- Technical analysis of Cardano showed bulls have a reason to be enthusiastic.

- Social sentiment remained weak despite the breakout past $0.4.

As a seasoned analyst with over a decade of experience in cryptocurrency market analysis, I have witnessed numerous bull and bear markets. The technical analysis of Cardano [ADA] presents an interesting case. The bullish breakout past $0.4 was a significant development, but the road ahead is filled with challenges.

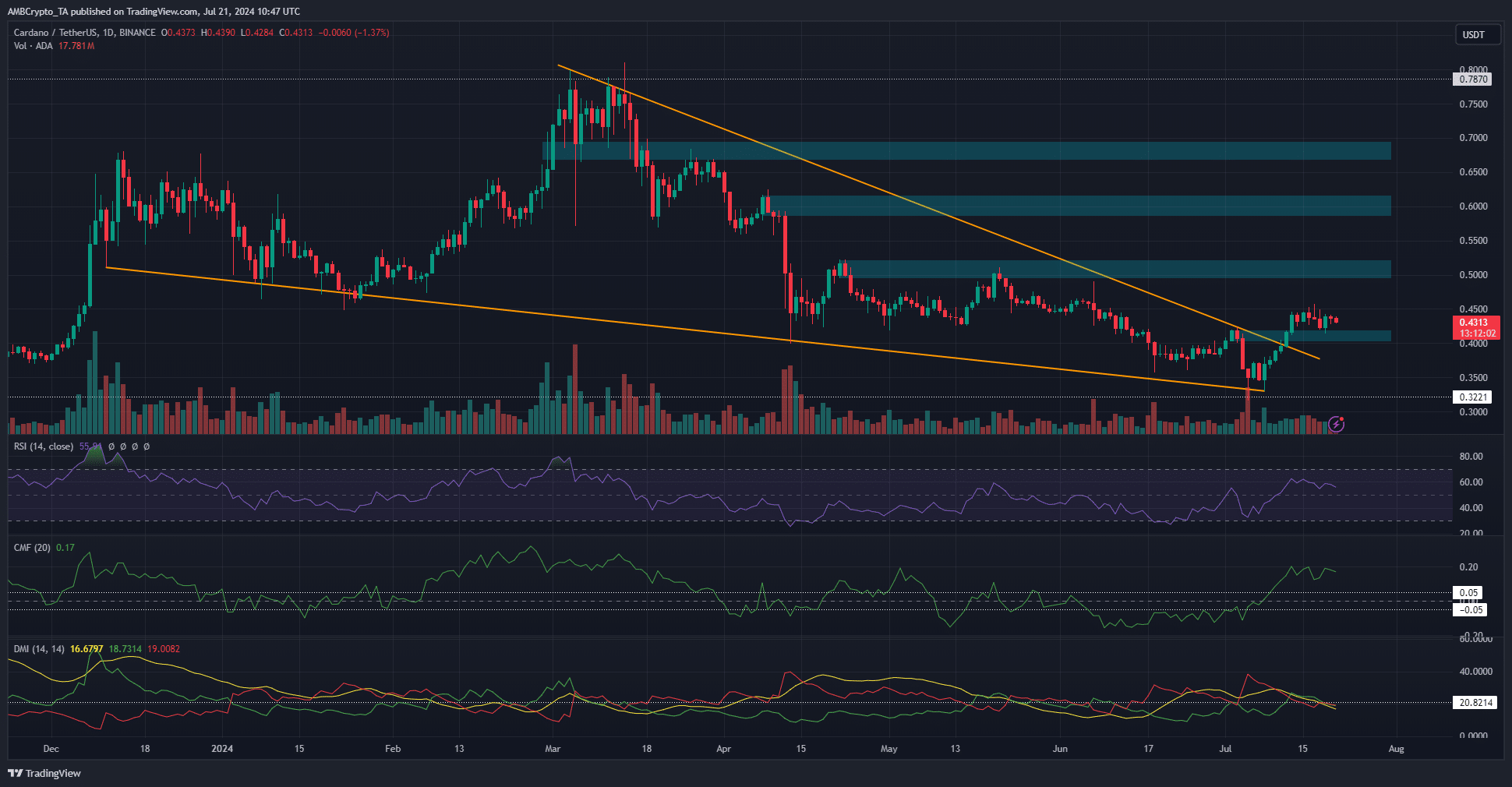

Previously, Cardano’s [ADA] price action followed a descending triangle formation. However, there was a surprising upward surge signaling a potential breakout. This event could lead to a substantial 70% increase in value for the token. Nevertheless, bulls may encounter several challenges along the way.

