-

Bullish sentiment and technical indicators hint at ADA’s potential breakout.

Neutral whale activity but liquidity trends lean bullish.

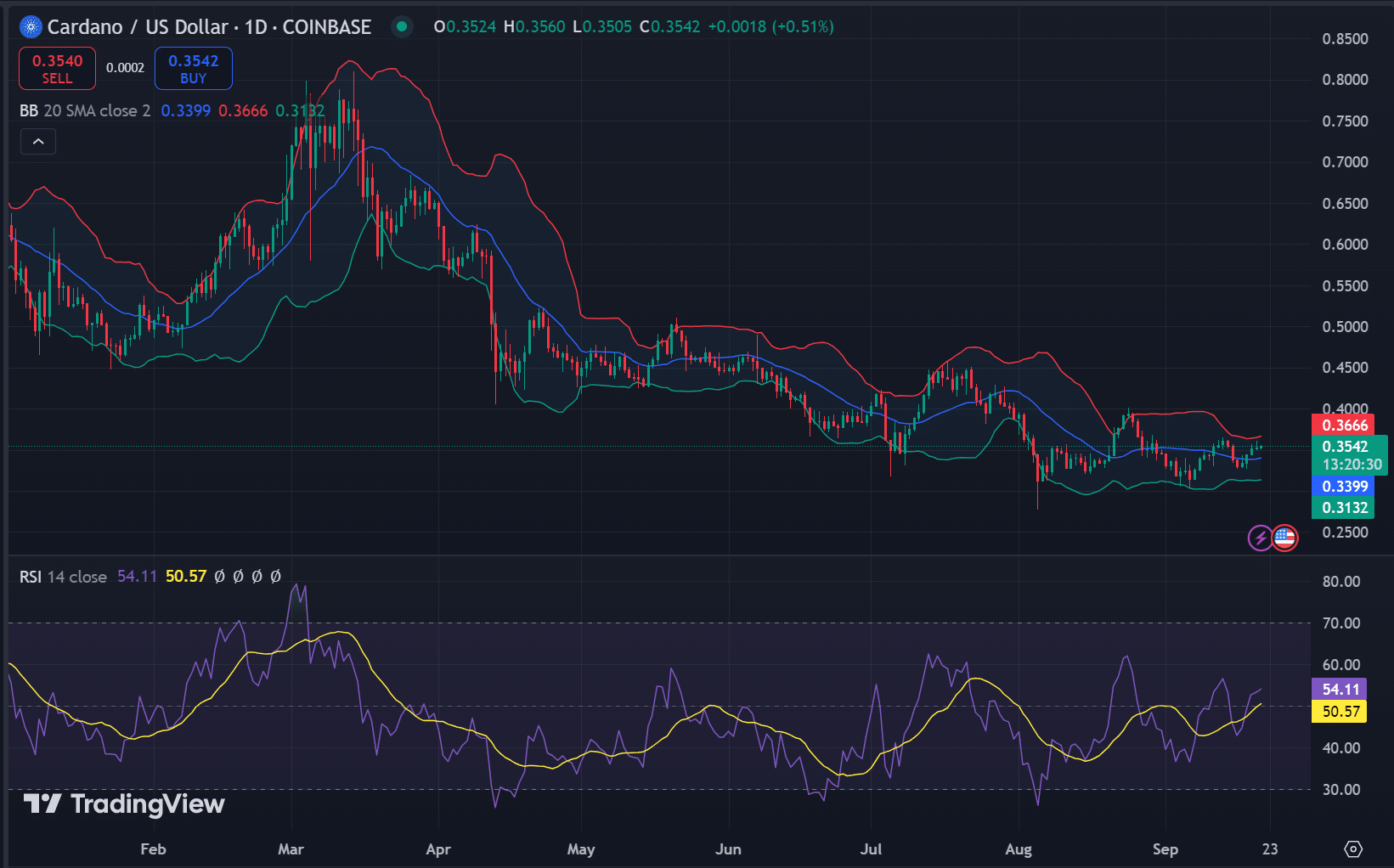

As a seasoned analyst with years of observing and navigating the cryptocurrency markets, I find myself increasingly optimistic about Cardano (ADA). The technical indicators hint at a potential breakout for ADA, with the Relative Strength Index (RSI) showing a neutral momentum with a slight bullish bias, and the Bollinger Bands squeezing, which often foreshadows an impending price surge.

There’s a notable optimistic feeling among both individual (retail) and large-scale (institutional) investors regarding Cardano [ADA]. The crowd sentiment score of 2.73 and the smart money score of 0.74 suggest that confidence in ADA’s ability to rise is increasing.

This could catalyze a significant rally in the upcoming market cycle.

Are ADA’s technical indicators pointing toward a surge?

The current configuration of Cardano is exhibiting optimistic indicators. Specifically, the Relative Strength Index (RSI) stands at 50.57, suggesting a neutral trend leaning slightly towards bulls.

This implies that purchasing momentum is growing steadily, though it hasn’t quite reached the point of being overbought. This leaves some space for potential additional increases.

Moreover, the Bollinger Bands (BB) are narrowing, typically indicating a potential price surge. As Cardano is currently priced around $0.354, moving beyond the upper band at approximately $0.3666 might trigger additional growth.

