- ADA has continued its positive trend with a 6% rise as of press time.

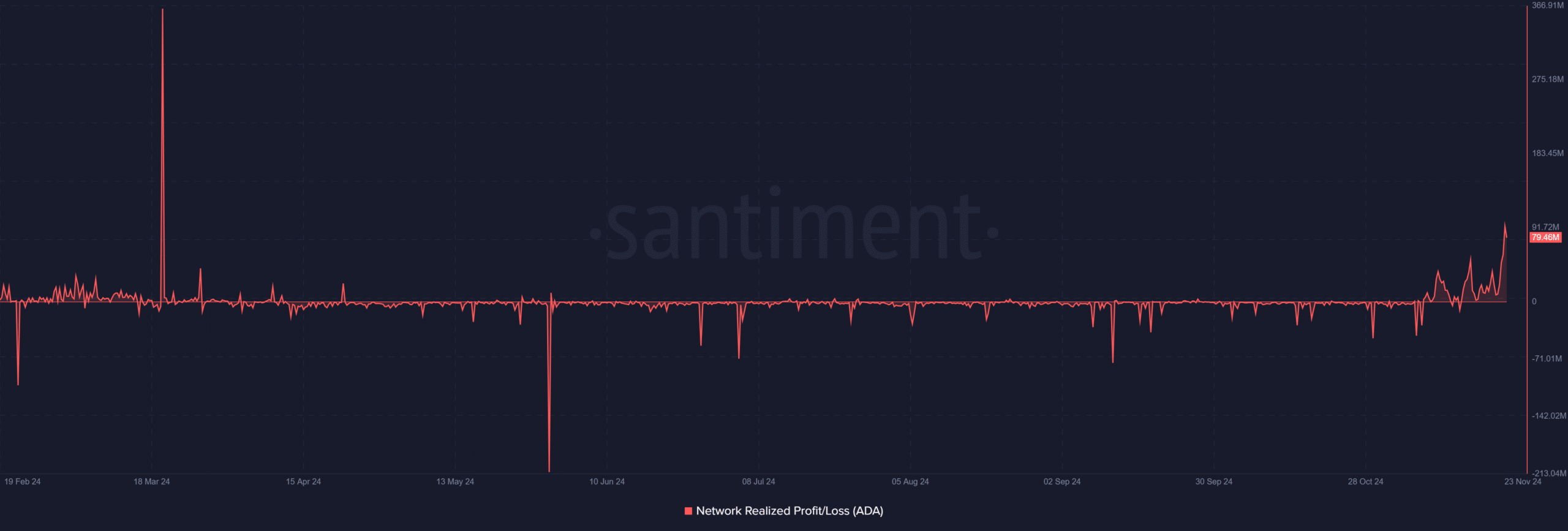

- The unrealized profit/loss volume surged for the first time since 2023.

As a seasoned researcher with years of experience tracking the cryptocurrency market, I must admit that witnessing Cardano [ADA] break through the $1 barrier again is truly exhilarating. It’s like watching a phoenix rise from the ashes, only this time it’s a digital asset soaring to new heights.

Cardano [ADA] has made headlines by breaching the significant $1 mark, a level not seen in over a year. This milestone has been supported by a combination of on-chain activity, social engagement, and price momentum.

With bullish sentiment building, can Cardano sustain its upward trajectory?

