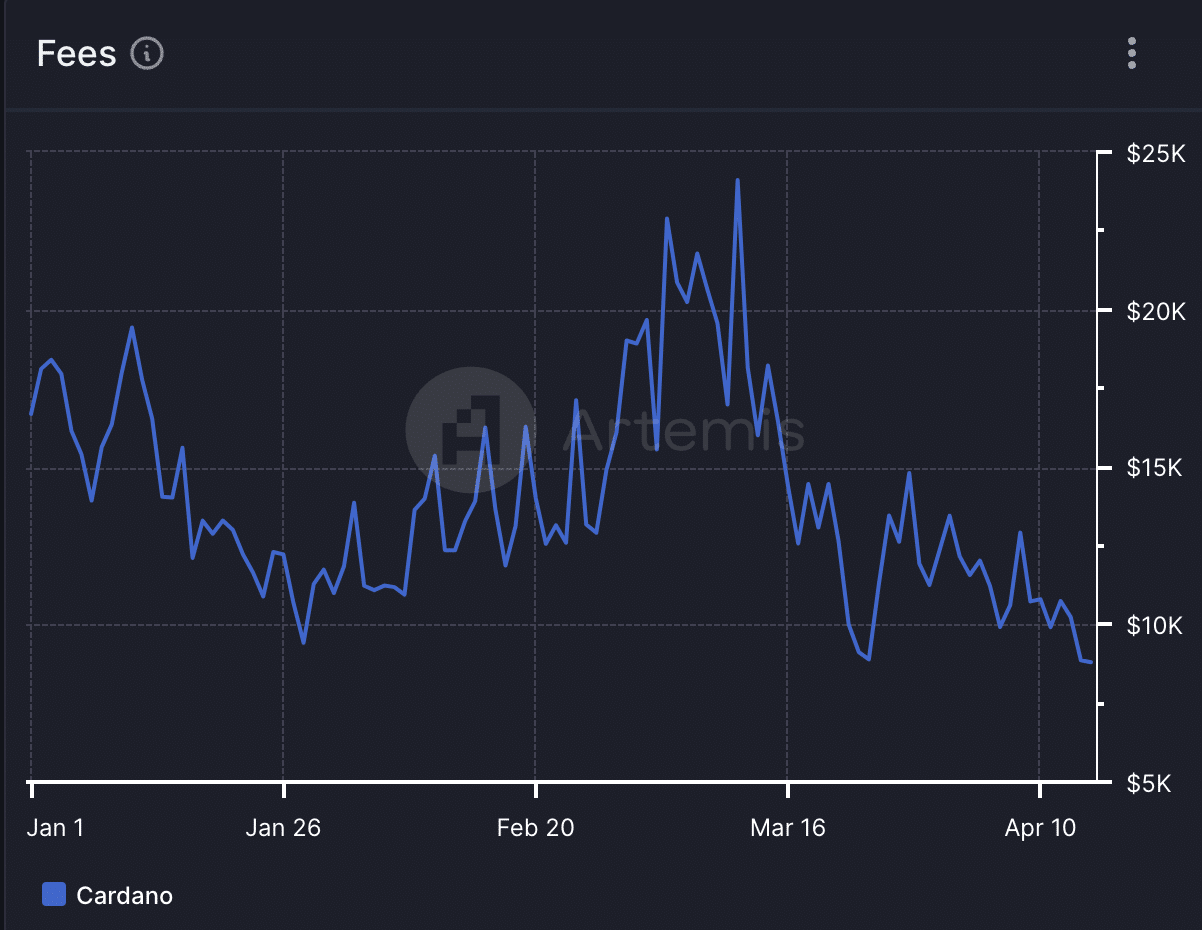

The cost of transaction fees on the Cardano [ADA] network, as reported by Artemis’ data, has reached a new low for the year so far due to a decrease in user activity on the main blockchain.

Starting from the 15th of April, Cardano users have collectively paid $9,000 in transaction fees. Compared to the $17,000 worth of fees recorded on the 1st of January, this represents a significant drop of more than 90%.

On March 11th, based on Artemis’ data, Cardano experienced a high point of approximately $24,000 in daily transaction fees. Since then, there has been a general decline in transaction fees.

The drop in day-to-day fees for transactions on Cardano can be attributed to fewer people using the network.

Data from the blockchain indicated that there were 71,300 distinct Cardano wallets engaged in transactions every day on March 6th, marking a new year-to-date record. Subsequently, this number began to decrease.

At 38,000 as of 14th April, Cardano’s daily active address count has since plummeted by 47%.

The decrease in the number of daily active addresses on Cardano’s blockchain has led to a corresponding decline in the number of daily transactions. According to recent data from Artemis, this downward trend has worsened over the past month, with a 47% reduction in transaction volume.

DeFi and NFT ecosystems suffer

In recent times, less people have been using the Cardano platform, which has had consequences for its decentralized finance (DeFi) and non-fungible token (NFT) sectors.

The amount of money locked in Decentralized Finance (DeFi) platforms on Cardano, according to DefiLlama’s data, reached a three-month minimum, currently at approximately $306 million.

The network’s TVL reached a YTD peak of $456 million on 15th March and has since declined by 33%.

Regarding its NFT sector, Cardano has witnessed a similar decline.

According to CryptoSlam’s data, the network experienced a 39% decrease in NFT sales volume over the past month, while the number of total NFT sales transactions completed dropped by 46%.

