-

The Elliot Wave showed that ADA had slipped below the crucial support.

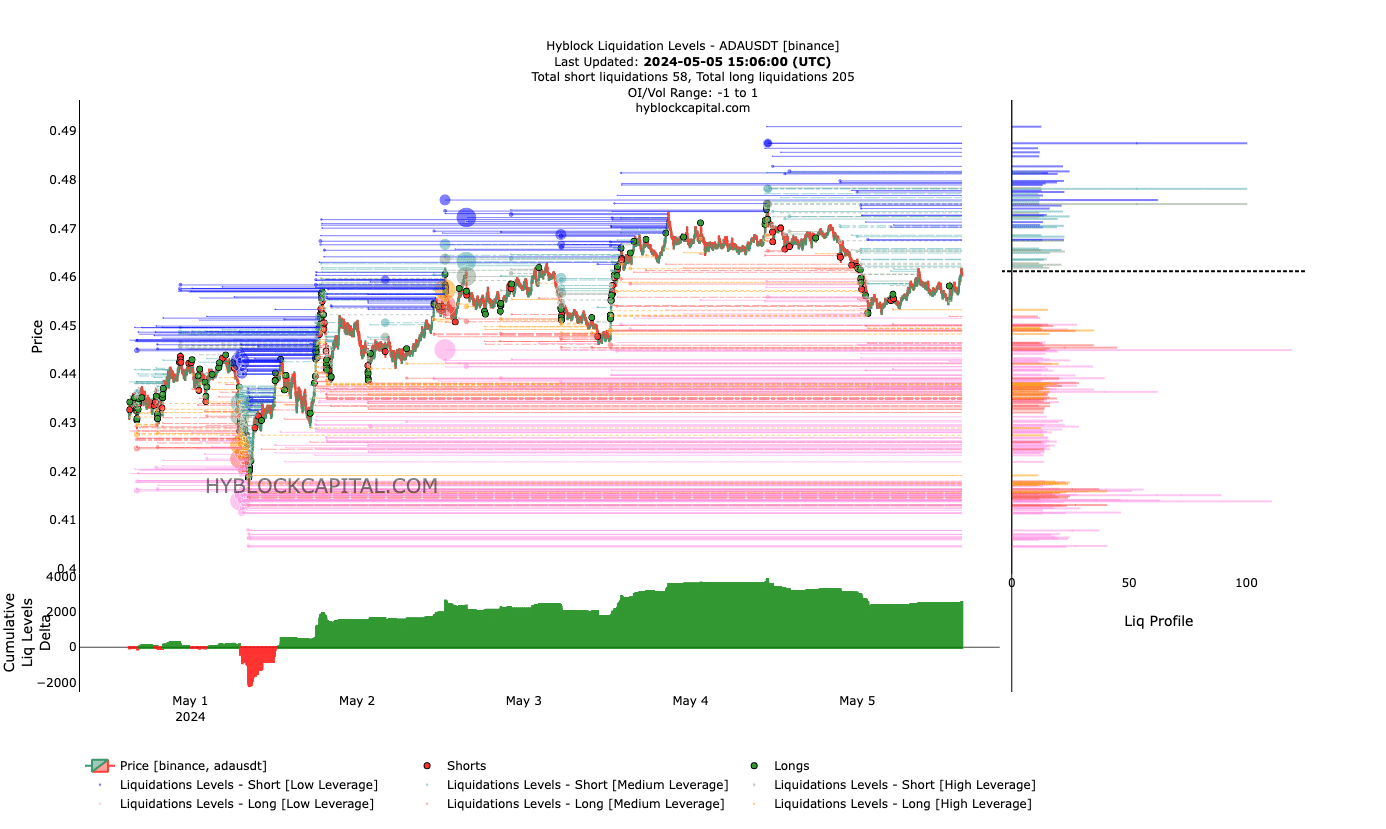

Signals from the liquidation levels and OI predicted a decrease to $0.42.

