-

ADA has been trading at almost 90% below its record high posted on September 2021.

More than 74% of blocks have been created on a Chang-ready node version.

As a seasoned analyst with over two decades of experience in the crypto market, I’ve seen more than a few rollercoaster rides. And Cardano [ADA] is no exception.

The continuous Chang hard fork for Cardano‘s native cryptocurrency, ADA, is a positive step forward in the chain’s progression towards establishing self-governing capabilities within its blockchain system.

However, the Chang upgrade has not profoundly influenced ADA’s price action.

Chang upgrade approaching

Previously, Cardano communicated that the Chang hard fork would take place in two stages, referred to as Chang #1 and Chang #2. Each stage will introduce distinct governance features.

Last month, we started the initial stage that sets up a system for decentralized management among ADA owners, establishing its foundation.

As a researcher, I’ve identified two crucial milestones in the progress of Chang:

According to the state of stake pool readiness, it’s confirmed that a sufficient number of Staking Pool Operators (SPOs) have successfully installed the Node version 9.1.0 release in Cardano.

Recent data from explorers indicates that a significant majority, approximately 74.02%, of blocks mined over the past 8 hours were produced by SPOs (Stake Pool Operators) using version 9.1.0 – the leading contender for the upcoming hard fork on the mainnet.

Currently, the preparedness for liquidity in the event of a hard fork is only at 20.16%. As it stands, six exchanges such as WhiteBIT, Bitfinex, and BitMart have expressed readiness to facilitate the Chang hard fork.

Seventeen additional team members were making sure that their systems aligned with the newest node variant, preparing for smooth transaction and operation processing after the upgrade.

Later this year, we anticipate moving into the next stage of Chang, where we’ll put into action the key governing elements, though a precise schedule hasn’t been announced as of now.

Network activity and ecosystem growth

Over the past week, according to blockchain analysis company Santiment, Cardano placed third in significant development activity over a 30-day period ending on the 5th of August.

From the perspective of user involvement, a subtle rise in the Cardano network’s operational pace appears to have led to a decrease in the number of new users joining.

According to AMBCrypto’s analysis using IntoTheBlock data, the count of Cardano wallets holding ADA has remained fairly stable around 4.45 million for more than a year now.

In the past three months, both the number of transactions on our network and its active user count have remained relatively consistent.

As a researcher delving into the world of cryptocurrencies, I’ve observed an intriguing fact about Cardano: it processes roughly $7.2 billion in daily on-chain volume. This finding, when considered alongside its Network Value to Transactions (NVT) ratio of 2.62, suggests a relatively modest network valuation relative to the transactional activity it supports.

The low NVT ratio indicated that ADA was undervalued compared to its usage on the network.

