- Capybara Nation spiked 348%, hitting an all-time high of $0.00002041 before a sharp pullback.

- Trading volume surged by 371%, signaling growing market interest in Capybara Nation (BARA).

As a seasoned crypto investor with a knack for spotting trends, I find myself intrigued by Capybara Nation (BARA). The 348% surge in just 24 hours is certainly eye-catching, even to someone like me who’s seen their fair share of market volatility.

In just the past day, the value of Capybara Nation [BARA] has significantly risen by an impressive 348.90%. This surge has propelled its current price to approximately 0.0000114 dollars, as reported at the time of press.

Remarkably, the recent rally recorded a 24-hour trading volume of approximately $17.9 million, representing a significant surge of over 371.80% compared to the preceding day’s figures.

Compared to the overall market, BARA’s recent performance seems less impressive, as it has lagged behind, with the global cryptocurrency market experiencing a growth of 9.30% within the same period.

In contrast to other coins within the Cronos Ecosystem, I’ve managed to outperform them, even though they’ve collectively dropped by 0.60%.

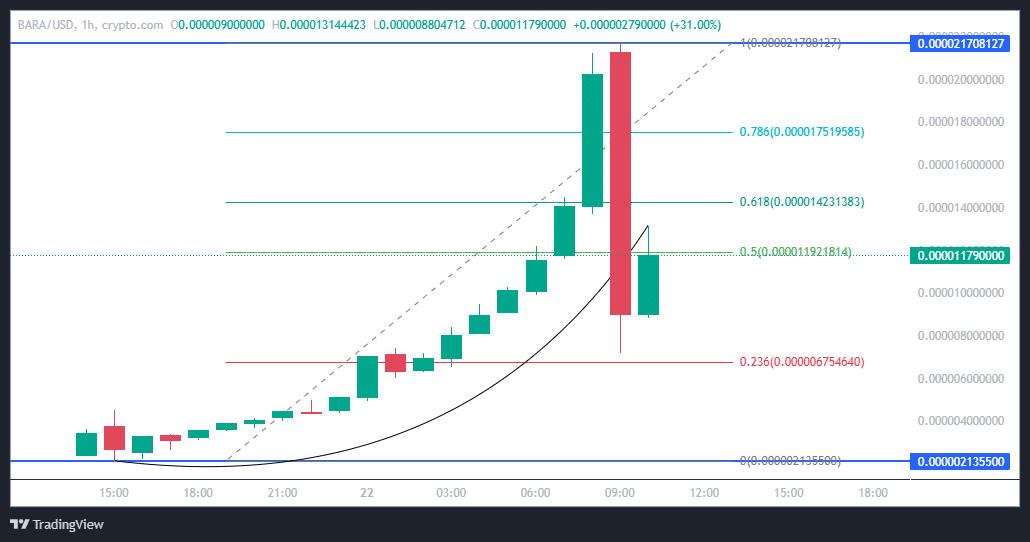

Price hits a peak before pulling back

In simpler terms, the value of BARA peaked at $0.00002041, then dropped back to around 50% of that peak or $0.00001192, suggesting a temporary adjustment or correction after its rapid increase.

The current resistance levels are located at $0.000014231383, which is the 0.618 Fibonacci level, and $0.000017515985, which is the 0.786 Fibonacci level. Support can be found at $0.000006754640, the 0.236 Fibonacci level.

The significant drop was evident from the large red candle on the hourly chart, signaling strong selling activity following the recent high. If the price drops below the 0.5 Fibonacci level, it might challenge the 0.236 level. On the other hand, a rebound above the 0.618 could suggest renewed bullish sentiment.

Technical indicators suggest mixed momentum

During the latest market movement, the Bollinger Bands indicated increased price fluctuations, with the value peaking at approximately $0.00001864999 and subsequently settling around $0.00001155000, which is near the midpoint of the bands.

At the current price level of $0.000012581307, the upper band is serving as a barrier or resistance, making it difficult for prices to rise further. Meanwhile, at $0.000006512615, the lower band offers potential support, meaning that if prices fall, this level might help stop or slow down the decline.

The cost of BARA hovers around its 20-day Moving Average, suggesting ambiguity regarding its future direction. Attentive traders keep a close eye on these points, hoping to spot indications of either a potential burst beyond this range or a possible drop beneath it.

The Relative Strength Index (RSI) currently sits at 50.66, indicating it’s pulling back from previously observed overbought conditions around 70 during the rally. This means the coin is neither excessively bought nor sold right now, offering a neutral stance. If the RSI climbs above 60, it might signal a return of bullish sentiment.

As I observed the moving averages convergence divergence (MACD) indicator in my research, it signaled a bearish crossover. Specifically, the MACD line dipped to 0.00000639789 and crossed beneath the signal line at 0.000006384189, indicating potential downtrend in the market.

Despite a noticeable slowdown in momentum, the histogram continues to hover around zero, suggesting that a swift reversal of the current trend might occur if trading volume picks up again.

The rise in BARA’s price and the corresponding increase in trading activity suggest growing enthusiasm towards this cryptocurrency.

Read More

2024-11-23 07:03