- ADA declined by 21.78% over the past week.

- Cardano has seen a shift in market sentiment to bearish as sellers dominate.

As a seasoned crypto investor with a knack for navigating the volatile waters of the digital asset market, I must admit that the recent decline in Cardano [ADA] has left me somewhat concerned but not entirely surprised. After all, we’ve seen such corrections before, and they often serve as opportunities to accumulate more at lower prices.

Over the past week, after reaching a peak of $1.3, the price of Cardano [ADA] has noticeably dropped, reaching a low of $0.911.

Currently, at the moment, the price of Cardano stands at $1.02. This represents a decrease of 12.25% in its daily performance. Before this dip, however, Cardano had been moving upwards, increasing by as much as 75.91% over the past month.

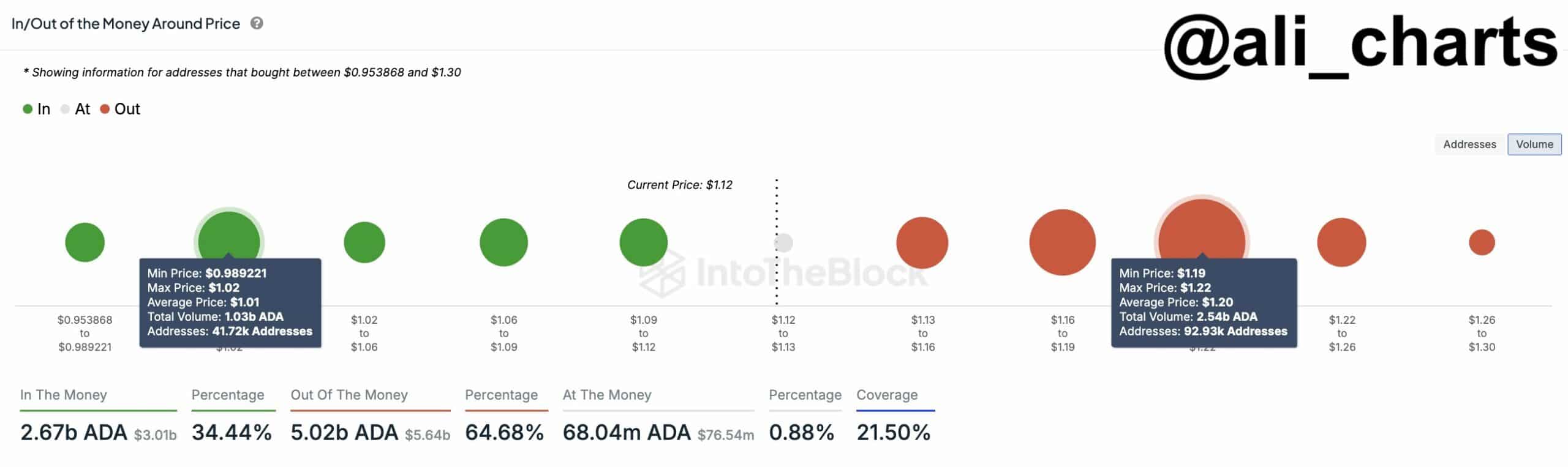

In my current role as a researcher, I’ve been closely observing the latest market trends, and it seems that the recent conditions have sparked quite a conversation among analysts. Among them, there’s Ali Martinez, who believes that the price point of $1.2 could potentially serve as a crucial support level.

Analyzing market sentiment

According to Martinez’s discussion, there’s a significant support level for Cardano at approximately $1.2. This level is backed by about 93,000 wallets containing around 2.54 billion ADA tokens.

As he explains, if the altcoin falls below this point, there’s a risk that its value could drop below $1 until such time as it picks up another strong upward trend.

As I, the analyst, observed, it appears that Cardano (ADA) may be replicating its 2020 performance. In the past, ADA surged significantly from approximately $0.141 to a peak of $1.547.

Consequently, the dip might present a chance for purchasing, potentially leading to a recovery. As Martinez suggested, this recovery could drive the price of ADA upwards, with an anticipated range of $4 to $6.

