- Solana now holds 51% of NFT royalties, surpassing Ethereum.

- Low fees and fast transactions are driving SOL demand and investor interest.

As a seasoned researcher with years of experience observing the dynamic world of cryptocurrencies and blockchain technology, I must admit that Solana’s [SOL] recent surge in the NFT market is nothing short of impressive. The way it has outmaneuvered Ethereum [ETH], traditionally a heavyweight in this sector, speaks volumes about its competitive edge.

In a recent development, Solana (SOL) has soared to claim about 51% of the Non-Fungible Token (NFT) royalty market, outpacing Ethereum (ETH). This growth suggests that many NFT artists and enthusiasts are drawn to Solana’s fast and cost-effective blockchain.

It’s quite possible that Solana’s strong presence in the Non-Fungible Token (NFT) market will boost interest in its own cryptocurrency and increase trust among investors.

Is Solana becoming the go-to blockchain for NFTs?

Solana’s advantage in the NFT market lies in its ability to process transactions quicker and at a lower cost compared to other blockchain platforms such as Ethereum.

The benefits offered make it a tempting option for NFT creators and enthusiasts who prioritize both speed and affordability.

Enabling creators and collectors alike, Solana reduces obstacles for creating and trading Non-Fungible Tokens (NFTs) at an affordable price point. This facilitates smooth transactions free of the burden of excessive gas fees, making it a preferred platform for all involved.

