-

ADA has declined to the $0.37 price range.

The ADA unrealized loss has grown in the last few weeks.

As a researcher with extensive experience in analyzing cryptocurrency market trends, I have been closely monitoring the performance of Cardano (ADA) over the past few weeks. The recent decline of ADA to the $0.37 price range is a concerning development for investors who purchased the asset at higher prices.

Over the past few months, the value of Cardano‘s [ADA] cryptocurrency has faced significant downward pressure, leading to an uptick in the quantity of wallets containing the token with unrealized losses.

Many investors who bought Cardano at higher prices are currently experiencing losses on their investments, as indicated by this trend.

Cardano at a loss

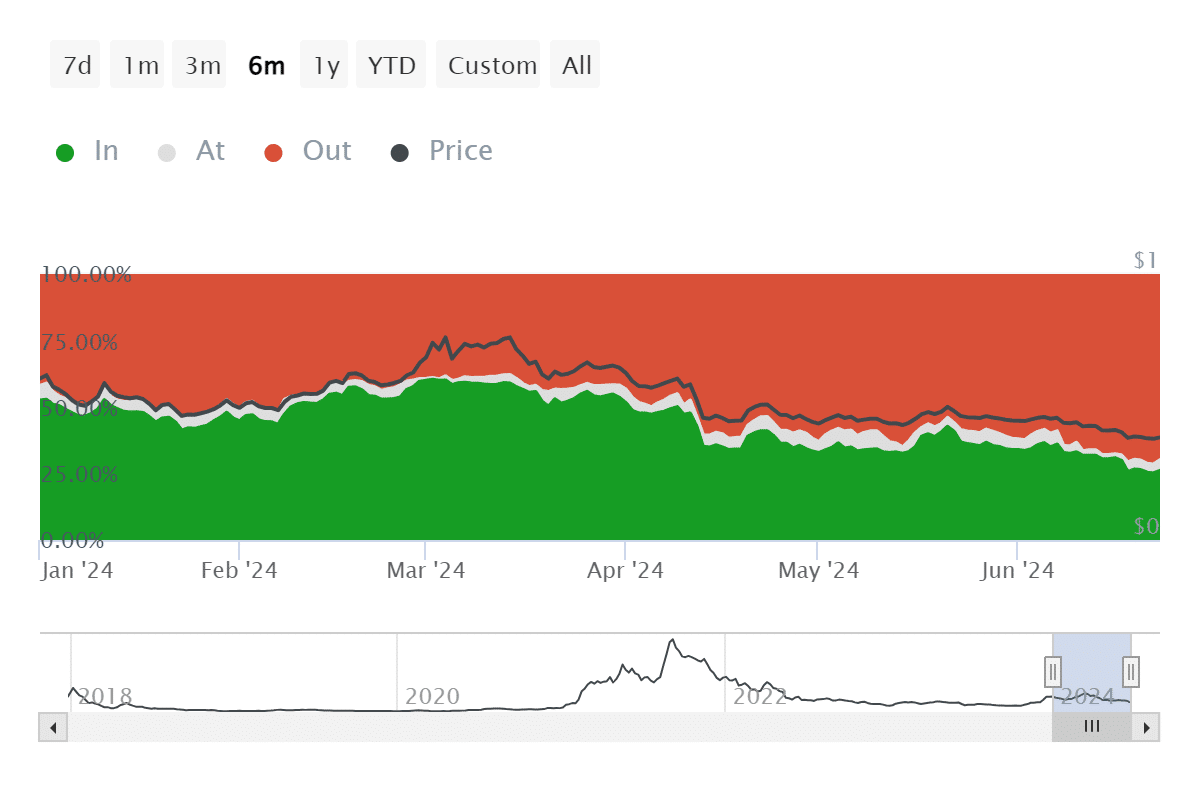

An examination of the Global In/Out of the Money metric for Cardano, as presented by IntoTheBlock, sheds light on the present distribution of investor positions.

The data shows that, as of now, 3.31 million addresses are “out of the money.”

The price of Cardano at that moment was under the typical price point where these specific addresses had bought their ADA.

