- At press time, token was trading off a major support level and had breached a descending trendline

- On-chain metrics indicated strong accumulation of SUI by traders, which could drive its price higher

As a seasoned crypto investor with battle-tested nerves and a knack for spotting trends, I find myself intrigued by the current state of SUI. The token has shown impressive resilience and growth over the past month, breaching significant support levels and defying the bearish trend that had been in place.

Over the last month, SUI’s price performance has been remarkable, showing a rise of 16.6%. At this moment, it appears that SUI is experiencing another surge, with an increase of 18.57%. This upward trend has significantly boosted its trading volume, which currently stands at approximately $1.1 billion, marking a 93.54% jump.

The increase previously mentioned could be seen as evidence of robust market enthusiasm. Furthermore, it may hint at the possibility of continued positive trajectory.

SUI presents bullish prospects

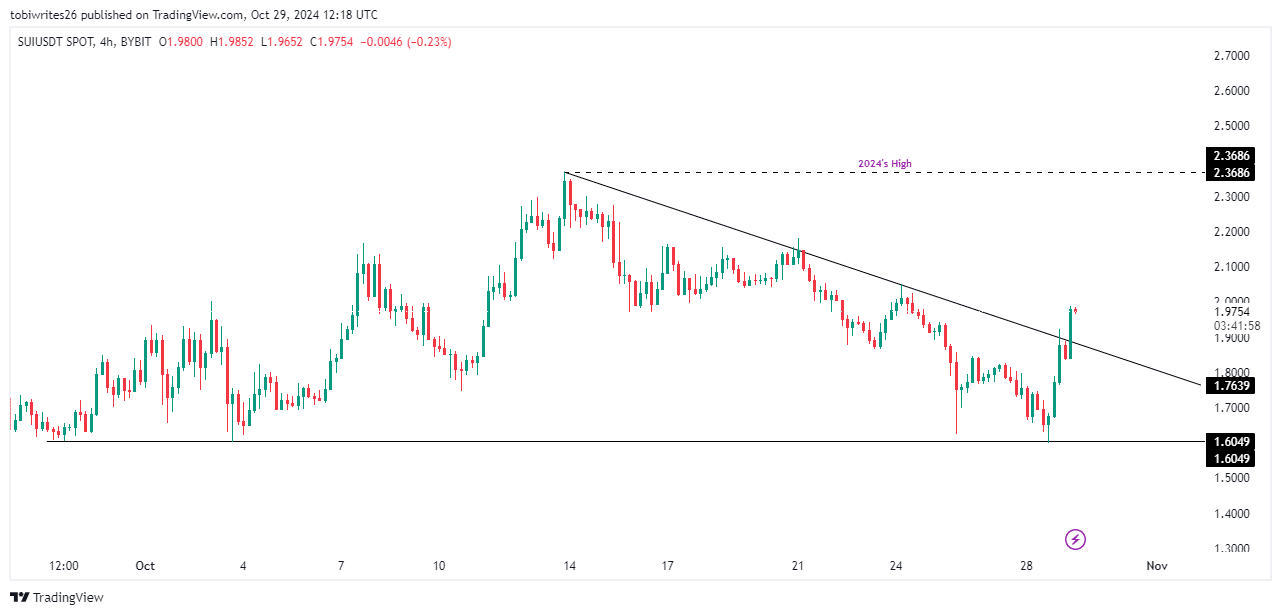

At the current moment, based on a 4-hour analysis, Swiss Franc (SUI) is found in a bullish position. This bullish trend is supported by a rise above a downward trendline that started shaping on October 13th. This surge seems to be fueled by a bounce back from the support level at $1.6049.

Should the rally persist, Swisscoin (SUI) might reach a height of approximately $2.3686, equaling its highest point in October and potentially setting the maximum trading level for the year 2024.

If downward pressure continues, SUI might pull back, possibly stretching out the falling trendline pattern.

Trader activity signals strong buy for SUI

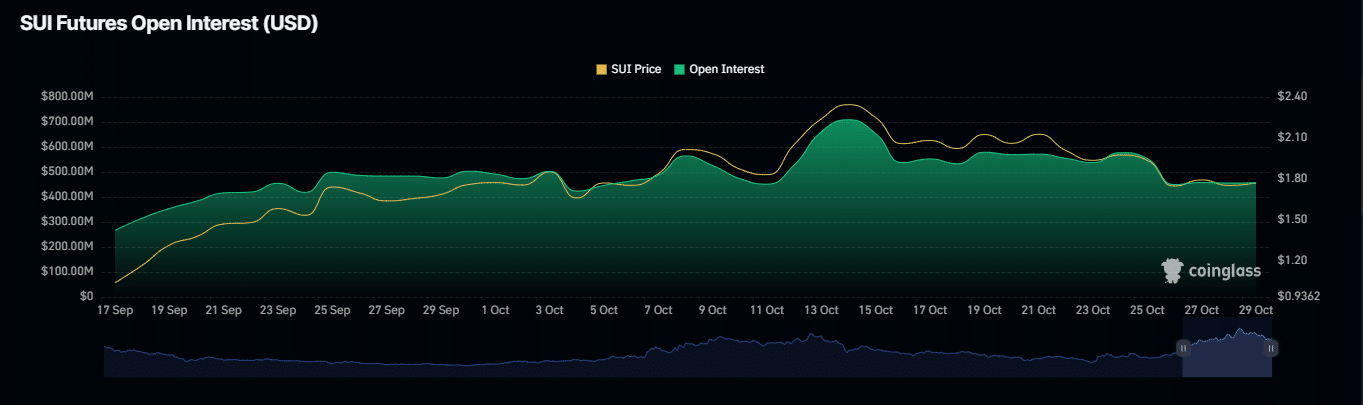

According to AMBCrypto’s on-chain analysis, it appears that SUI might continue its upward trend without any immediate indications of a downturn. Additional data from Coinglass, such as Open Interest and liquidation statistics, also hint at the possibility of continued growth in this direction.

The amount of active Futures contracts, referred to as Open Interest, increased by 17.22%, reaching a total value of approximately $519.5 million. This surge suggests a strong appetite for long positions, underscoring optimistic expectations and hinting at the possibility of continued price growth.

Furthermore, approximately $4.14 million worth of Short positions for SUI were closed during the last 24 hours due to the market’s upward trend, which worked against those who anticipated a decrease in price.

In simple terms, as both the number of new positions (Open Interest) and forced closures of existing short positions (short liquidations) have increased, it looks like the upward trend for SUI may gain significant speed over the coming trade days.

Liquidity flow’s findings

Ultimately, it appears that the Chaikin Money Flow (CMF) indicator indicates a persistent accumulation of shares in SUI, as it follows the movement of liquidity within the market.

Given that the Cumulative Moving Average (CMF) stands at 0.13, suggesting a positive trend, this could mean that the Shareholder’s Universe Inc.’s (SUI) share price might further increase, possibly reaching or even exceeding its projected peak by 2024.

Read More

2024-10-30 13:11