-

ADA has seen fluctuations between positive and negative sentiments.

Technical indicators indicated a declining selling pressure.

As a seasoned crypto investor with a knack for spotting hidden gems and understanding market trends, I’ve seen my fair share of ups and downs in the digital asset world. Cardano [ADA] has been an interesting case study for me, given its unique position and potential within the broader ecosystem.

Over the past few months, the cryptocurrency Cardano (ADA) has encountered criticism, as some people have branded it a “stagnant” or “ineffective” currency, given its price fluctuations.

Yet, contrary to the pessimistic outlook, ADA continues to hold a prominent place within the realm of leading digital currencies.

Furthermore, its role within the Artificial Intelligence (AI) sector may act as a positive driving force, presenting an optimistic outlook that addresses and overcomes existing doubts about its future potential.

Cardano faces “dead coin” narrative

The idea that Cardano is a “failed currency” primarily stems from its difficult price trajectory during the last couple of years.

Over the past few months, an examination shows that although Cardano occasionally spiked in value, it persistently finds it difficult to exceed the $1 mark.

Furthermore, it’s been observed that ADA doesn’t always follow the broader market’s movements closely, demonstrating a relatively subdued reaction to economic events that usually impact other investments.

As an analyst, I’m observing that even amidst various challenges, Cardano has managed to hold its ground among the leading digital assets. At this moment, according to CoinMarketCap data, ADA stands firmly at the tenth position, boasting a market capitalization surpassing $12 billion.

Hoskinson’s AI speech sparks interest

Engaging in the field of Artificial Intelligence (AI) by Cardano could potentially spark optimism among investors, implying a rise in their buying interest.

At a recent artificial intelligence gathering, Charles Hoskinson, the creator of Cardano, delved into the intertwining of blockchain technology and AI. He emphasized the possible contribution of ADA in this expanding area.

As a seasoned tech investor who has witnessed the evolution of various industries, I find the recent discourse surrounding ADA‘s potential integration with AI to be particularly intriguing. With my background in technology and investment, I can appreciate the potential impact such an alliance could have on ADA’s growth trajectory and relevance. Investors like myself are always on the lookout for innovative partnerships that could lead to exponential growth, and this integration seems ripe with possibility. If executed successfully, it could bolster investor confidence in ADA’s future prospects, making it an attractive investment option for those looking to capitalize on emerging technologies.

As interest in AI-connected investments increases, there’s a rising optimism about Cardano’s involvement in artificial intelligence, fueling a positive outlook.

It appears that advancements in artificial intelligence (AI) often lead to a rise in the value of cryptocurrencies such as ICP and Worldcoin.

Enhancing the ADA token with Artificial Intelligence (AI) features could give it a unique edge over other cryptocurrencies. This upgrade could capitalize on the increasing curiosity, driving more expansion and attracting more investors towards its platform.