As a crypto investor, I’ve delved deeper into the market analysis of Cardano, and my findings reveal that around 74% of all ADA wallets are currently underwater in terms of their investments. This substantial proportion underscores the far-reaching impact of the recent price drop.

An in-depth analysis revealed that those who bought ADA around $0.39 are almost at breakeven point, even with the overall market decline.

Approximately 2.57 billion ADA tokens are housed across some 180,000 addresses within this specific investor segment.

Cardano addresses become less active

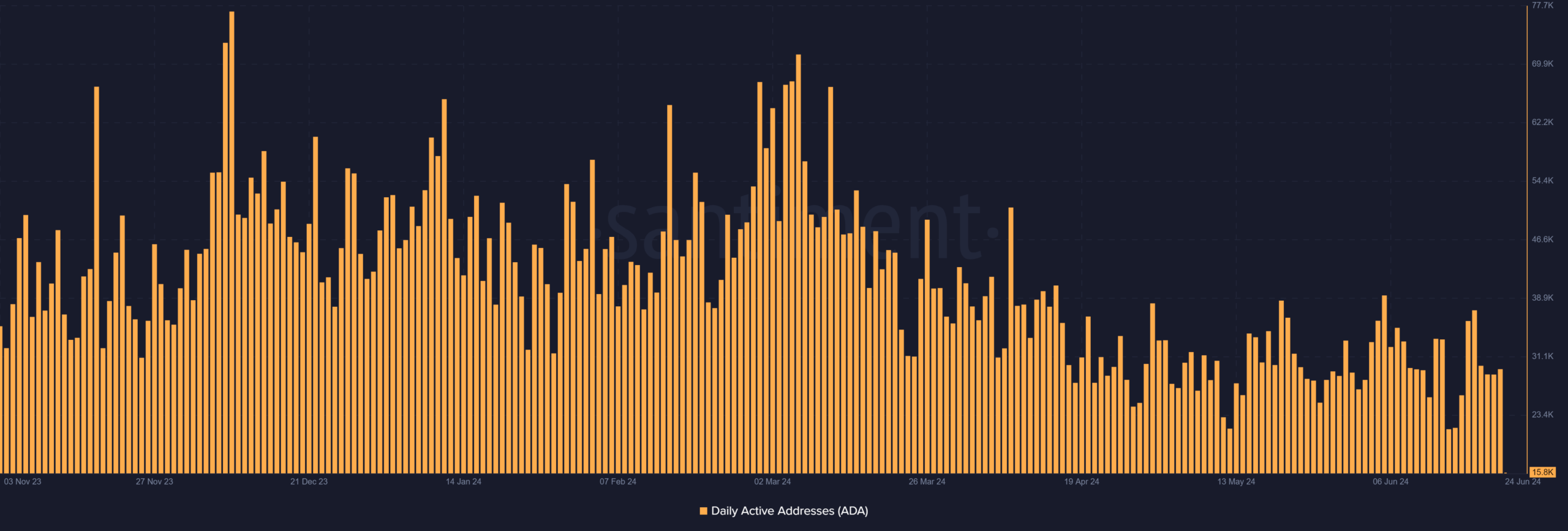

Over the past several days, the number of daily active addresses on the Cardano network has shown a steady downward trend.

Based on Santiment’s chart, approximately 29,000 active addresses were in use by July 20th.

Since then, the number of active cryptocurrency addresses has remained around 29,527, as of the close of trading on 23rd June.

Based on the most recent information, the number of active addresses is approximated to be around 15,000 – a substantial decrease from previous figures. This notable reduction in active addresses may indicate decreased network activity and user involvement.

Based on a recent examination of Cardano’s trading activity, there was a noticeable decrease, only to be followed by a surge in volume once again.

Based on the most recent information available, the trading volume amounted to around $280 million as of now, representing a significant jump from the $202 million transacted during the previous day’s market closing on June 23rd.

