-

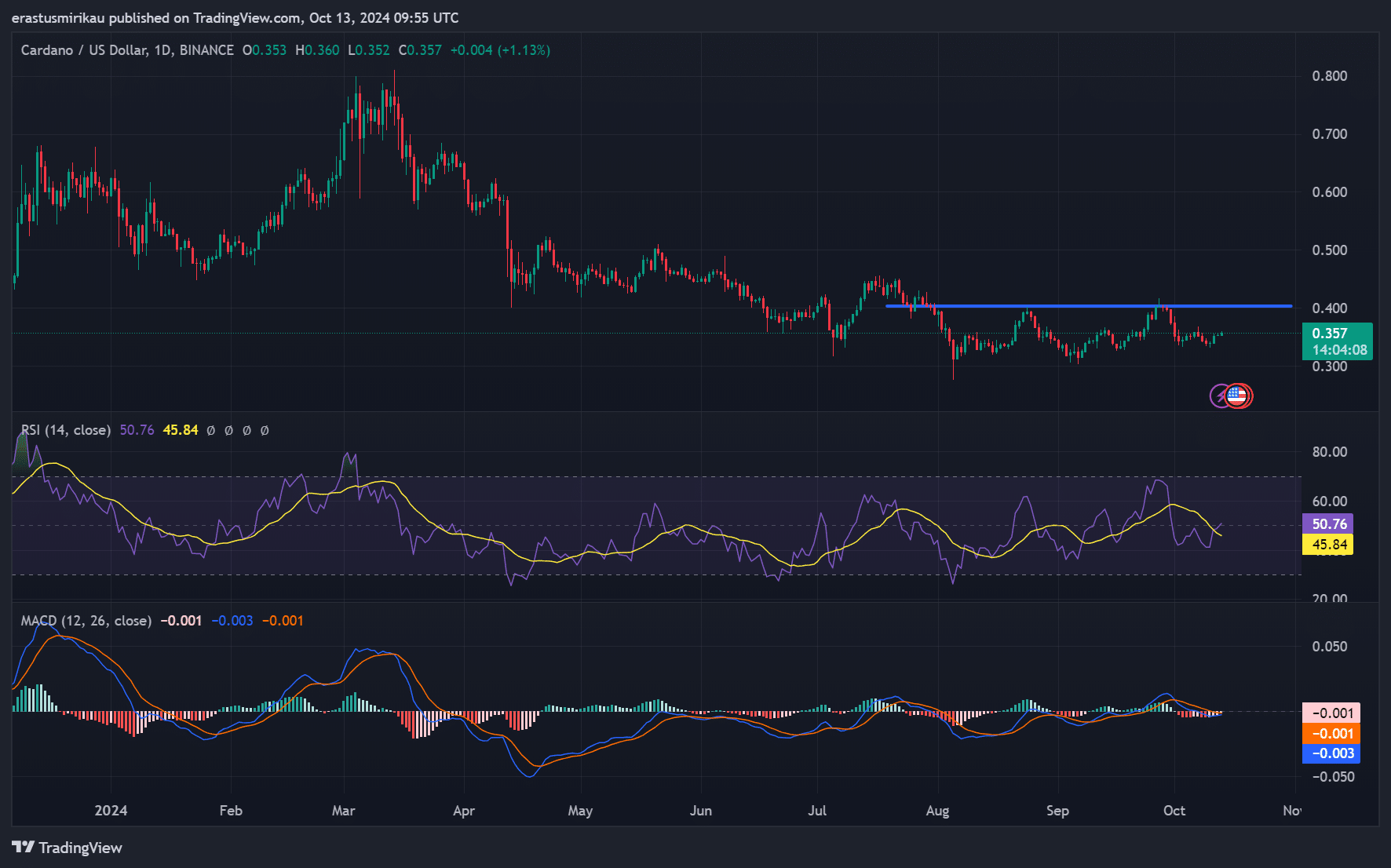

ADA was showing neutral momentum, with the RSI at 45.84 and nearing key resistance at $0.40.

