-

ADA continued the stop-and-start price trend.

Active addresses increased slightly.

As a long-term Cardano investor, I’ve seen my fair share of ups and downs in the market. The recent price trend for ADA has been stop-and-start, leaving me feeling uncertain about its future direction.

Following a two-day decline, the current upward trend in Cardano (ADA) is surely good news for its holders. But, what indicators suggest that this uptrend could continue for an extended period for ADA?

ADA sees a slight positive trend

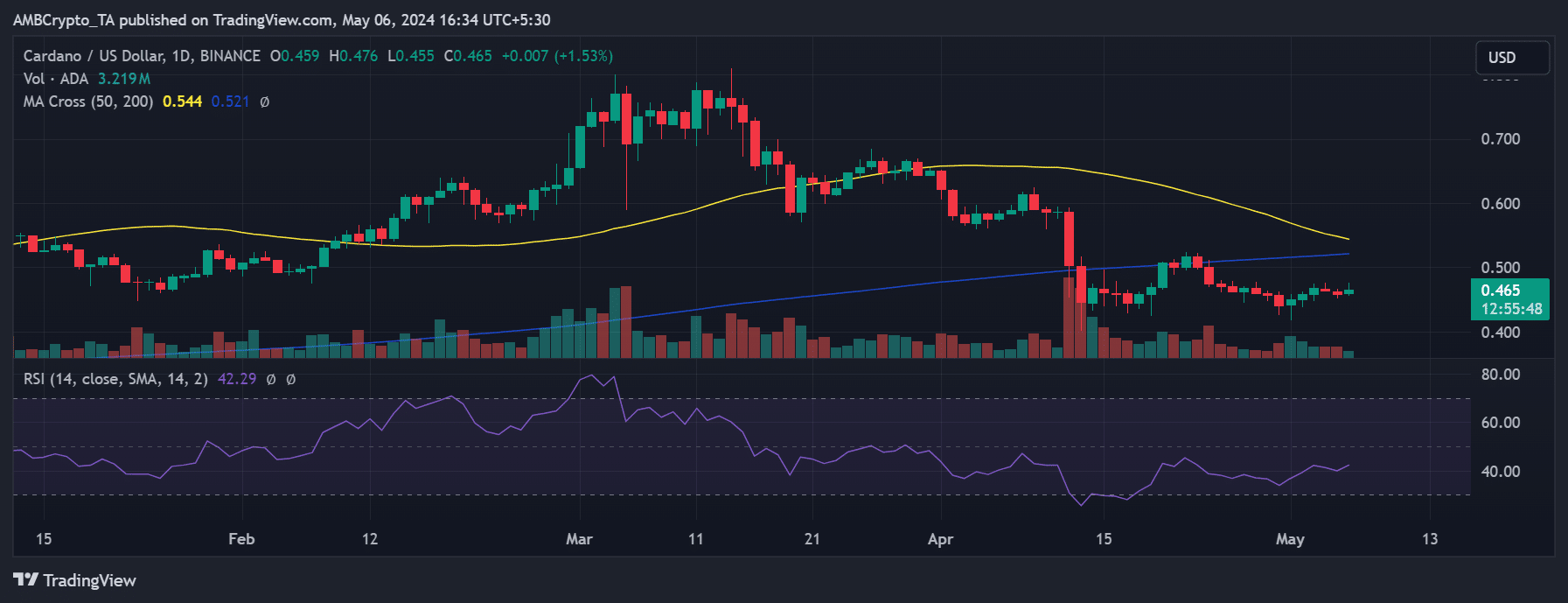

AMBCrypto’s analysis Cardano’s price trend indicated a fluctuating pattern in recent days.

The first three days of May brought about an optimistic start to the month as the price showed a steady increase. Specifically, there was a three-day stretch where the price climbed from approximately $0.45 to $0.46.

