-

ADA surged over 15% in the past week, with technical charts showing bullish reversal signals.

Increasing active addresses and rising Open Interest indicate growing interest in ADA.

As a seasoned researcher with years of experience navigating the complex world of cryptocurrencies, I have seen my fair share of bull and bear markets. The recent surge in ADA has piqued my interest, and upon closer inspection, it seems that Cardano might be poised for a significant upward movement.

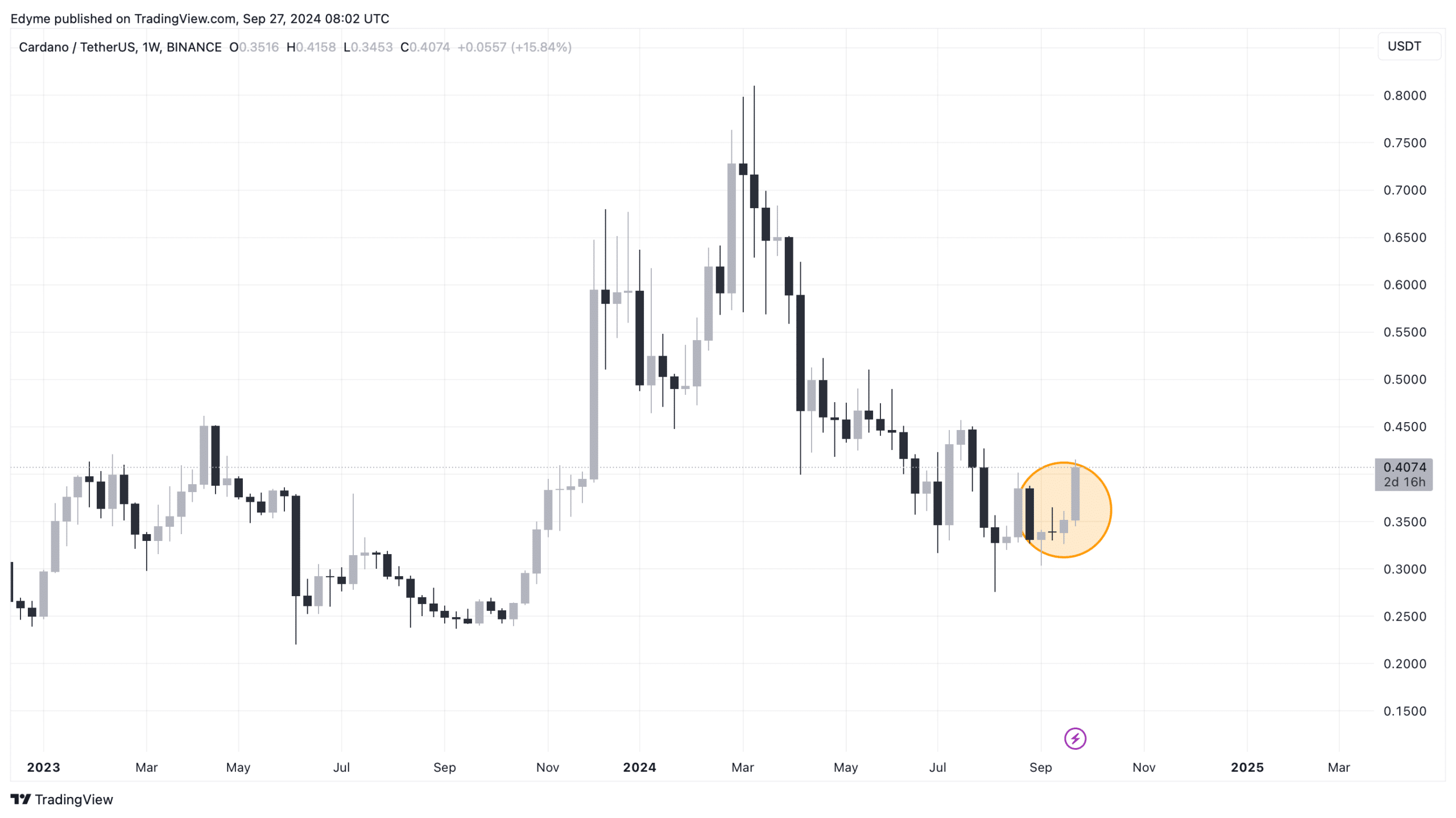

After a prolonged decline earlier in the year, there has been a marked recovery in the price of Cardano [ADA]. Following its peak of around $0.77 in January, ADA experienced a substantial drop in value.

