- Wormhole’s breakout and retest at $0.277 set the stage for a potential rally.

- Market sentiment strengthened as Open Interest rose, despite mixed technical signals.

As a seasoned researcher who has seen numerous crypto market cycles, I can confidently say that Wormhole [W] has shown remarkable resilience and potential in its recent price action. The breakout above the descending trendline, followed by a successful retest at $0.277, is a bullish confirmation that sets the stage for a potential rally towards $1.0084.

It appears that the Wormhole [W] has demonstrated great strength, managing to escape from its prolonged decline and revisiting $0.277 as a robust foundation point.

The bullish signal has paved the way for possible gains, as Wormhole now aims to break through a significant resistance level at approximately $0.362. As we speak, Wormhole is being traded at $0.3197, representing a decrease of 2.64% over the past day.

Nevertheless, a generally positive outlook persisted among traders since they were primarily concerned with if Wormhole could surpass the current resistance level and potentially reach heights of $1.0084 or more.

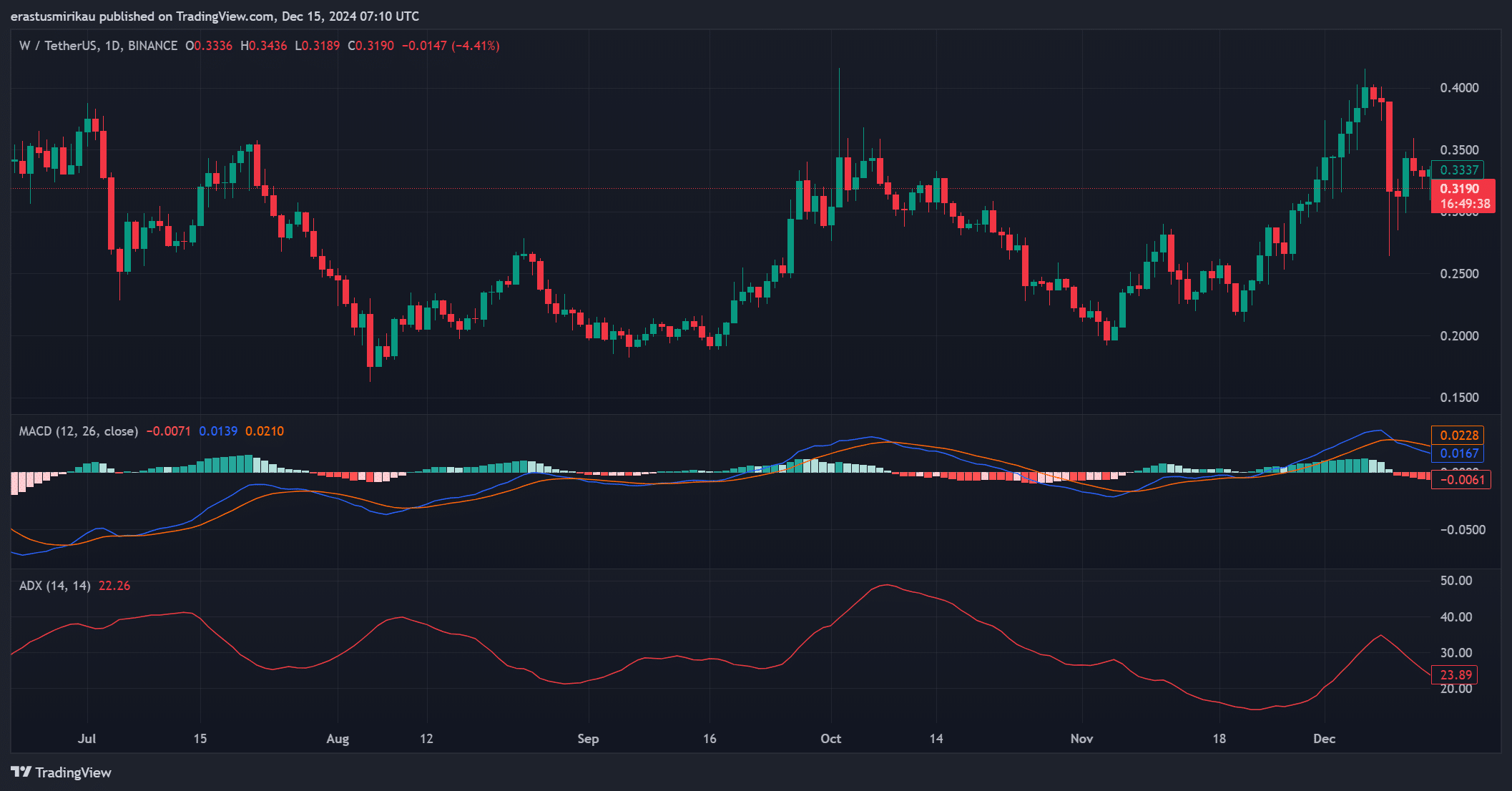

Wormhole price movement and key resistance

The behavior of the Wormhole indicates it could continue to rise, showing signs of increasing bullish energy. Crossing above the downward slope of its trendline and then successfully retesting at $0.277 suggests that investor optimism is on the rise.

Yet, overcoming the $0.362 barrier is crucial to validate the strength of the rally. If this level is surpassed, it may pave the way towards the potential target of $1.0084, which corresponds to a significant resistance area for further growth.

Conversely, if the price doesn’t rise above $0.362, it might lead to a period of stagnation. The significant support level at $0.277 would still be crucial during this time.

Consequently, the upcoming sessions play a crucial role in deciding if $W will continue to rise or fall back towards its support points for potential retesting.

What do technical indicators suggest?