As a crypto investor, I’ve experienced some exciting gains in the market, pushing the price up to around $0.60. But unfortunately, these victories were short-lived as the market took a downturn and brought the price back down to approximately $0.45. This pattern of brief uptrends followed by prolonged downtrends has continued, raising concerns about the sustainability of any potential momentum in this market.

As of this writing, ADA was trading with a nearly 1% increase, returning to the $0.46 price zone.

In spite of this, the trend stayed deeply rooted in a downturn, as evidenced by its Relative Strength Index (RSI) barely exceeding the 40 threshold.

But the price chart suggests a potential death cross if ADA fails to sustain its uptrend.

When the short-term moving average (yellow line) is surpassed by the longer-term moving average (blue line), a death cross formation occurs, which often indicates a downturn in the asset’s price trend.

From my perspective as an analyst, at the moment, the price of ADA is moving beneath both the blue and yellow trendlines, indicating a degree of ambiguity regarding its future direction.

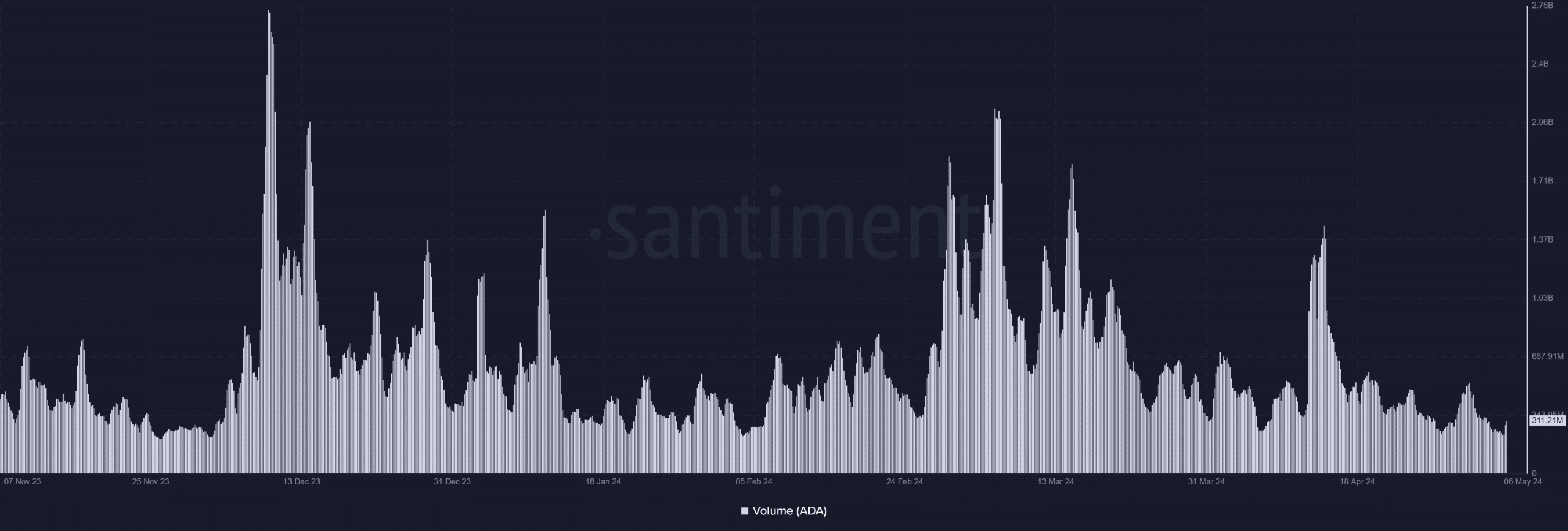

Cardano volume shows declining trading activity

As an analyst, I’ve examined Cardano’s trading volume, and the trends I’ve observed aren’t particularly promising. Over the last several days, there has been a noticeable decrease in trading volume for this cryptocurrency.

In the first part of the month, the trading volume exceeded $400 million, momentarily reaching above $500 million.

As of now, the trading volume has dropped to approximately $279 million. Normally, a surge in trading volume leads to price fluctuations, indicating higher market activity.

