- CANTO was outperforming the broader market at press time.

- The recent outage on the Canto blockchain sparked concerns.

As a seasoned researcher with years of experience in the cryptocurrency market, I have seen my fair share of network outages and price volatility. The recent performance of CANTO has left me both puzzled and intrigued. On one hand, the token is outperforming the broader market, up by a staggering 40% despite the series of outages that have rocked the network in the last few days. This is unusual, to say the least, as network outages typically lead to a dip in prices rather than a surge.

Despite several network disruptions over the past few days, CANTO managed to surge by 40%. On Sunday, 11th August, the system encountered an outage but was temporarily restored for approximately 90 minutes following a developer-applied solution. However, it soon went offline once more.

According to Canto Explorer, the last block was produced on August 12th at 14:02 UTC. The developers have reported that the downtime was due to unexpected consequences stemming from a recent network update.

The team announced that block production will resume on 13th August once a new patch is deployed.

Despite network outages generally causing price drops, CANTO is experiencing a significant recovery. This token has been standing out as one of the top performers in the market over the past 24 hours due to increasing investor attention and substantial trading volumes.

What’s driving the rally?

As a researcher, I’m reporting that as of my writing, CANTO was trading at $0.064. Notably, it recorded an impressive surge of over 40%. Delving into the data from CoinMarketCap, I found that this increase was accompanied by a significant rise in trading volumes, which jumped by approximately 87%. This spike could be attributed to a strong buying pressure, suggesting heightened interest in CANTO.