From my analysis perspective, the technical indicators I’m observing seem to paint a somewhat conflicting picture. Specifically, the Moving Average Convergence Divergence (MACD) is suggesting a modest bearish divergence, as the MACD line has dropped below the signal line. This potential shift could hint at a possible deceleration in momentum.

However, the ADX read 22.26, suggesting moderate trend strength.

If Wormhole manages to surpass $0.362, this might spark a renewed upward trend, potentially boosting the ADX, indicating a more robust drive in the price increase.

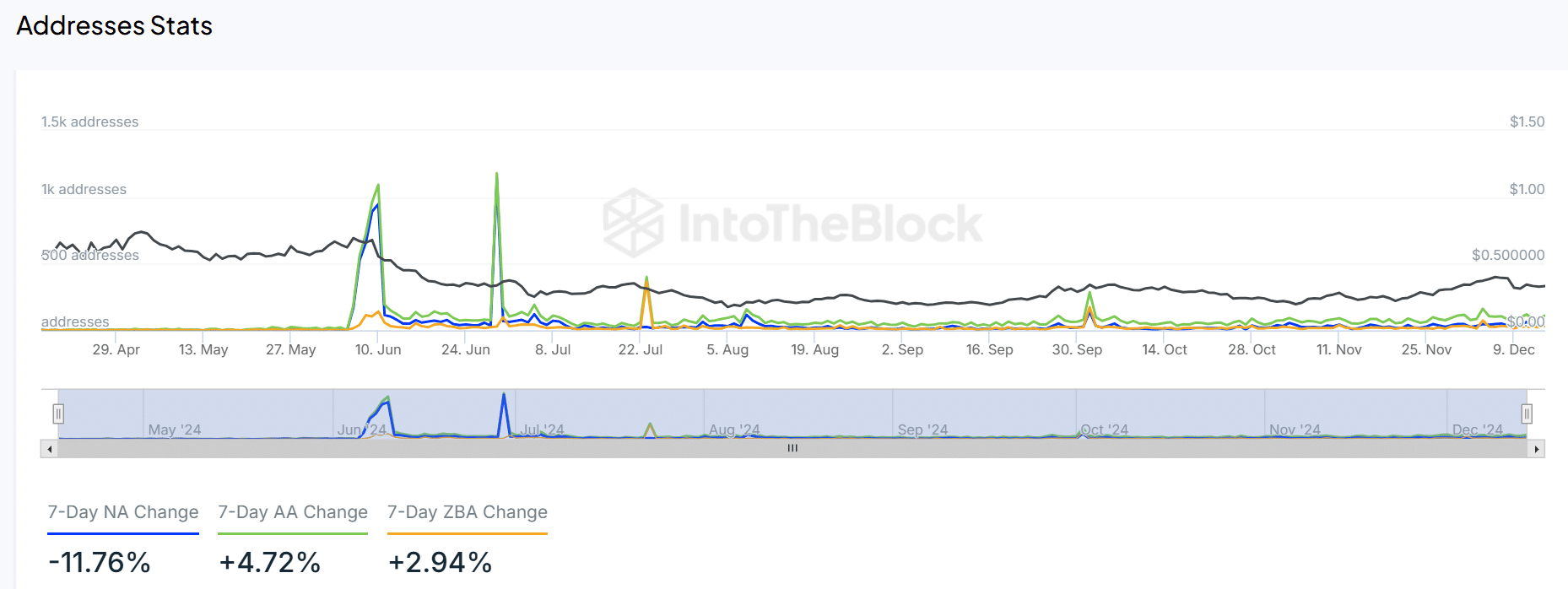

Wormhole address stats and network engagement

Data recorded on the blockchain offers valuable supplementary information about Wormhole’s activity. Over the last seven days, there has been a 4.72% increase in active addresses, indicating consistent user involvement.

On the other hand, there’s been a decrease of 11.76% in the number of new addresses, indicating difficulties in drawing new users to the network.

Consequently, it’s crucial to increase participation within our existing community as we strive to maintain steady growth over the long term.

Liquidation data and market sentiment

The data on liquidation suggests that traders are generally optimistic, as reported by Coinglass analytics. This is because a larger sum was long liquidated ($42,170) compared to short liquidations ($34,590). This imbalance indicates that traders have more faith in Wormhole’s recovery.

Moreover, there’s a 5.97% increase in Open Interest, taking it up to $70.62M, suggesting an uptick in market action and possibly more market fluctuations ahead.

A wormhole could maintain its surge towards $1.0084, but surpassing the resistance at $0.362 is vital for verifying its upward trend and momentum.

If we manage to push past this resistance level, it will strengthen traders’ faith and open up possibilities for substantial price growth.

If the price doesn’t manage to advance past this point, it might move sideways or even revisit the significant support level at $0.277 again.

Read More

- The Bachelor’s Ben Higgins and Jessica Clarke Welcome Baby Girl with Heartfelt Instagram Post

- WCT PREDICTION. WCT cryptocurrency

- The Elder Scrolls IV: Oblivion Remastered – How to Complete Canvas the Castle Quest

- Chrishell Stause’s Dig at Ex-Husband Justin Hartley Sparks Backlash

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- AMD’s RDNA 4 GPUs Reinvigorate the Mid-Range Market

- Royal Baby Alert: Princess Beatrice Welcomes Second Child!

- New Mickey 17 Trailer Highlights Robert Pattinson in the Sci-Fi “Masterpiece”

- Studio Ghibli Creates Live-Action Anime Adaptation For Theme Park’s Anniversary: Watch

- Sea of Thieves Season 15: New Megalodons, Wildlife, and More!

2024-12-15 21:12