-

The recent downtrend pulled WIF toward its 5-month low while the price struggled to break above the near-term EMAs.

Derivates data reaffirmed a bearish edge, but the long/short ratio on Binance showed some bullish interest.

As a seasoned crypto trader with years of experience navigating the volatile and unpredictable world of digital assets, I must admit that analyzing WIF has been quite the rollercoaster ride. The recent downtrend pulled it toward its 5-month low, but then came the glimmer of hope as buyers entered the market after WIF’s rebound from the $1.2 support level.

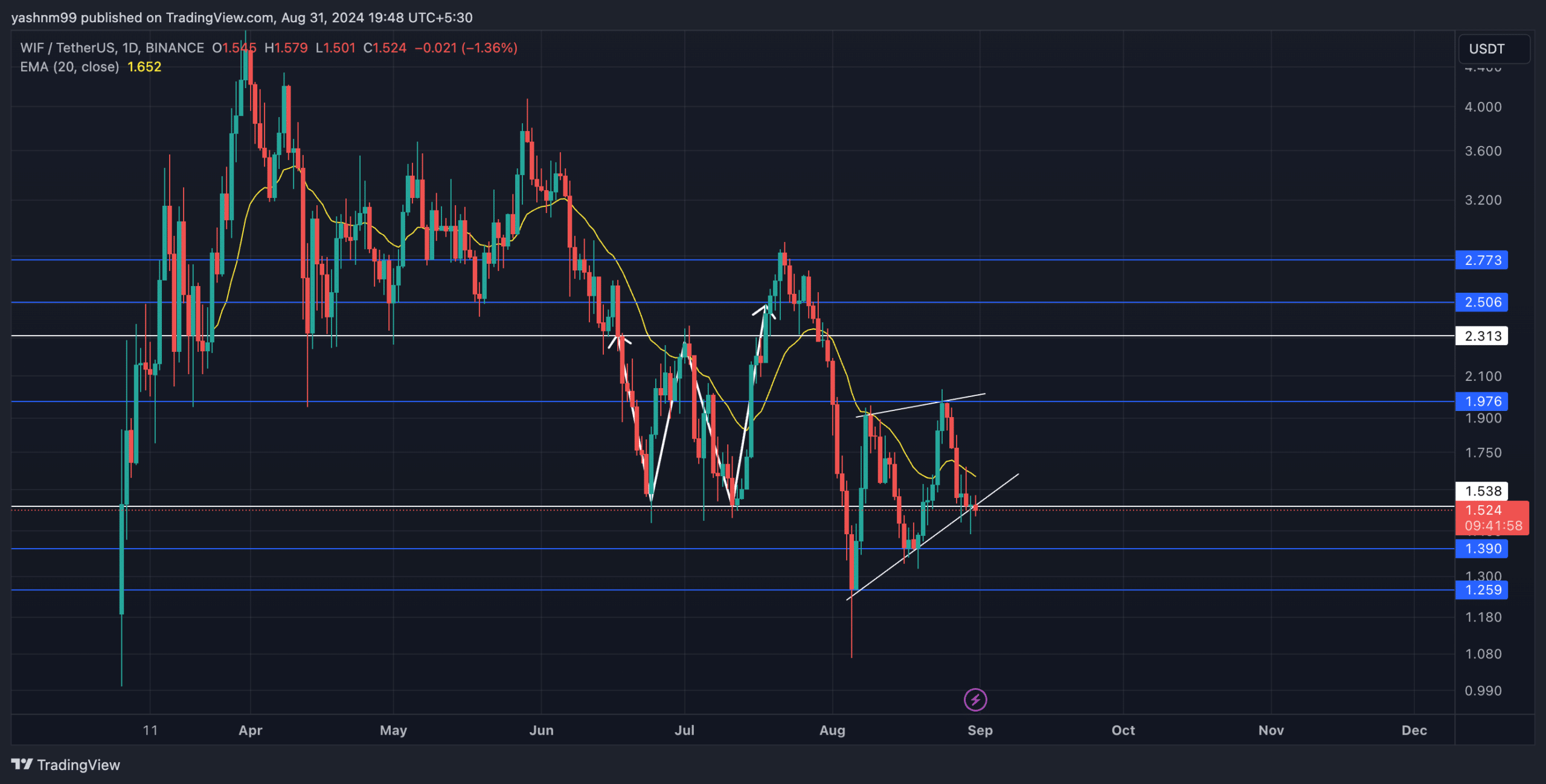

At last, dogwifhat [WIF] spotted a ray of optimism as purchasers made their move following WIF’s recent recovery from the $1.2 backing level. Currently trading at approximately $1.53, the meme coin encountered obstacles around the 20-day Exponential Moving Average (EMA) close to the $1.6 threshold.

Considering the intersection of potential resistance points around the $1.53 mark, it seems plausible that WIF may experience a short-term increase in value, followed by a resumption of its broader downward trend.

dogwifhat struggled to sustain above the 20 EMA

Over the past five months, WIF has shown a continuous drop since reaching its all-time high, and it’s been challenging for it to maintain crucial support points. After plummeting approximately 66% within two months, a recent recovery at the $1.2 support now seems to pave the way for potential buyers to challenge the resistance of the 20 EMA.

It’s important to mention that the latest changes in price have created a pattern resembling a rising wedge on the daily graph. This kind of pattern usually signals a continuation, suggesting it might result in further price drops over the next few weeks.

Over the next few days, it’s possible that WIF will recover from its current support around $1.5. This support level is significant because it coincides with several other support points. If WIF rebounds here, it could move towards the $1.8 to $2 resistance range.

Despite the persistent bearish influence, as the meme coin stayed beneath the 20 Exponential Moving Average (EMA), a drop below the $1.5 support level would validate a pattern break and potentially trigger a decline towards the $1.2 support.

Currently, the Relative Strength Index (RSI) has dipped below the 50 level and also fallen beneath its moving average, suggesting a potential bearish outlook. It may be prudent for traders to wait for a price break above the neutral point before entering any long trades.

Derivates data revealed THIS

The trading volume dropped by 8.25%, landing at approximately $837.33 million, which could signal some apprehension among traders. Meanwhile, open interest dropped by 2.53% over the last day, suggesting that traders might be liquidating their positions—perhaps in preparation for potential future losses.

In simpler terms, the 24-hour balance between long and short positions was slightly skewed towards shorts at 0.9539, hinting at a slight pessimism. On Binance, though, top traders’ long positions outnumbered their short ones by more than twice (ratio over 2), suggesting that some traders might be preparing for a possible market recovery.

Realistic or not, here’s WIF’s market cap in BTC’s terms

As a researcher, I advise keeping a close eye on the market trends to anticipate significant movements. Specifically, look out for a possible breakout above the 20 Exponential Moving Average (EMA), or a decline below the immediate support level. These events could shape the short-term direction of the market.

As a crypto investor, I always keep a keen eye on Bitcoin‘s mood swings and wider economic indicators, for they significantly impact the overall ebb and flow of the altcoin market.

Read More

- PI PREDICTION. PI cryptocurrency

- WCT PREDICTION. WCT cryptocurrency

- Gold Rate Forecast

- LPT PREDICTION. LPT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- Solo Leveling Arise Tawata Kanae Guide

- Despite Bitcoin’s $64K surprise, some major concerns persist

- Chrishell Stause’s Dig at Ex-Husband Justin Hartley Sparks Backlash

- Playmates’ Power Rangers Toyline Teaser Reveals First Lineup of Figures

- New Mickey 17 Trailer Highlights Robert Pattinson in the Sci-Fi “Masterpiece”

2024-09-01 10:15