As a researcher with experience in analyzing cryptocurrency trends, I have closely monitored Cardano’s [ADA] performance over the past few weeks. According to data from Santiment, Cardano was among the top-ranking cryptocurrencies on June 10th, with a volume of over $500 million. However, despite this strong showing, ADA remained in a bear trend.

As a researcher examining cryptocurrency data from Santiment, I found that Cardano [ADA] held a strong position among the top-performing digital currencies on the 10th of June. Specifically, ADA secured the second spot in the rankings, trailing only behind Bitcoin [BTC].

As a crypto investor, I’ve closely followed AMBCrypto’s analysis, and I observed that the sentiment towards Cardano (ADA) was quite balanced. The positive and negative trends were nearly equal in frequency, making it an intriguing asset to watch.

As a researcher delving into the latest developments in the blockchain world, I’ve noticed some prominent themes emerging in the discourse. These topics include the surge of interest in smart contract Non-Fungible Tokens (NFTs), comparisons with Ethereum [ETH], and the increasing decentralization of the network.

From my perspective as a researcher, at present, ADA is no longer making waves as one of the most talked-about cryptocurrencies. It seems to have dropped out of the trending coins list entirely. This observation suggests that there’s been a noticeable decrease in conversations surrounding ADAduring the past 24 hours.

Cardano’s trends fall

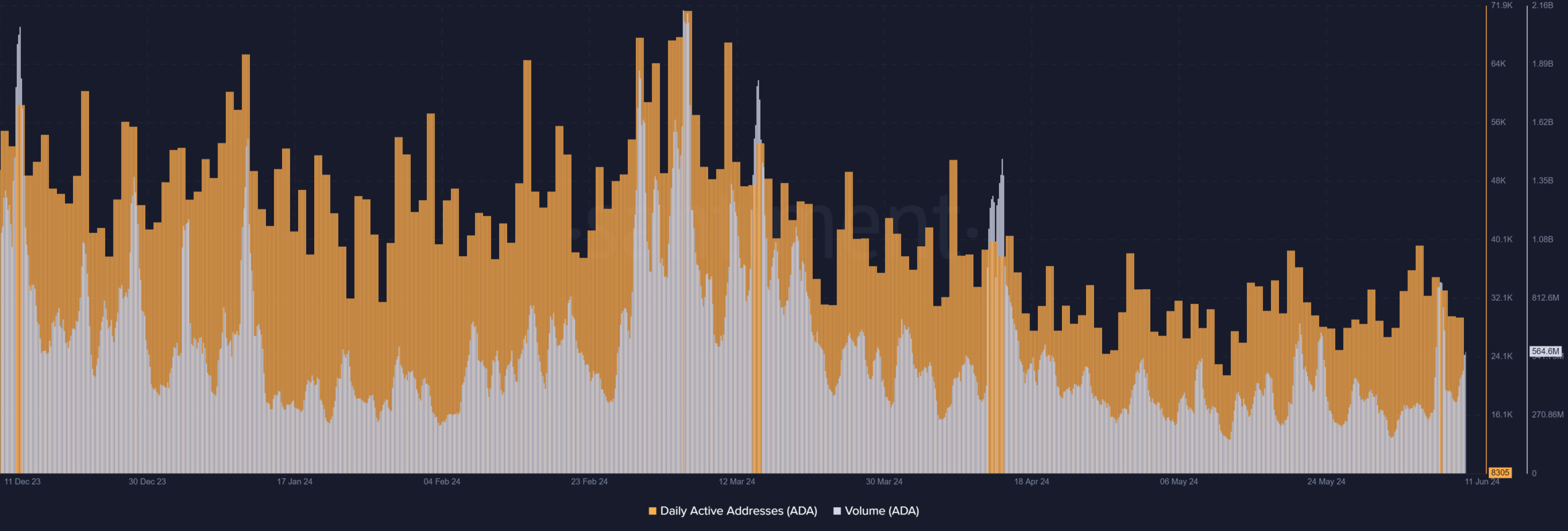

According to AMBCrypto’s examination of the daily active address count for Cardano, as presented by Santiment, this metric has been declining consistently over the past several months.

As a researcher studying the trends of Active Addresses in the ADA network, I’ve observed a downward pattern since around March. The average count of active addresses during this period fell between the ranges of 40,000 and 50,000.

Approximately 39,000 Cardano addresses were in use during May’s peak period. Currently, that figure has decreased substantially to roughly 6,400.

As a crypto investor, I noticed an intriguing shift in one particular metric during the past 24 hours – the trading volume. The chart from AMBCrypto showed that it had reached approximately $450 million by the market close on the 10th of June.

At present, the trading volume surpasses $550 million. Yet, it was further discovered that sellers have taken the lead in terms of volume.

