- Uniswap surged by over 8% after retesting a key support level.

- 520% surge in active addresses suggests growing network adoption

As a seasoned analyst with a decade of experience under my belt, I must say that Uniswap [UNI] is presenting some tantalizing opportunities for potential investors. The altcoin has shown remarkable resilience in retesting and successfully defending its key support level at $8.75, leading to an 8% surge. This bullish momentum is further corroborated by the technical breakout from an ascending triangle pattern, a historical precursor to a bull run.

Uniswap’s [UNI] token has shown remarkable resilience, holding firm at the $8.75 support and recording a noteworthy increase of 8%.

The altcoin’s recent price action suggests that bulls are regaining control of the market momentum.

Technical breakout signals bullish momentum

Uniswap has burst free from an upward-sloping triangle formation, a chart pattern often followed by a strong uptrend or bullish movement in the market.

Over the last week, UNI, having exited its consolidation period, has repeatedly encountered resistance at the $8.75 price point. This recurring event underscores the importance of this level as a substantial area where demand for the altcoin is particularly high.

The successful defense of this level indicates Uniswap’s strong buyer presence.

Uniswap metrics flash positive signals

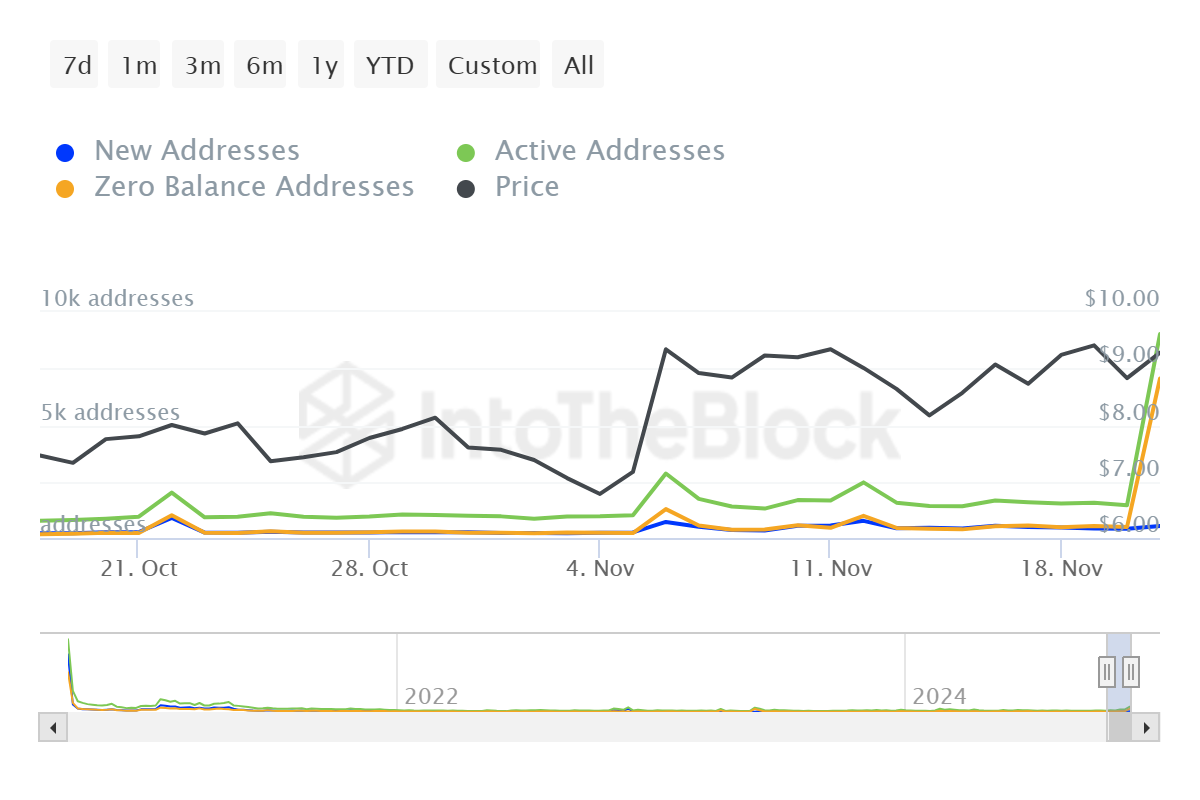

An examination of on-chain data by AMBCrypto indicates a considerable surge in network interactions. Specifically, there has been an impressive 520% rise in active Uniswap addresses within just the past 24 hours, hinting at a substantial upsurge in user involvement.