Over the last seven days, the value of this asset has significantly increased by more than 15%. Moreover, it has continued to rise in the past day, now standing at $0.41, which represents a 2.6% growth.

ADA’s potential upside

The surge in value has piqued the interest of the Cardano community, leading experts to evaluate whether this trend will endure or if it’s just a temporary spike.

Delving deeper into ADA‘s weekly price chart, I noticed a significant bullish indicator – a bullish engulfing candlestick pattern emerged, following an inverted dragonfly doji. This pattern suggests a potential price surge could be on the horizon for Cardano investors.

Based on my years of trading experience, I have found this pattern to often serve as a crucial turning point, implying that a corrective phase might be nearing its end and a substantial upward trend could potentially commence. It pays to stay vigilant and keep a close eye on market movements when this pattern appears.

The presence of this pattern indicates the potential for sustained upward momentum for ADA, hinting at the possibility of a longer-term rally.

Backing it up with fundamentals

Although the technical perspective points to a continuation of ADA’s rally.

It’s crucial to verify these positive trends against the core market indicators to ascertain if they are supported by strong fundamental market conditions.

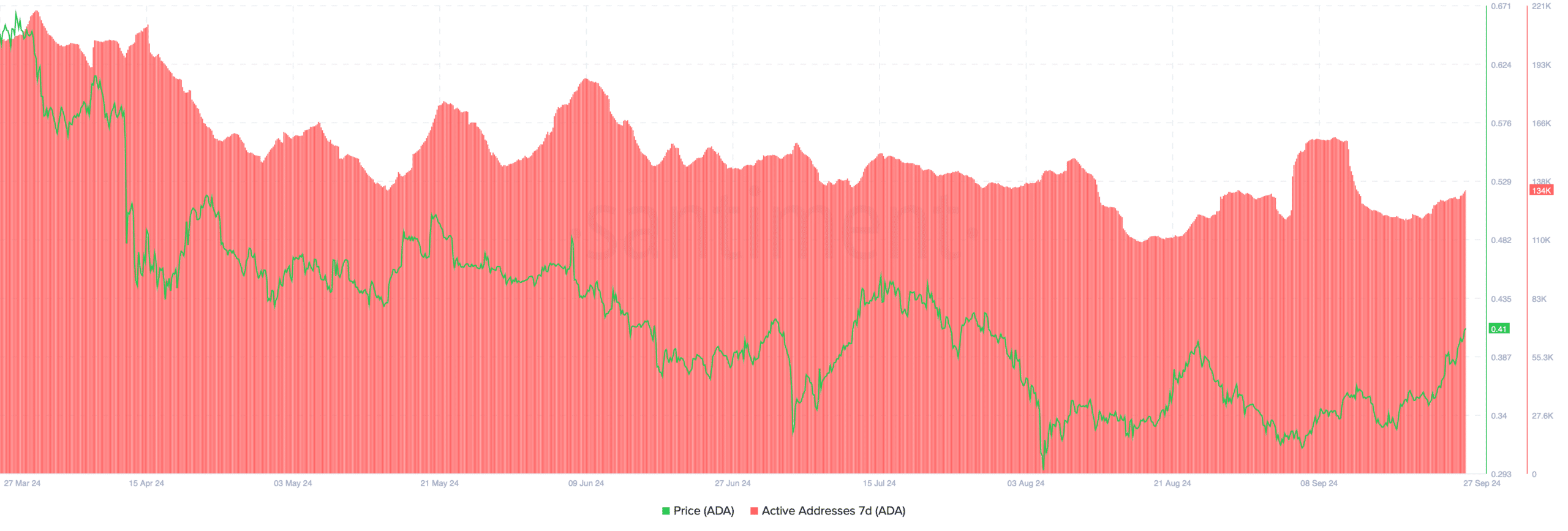

A key indicator to consider is ADA’s retail interest, as measured by the number of active addresses.

