-

Cardano completed its upgrade on the first day of the month.

ADA’s reaction has been rather stifled as it remained below its moving averages.

As a seasoned investor with over a decade of experience in the crypto space, I’ve seen my fair share of ups and downs. The recent Cardano [ADA] hard fork was highly anticipated, but its impact on ADA’s price has been rather underwhelming so far.

After experiencing a few technical setbacks, requiring adjustments to the schedule, the eagerly anticipated Cardano [ADA] hard fork is now complete and in effect.

The recent update has brought about modifications to the network structure, signifying a substantial achievement for the blockchain’s underlying framework.

Although there have been significant improvements, the circumstances for ADA continue to be difficult due to an increasing number of crypto heavyweights releasing their assets.

Crypto whales dump ADA

Despite the expectation that the latest Chang hard fork would boost Cardano’s (ADA) network capabilities, it hasn’t led to a favorable price increase as yet. On the contrary, there seems to be a significant pattern of large crypto investors (whales) selling off their ADA holdings.

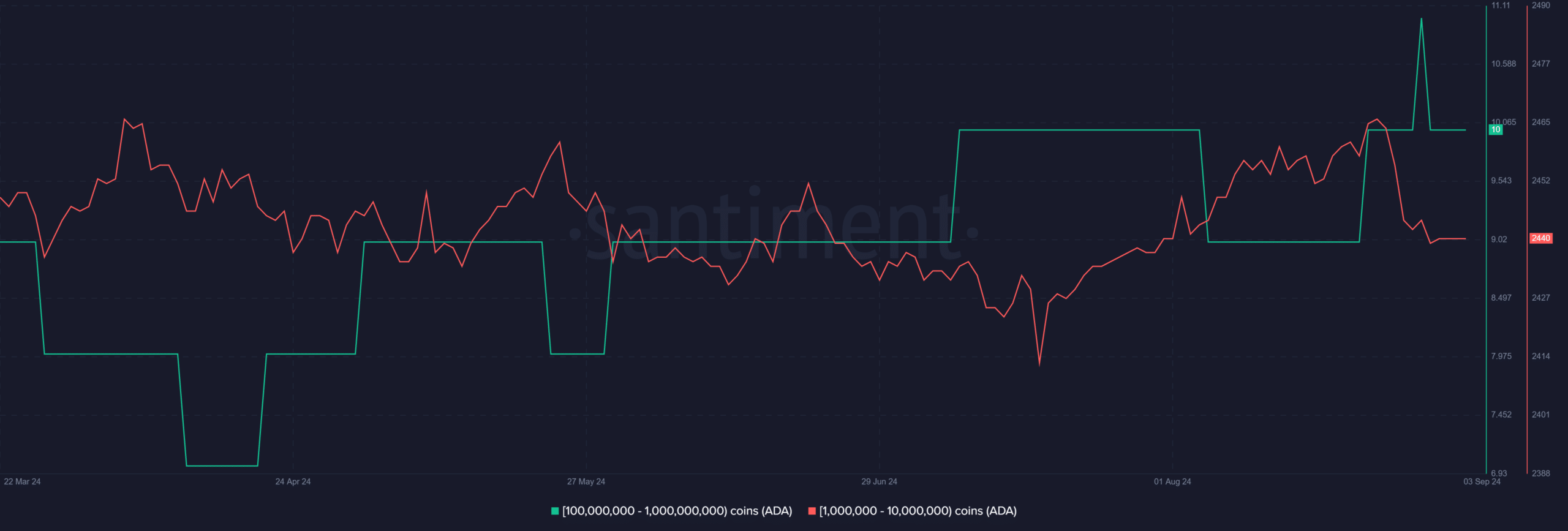

As a researcher, I’ve uncovered some intriguing insights from data provided by Santiment. Specifically, it appears that the wallets identified as whales, with a balance of ADA tokens ranging between 1 million and 1 billion, have recently reduced their holdings.

This proposal implies they significantly reduced their ownership of those assets when the update was about to take place.

It turned out that a group of whale wallets had transferred approximately $326 million in ADA, which amounted to around 15% of their overall supply.

The significant drop in ADA‘s value suggests that some big investors may have doubts about its short-term price growth, even with the technological improvements resulting from the hard fork.

The conduct of these whales serves as a vital signal of investors’ emotions, as their actions frequently mirror wider anxieties or predictions.