As I delve into my data analysis, I’ve noticed an astonishing spike in large-scale transactions that aligns closely with a staggering 143% rise in such transactions. This suggests a significant upsurge in the attention of ‘whales’ towards UNI, underscoring their growing interest in this particular cryptocurrency.

As an analyst, I’ve observed a notable increase in both the number of active addresses and large transaction volumes, which points towards a growing institutional involvement in this space.

Increased engagement in a network usually comes before prolonged price changes, because more active trading tends to result in better price determination.

Critical liquidation level ahead

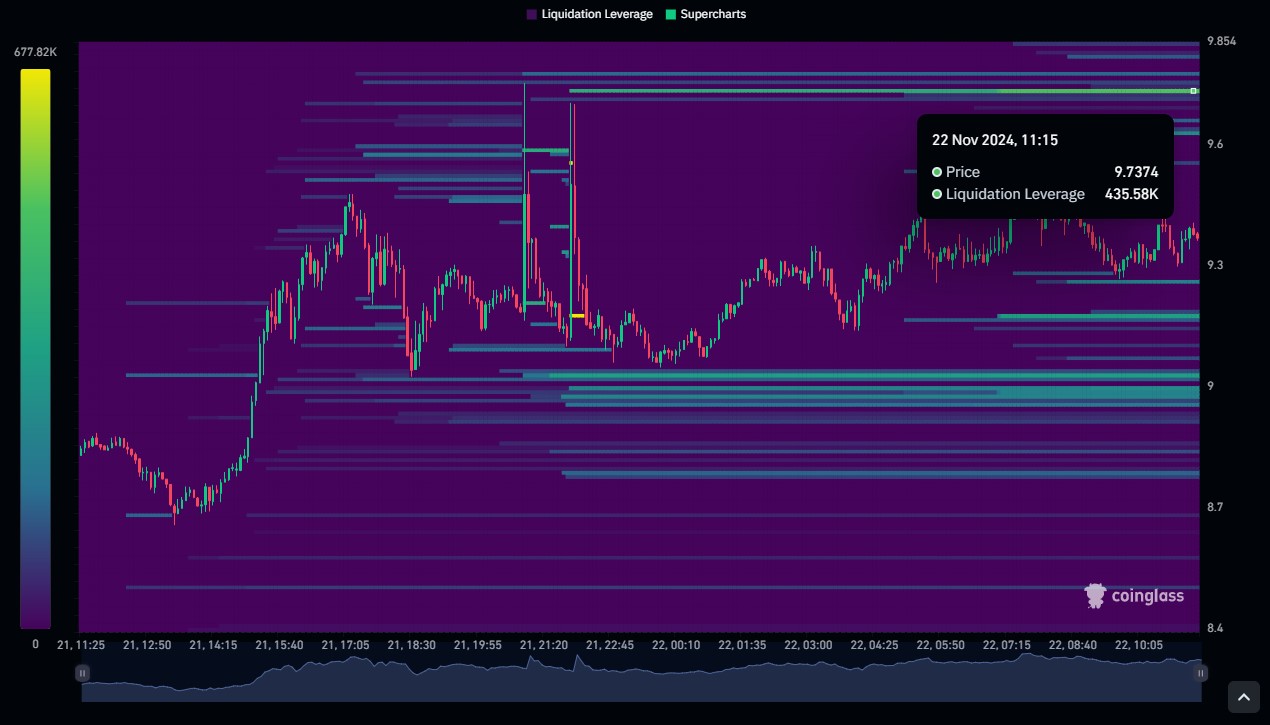

According to Coinglass’s analysis of liquidation map data, there is a substantial concentration of positions centered around the $9.73 price point, totaling roughly 430,000 units of UNI that were liquidated.

In simpler terms, the liquidation pool could attract UNI prices upwards, benefiting those who hold long positions. This trend increases the possibility of a bullish rally for Uniswap.

Realistic or not, here’s UNI’s market cap in BTC’s terms

As an analyst, I find myself observing a positive outlook based on Uniswap’s technical and on-chain data. Nevertheless, the significant resistance at $9.73 continues to hold considerable importance.

If a breakthrough occurs at this point, it might lead to a chain reaction of sell-offs, possibly amplifying the price increase even more.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

2024-11-23 05:11