What ADA charts say

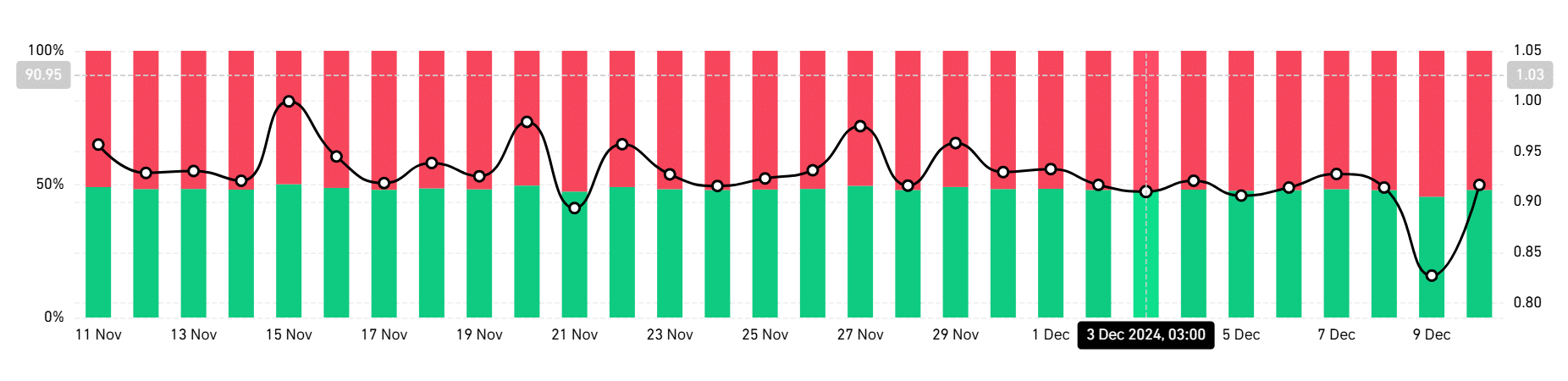

Over the last week, AMBCrypto’s analysis indicates a shift in market sentiment for Cardano, moving from optimistic (bullish) to pessimistic (bearish). This is due to an increase in selling activity, which currently controls the market.

The preponderance of sellers was clearly demonstrated, as the Relative Strength Index (RSI) for ADA fell from 79 to 53, indicating an increase in selling force within the market.