On-chain metrics support price action

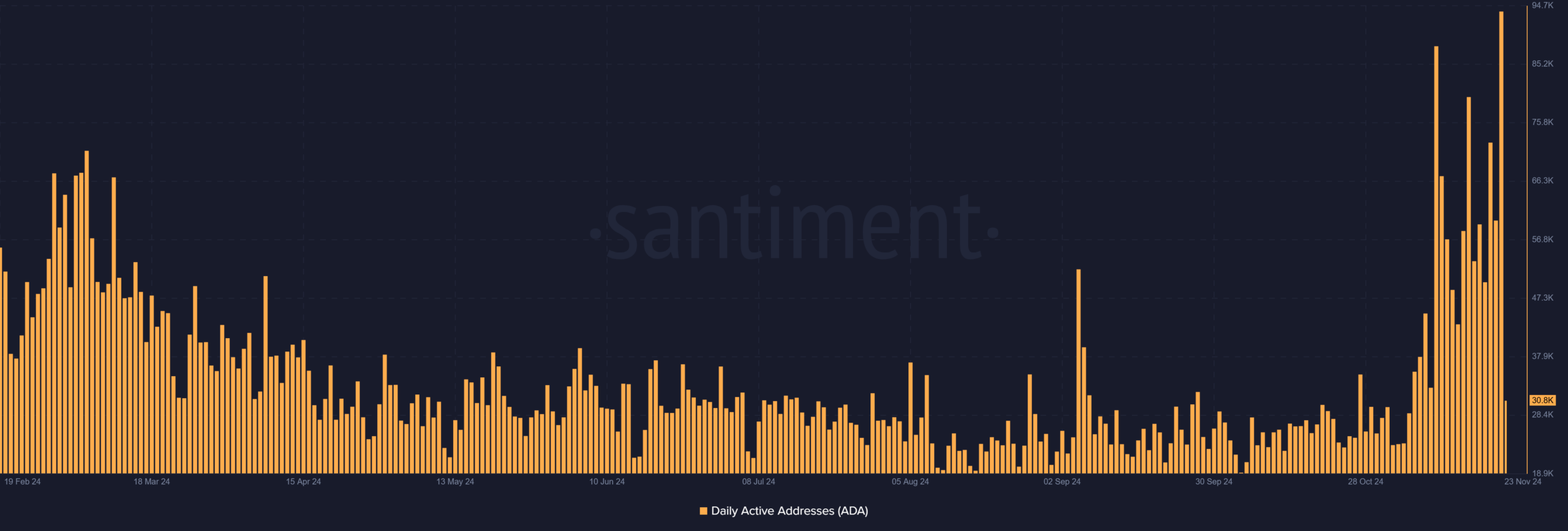

Based on AMBCrypto’s examination of Santiment data, it appears that the number of Cardano users engaging in daily activities has significantly increased, suggesting a rise in user activity.

Over the last few weeks, we’ve seen a significant increase in the number of active wallets and transactions within our system, which aligns with Cardano’s (ADA) surge in value.

By the close of trading on the 22nd of November, there were nearly 94,000 active wallets in use. This was the highest number in months that we’ve seen.

This increase in activity reflected growing utility and investor confidence.

Furthermore, it’s worth noting that Cardano’s Network Profit/Loss surged nearly to $94 million during the latest trading day, indicating that a significant number of investors appear to have benefited from the recent market fluctuations.

In line with the general trend in the market, ADA has been experiencing continuous growth over the past few weeks.

Social volume, sentiment boost Cardano

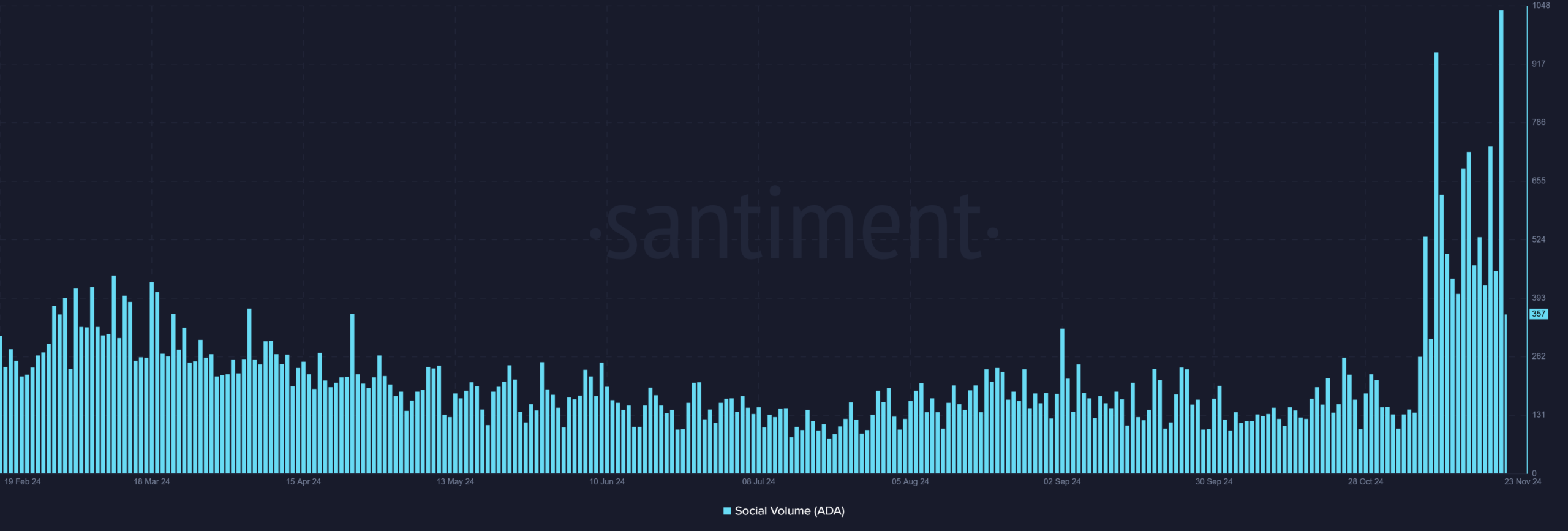

Cardano’s social volume explosion underscored its growing prominence in the crypto space.

Monitoring social activity gauges the frequency of references and conversations about ADA on various social networking sites, and the recent peaks indicate an increase in public engagement and curiosity about it.

According to AMBCrypto’s assessment, the Social Volume surged above 1,000 during the latest trading session on November 22nd – a figure not reached for several months prior.

Historically, periods of increased social interaction have tended to coincide with fluctuations in prices, drawing in fresh investors and strengthening optimistic market outlooks.

