-

The Cardano Chang hard fork upgrade has gone live, bringing decentralized governance to the network.

However, ADA’s price has plunged in a possible sell-the-news event.

As a seasoned analyst with over a decade of experience in the cryptosphere, I’ve seen more market fluctuations than I care to remember. The Cardano [ADA] Chang hard fork upgrade going live is indeed an exciting development, introducing decentralized governance to the network and expanding ADA’s utility. However, the token’s price drop following the event seems to be a classic case of “buy the rumor, sell the news.”

At the moment, Cardano [ADA] is being traded at approximately $0.329. Over the past day, it has yielded to the overall bearish trend in the cryptocurrency market, resulting in a 3.3% decrease in value.

This drop comes despite a key upgrade on the network to boost ADA’s utility.

Cardano Chang hard fork goes live

The Cardano network has completed the Chang hard fork upgrade. This upgrade seeks to introduce decentralized governance to the Cardano ecosystem.

Under the revised system, there will be a Constitutional Council, Elected Delegates, and Staking Service Providers. This setup enables ADA owners to participate in crucial network decisions through voting.

The Cardano Foundation said,

Today’s Chang hard fork signifies a significant achievement for the Cardano blockchain, its environment, and its supporters – it represents the realization of a fully autonomous, decentralized network as initially intended.

Despite the Chang hard fork enhancing the usefulness for ADA owners, the token hasn’t shown a positive response.

Sell the news event?

The Chang hard fork upgrade turned out to be a sell-the-news event.

In the past day, trading volumes have surged over 60% as reported by CoinMarketCap. This significant increase may be attributed to heightened selling activities.

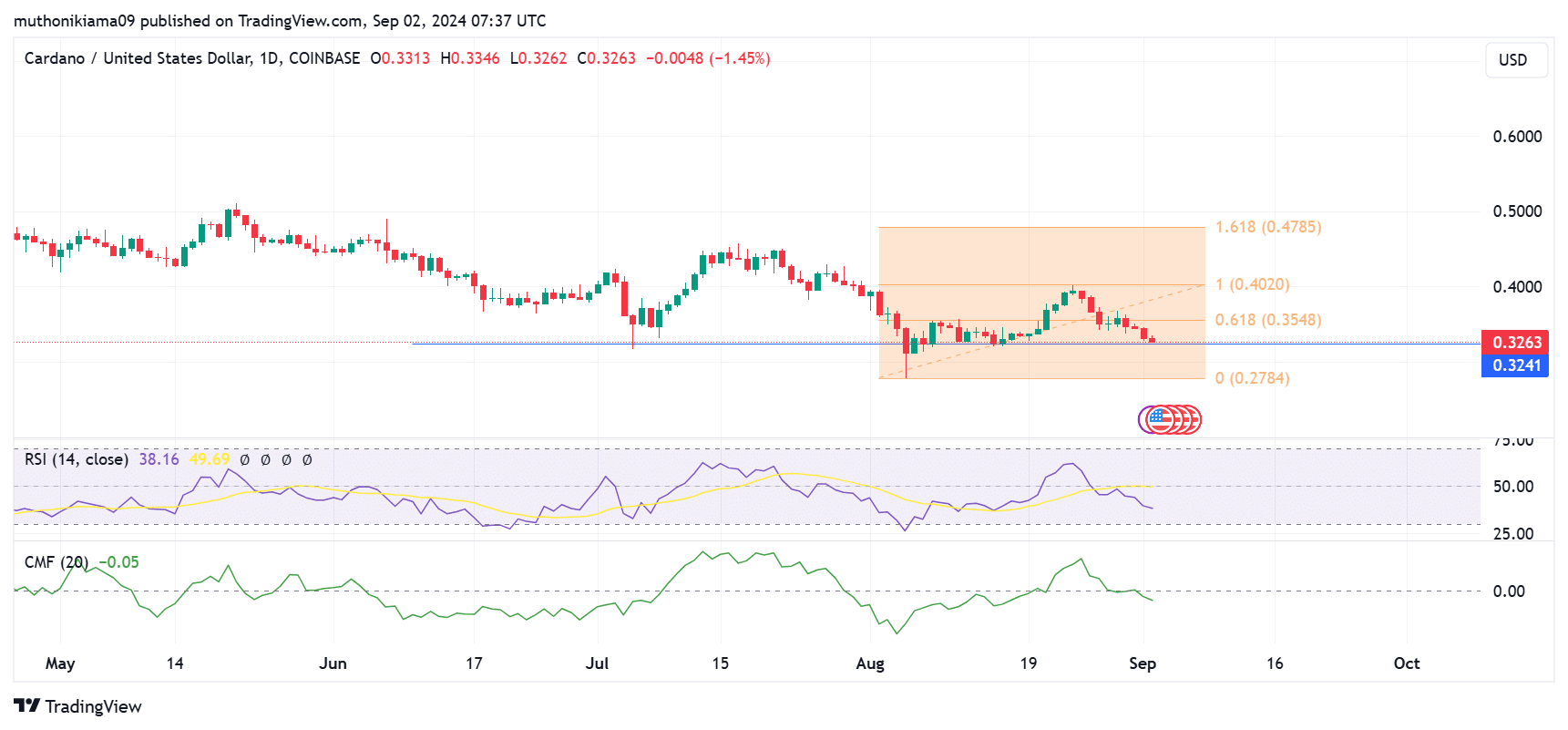

On the day’s graph, the Relative Strength Index (RSI) stood at 39, implying that the sellers held dominance. Over the last week, this index has been creating progressively lower troughs, hinting that potential buyers were holding back.