Low demand for ADA as well

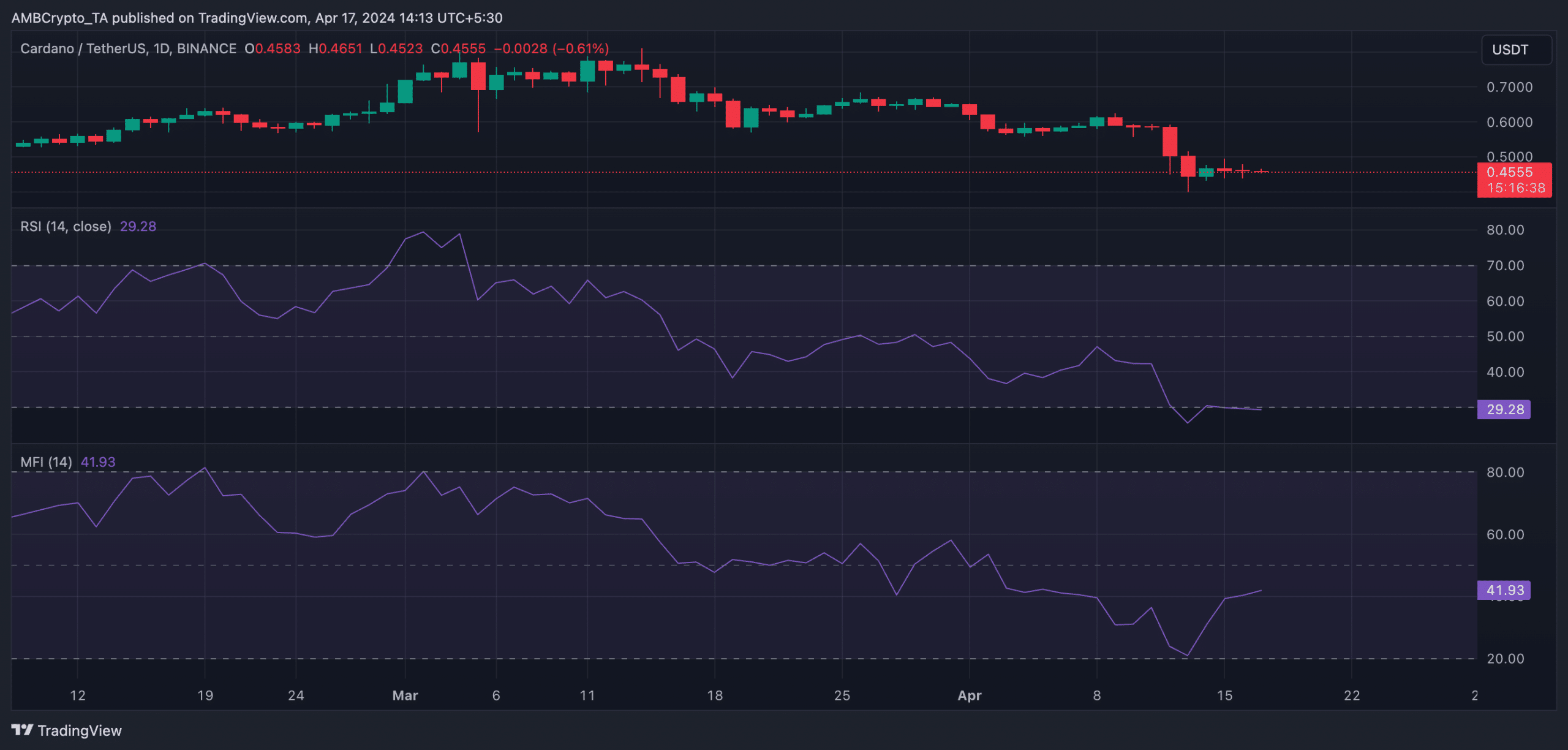

ADA, the native cryptocurrency of the network, is also experiencing a downturn. Currently trading at $0.45, its value has dropped by nearly a quarter (21%) over the past week.

An analysis of the altcoin’s important signs for momentum, examined on a day-to-day basis, showed a noticeable decrease. Currently, its Relative Strength Index (RSI), which is an indicator of overbought and oversold conditions, stood at 29.51, suggesting that it had been bought too much in the past and was now underbought.

Read Cardano’s [ADA] Price Prediction 2024-25

Likewise, its Money Flow Index (MFI) trended downward at 41.94.

At these values, these indicators showed that selling activity outpaced coin accumulation.

Read More

- The Bachelor’s Ben Higgins and Jessica Clarke Welcome Baby Girl with Heartfelt Instagram Post

- WCT PREDICTION. WCT cryptocurrency

- Royal Baby Alert: Princess Beatrice Welcomes Second Child!

- Sea of Thieves Season 15: New Megalodons, Wildlife, and More!

- SOL PREDICTION. SOL cryptocurrency

- PI PREDICTION. PI cryptocurrency

- PGA Tour 2K25 – Everything You Need to Know

- Shrek Fans Have Mixed Feelings About New Shrek 5 Character Designs (And There’s A Good Reason)

- AMD’s RDNA 4 GPUs Reinvigorate the Mid-Range Market

- Buckle Up! Metaplanet’s Bitcoin Adventure Hits New Heights 🎢💰

2024-04-17 21:11