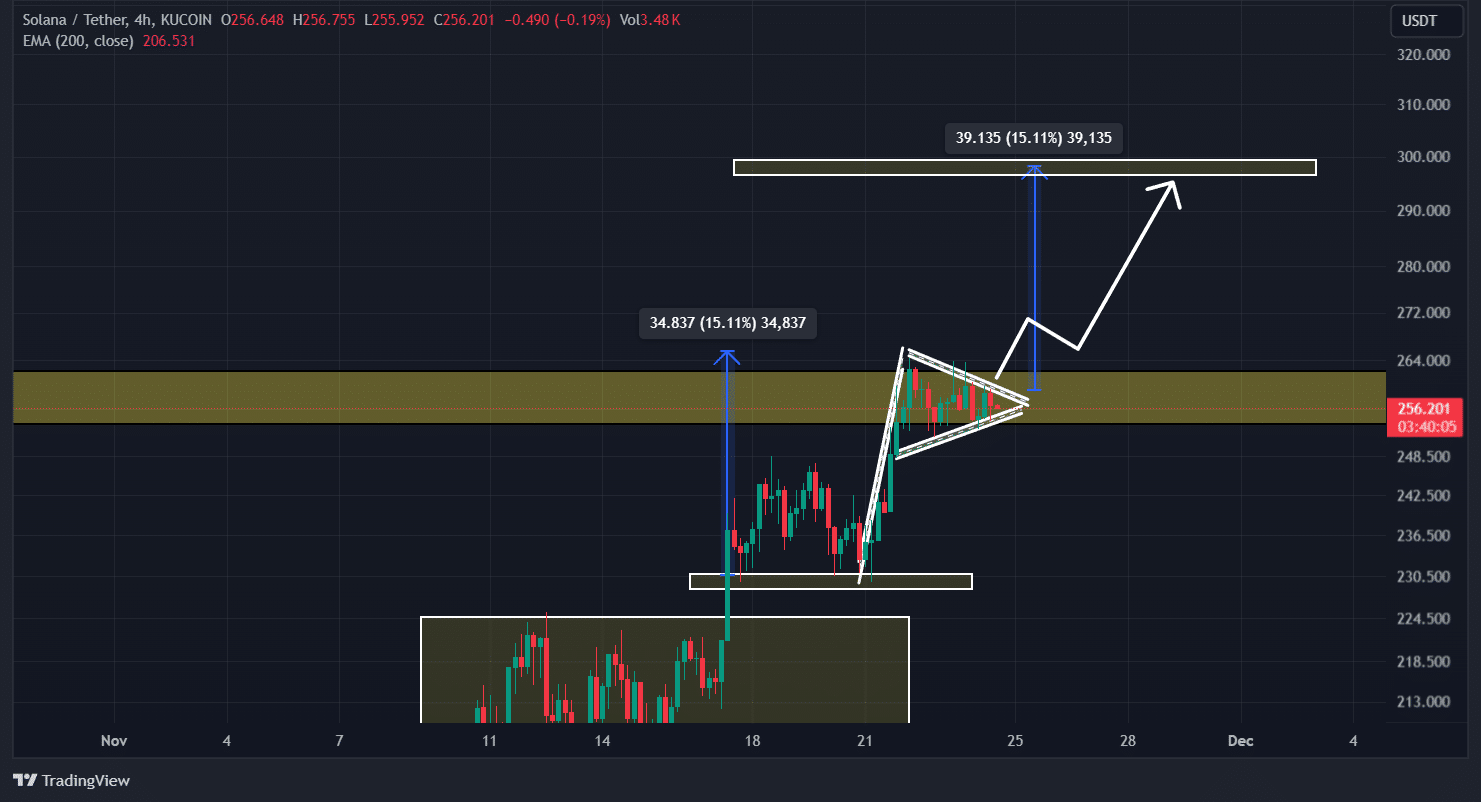

- Solana’s bullish pennant pattern hinted that SOL could reach the $299 level following the breakout.