Cardano shows positive movement amid dead coin talks

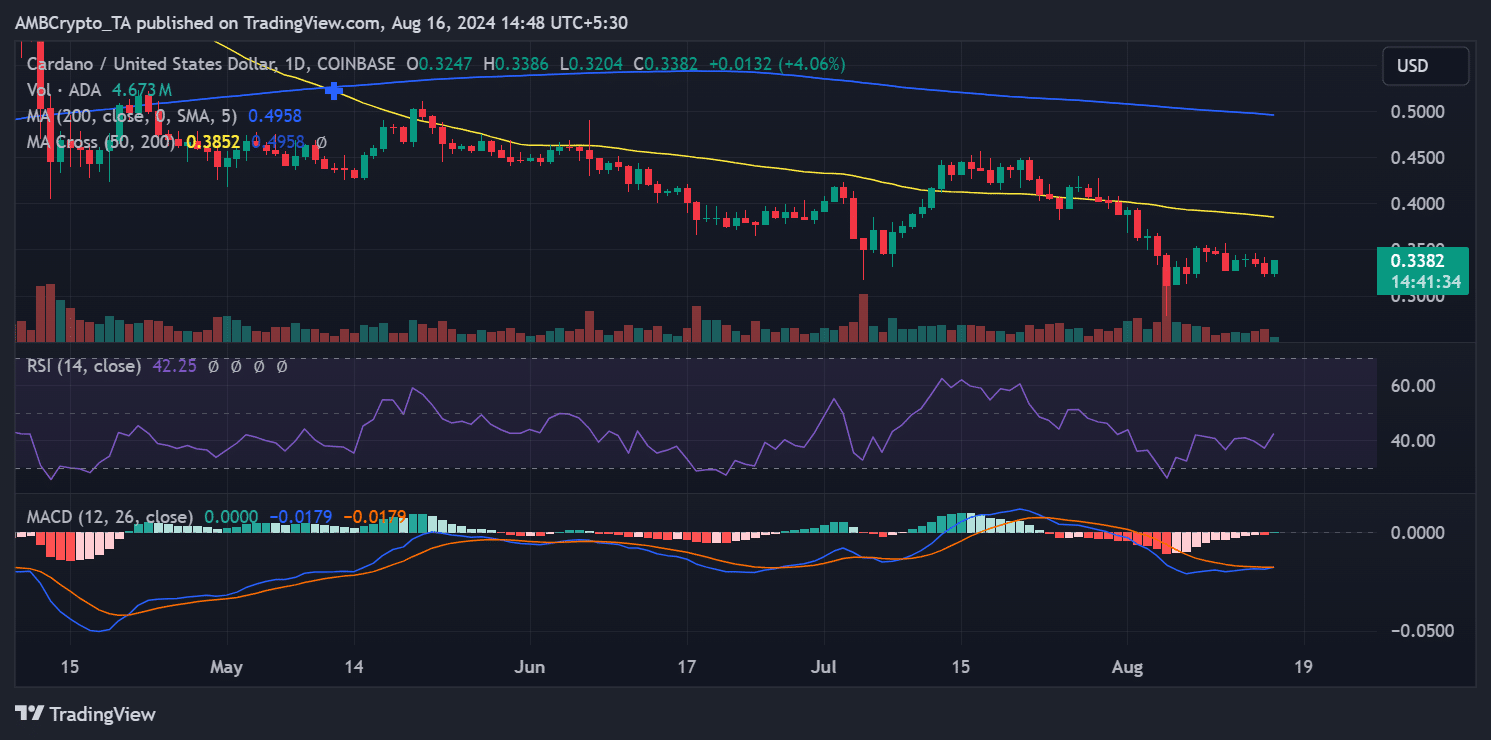

Currently, ADA is hovering around $0.3382, signifying an upward trend with a notable increase of more than 4.06%.

Furthermore, the Relative Strength Index (RSI) stood at approximately 42.25, which places it within the neutral range yet hinting towards the oversold territory.

Furthermore, the Moving Average Convergence Divergence (MACD) value was zero, while the signal line hovered just beneath -0.0179.

The MACD histogram displayed a mix of red and green bars, indicating diminishing momentum.

As a researcher, I’ve noticed an intriguing pattern emerging in my analysis: the blend of RSI and MACD indicators seems to imply that selling pressure could be subsiding. Moreover, the discernible trend suggests a possible price reversal if Cardano (ADA) manages to surpass its 50-day moving average (the yellow line).

If ADA persists in falling short of its moving averages, it could potentially result in more consolidation or an extended downtrend for me as an analyst’s perspective.

Notable points to focus on involve the resistance at the 50-day Moving Average and support situated close to the present price point, approximately $0.3204.

ADA’s Funding Rate fluctuates

A look at the funding rate trends for Cardano, as presented by Coinglass, shows it’s been mostly upward, even in the face of the “dead coin” speculation.

However, the Funding Rate has recently fluctuated between positive and negative zones.

Currently, the figure stands around negative 0.008%, implying that sellers are in control and there’s a general expectation for ADA‘s price to fall, as this trend indicates.

The shifting balance between favorable and unfavorable Interest Rates suggests a volatile market environment, where pessimistic attitudes are dominating at present.

Read More

- WCT PREDICTION. WCT cryptocurrency

- The Bachelor’s Ben Higgins and Jessica Clarke Welcome Baby Girl with Heartfelt Instagram Post

- Chrishell Stause’s Dig at Ex-Husband Justin Hartley Sparks Backlash

- Royal Baby Alert: Princess Beatrice Welcomes Second Child!

- AMD’s RDNA 4 GPUs Reinvigorate the Mid-Range Market

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- PI PREDICTION. PI cryptocurrency

- Studio Ghibli Creates Live-Action Anime Adaptation For Theme Park’s Anniversary: Watch

- SOL PREDICTION. SOL cryptocurrency

- Is Trump’s Presidency a Game Changer for the US Dollar and Bitcoin?

2024-08-16 21:57