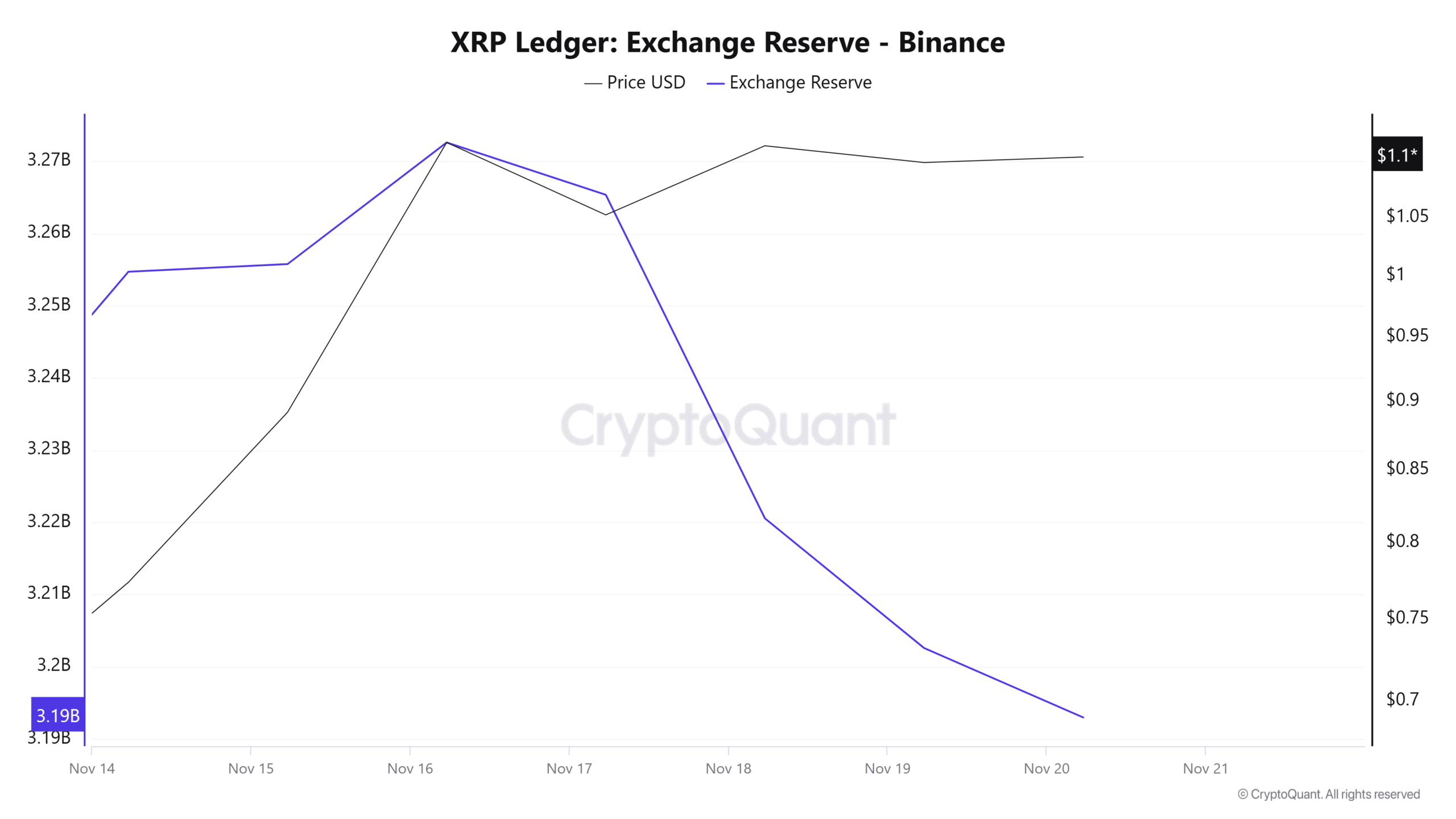

- XRP reserves on exchanges are continuously falling, indicating that whales and institutions were significantly withdrawing tokens.

- XRP could surge by 63% to reach the $1.90 level if it closes a candle above the $1.15 level.

As a seasoned analyst with over a decade of experience in the cryptocurrency market, I’ve seen enough bull and bear runs to last a lifetime. The current surge in XRP is certainly catching my attention, especially considering the significant withdrawal of tokens by whales and institutions, as evidenced by the $124M transfer from Binance.

🔥 EUR/USD Rollercoaster Ahead After Trump Tariff Plans!

The euro faces intense pressure — shocking forecasts now revealed!

View Urgent ForecastThe digital currency Ripple (XRP) is drawing increased interest from large investors and financial institutions due to the emergence of a favorable price trend shape.