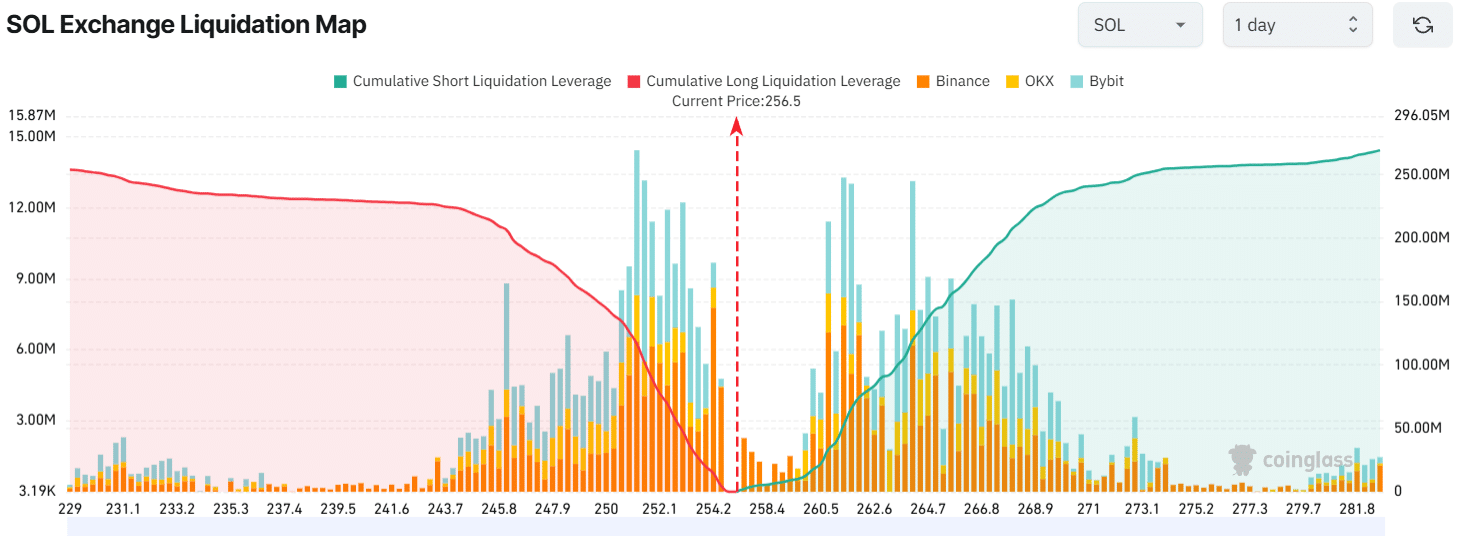

- Traders were over-leveraged at $251.2 on the lower side and $264.1 on the upper side.

As a seasoned researcher with years of experience in the dynamic and ever-evolving world of cryptocurrencies, I find myself intrigued by the current state of Solana (SOL). The bullish pennant pattern it has formed suggests a potential breakout towards $299, a prospect that is hard to ignore.

The globally recognized digital currency Solana (SOL), currently ranked fourth in terms of market value, appears ready to surge significantly due to its formation of a favorable trend in price action.

Recently, Solana (SOL) has hit a record peak, joining other significant cryptocurrencies. At the moment, it seems to be stabilizing just below this historic high.

This price consolidation near its ATH hinted at potential preparation for a further upside rally.

At this moment, I’m finding solid ground in Solana (SOL) due to its robust bullish trend, positive market vibes, and increased activity from both traders and investors.

Solana price action and key level

Based on AMBCrypto’s technical assessment, Solana (SOL) appears to have developed a bullish flag formation on the 4-hour chart, which suggests it could soon experience a significant price surge.

As an analyst, I’ve noticed a bullish trend arising in our recent market data, particularly close to the robust resistance level at around $260. This development appears to be influenced by both recent price movements and historical price momentum.

Should the price of SOL successfully burst through the current bullish flag formation, climbing beyond the resistance and concluding a four-hour candle at an elevated $260 price point, there’s a good chance it could experience a 15% surge to hit approximately $299 over the next few days.

Currently, the asset is being bought at prices higher than its 200 Exponential Moving Average (EMA), suggesting a rising trend. This is a signal that many traders and investors use when planning their investments.

Moreover, the Relative Strength Index (RSI) stood at 57.10, implying that Solana might continue to gain momentum over the next few days.

Mixed sentiment from on-chain metrics

In addition to technical analysis, on-chain metrics suggest mixed sentiment among traders.

As reported by the chain analysis company Coinglass, it appears that there’s been a 3.5% drop in open interest for Solana (SOL). This could mean that traders are closing their positions or are experiencing liquidations due to the recent price adjustment.

However, a breakout from the current price action pattern could attract both investors and traders.

Currently, the key liquidation points stand at approximately $251.2 (lower) and $264.1 (higher), as per Coinglass’s exchange liquidation chart.

As I delve into the market data, it appears that traders are significantly utilizing margin or leverage at these current levels. A potential breakout or breakdown beyond these levels might offer a more secure entry point for traders to engage in trades.

Read More

2024-11-25 03:03