From my perspective as an analyst, the present negative trend in ADA‘s price indicates a reduction in trading volume. This decrease in activity might impede the formation of a lasting uptrend.

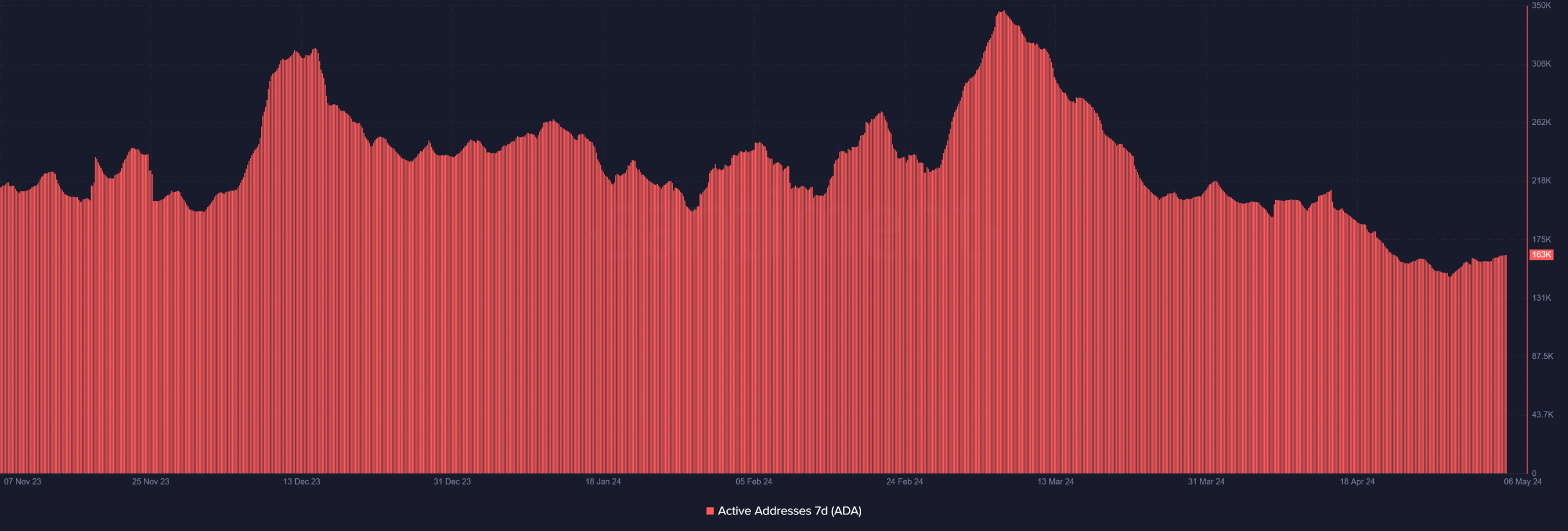

Slight tick in Cardano active addresses

According to AMBCrypto’s examination, there has been a noticeable increase in the number of active Cardano addresses over the past week.

As a researcher examining data from Santiment, I found that the number of active Ethereum addresses increased significantly between May 4th and the present moment. Specifically, there was a rise from approximately 159,000 to over 163,000 active addresses.

As a researcher studying the data, I’ve observed a noteworthy rise in this metric. However, based on my analysis, it seems that this increase alone may not be sufficient to cause substantial changes in trading behavior on the network.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- WCT PREDICTION. WCT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- LPT PREDICTION. LPT cryptocurrency

- Shrek Fans Have Mixed Feelings About New Shrek 5 Character Designs (And There’s A Good Reason)

- Playmates’ Power Rangers Toyline Teaser Reveals First Lineup of Figures

- FANTASY LIFE i: The Girl Who Steals Time digital pre-orders now available for PS5, PS4, Xbox Series, and PC

- SOL PREDICTION. SOL cryptocurrency

- Solo Leveling Arise Tawata Kanae Guide

2024-05-07 11:04