As a researcher, I’ve noticed an uptick in the number of active addresses associated with Cardano (ADA) based on data sourced from Santiment, a reliable market intelligence platform.

Previously this month, the count peaked above 150,000 active wallets, but then dropped to 120,000. As we speak, though, there’s a resurgence happening, as the number of active addresses has surpassed 130,000.

The surge in active ADA addresses implies a revived retail enthusiasm towards ADA, potentially indicating an upswing in trading actions and demand.

As a crypto investor, I’ve noticed that an increase in active wallets typically signals stronger buying interest. This surge in demand could potentially drive up the prices of the digital assets involved, leading to favorable market movements.

If this trend persists, it could strengthen ADA‘s existing uptrend and potentially sustain further growth.

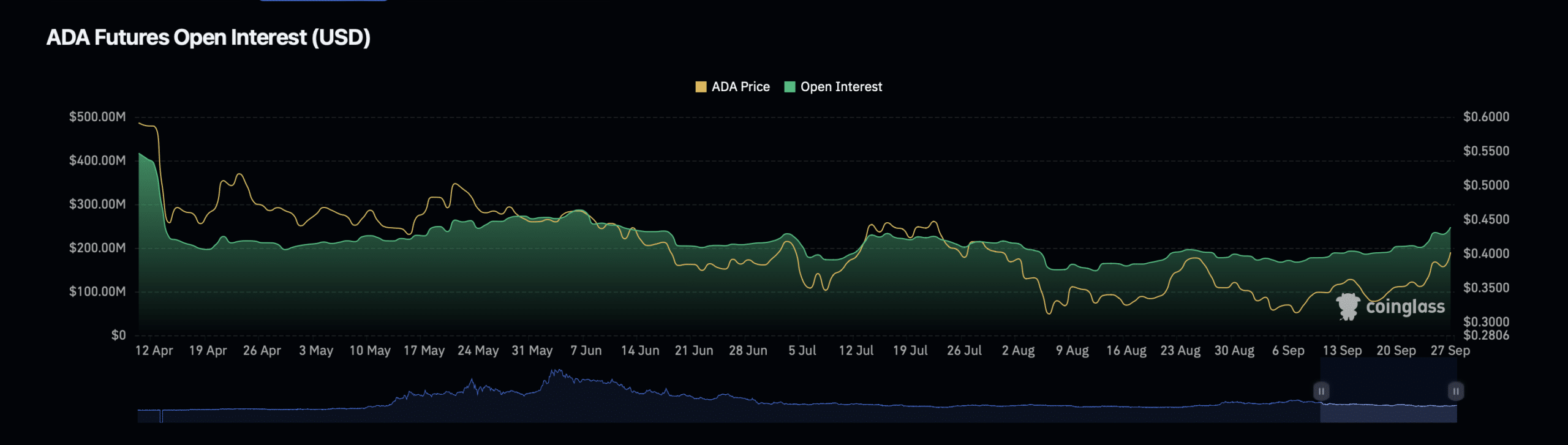

Another crucial metric contributing to ADA’s potential bullish trend is open interest, which reflects the total number of open contracts in the Futures market.

As a crypto investor, I’m excited to see that the Open Interest for Cardano (ADA) has experienced a significant increase of 6.77%, propelling its value to an impressive $255.04 million, as suggested by Coinglass data.

The boost in open interest is accompanied by an upsurge of 57.87% in the volume of open interest, currently worth approximately $442.38 million.

Read Cardano’s [ADA] Price Prediction 2024–2025

A growth in Open Interest together with price rises is typically viewed as an indicator of trader confidence, implying that fresh funds are flowing into the market.

In this situation, there’s a likelihood that the price increase will persist, given the potential for additional funds pouring into ADA futures agreements. This influx could intensify price fluctuations and prolong the ongoing upward trend.

Read More

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- Masters Toronto 2025: Everything You Need to Know

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Gold Rate Forecast

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- The Lowdown on Labubu: What to Know About the Viral Toy

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

2024-09-27 13:44