ADA/USDT price action

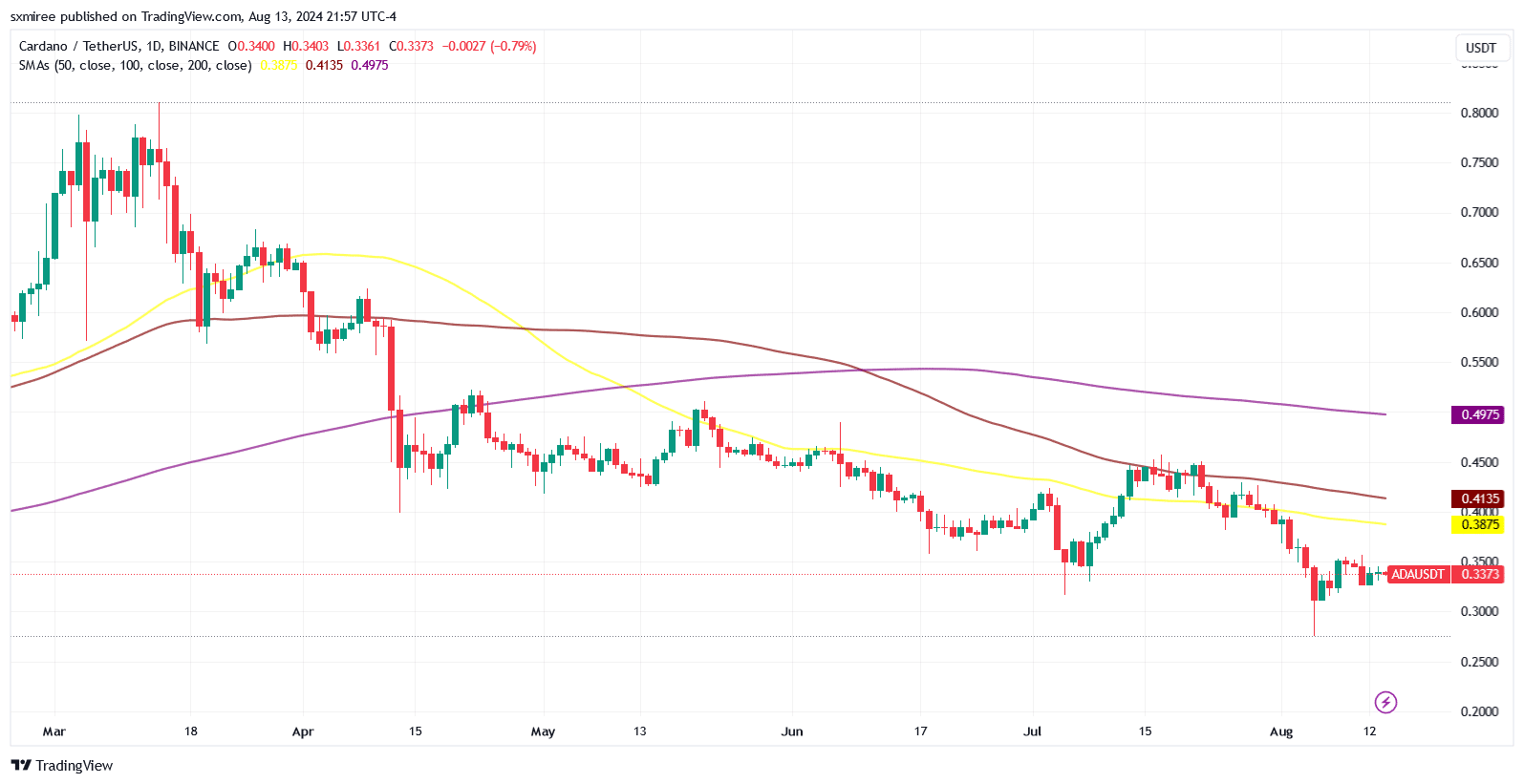

From mid-March, ADA experienced a four-month decrease in value, going from $0.82 down to $0.39 by the close of June. This decline intensified when the token’s price fell below the vital support level of $0.32 earlier this month.

In simpler terms, the bulls aimed to regain around $0.40 first, then attempt to surpass the $0.45 barrier which previously resisted ADA‘s advance back in mid-July.

Read Cardano’s [ADA] Price Prediction 2024 – 2025

At the time of writing, the ADA/USDT pair was priced at approximately $0.34, which is lower than both its 100-day and 200-day simple moving averages.

In simpler terms, the current trends are giving a somewhat unclear yet quiet signal, as investors closely monitor significant points to predict what the prices might do next.

Read More

- PI PREDICTION. PI cryptocurrency

- WCT PREDICTION. WCT cryptocurrency

- Gold Rate Forecast

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- LPT PREDICTION. LPT cryptocurrency

- Solo Leveling Arise Tawata Kanae Guide

- Despite Bitcoin’s $64K surprise, some major concerns persist

- SOL PREDICTION. SOL cryptocurrency

- Gayle King, Katy Perry & More Embark on Historic All-Women Space Mission

- Jack Dorsey’s Block to use 10% of Bitcoin profit to buy BTC every month

2024-08-14 10:16