Investors who chose to sell large quantities of ADA around the time of, or prior to, the update may be expressing doubt about the short-term advantages of the hard fork, or they could simply be adopting a more conservative stance in response to wider market fluctuations.

Cardano is still stuck in a bear trend

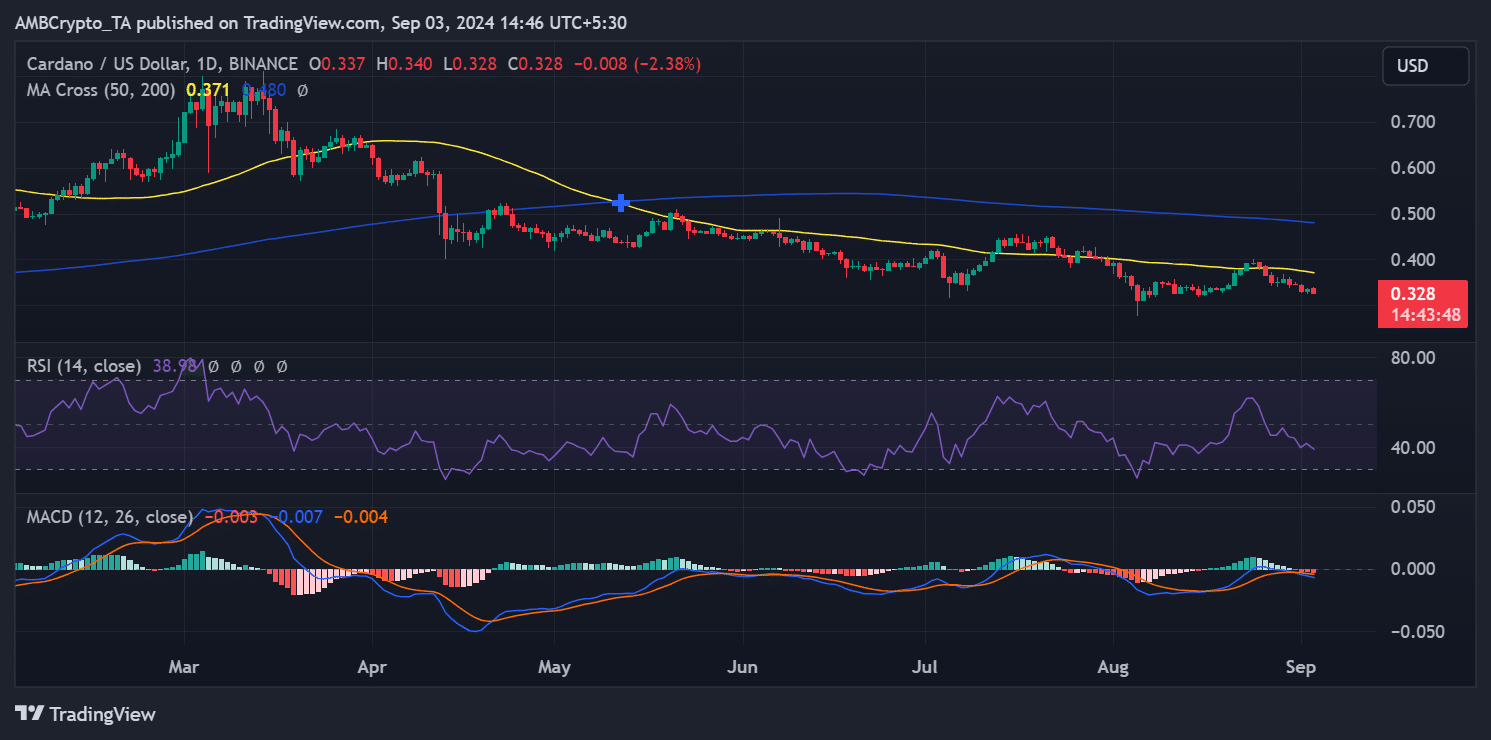

According to AMBCrypto’s examination, there was a significant change in the trend of ADA‘s price as it approached and after the most recent network update.

At first, ADA showed a steady increase, hitting its highest point on August 24th, as it managed to surpass a significant barrier in its path.

However, as the upgrade approached, this upward momentum reversed, and ADA began to decline.

As a researcher, I’ve noticed that the price has dipped beneath the short-term moving average (previously acting as a support line). However, this line now seems to be offering resistance instead.