Market sentiment remained cautious, with steady Open Interest indicating low volatility.

As a seasoned crypto investor with battle-tested nerves and a portfolio that can weather market storms, I find Cardano [ADA] to be a promising contender in the current cryptospace. At $0.3564, ADA is showing signs of a potential breakout, but it’s not all rosy just yet.

Investor interest in Cardano (ADA) is growing, with both popular and sophisticated investors showing a robust optimistic stance. Currently, ADA is being traded at $0.3564, representing an increase of 0.94% within the last 24 hours.

As the significant $0.40 barrier approaches, traders are keen to find out if Cardano possesses the strength to surpass this crucial point and initiate a possible uptrend, leading to a bullish momentum.

Can ADA build enough momentum for a breakout?

In simpler terms, the technical analysis provided by ADA shows contradictory indicators. Right now, the Relative Strength Index (RSI) stands at 45.84, suggesting that ADA is currently neither experiencing buying frenzy (overbought) nor a selling panic (oversold), but instead in a neutral zone.

Therefore, there is room for upward movement if buying pressure intensifies.

Additionally, the MACD is nearing a zero-cross, indicating a possible shift in momentum.

Yet, if potential buyers do not intervene, this might indicate consolidation. In such a case, Cardano (ADA) remains in a watchful position, hovering just under its resistance level.

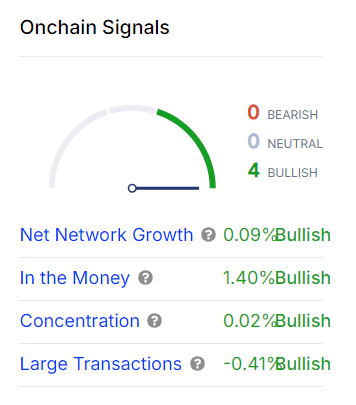

On-chain signals: Is ADA building strength?

Regarding blockchain statistics, Cardano exhibited encouraging yet subtle trends. The total number of users on the network increased by 0.09%, and about 1.40% of ADA holders currently have profits, based on the “in the money” indicator.

Moreover, the ADA concentration metric remained stable, showing no substantial shifts in the holdings of major investors.

On the other hand, there’s been a slight drop of 0.41% in larger transactions, suggesting that institutional investors may be adopting a more cautious stance.

Therefore, although the basics appear strong, they don’t seem to indicate a significant rally just yet.

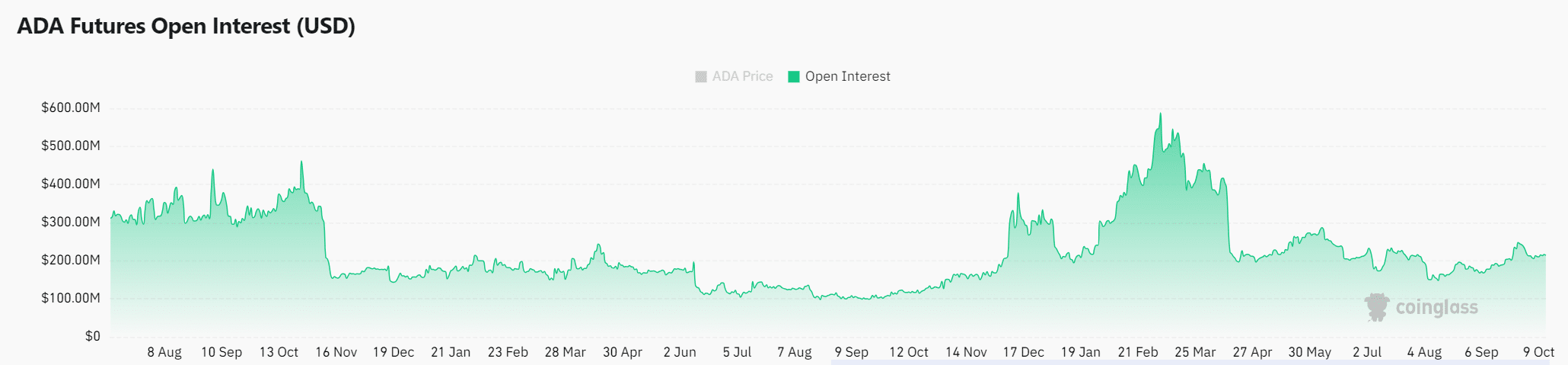

Open Interest: Steady growth, cautious optimism

The demand for ADA has grown by 0.71% and currently stands at a level of $216.17 million, indicating that traders are exhibiting a cautious optimism towards ADA’s ability to surpass its $0.40 resistance threshold.