ADA declines again

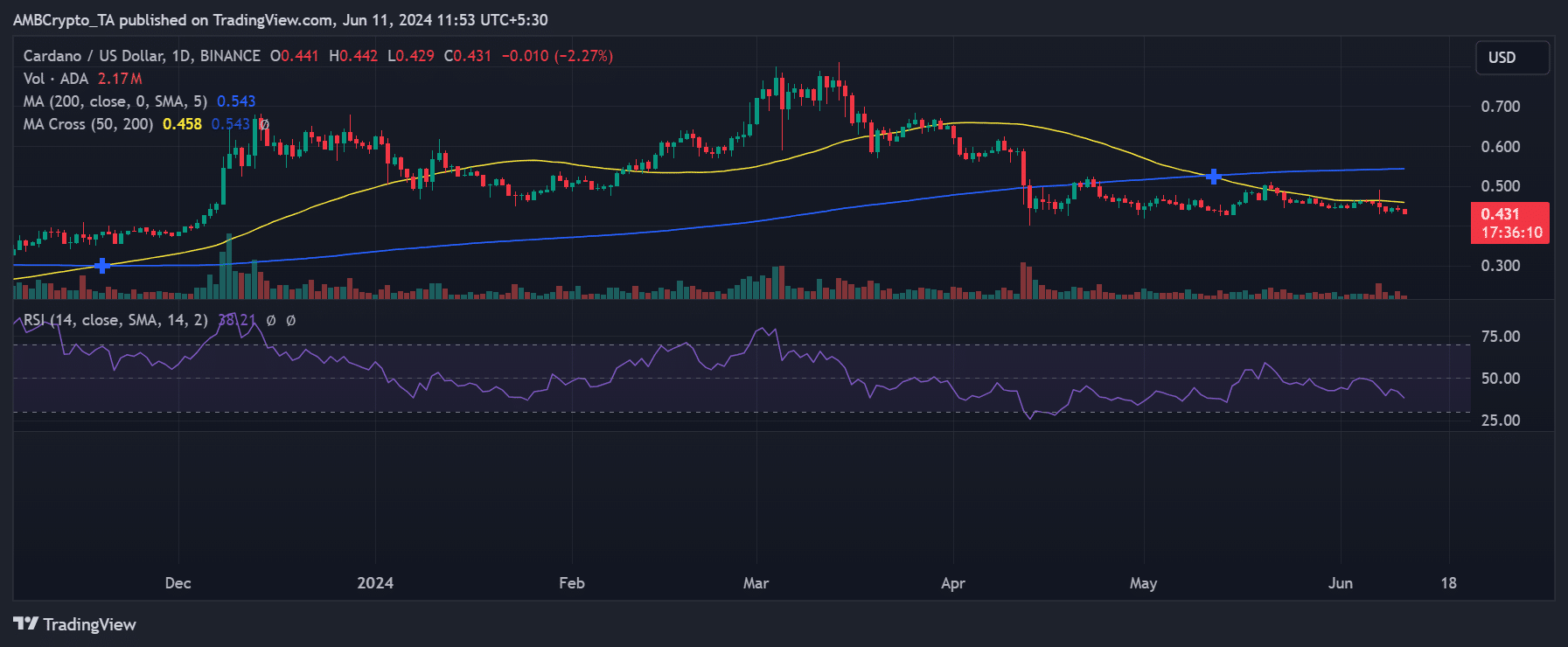

An analysis by AMBCrypto revealed that Cardano’s (ADA) price trend on the daily chart concluded with a downturn as of the 10th of June.

The chart indicated a drop of approximately 0.68%, with ADA trading at around $0.444.

From my current perspective as a researcher, the downward trend persists, and at present, I observe that ADA is being traded around $0.43 – representing a decrease of more than 2% compared to previous values.

As a researcher, I’ve observed that the short-term moving average, represented by the yellow line, continued to act as a resistance around the $0.46 price mark. Furthermore, the bearish trend persisted, given that the Relative Strength Index (RSI) fell below 40 at that point in time.

Read More

- LDO PREDICTION. LDO cryptocurrency

- JASMY PREDICTION. JASMY cryptocurrency

- Orca crypto price prediction: Buying opportunity ahead, or bull trap?

- Can Ethereum ETFs outperform Bitcoin ETFs – Yes or No?

- Chainlink to $20, when? Why analysts are positive about LINK’s future

- Citi analysts upgrade Coinbase stock to ‘BUY’ after +30% rally projection

- Why iShares’ Bitcoin Trust stock surged 13% in 5 days, and what’s ahead

- Spot Solana ETF approvals – Closer than you think?

- Injective at risk of pullback as key resistance holds strong – What now?

- Crypto mining ‘strengthens America’s energy grids’ – A 30% tax means…

2024-06-11 17:11