As a researcher, I observed that the Relative Strength Index (RSI) line dropped beneath the signal line, which suggests that the bearish trend continues to gather strength in this market analysis.

Examining the Chaikin Money Flow more closely reveals it’s now pointing towards increased selling pressure, since the indicator has moved into the negative territory.

In late August, I noticed a surge in both my Relative Strength Index (RSI) and Chaikin Money Flow (CMF). It seemed like the whole market was rallying at the time, which suggested that the upward trend of ADA was heavily influenced by the overall market sentiment.

If ADA‘s price drops and fails to maintain crucial support at $0.324, it might experience further dips, potentially falling back down to the support level seen on August 5, which was approximately $0.27.

If traders decide to seize the drop and stockpile, it’s possible that Cardano (ADA) could target its next resistance at around $0.402. A general bullish mood in the broader market might even boost the token, potentially pushing it up to $0.47.

Read Cardano’s [ADA] Price Prediction 2024–2025

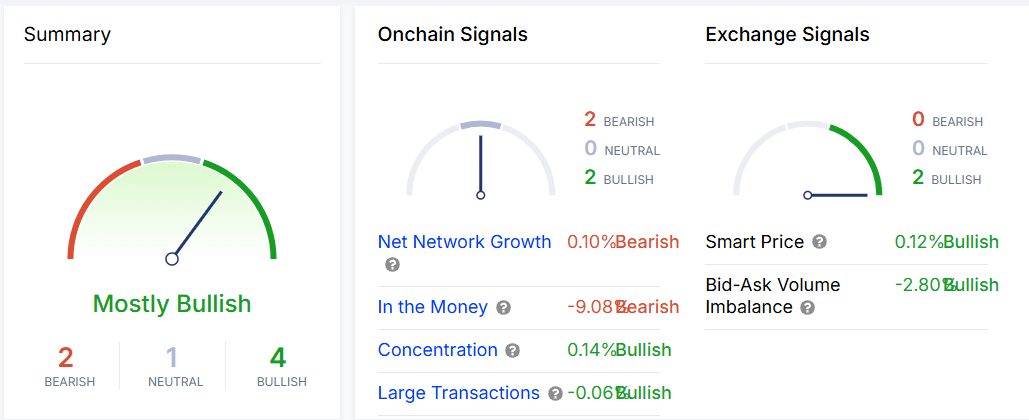

Although the technical signs now point towards a bear market, the on-chain data from IntoTheBlock indicates a bullish scenario, implying that the current downward trend might not last long.

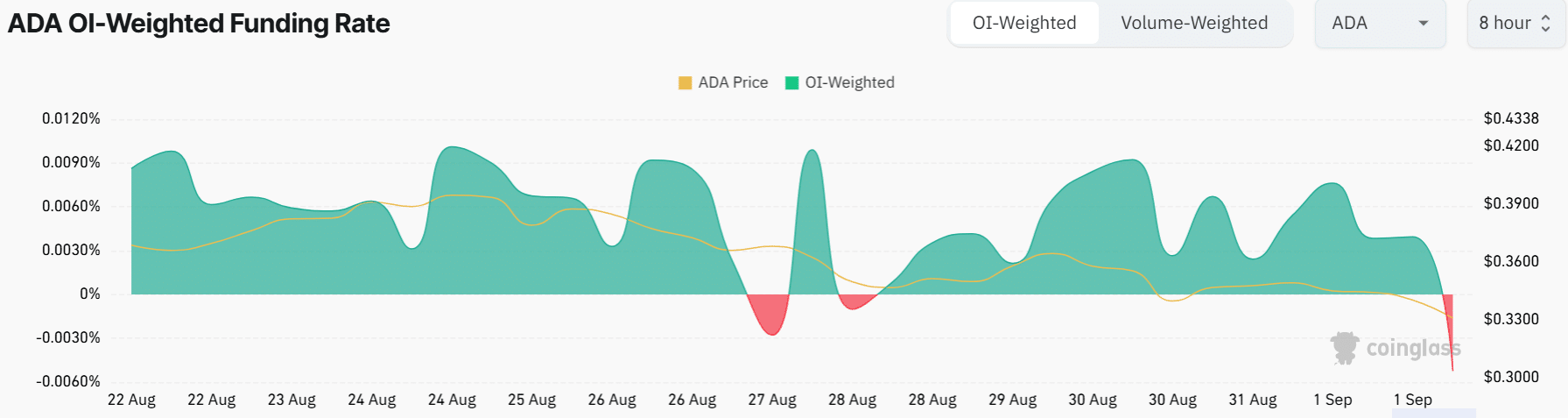

However, data from Coinglass strengthened the bearish thesis. ADA’s Funding Rates have flipped negative for the first time in nearly a week, showing the dominance of short traders.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- LPT PREDICTION. LPT cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- WCT PREDICTION. WCT cryptocurrency

2024-09-02 13:44