In simpler terms, the daily price chart showed signs of a bullish trend as indicated by the RSI’s robust rise and the significant inflow of funds suggested by the CMF.

The DMI signaled a potential trend change on the 13th of July when the DIs crossed over.

As a researcher studying the cryptocurrency markets, I noticed that the previous resistance level priced at $0.4 had been reversed and became a new support line. If the bulls were successful in holding this new level, then another price increase could follow. To further assess the market sentiment, I delved deeper into other relevant metrics analyzed by AMBCrypto.

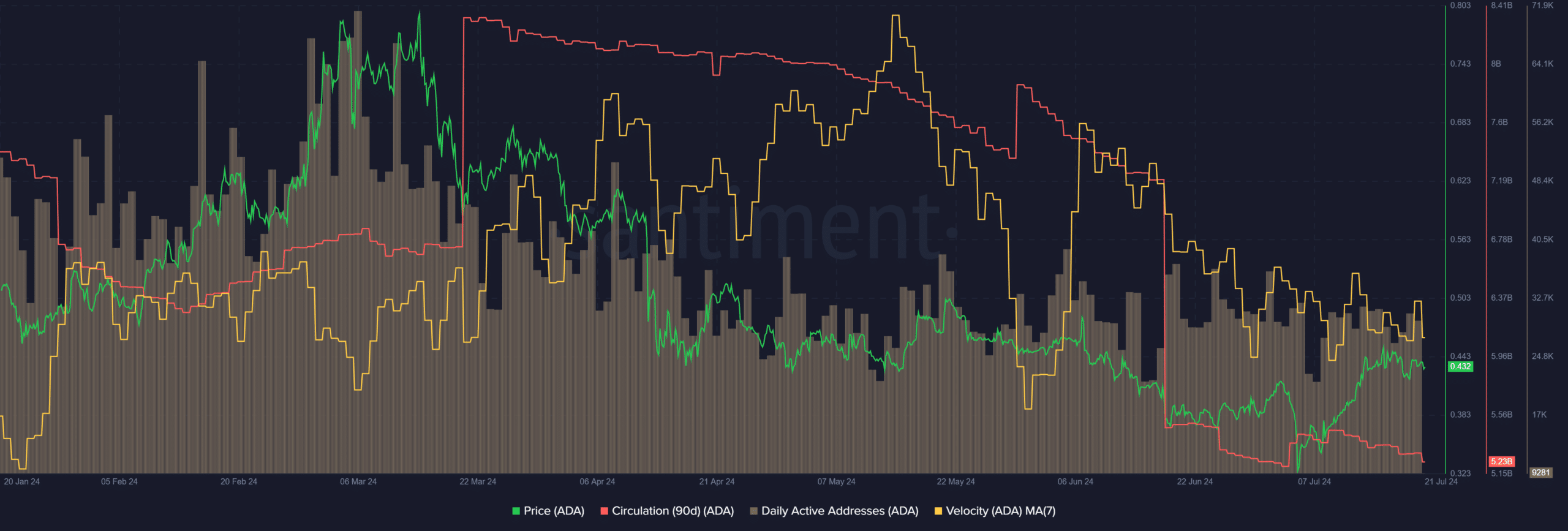

The active address count has been steady since April

Since April, the number of daily active addresses on Cardano has stayed between 32,000 and 34,000. Despite a price decline for Cardano starting in May, the user base has remained stable, indicating a positive trend.

The term indicated robustness of the network and continued faith in the blockchain despite some price instability.

