- Uniswap’s exchange netflow has surged by a massive 1195%, indicating higher trading activity

- Despite surging active addresses, a sharp 63% drop in large transactions raises concerns

As an analyst with over a decade of experience in the crypto market, I’ve seen my fair share of bull and bear runs. The recent surge in Uniswap’s exchange netflow by 1195% is reminiscent of the early days of DeFi mania. This increase in trading activity could indeed be a sign of retail traders jumping on the bandwagon, hoping to capitalize on short-term price movements.

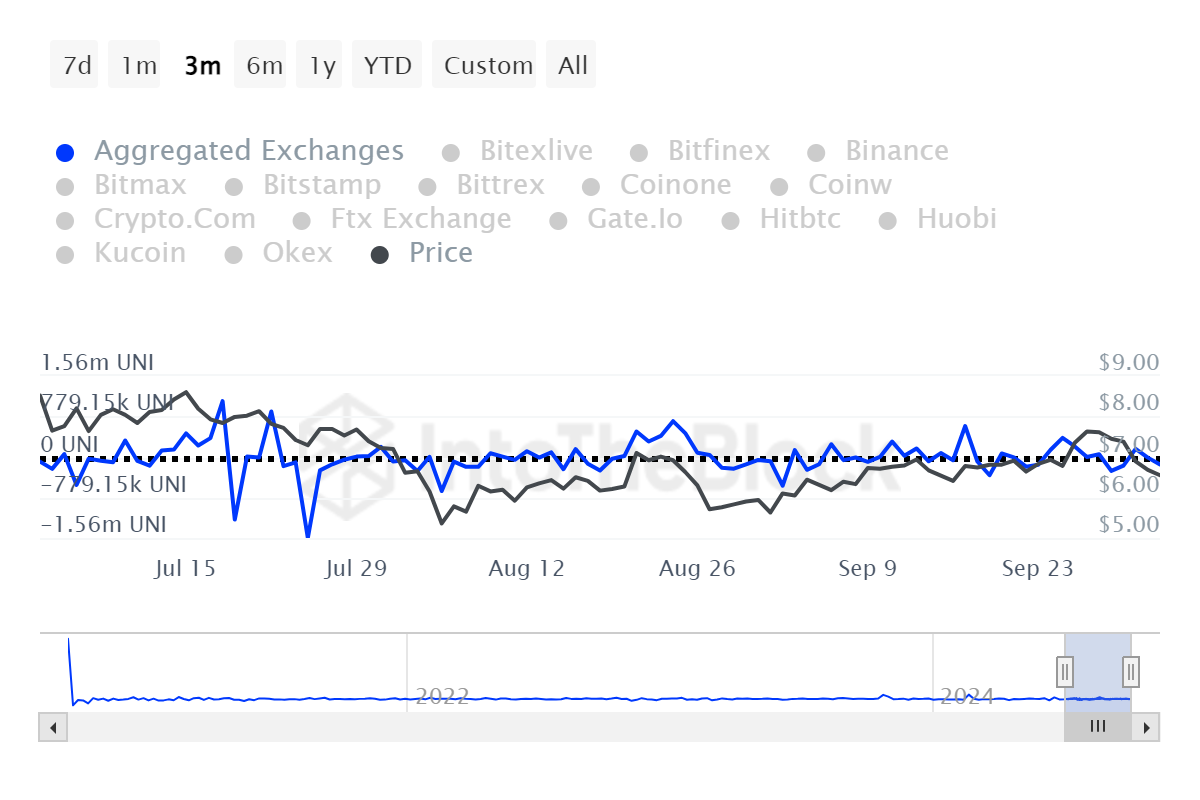

Uniswap (UNI) has seen a significant increase of 1195% in its exchange volumes, suggesting higher activity on the platform. This surge in activity has sparked discussions about whether this could lead to a potential price rise, as the number of active addresses has also increased by 11.9%.

However, large transactions have fallen by 63%, leaving some doubts about institutional interest.

What does exchange netflow surge mean for Uniswap?

A surge in Uniswap’s netflow suggests that funds are flowing into the market, potentially due to investors trying to capitalize on rapidly changing price fluctuations.

This usually means higher trading volumes as retail traders become more active.

An increase in activity levels frequently causes fluctuations in an asset’s price over the short term. For instance, with Uniswap, this increased activity might result in heightened buying and selling demand, potentially paving the way for a temporary rise in the value of UNI tokens.

Are retail traders stepping up?