ADA price declines again

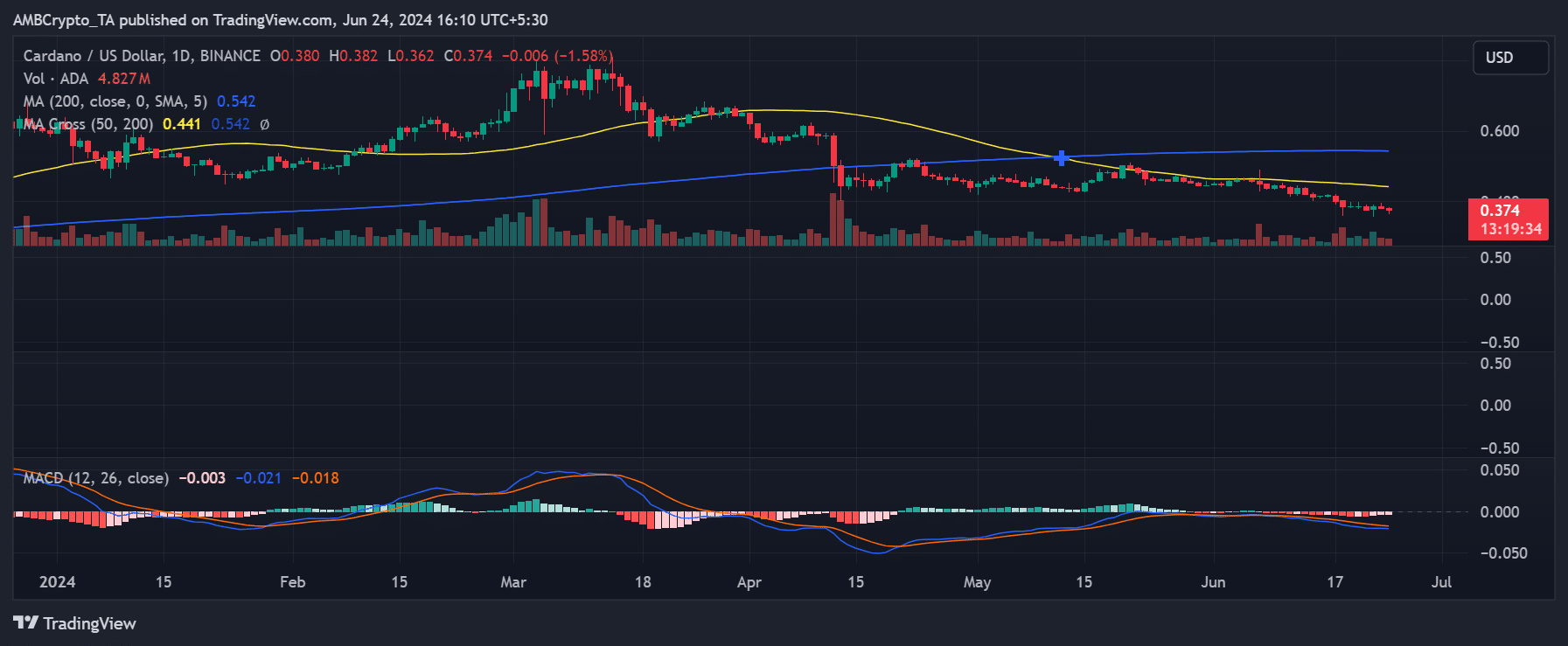

Based on AMBCrypto’s examination of Cardano’s daily chart, there was a nearly 1% decrease in its value on June 23rd. The cryptocurrency then traded approximately at the price of $0.38.

Currently, the price has dropped down to around $0.37 after experiencing a decrease of roughly 1.58%.

As an analyst, I’ve identified that the short moving average of Cardano, represented by the yellow line, has become a significant resistance point for the cryptocurrency. The price tends to bounce back when it approaches this level, with the current value hovering around $0.44.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Masters Toronto 2025: Everything You Need to Know

- WCT PREDICTION. WCT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- LPT PREDICTION. LPT cryptocurrency

- Elden Ring Nightreign Recluse guide and abilities explained

- Solo Leveling Arise Tawata Kanae Guide

- Despite Bitcoin’s $64K surprise, some major concerns persist

2024-06-24 23:03