Increased NFT activity pushes demand for SOL

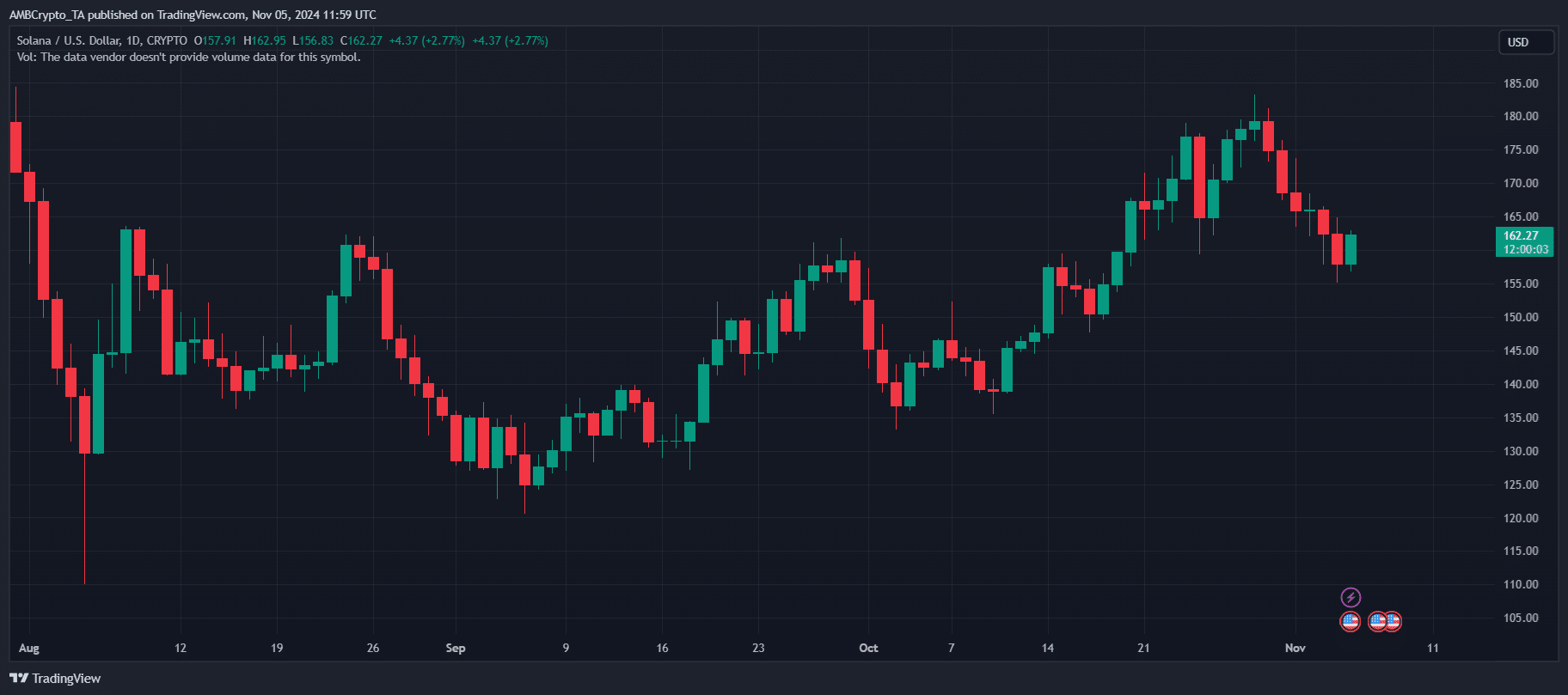

Over the past few weeks, Solana’s price has shown a series of higher lows, indicating a steady growth trend – peaking above $180 before a pullback to around $162.

Rising activity in Non-Fungible Tokens (NFTs), coupled with affordable costs and efficiency, is fueling interest in SOL, causing its value to climb. This interest, which is both pragmatic and speculative, stems from investors’ anticipation of Solana’s role as a front-runner in the NFT market.

If this momentum continues, SOL could maintain its upward trend.

From my perspective as a researcher, I’ve noticed that Solana’s outstanding performance within the Non-Fungible Token (NFT) market is significantly bolstering investor trust in its future prospects. As it continues to dominate the NFT landscape, both institutional and individual investors are progressively viewing Solana’s native token, SOL, as a promising investment opportunity.

Showcasing popular NFT collections on decentralized platforms like Magic Eden built on Solana, as well as growing corporate adoption of NFTs, underscores the increasing complexity and popularity of its ecosystem.

Furthermore, the increasing attention from venture capitalists towards projects tied to Solana underscores their faith in its potential to draw widespread participation from the mainstream.

Can Solana sustain its NFT-driven price gains?

The fast expansion of Solana within the Non-Fungible Token (NFT) sector is sparking enthusiasm about the potential increase in SOL’s value, yet there are potential hazards that might slow down its progression.

As a researcher delving into the realm of Non-Fungible Tokens (NFTs), I’m constantly grappling with the escalating saturation in this space. The emergence of competitors, such as Ethereum, which is now offering reduced gas fees, and innovative blockchains like Polygon and Avalanche, presents formidable challenges to our dominant position.

Furthermore, performance worries arise due to technical problems such as sporadic network downtimes.

As a Solana investor, I recognize that we’re on solid ground right now. However, to keep our advantage, it’s crucial for us to consistently work on network improvements, form strategic alliances, and expand into diverse application areas. This will not only secure our position but also open up new opportunities for growth.

The strong performance it’s shown in the NFT market provides a robust base, yet its lasting worth depends significantly on its ability to be flexible and responsive within a challenging and competitive environment.

Read More

- PI PREDICTION. PI cryptocurrency

- WCT PREDICTION. WCT cryptocurrency

- The Bachelor’s Ben Higgins and Jessica Clarke Welcome Baby Girl with Heartfelt Instagram Post

- Upper Deck’s First DC Annual Trading Cards Are Finally Here

- Michael Saylor’s Bitcoin Wisdom: A Tale of Uncertainty and Potential 🤷♂️📉🚀

- Has Unforgotten Season 6 Lost Sight of What Fans Loved Most?

- The Battle Royale That Started It All Has Never Been More Profitable

- SUI’s price hits new ATH to flip LINK, TON, XLM, and SHIB – What next?

- EastEnders’ Balvinder Sopal hopes for Suki and Ash reconciliation: ‘Needs to happen’

- McDonald’s Japan Confirms Hatsune Miku Collab for “Miku Day”

2024-11-06 10:15