Over the past two months, there’s been a significant decrease in the number of times tokens have been traded, indicating a shortage and fewer transactions. Additionally, within the last month, the frequency at which tokens are being exchanged has noticeably decreased.

Collaboratively, they signaled an increase in holdings and a decrease in risky betting. This may indicate a potential market rise within the near future.

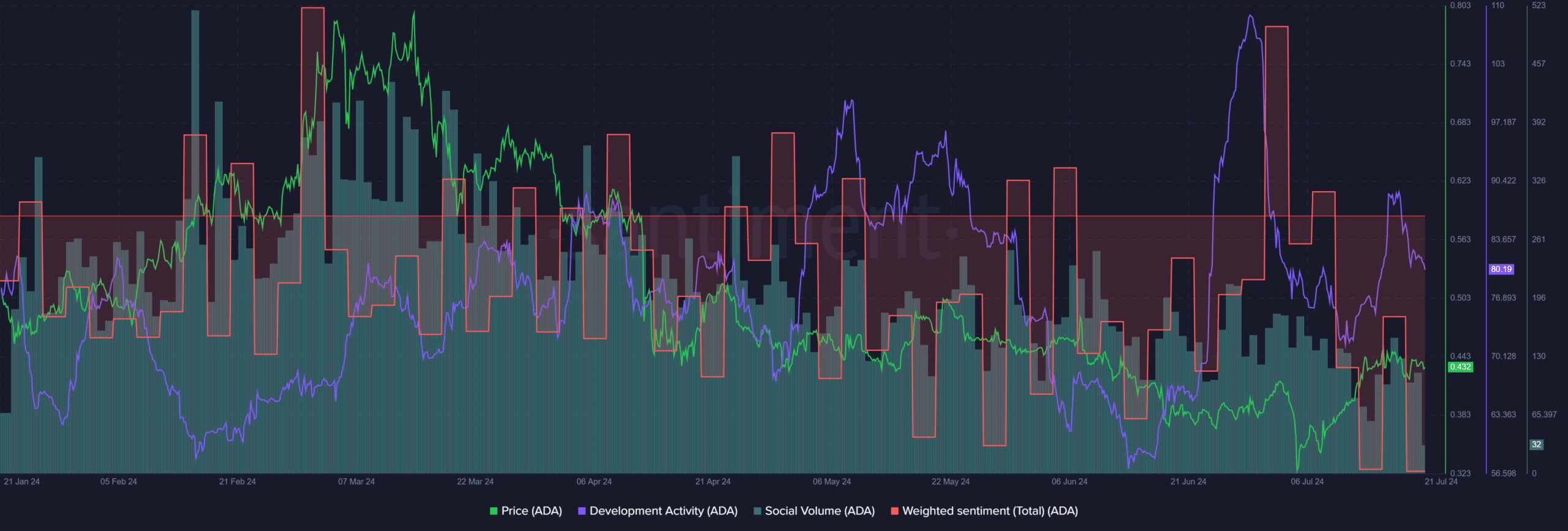

Social metrics were weakened

Despite the price downturn, development activities continued to be robust, signifying a promising outlook for long-term investors. Contrarily, the sentiment among traders showed a significantly negative trend over the past three days, yet the $0.4 level emerged as a potential support point.

Since early May, there’s been a gradual decrease in social media activity. Additionally, their analysis indicated that social media sentiment wasn’t boosting the bullish trend at that time.

Read Cardano’s [ADA] Price Prediction 2024-25

The Chang hard fork might lead to a robust price rise. However, traders should brace themselves for the possibility of minimal impact on the existing price trajectory.

The evidence at hand showed bulls have an advantage, but social media hype was missing for Cardano.

Read More

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Masters Toronto 2025: Everything You Need to Know

- There is no Forza Horizon 6 this year, but Phil Spencer did tease it for the Xbox 25th anniversary in 2026

- Mario Kart World Sold More Than 780,000 Physical Copies in Japan in First Three Days

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Microsoft Has Essentially Cancelled Development of its Own Xbox Handheld – Rumour

- The Lowdown on Labubu: What to Know About the Viral Toy

2024-07-22 05:11