-

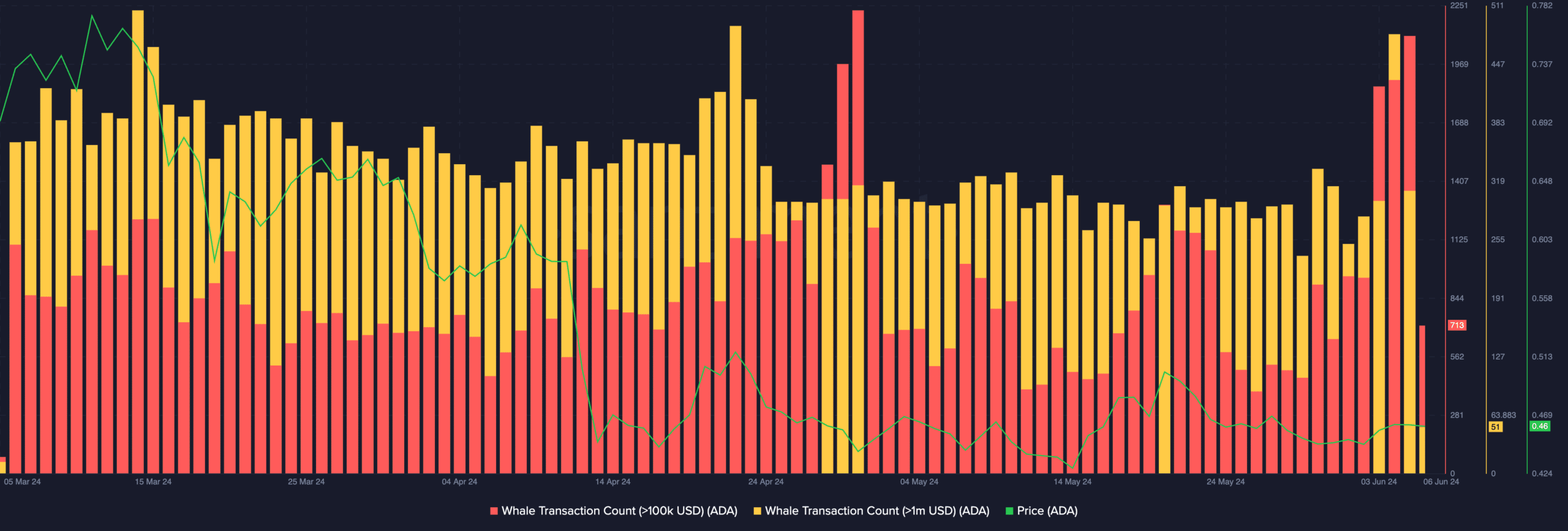

ADA’s whale activity jumped on 5th June.

This caused a brief uptick in the altcoin’s price.

As a seasoned crypto investor with a keen interest in Cardano (ADA), I’ve observed the recent surge in whale activity on June 5th with great intrigue. Santiment’s data indicated an increase in large transactions, leading to a brief uptick in ADA’s price. This was an interesting development that raised hopes of potential bullish momentum for the altcoin.

On the fifth of June, there was an increase in significant investor transactions, or “whale activity,” in Cardano [ADA], causing a short-term price rise based on Santiment’s market analysis.

Based on the information from the blockchain data source, there were 309 transactions involving ADA that exceeded $1 million in value on that particular day. This marked the highest number of such transactions for ADA in a single day since the 30th of April.

As a crypto investor, I’ve noticed an intriguing trend with Cardano (ADA) recently. According to data from Santiment, there were 2106 transactions conducted on ADA that surpassed the $100,000 mark on a single day. This figure represents a significant increase compared to the typical average of around 2024 transactions per day with values above $100,000. It’s fascinating to observe this heightened activity and the potential implications it could have for ADA’s price movement and overall market sentiment.

ADA bears continue to dominate the market

As an analyst, I observed a significant increase in large-scale transactions involving ADA, which in turn triggered a short-term price uptick for this cryptocurrency. According to Santiment, ADA ended the trading session priced at approximately $0.46.

Based on information from CoinMarketCap, the coin has lost some value since then and was priced at $0.45 at the current moment.

As a researcher studying the altcoin market, I have analyzed the key momentum indicators for Cardano (ADA). My findings suggest that selling pressure is currently dominating over any potential bullish trends for this cryptocurrency. Specifically, its Relative Strength Index (RSI) stood at 48.32 and its Money Flow Index (MFI) was recorded at 47.29 at the time of my investigation.

At these values, the indicators indicated a strong inclination among market participants to dispose of their coins instead of buying more.

As a financial analyst, I’ve observed that ADA‘s Chaikin Money Flow (CMF) has been decreasing, signaling an increase in selling pressure. Currently, this indicator is moving negatively and sits below the zero line at -0.07.

As an analyst, I would explain that this metric reflects the net inflow or outflow of funds in the coin’s market. A negative value indicates that more money is leaving the market than entering, suggesting market instability and potential selling pressure on the asset.

As an analyst, I’ve observed that the recent whale activities have momentarily boosted the price of ADA. However, the bearish sentiment remains dominant in the market, and they are currently exerting more control over the price trend.

As an analyst, I’ve examined the Altcoin’s Directional Movement Index (DMI) readings, and I noticed that the size of its positive directional index (represented by the green line) is smaller than that of the negative index.

When these lines are arranged this way, bear strength outweighs bull power in the market.

As a crypto investor, I’ve noticed that although the chances of a substantial price surge for ADA in the near future seem slim, futures traders continue to hold a optimistic perspective. The coin’s funding rate remains positive across various cryptocurrency exchanges.

Read Cardano’s [ADA] Price Prediction 2023-24

As a financial analyst, I can explain that in perpetual futures contracts, funding rates play a crucial role in maintaining the price alignment between the contract and the underlying asset’s spot price. By regularly transferring a small amount of funds between parties based on the difference between the two prices, these rates ensure a fair pricing mechanism and help mitigate any potential large price discrepancies.

As a crypto investor, I interpret a positive futures funding rate as an optimistic sign. It indicates that there’s a higher appetite for long positions in the market, implying that more investors are purchasing the asset in anticipation of its price increase.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

2024-06-06 12:07