-

ADA was caught in a tight supply region that could lead its price downwards.

Open Interest and network activity fell, suggesting a decline toward $0.40.

As a seasoned crypto investor with a keen interest in on-chain data and market trends, I’ve been closely monitoring Cardano (ADA) and its recent price movements. The latest findings from AMBCrypto have raised some concerns for me.

As a crypto investor, I’ve noticed that my Cardano [ADA] holdings have lost 6.11% of their value over the past month. But according to AMBCrypto’s latest analysis, there are signs that the token could be about to slip even further.

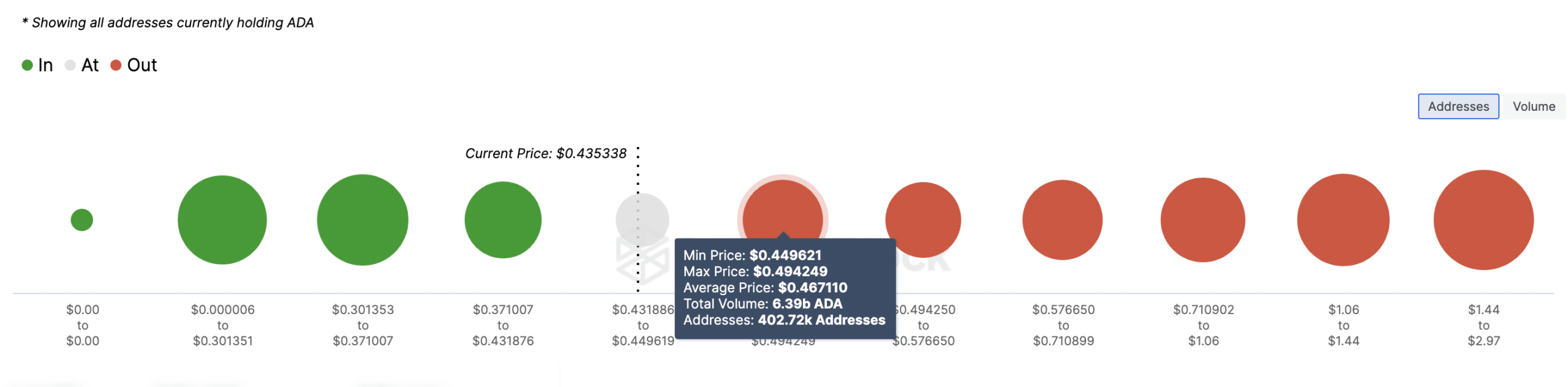

This assertion was backed by the Global In/Out of Money (GIOM) indicator provided by IntoTheBlock.

The GIOm classification system groups addresses according to their financial performance – profit-making, loss-incurring, or neutral at the breakeven point. By examining these labels, traders can identify possible levels of support or resistance in the market.

ADA bears wait to strike

As a researcher studying this data at the current moment, I’ve found that approximately 402,720 addresses have amassed a total of 6.39 billion dollars, with each address holding between 0.44 and 0.49 dollar. However, this group has missed out on further profits as they are now considered “out of the money.”

As such, there is a high chance that most holders could look to sell once ADA hits these levels.

As an analyst, I’ve identified a potential resistance level for the Cardano native token, ADA. If this level holds, ADA may experience a pullback and potentially reach a price of $0.42. In more challenging market conditions with significant selling pressure, the price could even dip down to $0.40.

From my current perspective as a researcher, the token’s value stood at $0.43 during my investigation. Surprisingly, despite this price drop, there was an uptick of 11.32% in large transactions on the network over the past 24 hours.

As an analyst, I’ve noticed that a rising trend in large transactions doesn’t automatically translate to increased buying demand. Based on price movements, this surge could be attributed to the transfer of tokens between wallets or even sell-offs.

Additionally, the number of active addresses during a 24-hour period served as another piece of evidence suggesting a potential price correction.

Based on Santiment’s data, approximately 35,000 active addresses were recorded on the Cardano network by June 8th.

No new buyer in Cardano’s land

At the point of publication, the figure had dropped to 32,100, implying a decrease in the number of distinct addresses engaged in transactions.