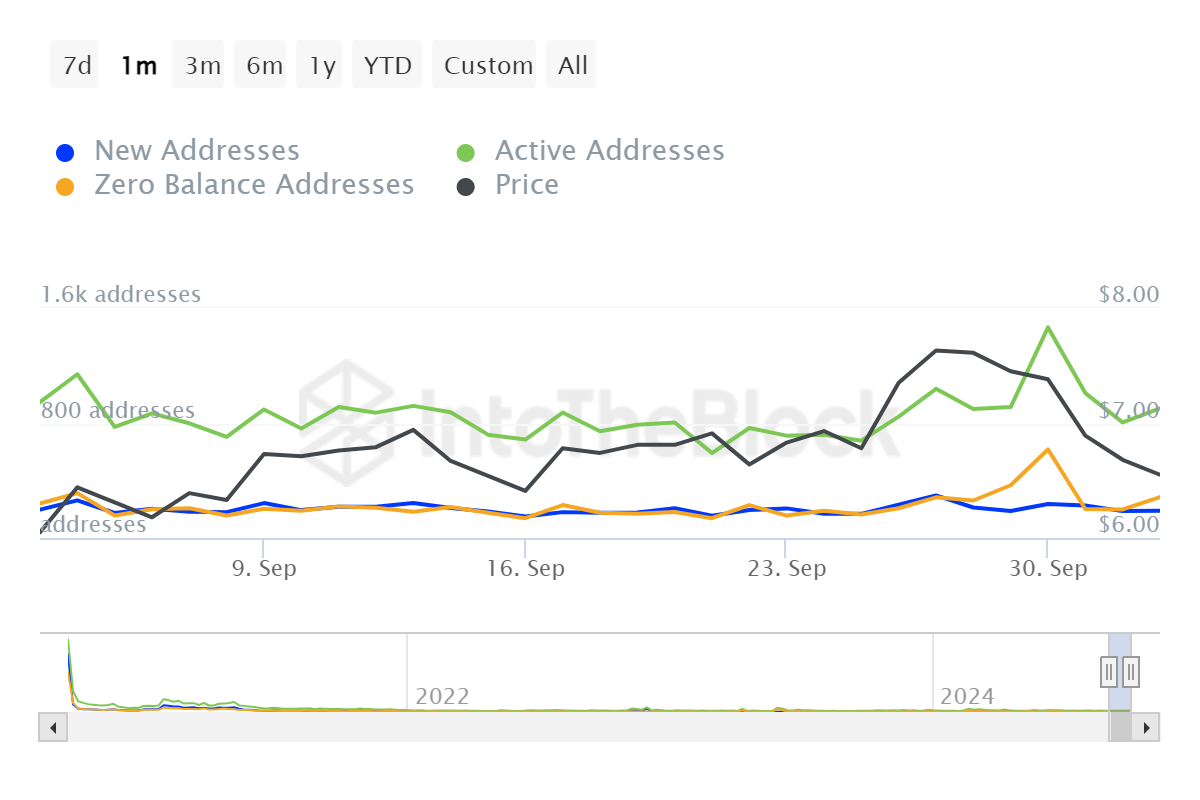

Increase by 11.9% in active addresses implies a growing interest among retail traders, as they join the platform. This influx of users might lead to an enhanced demand for Uniswap.

As a crypto investor, I’ve noticed that when institutional involvement is lacking, it’s usually the retail traders who keep things going. We, the individual investors, play a significant role in maintaining the momentum during periods of soft institutional interest.

Contrarily, the substantial decrease in large transactions hints at a noticeable reduction in whale involvement. This pattern implies that prominent investors are staying cautious and keeping a close eye on market movements.

In simpler terms, if the major players are not involved, a retail-led recovery might encounter obstacles over the long term.

Will Uniswap rebound?

It seems that the solution could be found in whether or not retail traders are able to maintain their trading activities and continue pushing the price higher for a while. If the retail activity continues to grow, it may lead to a temporary increase in the price.

Yet, if the number of transactions remains small, it could be challenging for the price of UNI to maintain its current rally momentum.

Individual investors might help maintain the stability of UNI for now, but it’s crucial institutional investors continue showing interest for a lasting restoration.

Read More

- The Bachelor’s Ben Higgins and Jessica Clarke Welcome Baby Girl with Heartfelt Instagram Post

- WCT PREDICTION. WCT cryptocurrency

- Royal Baby Alert: Princess Beatrice Welcomes Second Child!

- PI PREDICTION. PI cryptocurrency

- Sea of Thieves Season 15: New Megalodons, Wildlife, and More!

- SOL PREDICTION. SOL cryptocurrency

- Bitcoin’s Golden Cross: A Recipe for Disaster or Just Another Day in Crypto Paradise?

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- Superman Rumor Teases “Major Casting Surprise” (Is It Tom Cruise or Chris Pratt?)

- ETH Mega Pump: Will Ether Soar or Sink Like a Stone? 🚀💸

2024-10-05 12:39