Moreover, the price movements of Bitcoin (BTC) have significantly influenced the broader cryptocurrency market. This shift in market attitude has transitioned from a consolidation phase to a bullish trend as Bitcoin neared the $100K milestone.

XRP whale bags tokens worth $124M

On November 20th, amidst the market’s optimism, a significant player in the crypto world moved approximately 111 million XRP tokens valued at around $123.59 million from Binance to an unidentified digital wallet.

Based on my years of trading experience and observation of market trends, I firmly believe that this substantial withdrawal could be a result of the bullish market sentiment and XRP’s robust performance. I have witnessed similar scenarios in the past where a coin’s strong price action has attracted investors, leading to significant withdrawals from other assets. This is not uncommon in a thriving market environment, as traders often seek out high-performing coins like XRP.

Furthermore, it was observed that the quantity of XRP held on exchanges was steadily decreasing, suggesting a substantial withdrawal of tokens by both small investors, large holders (whales), and institutional entities.

This is a bullish sign as it reduces the likelihood of a price decline for the asset.

XRP’s technical analysis and key levels

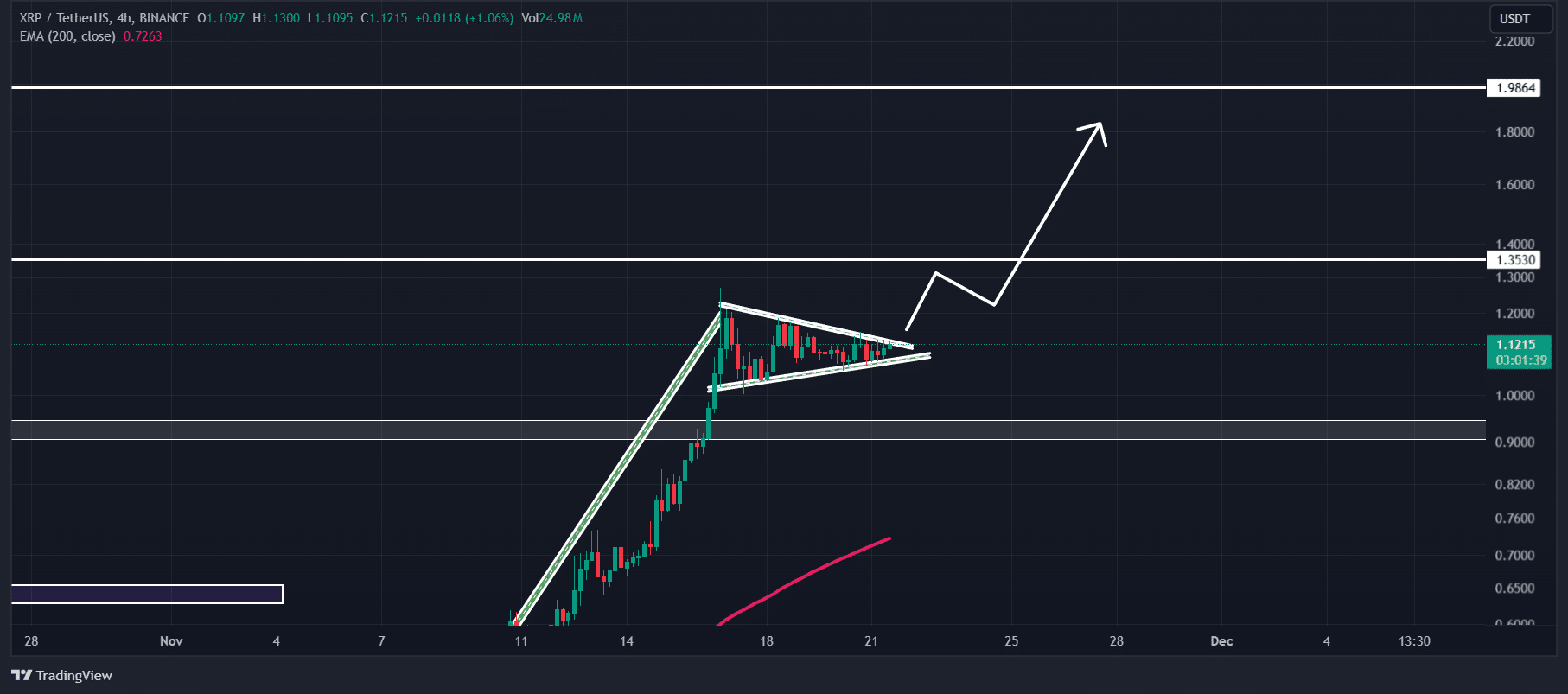

According to AMBCrypto’s technical assessment, there appears to be a bullish pennant formation in XRP’s price chart over a four-hour period. This structure is typically followed by a potential price surge as the pattern breaks out.