The attempted increase seemed like a false breakout for ADA’s price.

Examining the graph revealed a robust connection between the token’s worth and the network’s activity level.

As a researcher studying cryptocurrency trends, I noticed an intriguing pattern on the 7th of June. The number of active addresses surged to approximately 39,000, which in turn triggered a notable price increase for the cryptocurrency, pushing it up to around $0.48.

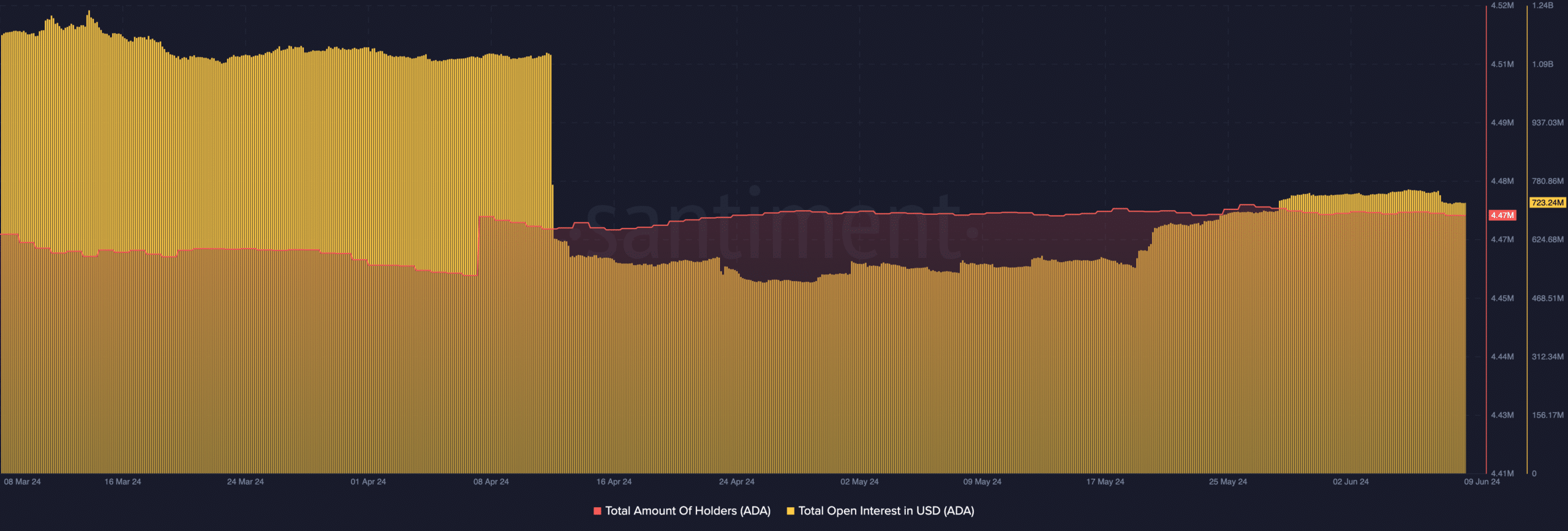

As a Cardano investor, I’ve noticed that a continued decline in the metric could potentially lead to a downturn in the price of Cardano. Furthermore, I took a closer look at the Open Interest (OI) figures provided by AMBCrypto for some additional insights.

The Open Interest (OI) indicator signifies the number of outstanding derivative contracts linked to a particular cryptocurrency that have not been closed. A rise in open interest implies fresh capital is entering the market, potentially leading to price growth.

As an analyst observing the derivatives market for Cardano, I’ve noticed a decrease in open interest (OI). This reduction suggests that traders have been closing their positions. If this trend persists, it could potentially lead to a decline in ADA‘s price, possibly dropping below $0.42.

Realistic or not, here’s ADA’s market cap in BTC terms

But it is important to note that invalidation might occur if interest starts to pick.

To summarize, based on on-chain information, there were approximately 4.47 million unique ADA holders as of the recent data. This number is roughly equivalent to what it was back in April. This finding implies that Cardano may have struggled to draw in fresh investors.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

2024-06-09 16:07