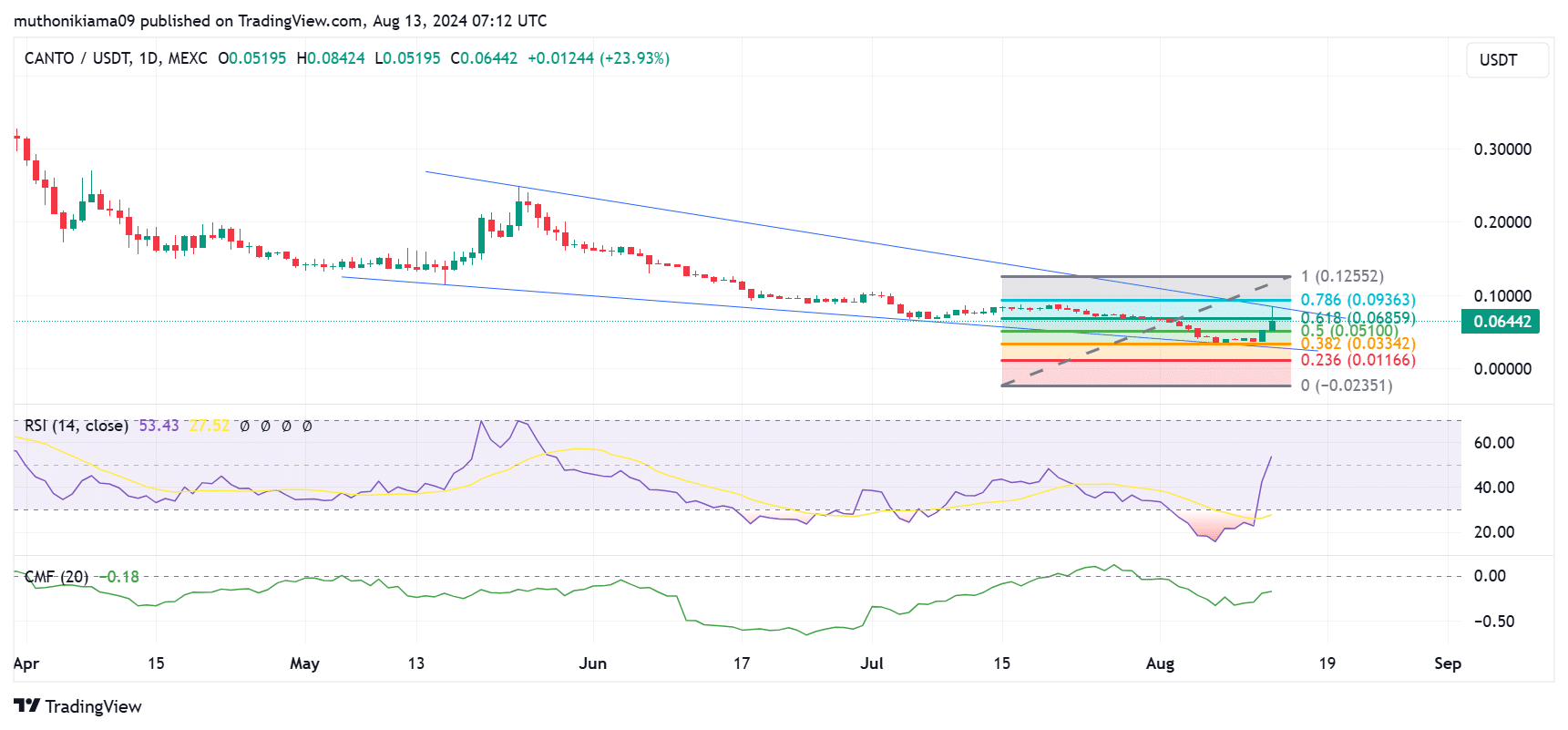

As a researcher, I noticed an upward trend in the Relative Strength Index (RSI) line, indicating a surge in buying momentum and a growing bullish sentiment within the market. Moreover, when the RSI crossed above its signal line, it served as a clear buy signal for me.

Despite currently experiencing a negative CMF, it’s showing signs of improvement with increasingly stronger bottoms. This suggests that demand is gradually overpowering supply, but for the uptrend to persist, additional buying support is necessary.

The emergence of a falling wedge pattern indicates a likelihood of the upward trend persisting, with prices rebounding following the recent dip that bottomed out at $0.036 on August 12.

If the price moves beyond the upper boundary of the falling wedge pattern, it’s expected that CANTO could potentially reach the 1 Fibonacci Retracement level, which is approximately $0.12. On the other hand, if the upward trend doesn’t hold and there’s a reversal, the token might decline to the 0.236 Fibonacci Retracement level, around $0.0116.

Community raises concerns

The CEO of Helius Labs, Mert Mumtaz, has expressed criticism towards the Canto network team for their insufficient involvement with the community.

He emphasized that even if you decide to move forward, it’s crucial to keep those who trust their funds with you updated about the situation.

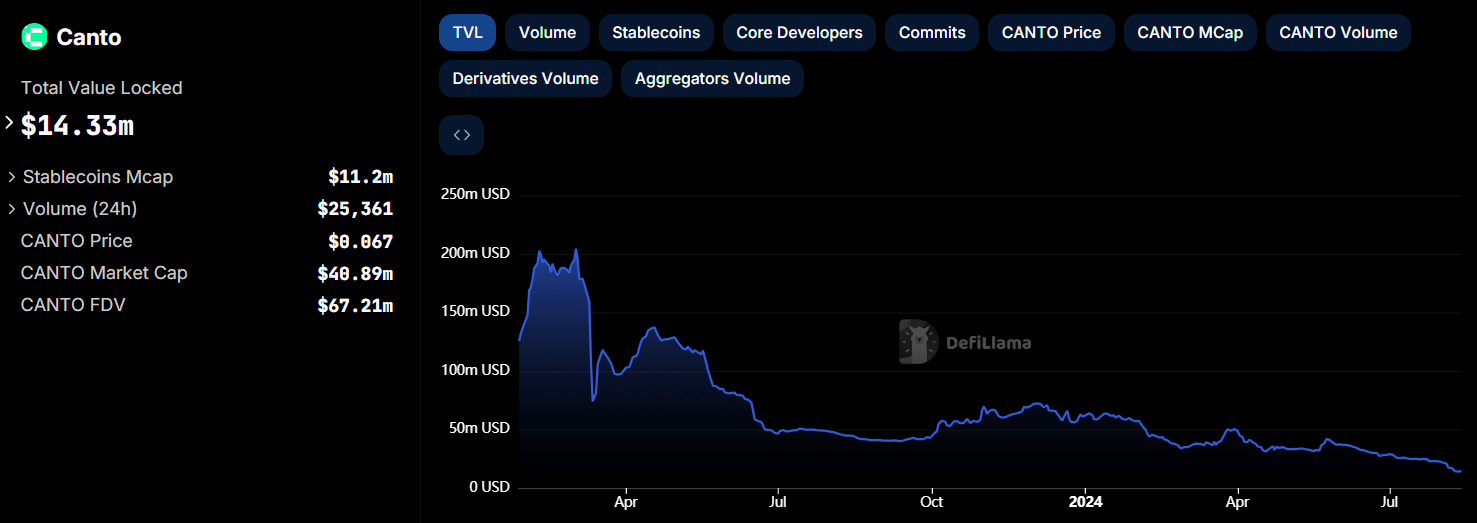

Analyst Marty Party from X additionally pointed out that there’s been a decline in on-chain transactions, which could potentially hinder the network’s expansion in the future.

As a crypto investor, I’ve noticed a concerning trend in the data from DeFiLlama. The Total Value Locked (TVL) in our network has plummeted from a staggering $200 million last March to just $14 million now. This dramatic decrease suggests waning interest and diminishing confidence among investors, myself included. It’s crucial we keep an eye on these trends to make informed decisions about the future of our investments.

Read More

2024-08-13 16:40