Should XRP manage to break free from its current pattern and conclude a candle above $1.15, there’s a strong possibility that it might increase by approximately 63%, potentially reaching $1.90 within the near future.

The RSI and 200 EMA for XRP suggest a surge in positive price movement, pointing towards a possible uptrend in the near future.

Rising Open Interest

However, on-chain metrics further supported the altcoin’s bullish outlook.

Based on data from analytical firm Coinglass, there’s been a surge in trading activity among participants, causing an increase in Open Interest (OI) levels.

In the last day, there’s been a 4.5% surge in Open Interest (OI) for XRP. Moreover, over the past 4 hours, it has climbed by approximately 2.78%. This escalating attention towards the digital coin suggests a positive, or bullish, market trend.

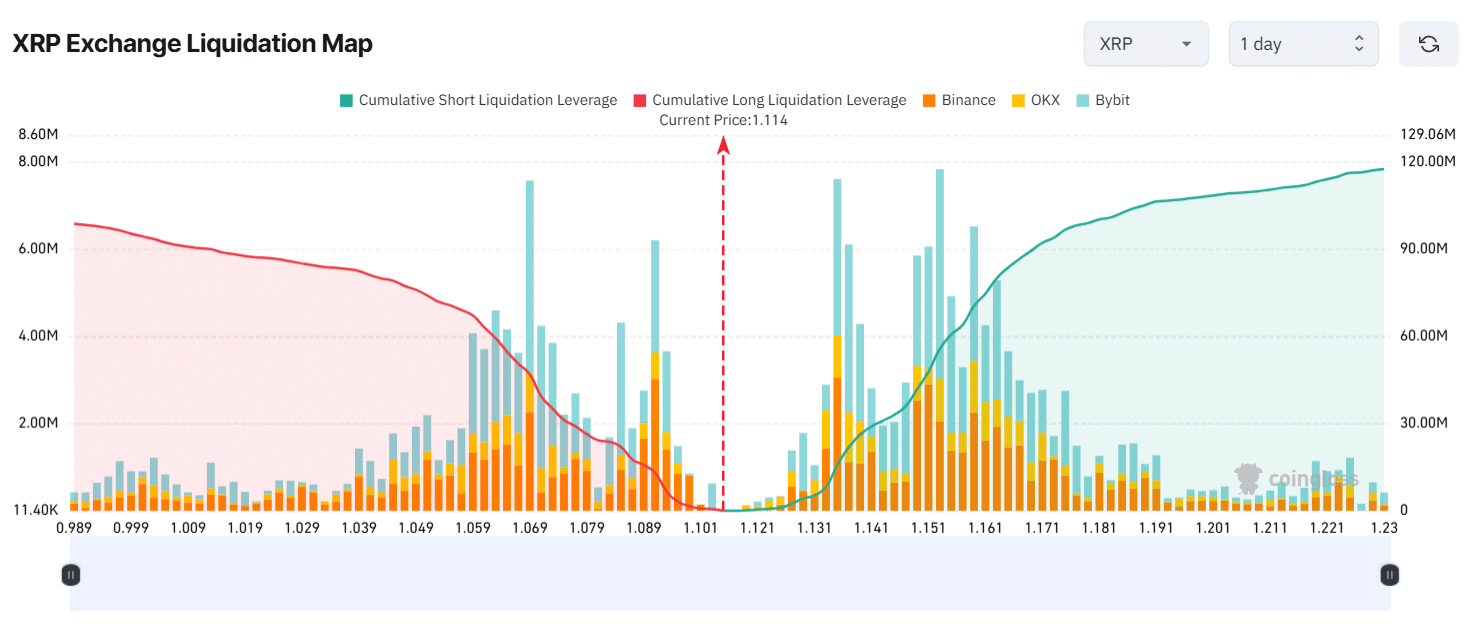

Key liquidation levels and market sentiment

Looking at current trader positions for XRP, it appears that important stop-loss points or levels for potential liquidations are situated around $1.069 on the downside and $1.135 on the upside.

According to Coinglass, traders are over-leveraged at these levels.

If the market outlook stays optimistic and the price reaches approximately $1.135, it’s estimated that around $15.76 million in short positions will get closed out.

In a reversal, if the price falls to around $1.069, it would lead to approximately $49 million in long positions being closed out or sold off.

Over the last day, the data on this liquidation shows that buyers who are betting on a rise (long positions) have significantly outnumbered those who are selling short on this asset.

Realistic or not, here’s XRP market cap in BTC’s terms

Currently, at this moment, XRP is being exchanged around $1.13, and it has experienced an increase of more than 3.2% in its value over the last day.

In that timeframe, the trading volume grew by 25%, suggesting greater involvement from both traders and investors due to an optimistic market perspective.

Read More

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Gold Rate Forecast

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- The Lowdown on Labubu: What to Know About the Viral Toy

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

2024-11-22 06:19