Currently, ADA is approximately valued at $0.32, marking a drop of more than 2%. The growth of around 1% seen during the last trading day has been reversed due to this recent dip.

Upon closer examination, it appears that ADA‘s Relative Strength Index (RSI) indicates ongoing bearish trends. At present, the RSI is close to dropping below the 40 mark.

If the Relative Strength Index (RSI) drops below 40, it might suggest that Cardano (ADA) is approaching an oversold state. This threshold is frequently linked to heightened selling activity and potential continued downward movement.

Fewer addresses become active

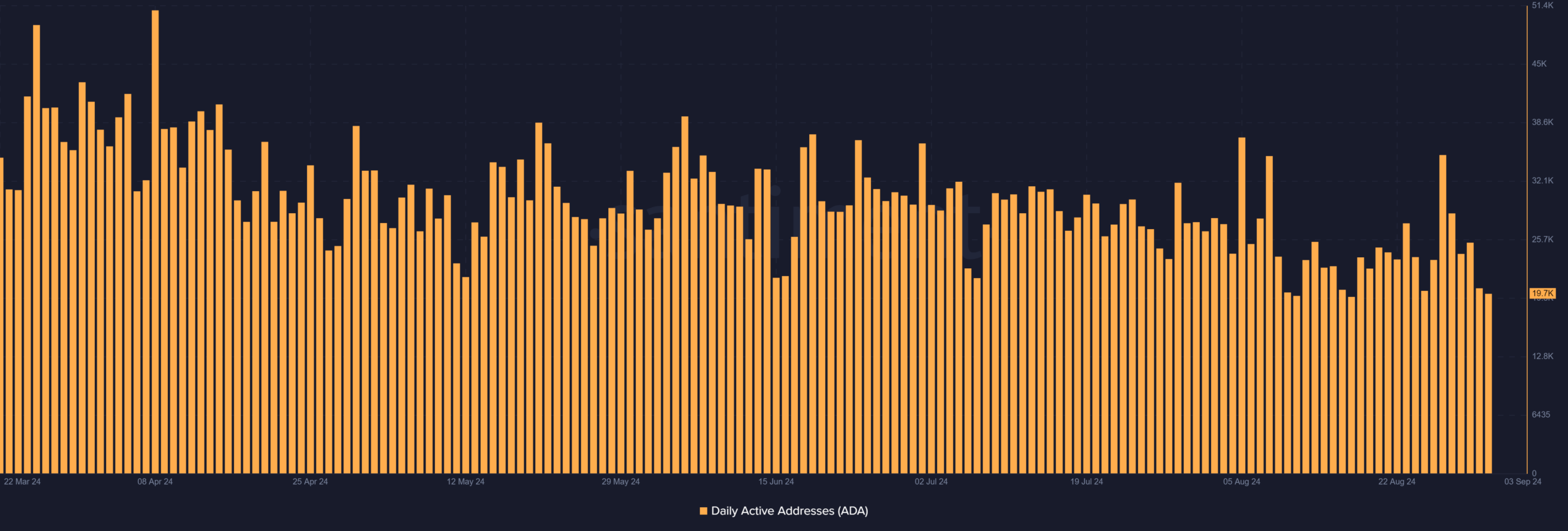

Over the last week, there’s been a noticeable decrease in daily active users on the Cardano network, as shown by a recent study.

As a cryptocurrency investor, I’ve noticed an intriguing surge in activity on the blockchain around August 27th. According to data from Santiment, this spike reached approximately 35,000 active addresses. This significant increase could be attributed to heightened interest in anticipation of the upcoming network upgrade, suggesting a potential positive development for the crypto community.

However, this activity level rapidly decreased in the days that followed.

Currently, it’s been observed that around 19,700 daily active addresses are being used. This significant decrease in active addresses suggests a notable drop in network engagement.

During this timeframe, it’s been observed that the large investors (or “whales”) in Cardano’s cryptocurrency, along with other holders, have shown a decrease in activity.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Masters Toronto 2025: Everything You Need to Know

- WCT PREDICTION. WCT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- LPT PREDICTION. LPT cryptocurrency

- Elden Ring Nightreign Recluse guide and abilities explained

- Solo Leveling Arise Tawata Kanae Guide

- Despite Bitcoin’s $64K surprise, some major concerns persist

2024-09-03 21:13