As a researcher with experience in analyzing cryptocurrencies, I believe that based on the information provided by More Crypto Online and my own analysis, there is a strong possibility that Cardano’s [ADA] price could slide down to $0.42. The Elliot Wave theory suggests that ADA has only seen a 3-wave corrective rally and could be in for a larger degree of downswing. Furthermore, the decrease in Open Interest (OI) implies that sellers are the aggressive ones in the market, which could add fuel to the bearish trend. Additionally, the positive CLLD indicates more long liquidations, suggesting a potential full retrace for Cardano. Therefore, I believe that the prediction of $0.42 is a valid one, and investors should exercise caution in their investment decisions regarding ADA.

Cardano‘s [ADA] bottom may not have been reached yet, according to More Crypto Online, a crypto channel, implying that further declines for the digital asset could be imminent.

Based on the information shared in the YouTube video, the host indicated that the Elliott Wave theory supported the market signal.

Explaining the thesis, the channel mentioned that,

Based on our observation so far, we’ve experienced just three waves of correction in the ADA price chart. Historically, such rallies don’t usually signal a bullish trend. Instead, Ada could potentially drop further or continue moving sideways.

Sellers are on the offensive side

The Elliott Wave Theory identifies repetitive price movements in financial markets, enabling traders to anticipate market peaks and troughs.

As a researcher examining the cryptocurrency market, I’ve noticed that More Crypto Online pointed out that once ADA dipped below the $0.48 support level, any previous bullish sentiment associated with the token was no longer valid.

If Wave 5 of the price trend occurs and results in a significant downturn, the cost of the Cardano token could potentially drop to around $0.42.

As of this writing, ADA’s price was $0.45. This was a 2% decrease in the last 24 hours.

As a crypto investor, I’ve noticed that AMBCrypto previously reported some intriguing similarities between the token’s recent price action and its remarkable surge during the last bull market.

As a researcher exploring the latest developments in the world of cryptocurrencies, I must admit that this new theory raises some concerns regarding a specific prediction. Yet, relying solely on technical data might not be sufficient to fully understand the situation for Cardano. Thus, we decided to delve deeper and investigate from an on-chain perspective.

To begin with, AMBCrypto analyzed the total number of ongoing contracts associated with a derivative instrument, which is referred to as Open Interest (OI).

A rise in the indicator signifies a growth in investors’ net positions, suggesting stronger buying sentiment among them, with potential aggression from long buyers.

However, Cardano’s OI was $548.6 million at press time— a decrease from the value seven days ago.

As an analyst, I would interpret the current situation as indicating that the sellers, or those taking short positions, are driving the price down. If this trend continues without intervention, it may lead to the predicted price of $0.42 becoming a reality.

Will ADA move to $0.42?

In addition to examining the Order-Initiated (OI) data, we also delved into the analysis of liquidation levels and their delta values, referred to as Cumulative Liquidation Levels Delta (CLLD). The significance of this examination lies in predicting potential price thresholds where substantial liquidations could take place.

As a researcher studying market trends, I’ve discovered that the CLLD (Cumulative Liquidity Demand) metric serves as an essential tool for traders in making informed decisions about entering positions. A positive value for CLLD implies a greater demand for long liquidation, meaning more traders are looking to close their long positions. Conversely, when the CLLD displays negative values, it signifies a higher demand for short liquidation, indicating that traders are predominantly looking to close their short positions.

Read Cardano’s [ADA] Price Prediction 2024-2025

As a Cardano investor, I observed from the given chart that there wasn’t any magnetic pull or significant area that could potentially trigger a price surge for Cardano. However, the CLLD (Composite Linear Regression Derivative) indicator showed a positive value, suggesting that a full retracement might be imminent for Cardano.

In simple terms, the current bearish sentiment may prevent ADA from initiating a bull run. It’s possible that the token’s price could decline to around $0.40 during this period. This level could represent the target price in an extremely bearish market scenario.

Read More

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- Masters Toronto 2025: Everything You Need to Know

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Gold Rate Forecast

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- The Lowdown on Labubu: What to Know About the Viral Toy

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

2024-05-06 11:03