Cardano’s technical indicators signal strength

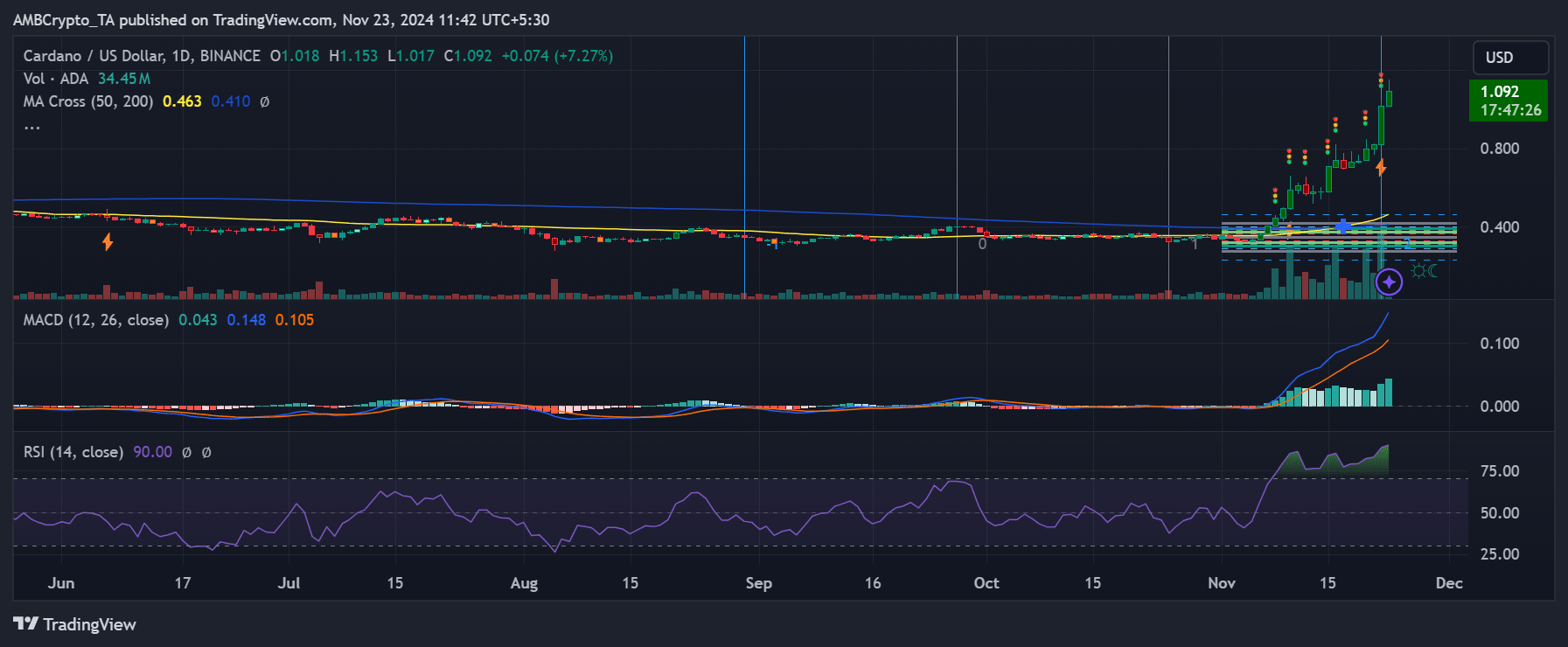

Technically speaking, the surge of Cardano beyond the $1 mark was backed up by robust signals.

At the present moment, it’s worth noting that the Relative Strength Index (RSI) indicated that ADA was in an overbought state, suggesting significant buying activity.

In simpler terms, the MACD (Moving Average Convergence Divergence) indicated a strong upward trend, as it showed its lines moving apart upwardly, suggesting that investors’ optimism was persisting.

As a crypto investor, I’ve noticed that the price chart underscores the pivotal impact of ADA surpassing its 200-day moving average, previously serving as a robust barrier to growth.

In this current position, ADA seems ready to continue its upward trend, assuming the overall market climate stays positive.

The Fibonacci retracement tool provided more perspective on ADA’s price action.

Following a significant breakthrough beyond important resistance points, Cardano (ADA) now stands above the 61.8% Fibonacci retracement threshold of its prior decline—an essential positive indicator for bulls.

The next critical Fibonacci target lies near $1.10, which ADA is approaching with strong momentum.

Additionally, the price point around $1.20, representing a 78.6% retracement, might function as a significant barrier for future progress, offering investors a defined guidepost for either cashing out profits or continuing to amass holdings.

Realistic or not, here’s ADA’s market cap in BTC’s terms

The break past the 61.8% mark and moving towards higher points indicates that Cardano (ADA) might be headed towards setting fresh record-high values.

As a crypto investor, I’m keeping a close eye on Cardano amidst the volatile market conditions. The bullish signs and data suggest that its upward trajectory is robust and it might reach even more significant milestones down the line.

Read More

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- Gold Rate Forecast

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

2024-11-23 13:12