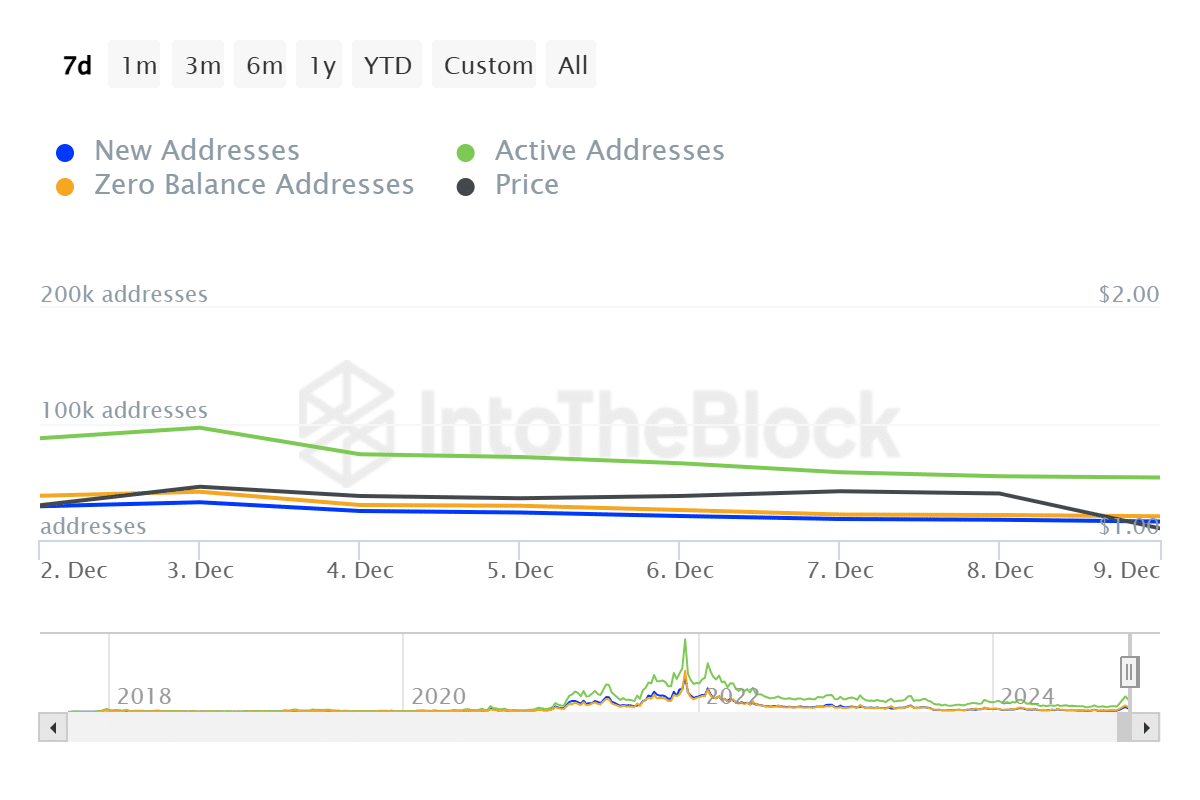

Moreover, the number of active Cardano addresses has dropped from approximately 170,830 to 90,360. A decrease in active users often indicates less engagement with the network, lower adoption rates, reduced market demand, and waning investor enthusiasm.

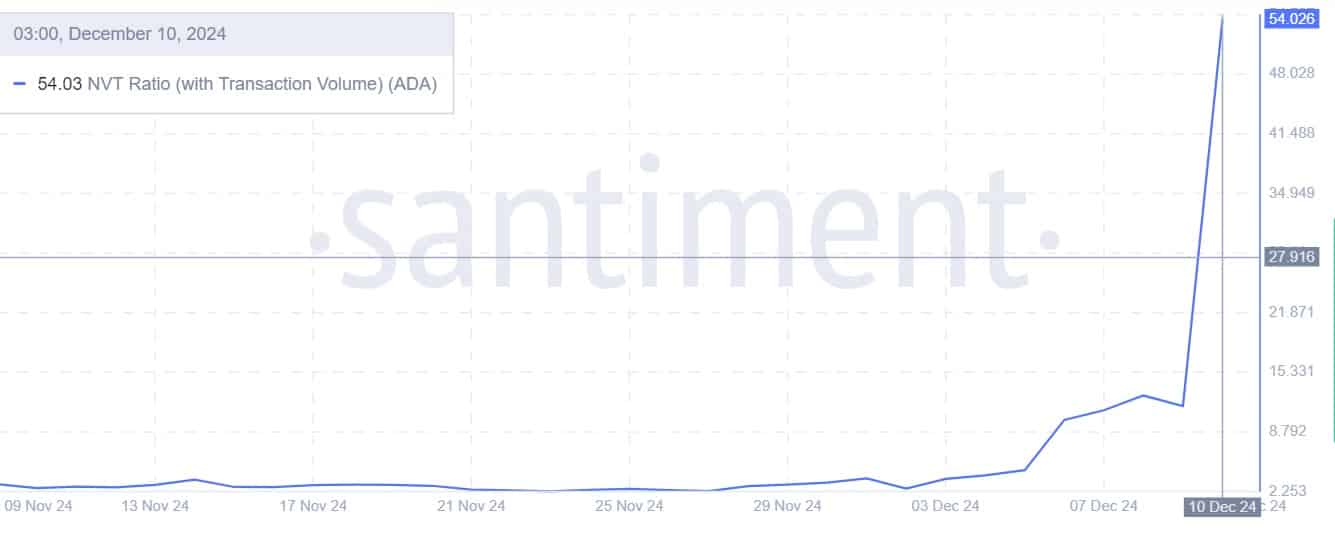

This decline in network activity is also noticeable following the increase in NVT ratio (alongside transaction volume). The altcoin’s NVT ratio has significantly increased from 11.63 to 54.03, suggesting that the altcoin’s market capitalization is increasing at a quicker pace than its transaction volume.

As a researcher, I’ve observed historically that when the NVT ratio (Network Value to Transactions ratio) is high, it tends to coincide with market peaks or overbought situations. Consequently, if transaction volume doesn’t pick up pace, prices may start to drop as market speculation cools off.

To summarize, it appears that investor opinions have changed significantly, with a growing number adopting a bearish stance by opening short positions. As per data from Coinglass, approximately 52% of these positions represent the total. This indicates that a large majority of investors are predicting a drop in prices.

Read Cardano [ADA] Price Prediction 2024-2025

Essentially, at this moment, Cardano (ADA) appears to be experiencing a downtrend, which might lead to a fall in its value. If the pessimistic outlook persists, we could see ADA’s price drop to approximately $0.9. Further pessimism could potentially drive the price down to around $0.77.

However, a trend reversal will see ADA reclaim $1.2 levels.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

2024-12-10 16:43