Furthermore, the rising trend in Open Interest suggests an expanding involvement in the market, yet not one that’s excessively bullish. As such, Cardano (ADA) appears ready to make a significant move, though traders are holding back until they see more definitive signs.

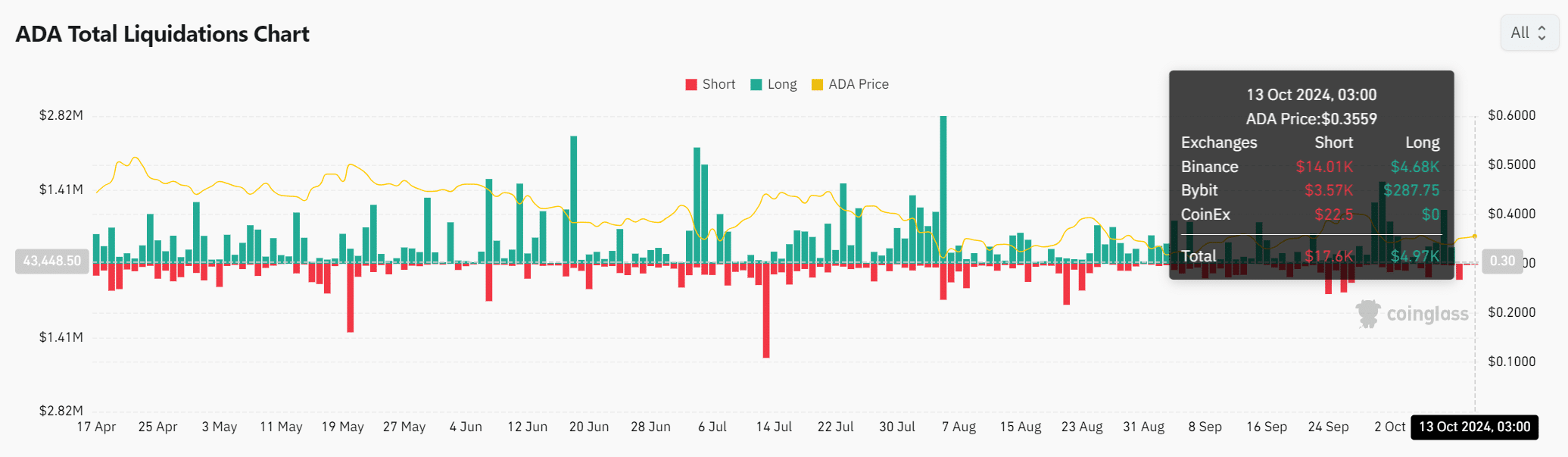

ADA liquidations: Calm before the storm?

The total liquidation data reflected a balanced market, with $17.6K in short liquidations and $4.97K in long liquidations.

This implied a modest level of trading activity, suggesting that traders weren’t heavily investing in predicted price swings. Consequently, the market stayed relatively tranquil, anticipating a clear catalyst to move forward.

Read Cardano’s [ADA] Price Prediction 2023-24

Is a breakout likely?

Cardano’s indicators show potential for a breakout, but the market is not there yet.

Although the technical aspects and blockchain information seem favorable, the gradual increase in open interest and minimal liquidation numbers hint that Cardano might require additional bullish energy to surpass the $0.40 resistance level.

Read More

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Gold Rate Forecast

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- The Lowdown on Labubu: What to Know About the Viral Toy

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

2024-10-13 23:04