Are on-chain signals a concern for ADA?

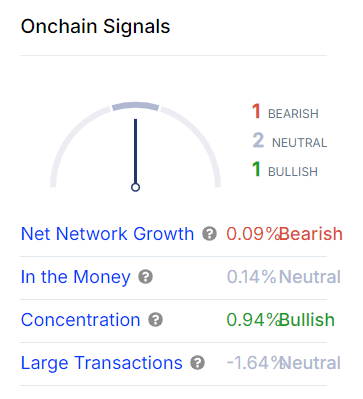

As an analyst, I’ve observed that while there’s a positive sentiment surrounding ADA, its network expansion seems to be decelerating, with a minor contraction of 0.09% as indicated by on-chain data. Although this decrease might appear worrisome at first glance, it’s essential to remember that network growth isn’t the only factor influencing price dynamics. Other factors such as market sentiment, partnerships, and technological advancements also play significant roles in shaping ADA’s price behavior.

The strong infrastructure and ongoing project development within the Cardano network might quickly spark renewed expansion as new ventures debut. Consequently, it’s plausible that the current decrease in network activity is just a short-term phenomenon.

The behavior of whales, who can sometimes predict the market’s movement, is mostly unbiased at the moment. There has been a slight dip of 1.64% in larger transactions as per on-chain analysis.

It seems like the lack of increased purchases indicates that whales aren’t actively buying. However, there’s no sign of selling either. This equilibrium might indicate a cautious stance, where big investors could be holding back, waiting to see what ADA‘s next major shift will bring before making their moves.

How will liquidity influence ADA’s price action?

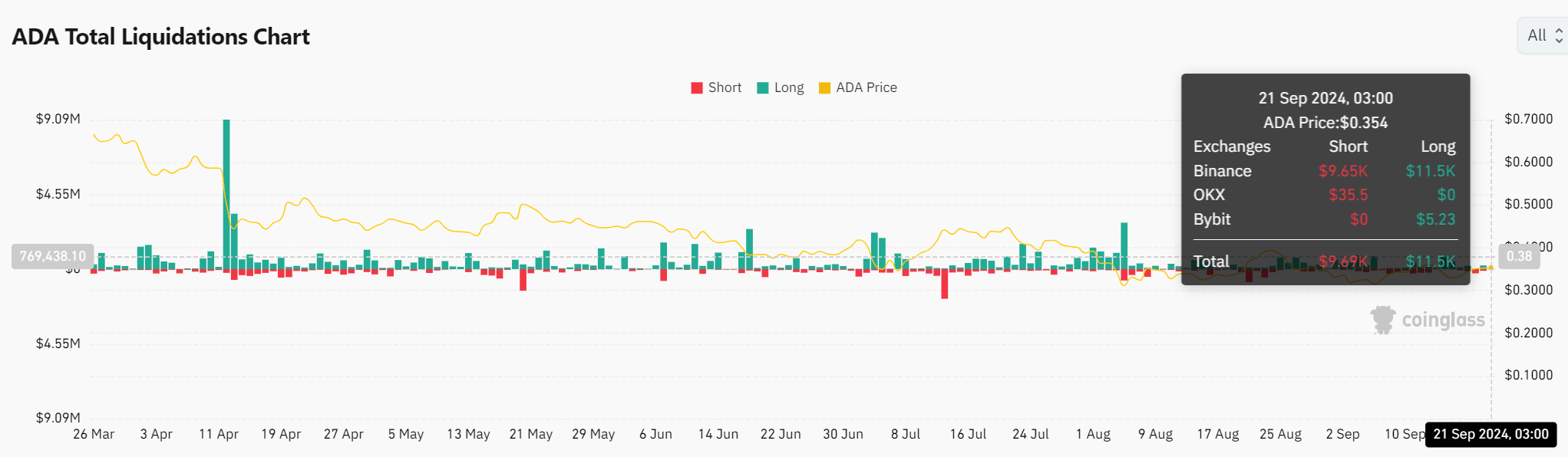

The data from ADA‘s liquidation process reveals a slight preference for long positions, as there are approximately $11,500 in long positions compared to $9,690 in short positions. This relatively even distribution of liquidations suggests that the market is uncertain but slightly optimistic.

Continued price increases might cause additional sellers of short positions, increasing demand and potentially pushing Cardano (ADA) prices even higher.

Read Cardano’s [ADA] Price Prediction 2023-24

According to ADA‘s optimistic outlook, its technical signals, and robust patterns in market liquidity, there could be a significant surge ahead.

Despite network expansion and significant whale involvement remaining unchanged, broader market indications suggest an imminent bullish breakout might occur.

Read More

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- There is no Forza Horizon 6 this year, but Phil Spencer did tease it for the Xbox 25th anniversary in 2026

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mario Kart World Sold More Than 780,000 Physical Copies in Japan in First Three Days

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Microsoft Has Essentially Cancelled Development of its Own Xbox Handheld – Rumour

- The Lowdown on Labubu: What to Know About the Viral Toy

- Masters Toronto 2025: Everything You Need to Know

2024-09-22 04:07